This week's five highlights

U.S-China Trade Tensions Ease, US-Canada Tensions Escalate

FOMC eases by 25bps, to conclude quantitative tightening on December 1

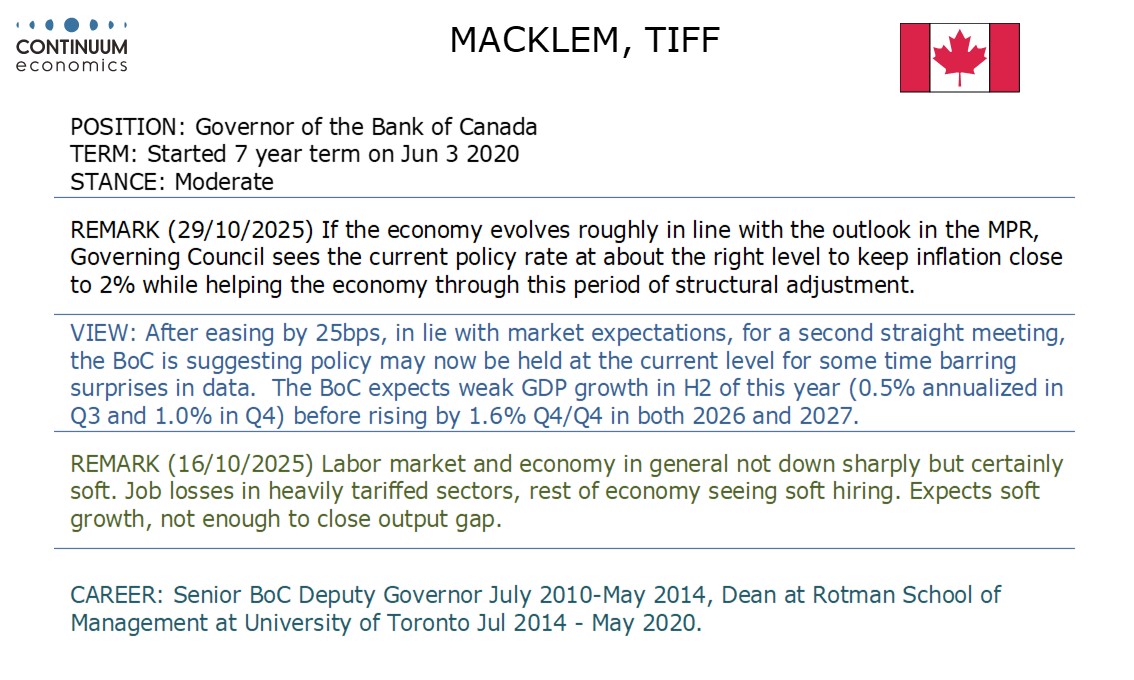

Bank of Canada Hawkish Ease with Current Rate Level Seen as Appropriate

7-2 Hold for BoJ

ECB Hedging its Bets

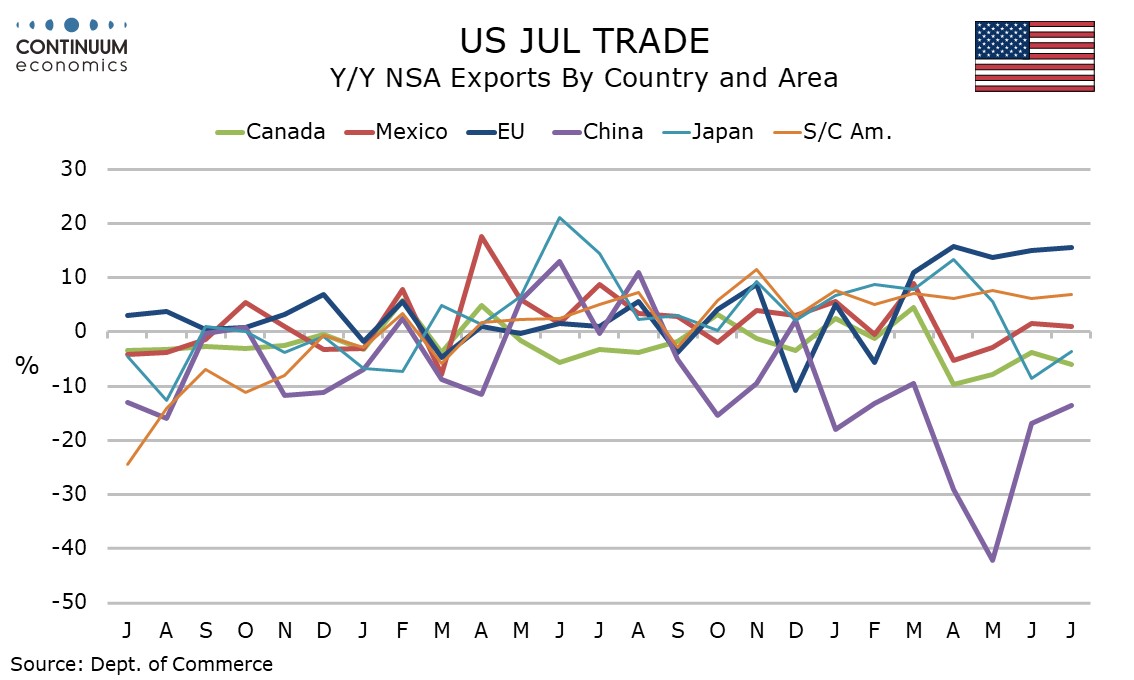

Trade tensions between the US and China appear to be easing, with it looking increasingly unlikely that the US will impose a threatened extra 100% tariff on China on November 1. However trade tensions with Canada have increased, with Canada receiving an extra 10% tariff, adding to downside economic risks and uncertainty in Canada. While we are not revising our call that the Bank of Canada will pause on Wednesday, the latest developments leave the call a close one.

It never looked very likely that Trump would impose the 100% extra tariff on China, with his rhetoric having turned more conciliatory soon after the threat was made. China has proven that it has leverage given its dominance of rare earth supply, with current signals that it will postpone the extra controls it recently announced for a year. The US also appears set to regain access to the Chinese market for soybean exports, which had become a significant issue in the US politically given problems faced by US farmers.

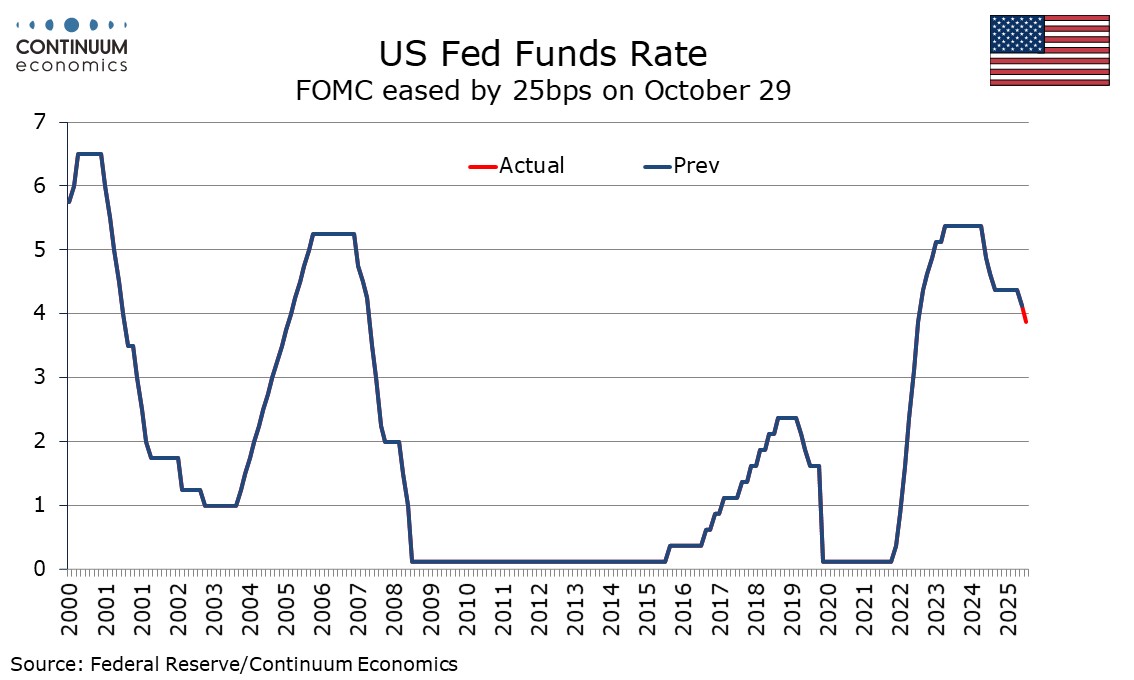

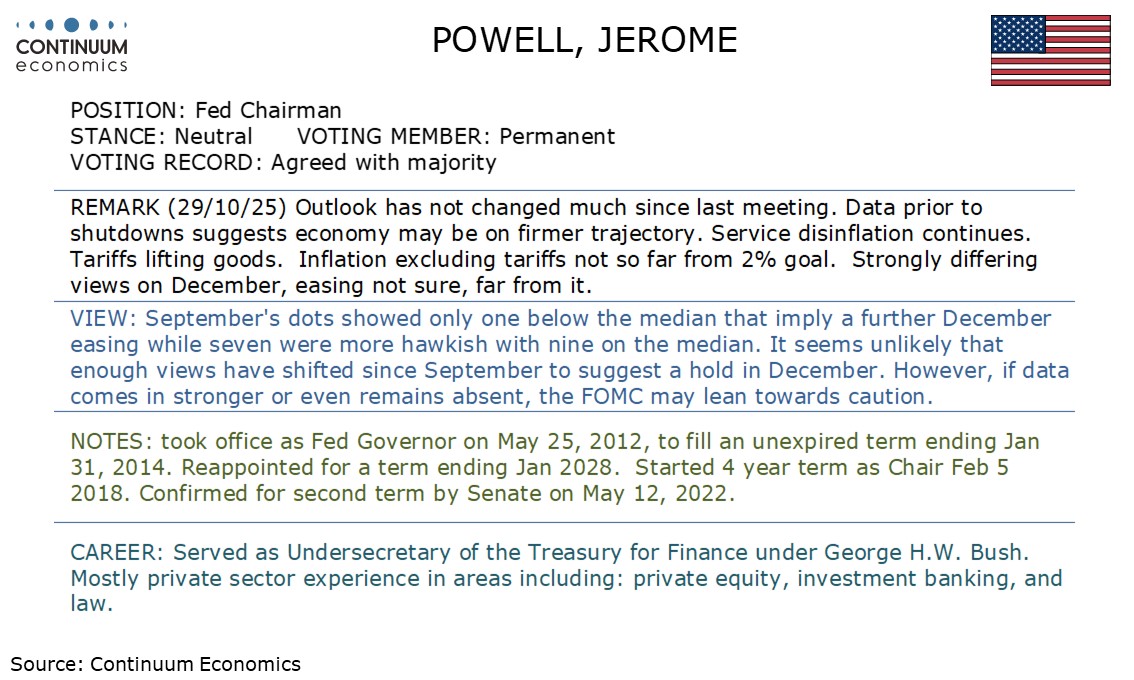

The FOMC has eased rates by 25bps to a 3.75%-4.00% range as expected and decided to conclude the reduction of its securities holdings on December 1 as Chairman Powell had hinted at on October 14. There were two dissents, Governor Miran favoring a 50bps move and Kansas City Fed’s Schmid delivering a hawkish dissent for no change. None of this is surprising.

Instead of stating that economic activity moderated in the first half of the FOMC now states that available indicators suggest activity has been expanding at a moderate pace, recognizing the absence of key data but generally seeing limited cause for alarm in what is available. There has been no fresh unemployment release since the last meeting but the FOMC states recent indicators are consistent with the unemployment rate having edged up but remaining low though August. They now stay downside risks to employment rose in recent months rather than have risen.

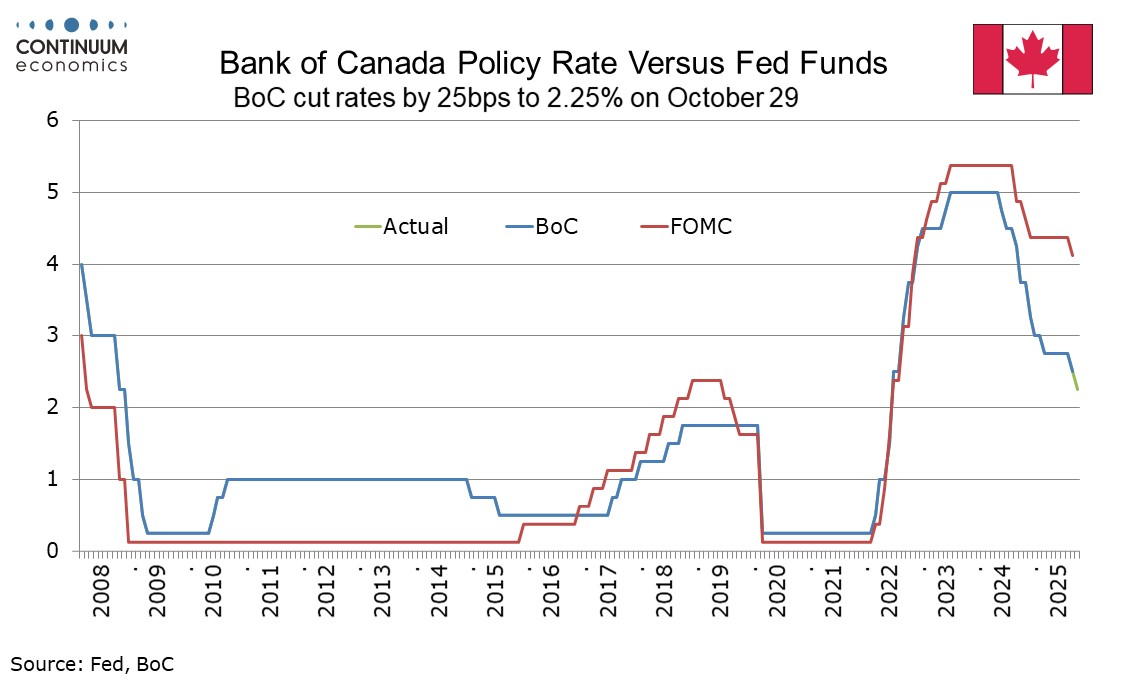

The Bank of Canada delivered a hawkish easing, cutting rates for the second straight meeting by 25bps, to 2.25%, but stating that if inflation and activity evolve in line with its projection, the current rate is seen as about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment (brought about by US tariffs).

While any move in the next six months is likely to be lower, that might require a recession which is not the BoC’s central view. We now expect steady policy from the BoC through the first three quarters of 2026. Policy is now at the low end of the neutral range of 2.25-3.25%, and in time the BoC is likely to return to its midpoint. We expect one 25bps tightening in Q4 2026 and one more in early 2027.

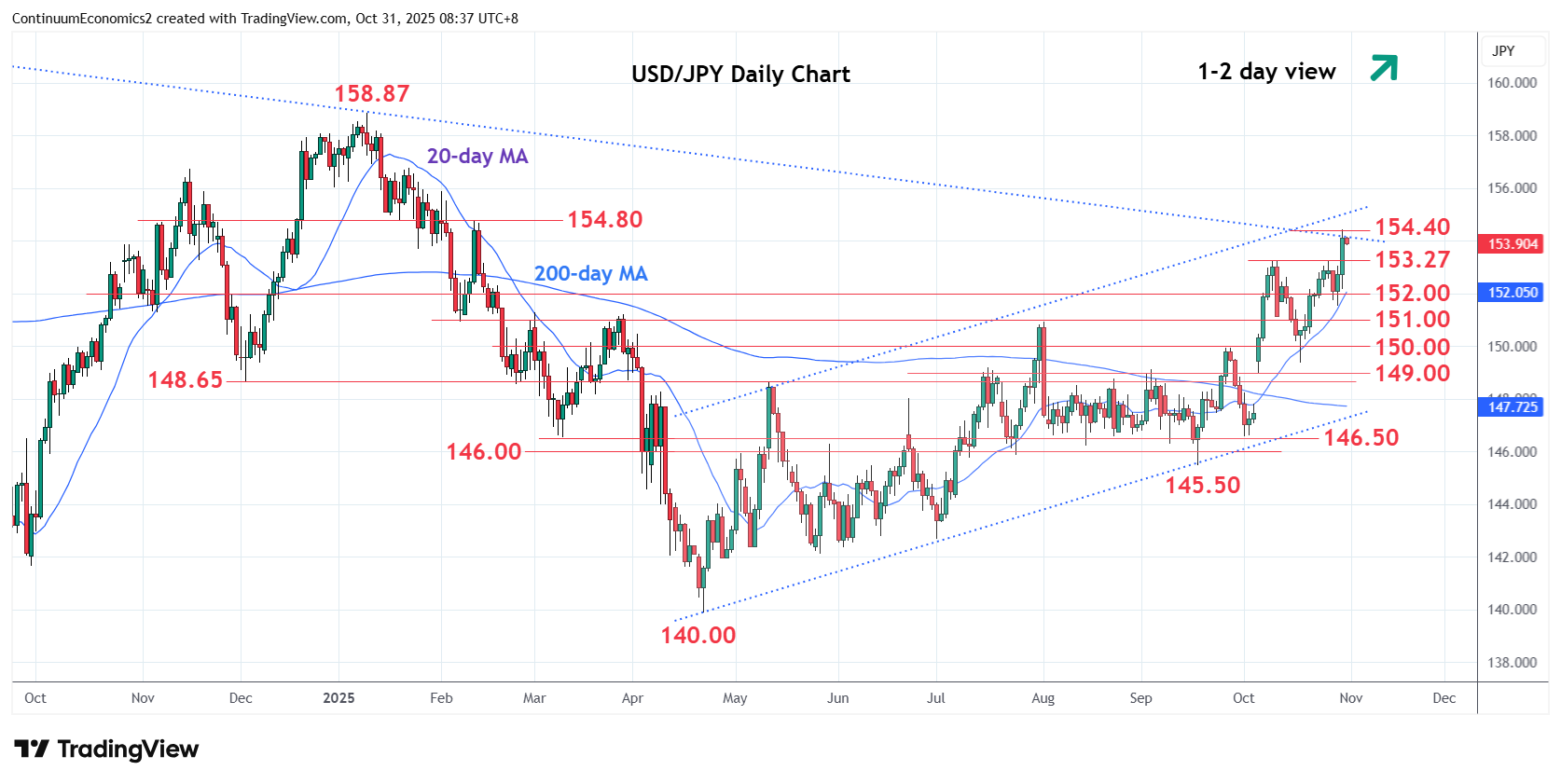

The BoJ has kept rates unchanged at 0.5% in the Oct 30th meeting with a 7-2 vote, citing short term stalling inflation and downside risk for economic growth. Despite the current inflationary dynamics are supportive and the clarity from the U.S.-Japan trade front have freed the BoJ's hand to tighten, the elephant in the room is the uncertainty in fiscal policy from the new PM Takaichi. The BoJ would not risk a head-lock with Takaichi on her first month with little risk of inflation overshooting.

There isn't much changes in the October economics outlook, only real GDP for fiscal 2025 is revised 0.1% higher to 0.7% and ex fresh food & energy CPI for fiscal 2026 is revised 0.1% higher to 2%. The continue to see a certain level of trade uncertainty globally despite most countries had a deal with the U.S., so as geopolitical uncertainty in Middle East and Ukraine-Russia.

The forward guidance did not change for the BoJ vowed to increase interest rate according to economic and inflationary development. We see there should be a 25bps hike in the coming meeting after they get clarity on Takaichi's policy.

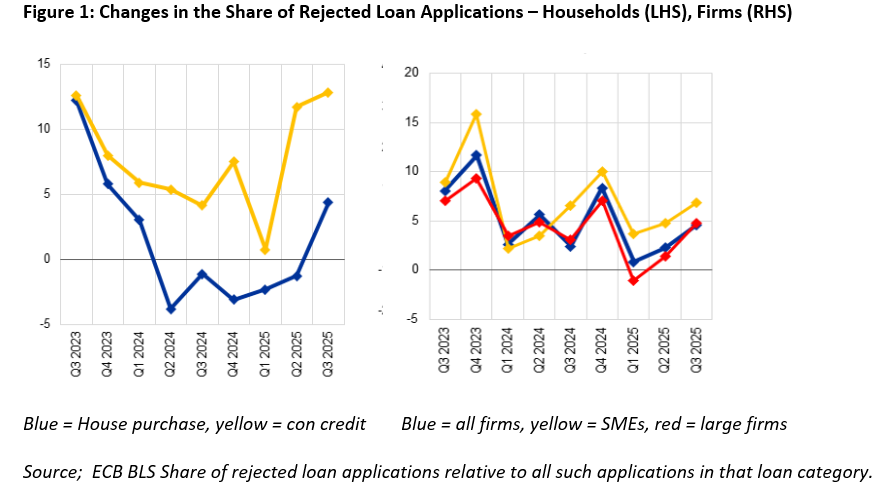

There ie nothing tangible in the ECB update today to suggest that a further easing is likely at the next meeting on Dec 17-18. However, amid a hint of what we think is a complacent upgrade about the EZ’s resilience alongside a perceived reduction in global risks, the easing window has not been closed. The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. But we feel that even if our call that a further rate cut may occur at the final Council meeting this year proves wrong then this merely defers what we still see up to 50 bp of easing through H2 next year. Moreover, the ECB will be loath to suggest anytime soon that the next move is more likely to be hike, not least as it may be reassessing an economic picture that it not as resilient as it has widely suggested and be wary that any such hints could turn current budget worries into a genuine fiscal crisis in parts of the EZ. In fact, the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it alleges (Figure 1) and where such banking sector wariness may be a sign that global risks have materialised rather than dissipated.

Council divisions over the inflation outlook are likely to magnify when the ECB updates its projections again in December as this will include the first glimpse for 2028 where the outlook is even more uncertain that usual, complicated further by (necessary, tenuous and possibly revised) assumptions about the manner and timing of planned energy tariffs. These could actually take headline inflation back below 2% in 2028, albeit due to possible one-off base effects that would only stir deeper divisions with the Council. We, however, suggest that basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious.