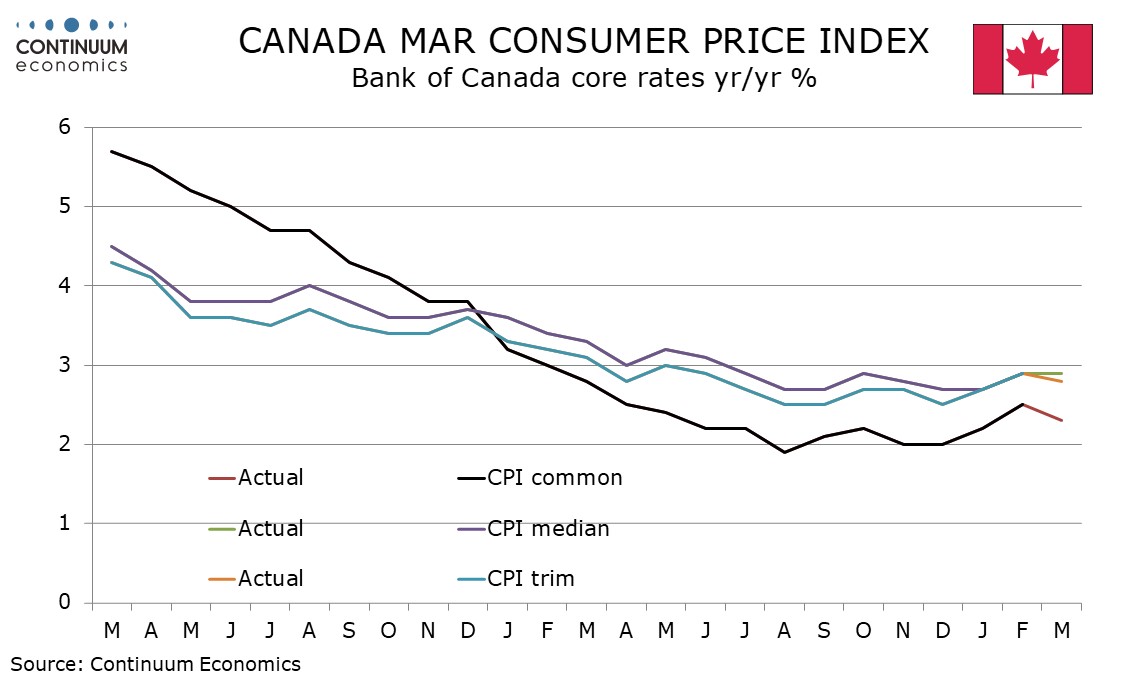

CAD flows: CAD softer after weaker CPI

Weaker Canadian CPI has led the market to price in a greater chance of BoC easing tomorrow, triggering some CAD weakness

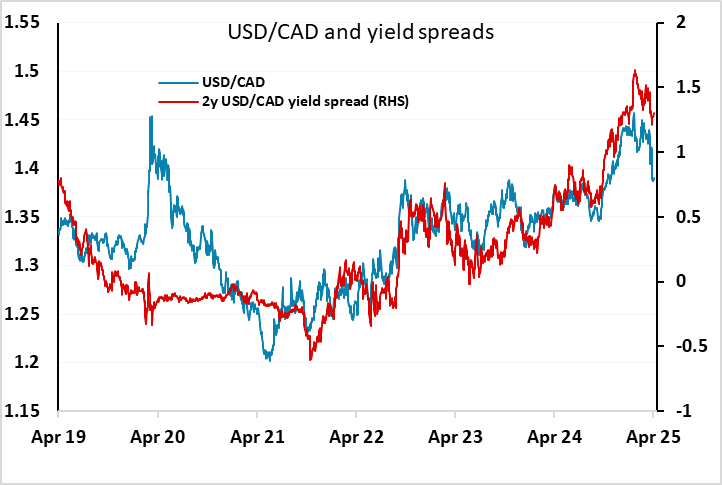

Weaker than expected Canadian CPI data have increased the market estimate of the probability of a BoC rate cut tomorrow from around 40% to around 50%, triggering a 20 pip gain in USD/CAD. USD/CAD has still been broadly correlated with yield spread moves in the last few weeks despite the USD breaking from its yield spread relationship with the EUR, so if the BoC do cut tomorrow we can expect to see further USD/CAD gains to towards 1.40. However, we stick to our call of no change in rates this time, with the last set of BoC minutes suggesting they would be cautious, and while they are likely to leave the door open for easing further down the road, this may allow a USD/CAD dip down towards 1.38.