This week's five highlights

No dramatic divisions from FOMC Minutes

This Week's Fed Speakers

RBNZ Provides More Dovish Surprise

Japanese New PM Sunk JPY

Another France Prime Minister Bites the Dust

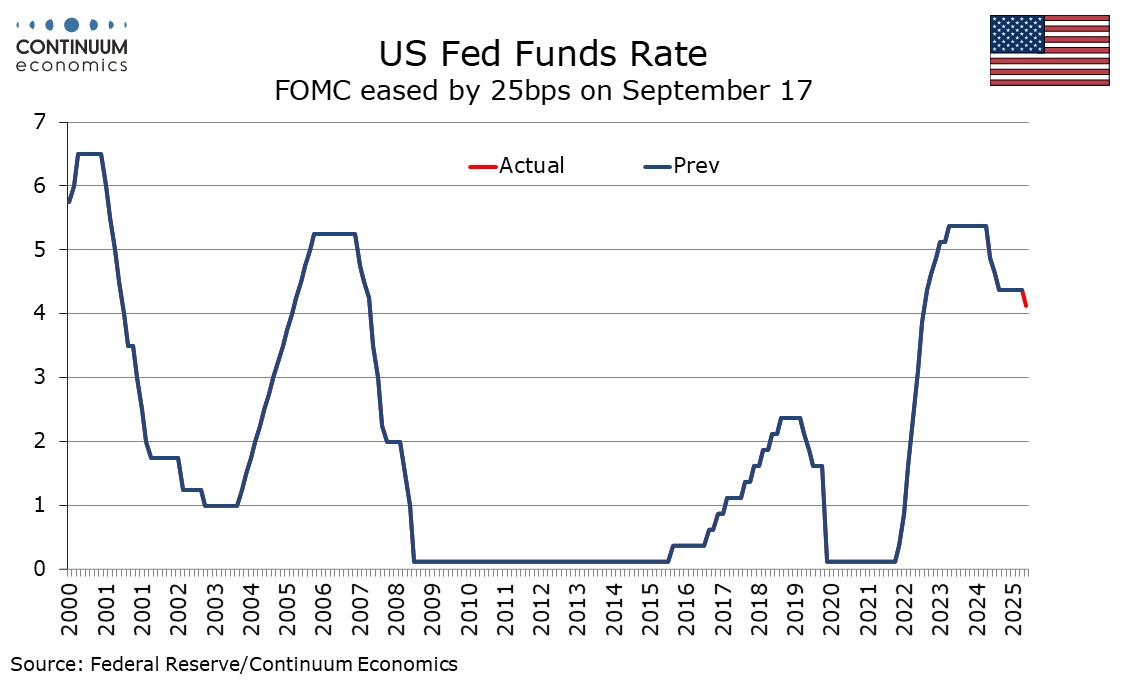

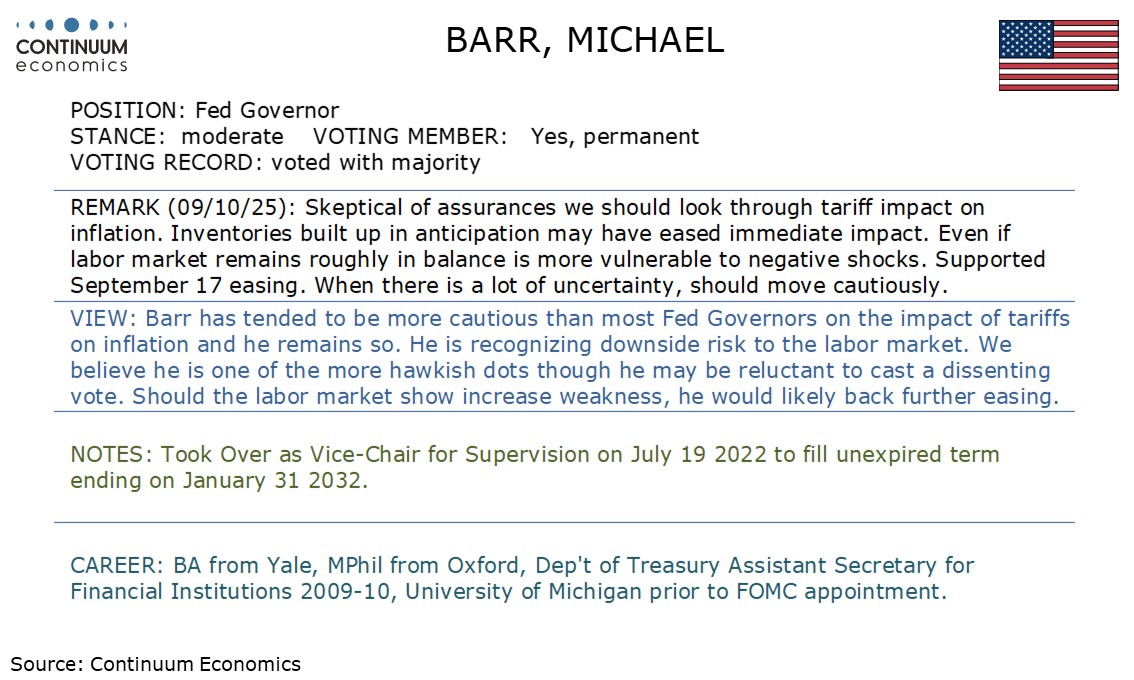

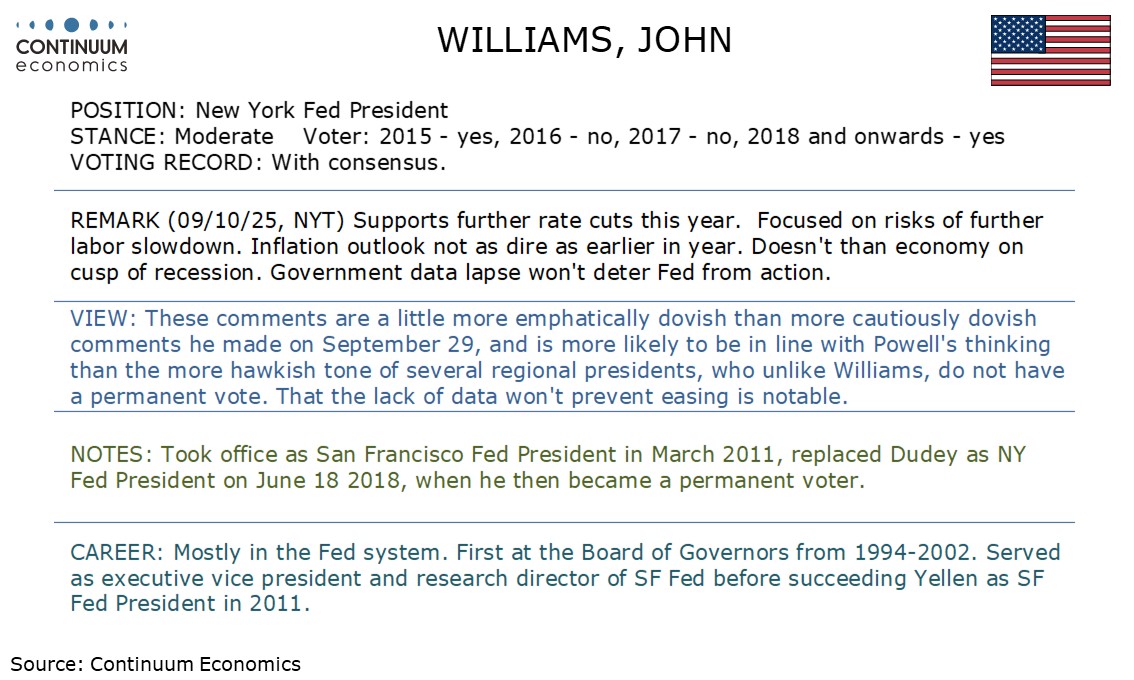

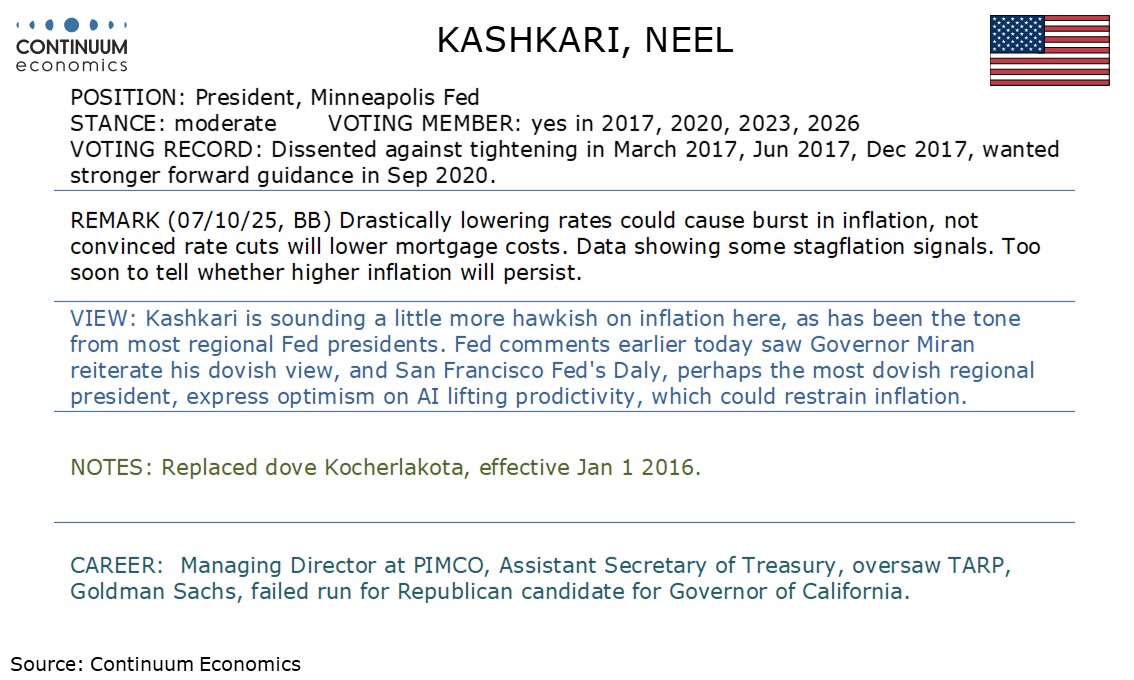

FOMC minutes from September 17 do not show a clear split between two camps, despite Fed speakers since the meeting showing some with clearly hawkish concerns and others significantly less so. This reflects a broad consensus to ease by 25bps at this meeting. While future decisions are not set in stone, most expected further easing in the remainder of this year. A majority emphasized upside risks to their outlooks for inflation though the tone is not starkly hawkish. Some remarked that they perceived less upside risk than earlier in the year with some seeing the impact of tariffs as somewhat muted relative to expectations. Most expected tariff impacts to be realized by the end of next year, suggesting uncertainty will persist for some time. Slowing job growth was seen as reflecting supply and demand. Participants generally assessed other labor market indicators did not show a sharp deterioration. However most judged that downside risks to employment had increased while upside risks to inflation had either diminished or not increased. The 25bps easing that was delivered was seen reflecting a shift in the balance of risks.

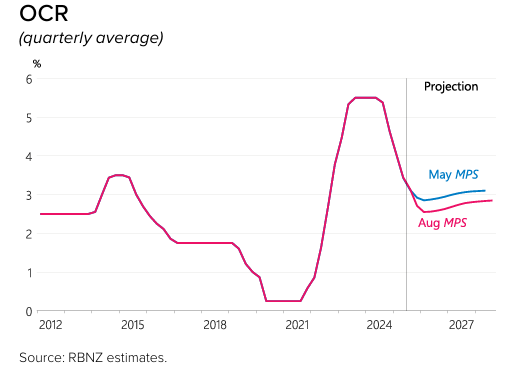

The RBNZ cut its cash rate by 50bp to 2.5% in the October meeting with no official revision to the OCR forecast since August. Different from the August cut, the 50bps cut in October is a consensus cut, which means all members agree that short term CPI may be volatile but the long time economic condition needs more accommodation. In the forward guidance, the RBNZ is consistent with their August forecast which points towards at least one more cut in the November meeting.

Some key takeaways:

Spare Capacity: The RBNZ highlight "spare capacity" in their statement. The priority of such "spare capacity" has even exceeded inflation. The RBNZ sees prolong spare capacity in New Zealand and weighed being accommodative to stimulate the economy to be more important than containing any short term spike in CPI.

Short term Inflation Expectation: It is forecasted Q3 CPI will be at 3% y/y but should be converging towards the mid point of target range in 2026. They also see global inflationary pressure to ease further in 2026.

Slowing Outlook: The RBNZ believe the global economic outlook will slow in 2026 after the AI boom in 2025. Thus, balancing the upside and downside risk with the broader picture, the RBNZ thinks that lower interest rate will be more beneficial to New Zealand and will be cutting further.

On the 4th of October, Sanae Takaichi has beaten Shinjiro Koizumi to be the new LDP party leader. She has always been a top contender but was closely matched by Koizumi, who did not received more support in the second round of vote as expected. Sanae Takaichi is holding a hawkish view against immigration and seem to be tapping into the nationalist side by suggesting review of current U.S.-Japan trade agreement. However, the LDP coalition does not have the numbers in the house and would require co-operation with opposition. It would seems to be unwise if the new Japanese PM to tackle both external and internal at once. Takaichi may focus on domestic issue, such as lowering consumption tax, increasing fiscal spending while scratching her head to increase government income to avoid further fiscal imbalance before exerting herself against Trump.

And what does this mean for the BoJ and monetary policy? Sanae Takaichi was a firm supporter of "Abenomics" and market participants seems to believe she will likely preach the same philosophy. Market pricing of an imminent October hike has mostly been called off with almost zero expectation of more hiking in 2025. So far, we have not heard any direct attack towards the BoJ but Takaichi 's remark do warrant concern on BoJ's tightening steps. The JPY took a beating on such expectation.

On the chart, the pair saw break above the 153.00 level to reach fresh high at 153.27 but bullish momentum slows as daily studies extend into overbought areas. Pause here likely as prices consolidate strong gains from the 149.00 low of Monday. However, further gains not ruled out within the bullish channel from the April low. Higher will see potential to the 154.00 level and 154.40, 76.4% Fibonacci level. Meanwhile, support is raised to the August high at 152.00 level which should underpin. Below this will open up room for pullback to the strong support at 150.92/150.00, August/September highs.

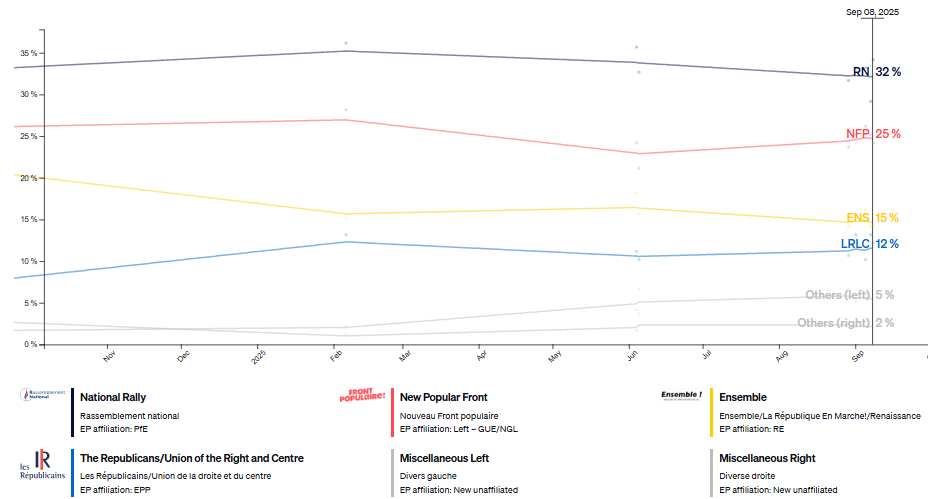

Figure: Parliament Divided Three Ways

Either side of the English Channel, politicians are competing to see whether France or the UK can provide a prime minister with the shortest time in power. In the UK that was Liz Truss whose 49 days at the helm of the government in 2022 has now been surpassed by French PM Lecornu who has resigned less than a month after his appointment, after right-wing allies indicated they would withdraw from his government. This underscores that France now has a problem not only in any President Macron-produced administration staying in power but actually even in forming any fresh government. Given that fiscally, existing budget measures from the previous year will continue, this suggests no immediate fiscal crisis even though the hefty budget cuts markets and Macron is seeking will continue to be elusive. However, three key issues need highlighting.

First, despite extending existing budget laws, the budget situation is actually getting worse as the French economy buckles, some of which is a reflection of political uncertainty. PMI data very much suggest that the economy is contracting, not least in the very rate sensitive construction sector. Indeed, the PMI numbers for the sector, out today, point to a dearth of new projects, with underlying data signalling a quicker reduction in new order inflows. As a result, the PMI for the sector posted 42.9 in September, down from 46.7 in August, signalling a sharp and accelerated contraction.

Secondly, a fresh election is both unlikely to occur and/or help solve the stand-off in parliament where the French voting system effectively undermines the right-wing National Rally’s opinion poll lead. Instead, and ahead of key local and mayoral election next March, the three-way split within parliament is seeing the various parties concerned via for votes - and this means not backing unpopular budget cuts.

Third, France’s current politics-driven fiscal woes suggests the much vaunted TPI tool that the ECB flaunts is highly unlikely to be used. Luckily for France (at least compared to the UK) it is the current low level of ECB policy rates that is cushioning the French market on a relative basis. Thus with policy rates possibly falling further, whatever surfaces as the next French government can afford to kick the fiscal can further down the road. However, this may be only for the time being as when the ECB starts to tighten afresh, or when/if speculation about such action emerges more forcefully market scrutiny of France will intensify, especially as this may coincide with heightened French political uncertainty in 2027 related to the then-likely presidential election. The question is whether this possibility will make the ECB try and place any such market thinking!