This week's five highlights

U.S.-EU Trade Agreement More a Framework Than a full Deal

No TACO From Trump

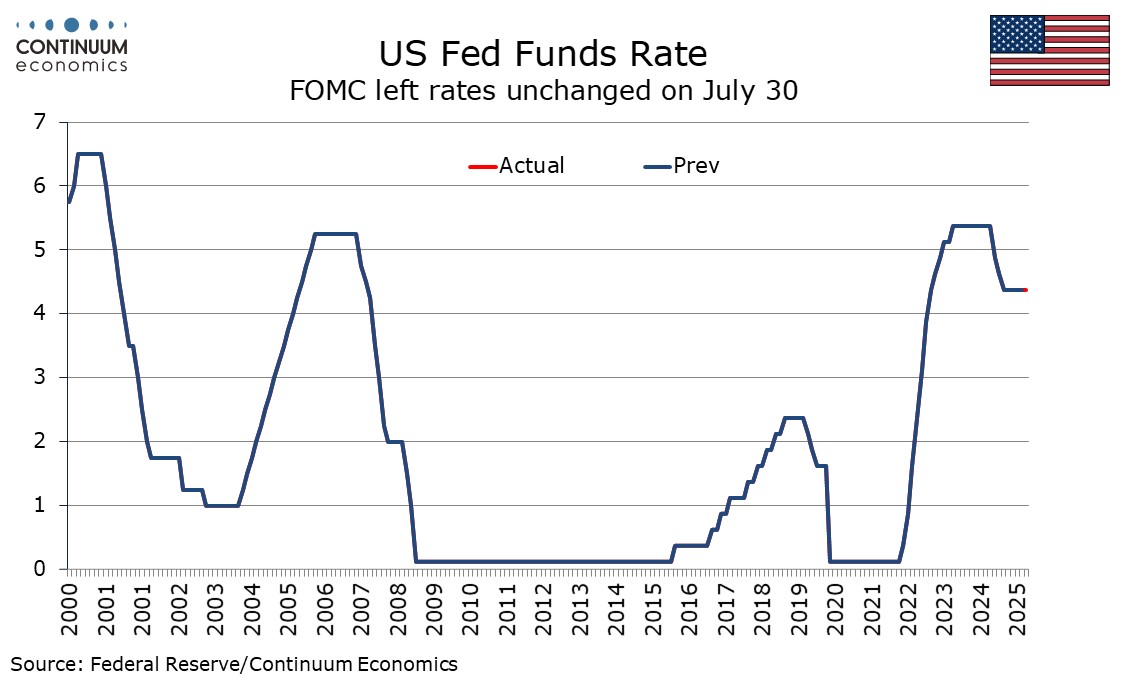

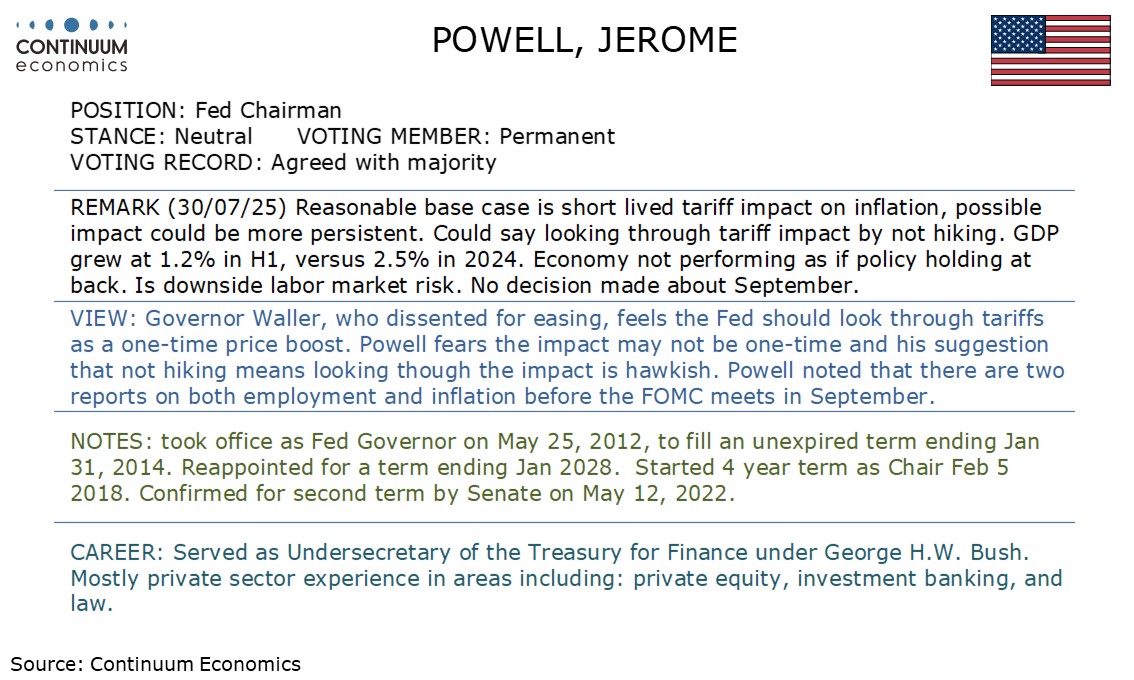

FOMC leaves rates unchanged

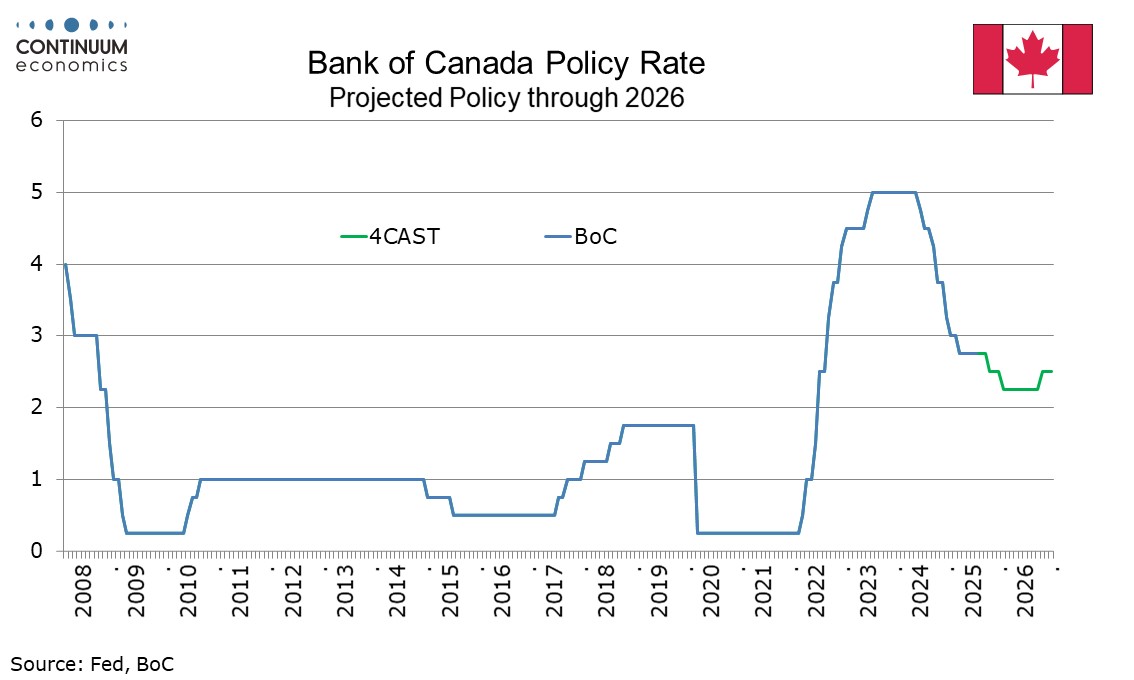

Consensus to hold for Bank of Canada

BoJ As Expected

In what seems to have been a fully-fledged political capitulation to the U.S. the EU, it seems, is accepting an agreement that would see an almost-blanket reciprocal 15% tariff on its exports to the U.S. But there still some imponderables, not least the range of sectoral concessions, whether EU member states will back the deal and the extent to which the result of its 232 trade investigations in two weeks will actually decide separately on tariff rates for the likes of chips and pharmaceuticals. Thus, this is more a framework than a formal deal, and thus while it may moderate what is global trade uncertainty, it will not end it. Regardless, a circa-15% deal will be seen by most as damage limitation on behalf of the EU in order to avoid an even more punitive 30% tariff that had been threatened. But in what may turn out to be more than 15% effectively, any such tariff is more than the 10% rate the EU thought it would get just a few weeks ago and which forms the baseline for the ECB’s existing forecasts - something the latter clings to for the time being.

But, although it is uncertain what the impact will be, we think that according to its recent scenario pictures, when the ECB updates its forecasts at the Sep 11 decision, it should be reining in both its inflation and growth outlooks more in line with its severe scenario (Figure 1). Indeed, the ECB largely sees tariffs as being disinflationary for the EZ and even if a trade deal is reached it may merely reduce current uncertainty not end it nor repair the damage it will cause. Unless business surveys due in the interim improves markedly (not our expectation), this tariff damage we envisage, should trigger a 25 bp cut on Sep 11, not least as the core 2026 and 2027 HICP readings are already down to 1.9%. But the Council will be divided as likely comments due in coming weeks may illustrate.

Just when everyone expected Trump to chicken out every time by tariff deadlines, he didn't on August 1st. There is no TACO for Canada and Switzerland as both got hit by 35% and 39% of tariffs respectively. Taiwan, Cambodia, Thailand, Malaysia, Vietnam, Indonesia all got around 20%. Australia got 10%, New Zealand 15%, so as Israel, Turkey and Venezuela. Transshipping tariff for Canada is 40%. Trump continual to express his willingness to negotiate but it seems this countries are having a hard time to come to an agreement. Taiwan is expected to be coming very close to a deal but Canada may be bearing the blunt for a while.

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The wording of the statement also contains a dovish shift, stating that growth moderated in the first half of the year, despite the stronger than expected Q2 GDP outcome. In June’s statement the FOMC said that although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. This statement again saw the FOMC refer to swings in net exports, which depressed Q1 and lifted Q2 GDP, but now state that growth of economic activity moderated in the first half of the year. The pace averages less than 1.5% when Q1’s 0.5% decline and Q2’s 3.0% increase are averaged. Final sales to domestic buyers (GDP excluding net exports and inventories) slowed to 1.1% in Q2 from 1.5% in Q1.

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now expect the low to be reached in January 2026 rather than October 2025. We now expect easings in October of 2025 and January of 2026, each meetings on which a quarterly Monetary Policy Report will be released. In 2026 we expect a tightening in October. Currently rates are in the midpoint of the 2.25-3.25% range the Bank Of Canada sees as neutral. As the economy is hit by US tariffs and recent strength in underlying inflation fades, we expect the BoC will see scope to lower rates.

This meeting saw the BoC release a quarterly Monetary Policy report, which presented three scenarios, a central one based on current tariffs, and alternatives based on escalation and de-escalation. The central scenario presented with this report is compared to January’s MPR. April’s MPR presented two scenarios on tariffs, with an implication that the eventual picture would be somewhere in between. The BoC is forecasting a 1.5% annualized decline in Q2 GDP after a resilient Q1 in which exports were brought forward to avoid tariffs. The forecast suggests May could be weaker than a second straight 0.1% decline projected with April’s report, or that further weakness is expected in June despite a strong gain in employment in that month. In the current tariff scenario GDP resumes growth in the second half of the year to around 1% and picks up further in 2026 and 2027.

Headline inflation has been pulled down by the elimination of the carbon tax but underlying inflation is seen as having increased to around 2.5%. The increase is seen gradually unwinding in the current tariff scenario with inflation remaining close to 2%. The alternative scenarios do not obviously change the policy outlook, with escalation reducing growth but lifting inflation, while de-escalation lifts growth but reduces inflation.

The BoJ has kept rates unchanged at 0.5% in the July 31st meeting with inflation forecast revised higher. It came as no surprise for the BoJ needs more time to assess the impact of tariffs after the trade agreement between the U.S. and Japan being reached. Inflation forecast are all revised higher, with ex fresh food CPI for fiscal 2025 rising to 2.7% from 2.2% and ex fresh food & energy to 2.8% from 2.3%. It clearly suggest underlying inflation is more than transitory and looks set for an imminent hike. However, for 2026 neither core (1.8%) /core-core (1.9%) are above 2% after revision, showing the magnitude of hikes will be conservative. In 2027, the BoJ sees both items to be at 2%, further rationalizing their idea that inflation target is now sustainably. reached.

The growth forecast is little changed, being moderate in BoJ's eyes and potentially picking up momentum after 2027. However, they fear such outlook will have a downside skew due to trade uncertainty. It is understandable despite a trade agreement is reached to reduce tariffs, details are still lacking. One of the concern BoJ has is the pace of wage growth amid uncertainty, where we saw slowed to around 2% in the past months.

The rhetoric of "Will continue to raise policy rate if economy and prices move in line with forecast, in accordance with improvements in economy and prices" did not change. We forecast a 25bps hike in the September meeting before a terminal rate of 1% before Q1 2026.