SEK flows: Riksbank cut a slight surprise, but SEK downside risks modest

Riksbank cut 25bps with consensus for no change, but move had been 35% priced and Riksbank indictes this is likely to be the last cut

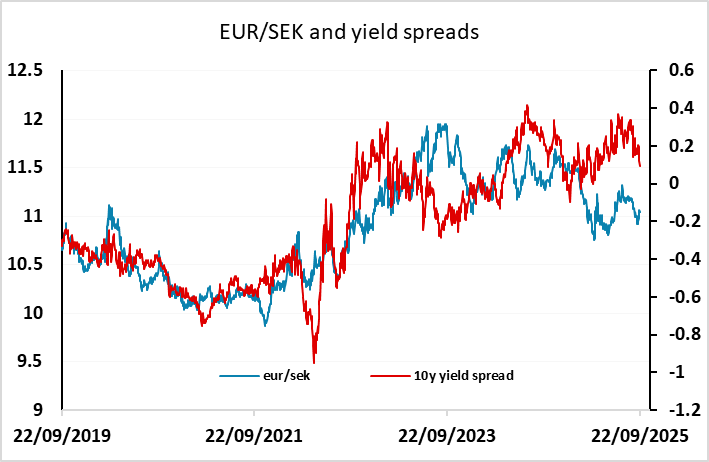

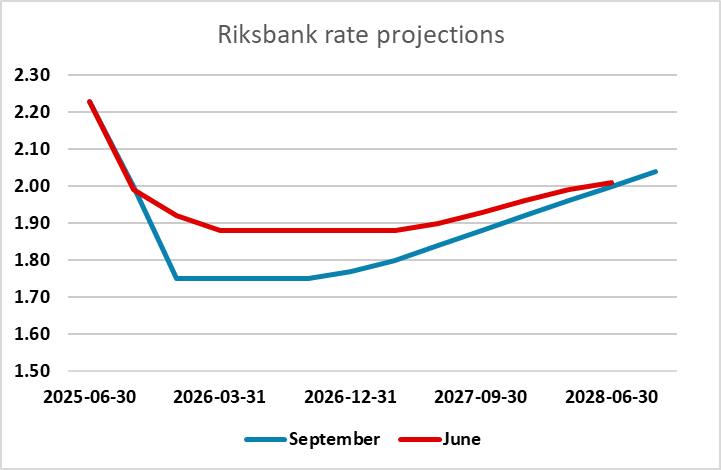

EUR/SEK is marginally higher in response to the Riksbank’s decision to cut rates 25bps at the latest meeting. The cut was a slight surprise, having been priced as only around a 35% chance ahead of the meeting. However, the Riksbank indicated that this is now likely to be the last cut for some time, with the next move likely to be a tightening in late 2026/early 2027. This has prevented the reaction from being larger, as a cut had been fully priced in for the end of the year, and the tightening is now seen coming earlier. The Riksbank justified the cut in spite of the expansionary budget in part because the indirect tax cuts would reduce inflation next year, and while they would boost growth, growth is starting from low levels. EUR/SEK nevertheless has scope to edge a little higher having moved lower ahead of yield spreads this year, but gains are unlikely to be substantial.