This week's five highlights

Trump’s Problems

FOMC Pauses With Risks Seen Diminished

USD Hurt by Hedging More than Asset Outflows

Stable Policy Rates for Sweden Riksbank 2026

Bank of Canada Rate Level Still Appropriate But Uncertainty Heightened

Overall, the Trump administration’s hyperactive start to 2026 is unlikely to achieve success on the number one issue for voters in the shape of cost of living concerns. Meanwhile ICE’s immigration tactics in Minnesota are causing concerns among swing voters, though Trump geopolitical adventurism is not causing a voters backlash as it overshadowed by domestic issues. Domestic political pressure will likely cause Trump to slowdown and become more focused on trying to actually achieve moderate successes to help the GOP in November mid-terms.

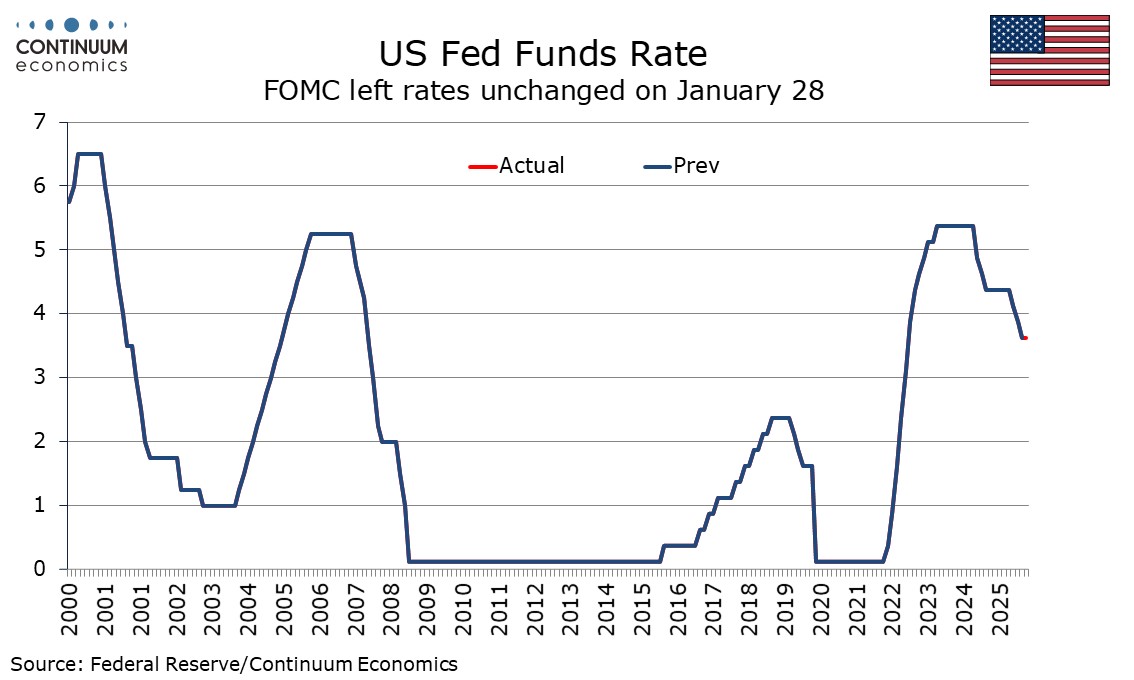

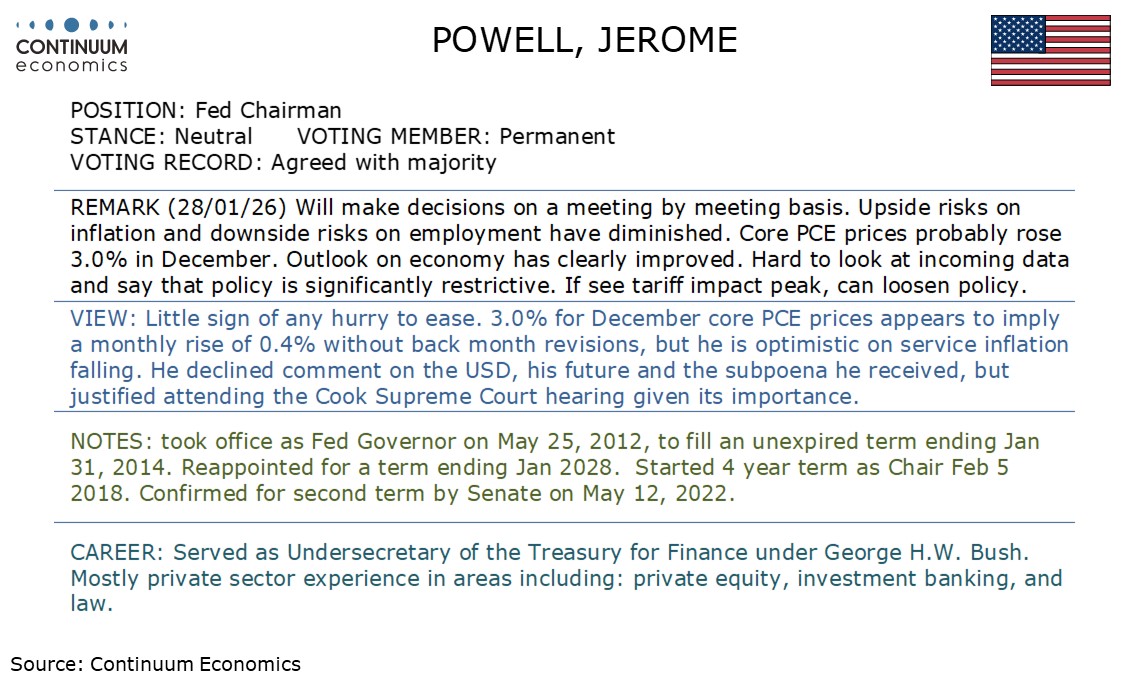

The FOMC has left rates unchanged at 3.5-3.75% as expected, with two dissents for a 25bps easing. The statement takes a slightly more optimistic view of the economy than the last one in December. We continue to expect two 25bps easing this year, coming in June and September. Economic activity is now seen as expanding at a solid pace rather than a moderate one, reflecting an upside surprise in Q3 GDP. the release of which came after December’s meeting, as well as positive signals for Q4. The unemployment rate, previously seen as edging up, is now seen as showing signs of stabilization, and a reference to downside risks to the labor market having risen is removed. They do however state that job gains have remined low, rather than having slowed. On inflation, a reference to it having moved up since earlier in the year is removed but it is still described as somewhat elevated. The change is likely to reflect softer CPI outcomes in Q4 as well as the start of a new year.

A dovish dissent from Stephen Miran was to be expected and it is notable that this time he only called for 25bps, with his previous dissents having been for 50bps. A similar dissent from Christopher Waller was less expected but not a major surprise given that he had shifted in a dovish direction in 2025. What is notable is that while Waller did dissent Michelle Bowman did not. We had felt that Bowman had taken a somewhat more dovish stance than Waller in 2025. Both had been seen as contenders for Fed Chair. It may be that Waller is still in the running, but Bowman is not.

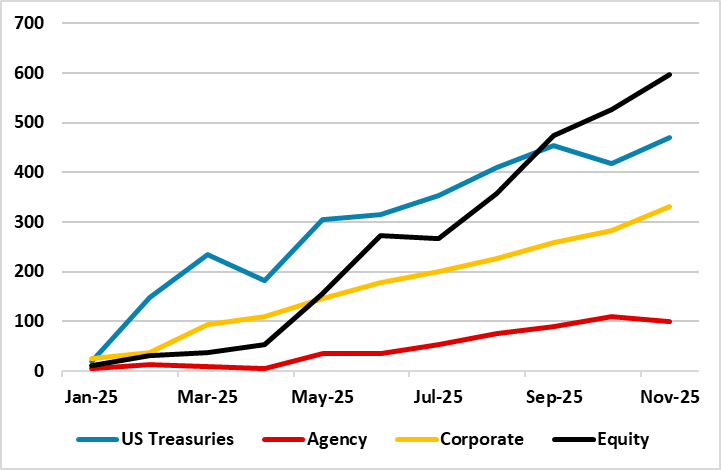

Figure: Cumulative Foreign Purchases of U.S. Assets (USD Blns)

The Greenland drama and fears of BOJ/Fed Intervention on USDJPY has put the USD under renewed downward pressure against DM Currencies. What happens next? Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue. We forecast 1.20 on EUR/USD by end 2026 and 140 on USD/JPY.

Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue.

Once again the Riksbank kept policy on hold with the key policy rate left at 1.75%. The Riksbank Board remains pleased with the data flow since its last rate cut on Sep 23, though vigilant on both sides. The Board promise of no change for some time to come was repeated, though we feel that the Riksbank projections for GDP and unemployment are too optimistic. Regardless, we still do not see any looming policy reversal, as we see this current policy rate (1.75%) staying in place through 2027, i.e. a little longer than the Riksbank.

Meanwhile, the SEK has had a good start to the year appreciating against the EUR as well as a weaker USD. Part of the 2026 story is that some fund managers feel that undervalued currencies can catch up with the EUR/USD move last year. However, we continue to prefer the higher yielding NOK and forecast EURNOK to 11.00 by end 2026 and NOKSEK close to parity.

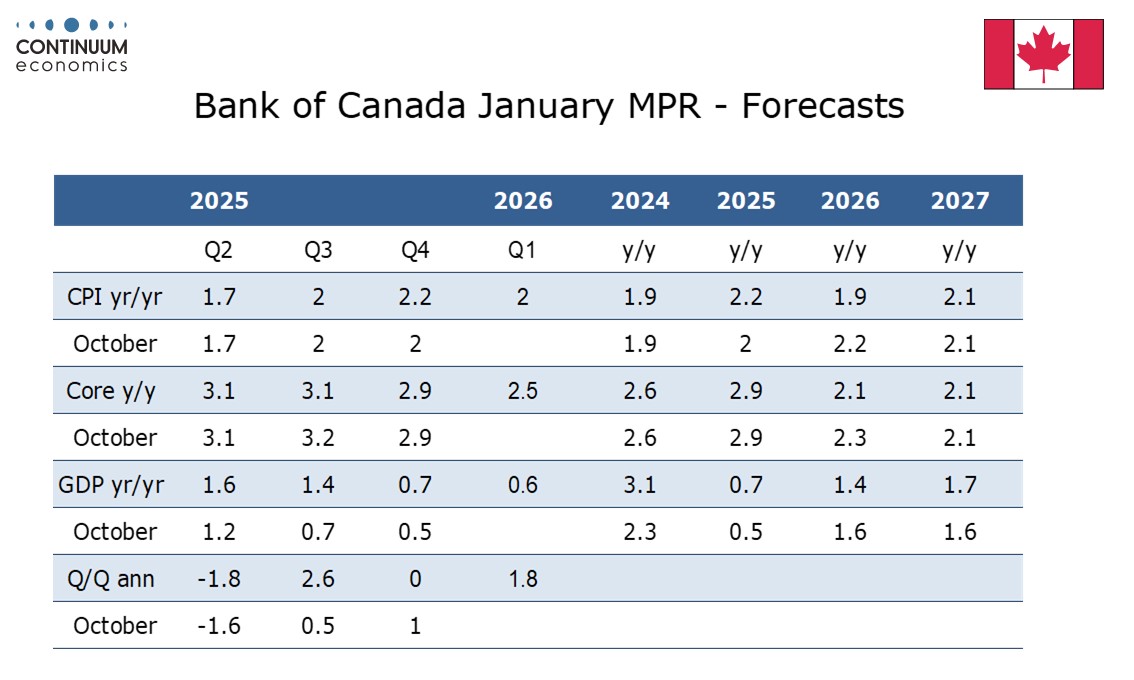

The Bank of Canada left rates unchanged at 2.25% as expected and continues to see the current policy rate as appropriate, Governor Macklem stating updated economic forecasts have not changed significantly since October. However in highlighting heightened uncertainty the statement appears to leave risks that the next move will be lower as somewhat higher, even if we do not expect that to be the case. This meeting contained the first quarterly Monetary Policy Report since October. A surprisingly strong Q3 GDP has not changed the projected GDP profile much though in forecasting a flat Q4 the BoC seems to be implying a positive December, while the 1.8% annualized forecast for Q1 is higher than we expected, and surprisingly stronger than the view for 2026 as a whole. The BoC does not seem concerned about a slightly firmer Q4 CPI, which came in part because of a year ago sales tax holiday. The statement was optimistic on its preferred measures of core inflation, stating they had eased to around 2.5% from 3.0% in October. The 2026 core CPI view has been revised down to 2.1% Q4/Q4 from 2.3%, only marginally above the 2.0% target.

The limited changes to the forecast allow the BoC to continue seeing the policy rate as appropriate though the main news in the statement was that uncertainty is now seen as heightened rather than elevated. This is presumably in response to Trump’s threat of a 100% tariff on Canada as well as the recent tension over Greenland, which like the US is a Canadian neighbor. We feel the risk of Trump imposing a 100% tariff on Canada is low, but the risk of him taking actions that while less extreme could do significant damage to Canada’s economic outlook is significant.