CHF flows: CHF steady despite Q3 GDP dip

CHF steady after weak Q3 GDP

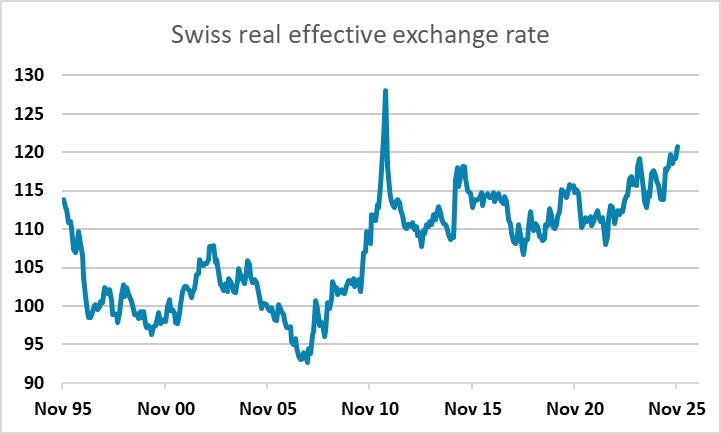

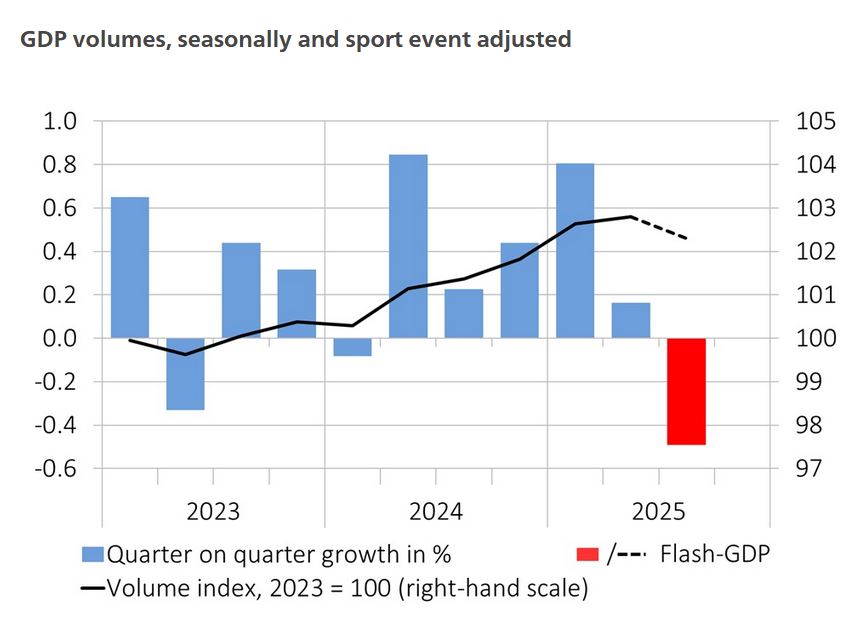

Swiss Q3 GDP came in at -0.5% q/q in Q3 due to weakness in the chemicals and pharma sectors. There is no information available on the expenditure breakdown for Q3 at this stage, but we know that Q1 was boosted by an export boom and Q2 by a big inventory build-up as exports fell back. Q3 likely saw an inventory decline, while exports are likely to have been weaker due to increased US tariffs, with the strength in Q1 having anticipated the tariff increase. All in all, the data reflected the impact of US tariff anticipation and implementation. The data hasn’t has a significant CHF impact, with EUR/CHF close to opening levels at 0.9220 after a brief dip ahead of the data. The 0.92 level remains key, but seems unlikely to break without a more significant turn in risk sentiment. Even then, some opposition from the SNB may be seen with the CHF at real terms highs excluding the 2011 and 2015 spikes.