This week's five highlights

Thoughts on Trump’s 50% Steel And Aluminum

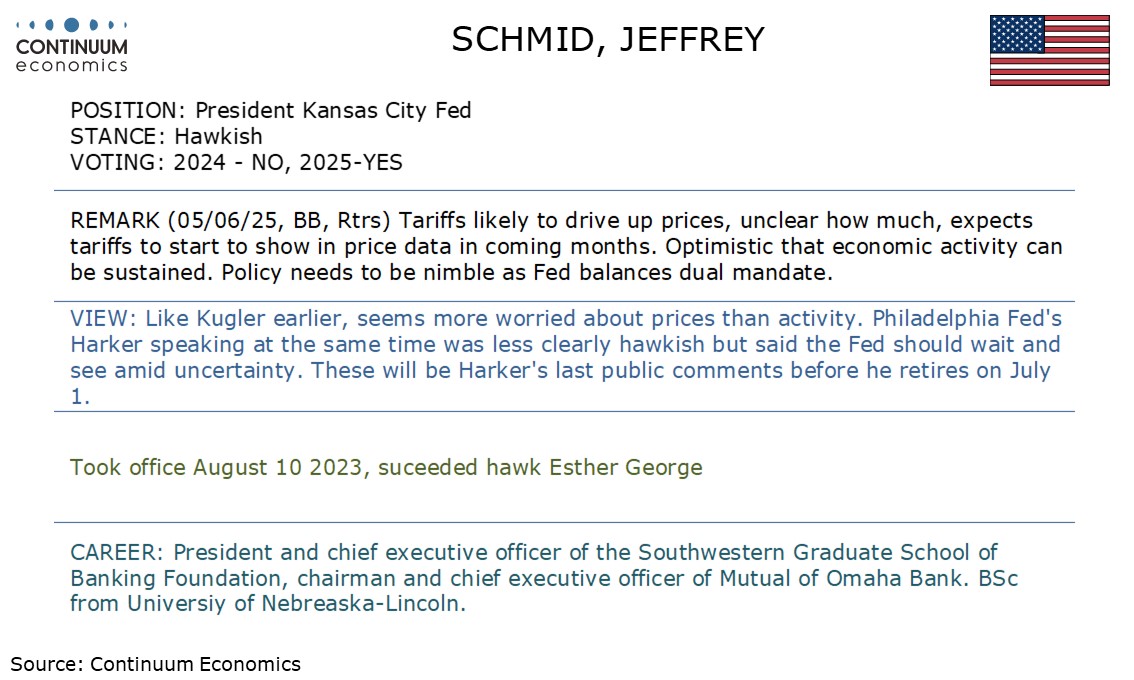

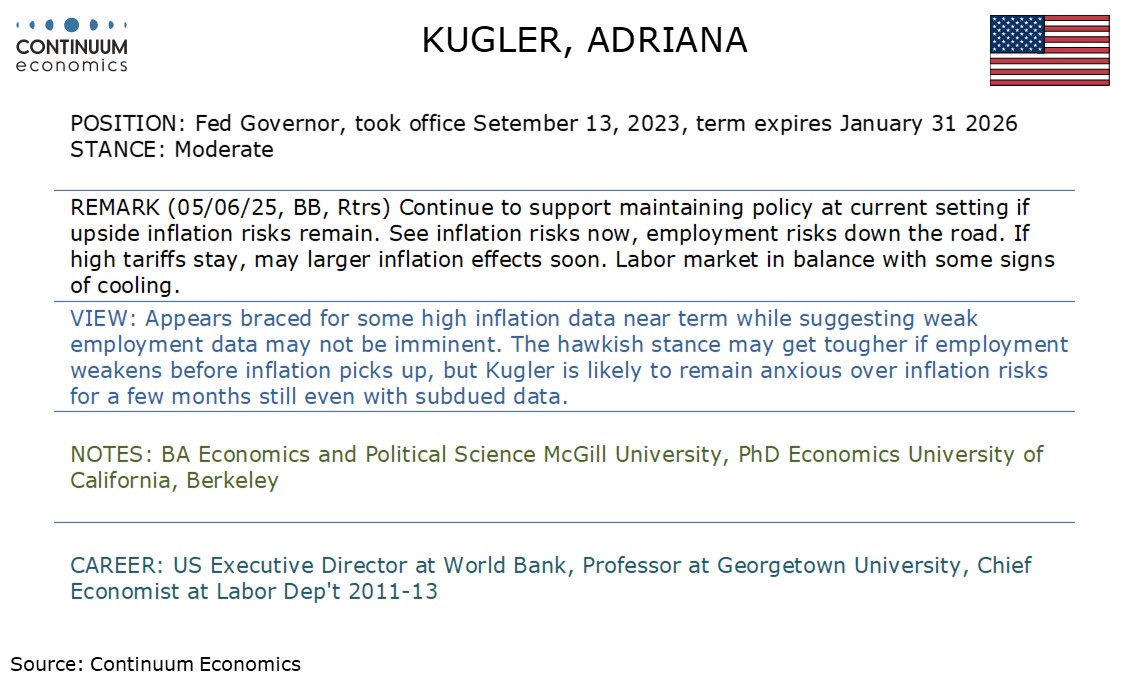

Fed Speakers This Week

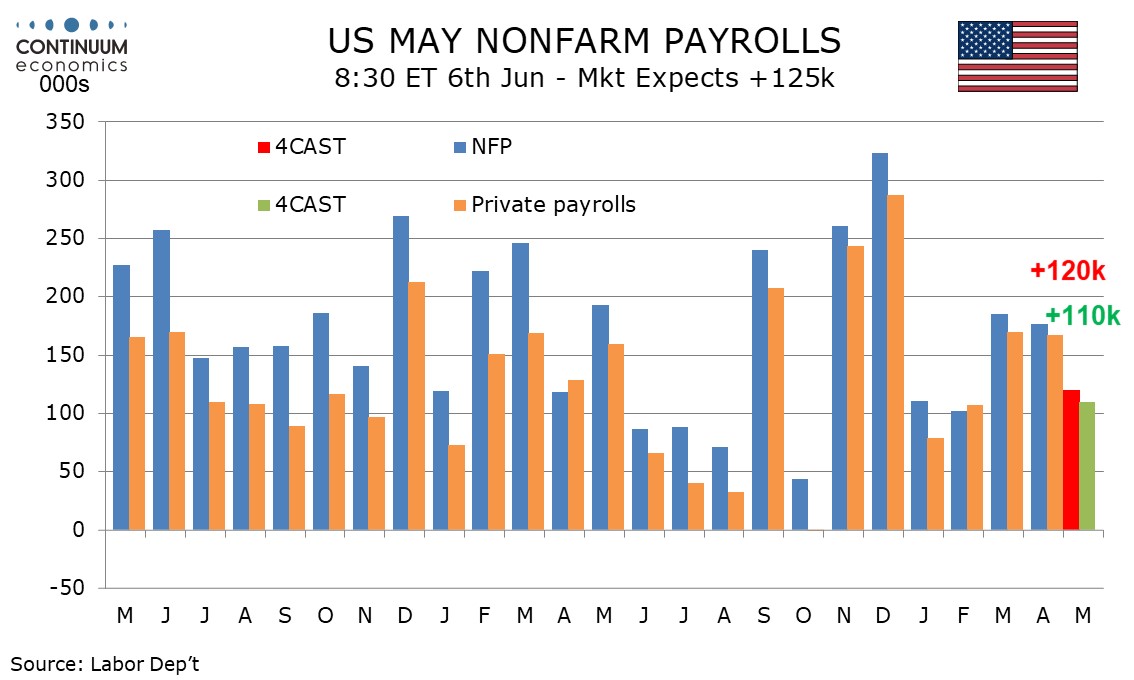

Some likely slowing for U.S. May Employment

Consensus to hold in June for Bank of Canada

China Banking Problems

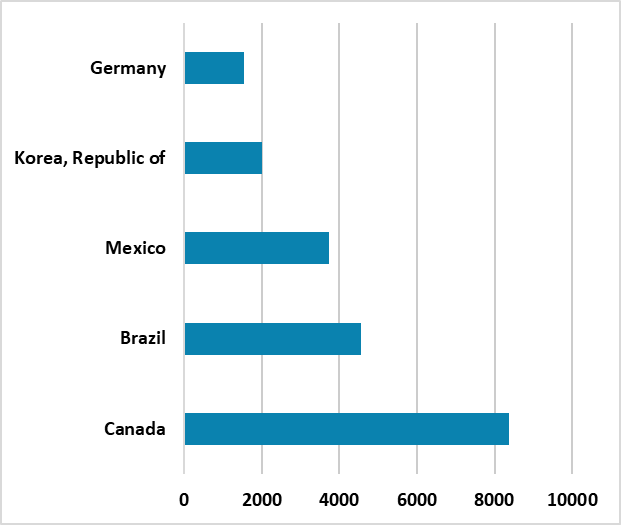

Figure: Top 5 Importers of Steel to U.S. (USD Mlns)

President Trump announcement of 50% steel and aluminium tariffs from June 4 reflects his well-known protectionist views of the U.S. steel industry and the intent to rebuild the industry. However, the wider context is that it reflects Trump’s desire to show that he is still in control after the US court of international trade ruling (here). Trump art of the deal involves maximum threats in negotiation, which needs to be backed up occasionally with action. This negotiating pressure has been undermined by the court ruling and uncertainty in the U.S. whether the Supreme court will uphold the original ruling or side the president. By imposing 50% tariff swiftly, Trump can claim that he is still in control and that countries need to do trade deals with him or else the situation will get worse.

This is high risk negotiations, but Trump likely feels cornered and has to show he can still take action. Section 301 takes too long and section 122 (up to 15% for 150 days) may be a card that the Trump administration plays if the Supreme court rules against reciprocal tariffs. The Trump administration is also trying to pressure China by claiming that the trade truce is being undermined by China, with USTR Greer indicating the real concern is that rare earth metals exports from China are not back to normal – a Trump focal issue. If the U.S. court of international trade original ruling is upheld, then the U.S. would lose the 10% reciprocal tariff but also the 20% fentanyl tariff. The countries most hit by the increase from 25% to 50% are Canada, Brazil/Mexico on steel. Trump will likely view this as an opportunity to negotiate again with Canada and Mexico for a better USMCA.

We expect a 120k increase in May’s non-farm payroll, with 110k in the private sector, slower than seen in March and April but stronger than what may have been weather-restrained months in January and February. We expect a slightly stronger 0.3% rise in average hourly earnings and an unchanged unemployment rate of 4.2%. Initial claims have edged up in May but by the time of the payroll survey week (two weeks before the latest initial claims data) the increase was only marginal. Weakness in ADP data should be taken cautiously, with payrolls unlikely to show the latter's weakness in education and health, which has been leading recent payroll gains. However payroll seasonal adjustments in May assume strong hiring and that could bring some downside risk to seasonally adjusted data.

A rise of 120k would be consistent with the low of the 6-month average seen in October of 2024. Four months in 2024 saw gains of less than 100k and with the economy showing signs of slowing a more significant slowing than in our forecast is not to be ruled out. We would however need to see a negative month to give a warning of recession. The household survey, which calculates the unemployment rate, showed strong gains in both the labor force and employment in March and both series could be vulnerable to a correction. We suspect employment will underperform the labor force, but not by quite enough to lift the unemployment rate, which was 4.185% in April before rounding, above 4.2% after rounding.

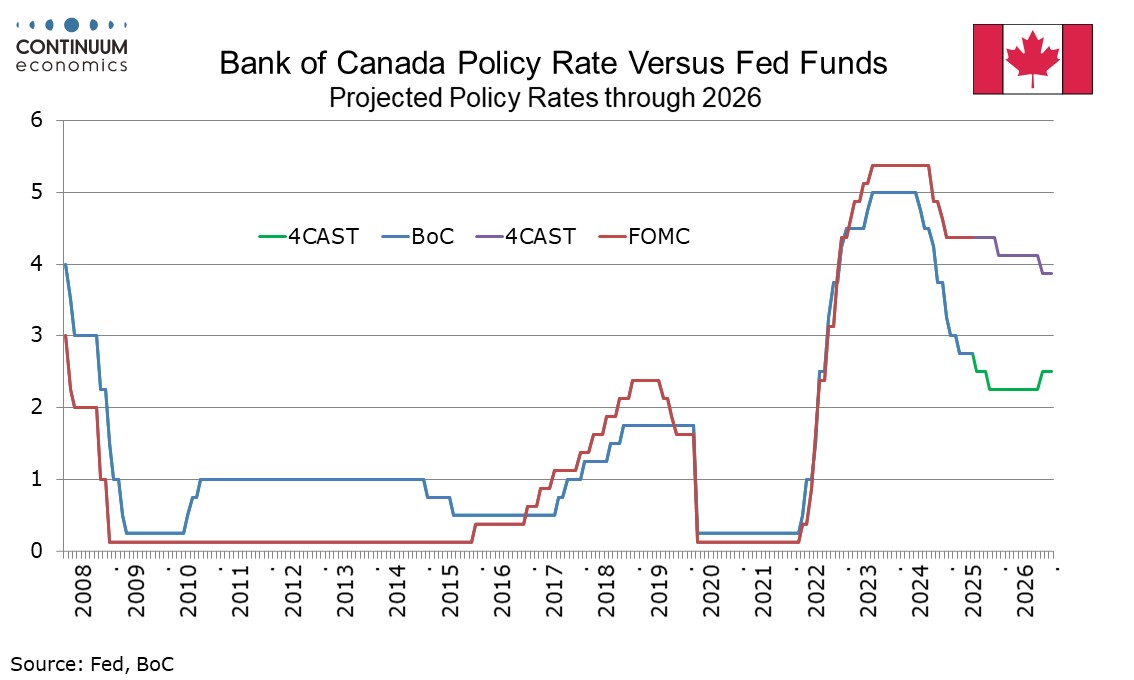

Governor Tiff Macklem stated that the Bank of Canada’s decision to leave rates unchanged at 2.75% was a clear consensus. There was more diversity of views on the path forward, though members thought there could be a need for easing, depending on data. We now expect two further easing in 2025, in July and October, which would take the rate to 2.25% at year end. Expectations had moved away from a June easing towards a June hold after stronger than expected April CPI and Q1 GDP data. Macklem noted those releases in the decision to keep policy on hold as more information on US trade policy and its impacts is awaited.

Of the two releases, the CPI appears more significant. While the overall CPI fell to 1.7% in April as the consumer carbon tax was estimated inflation excluding taxes of 2.3% was stronger than expected and up from 2.1% in March. The BoC’s measures of core inflation moved higher too. This suggests that underlying inflation could be firmer than thought, while Macklem said it is too soon to see the direct effects of retaliatory tariffs in the inflation data. CPI data for May, on June 24, and June, on July 17, will both be available before the BoC next meets on July 30. If the data provides relief, the BoC would be likely to ease. Deputy Governor Carolyn Rogers suggested a firmer CAD could be helpful.

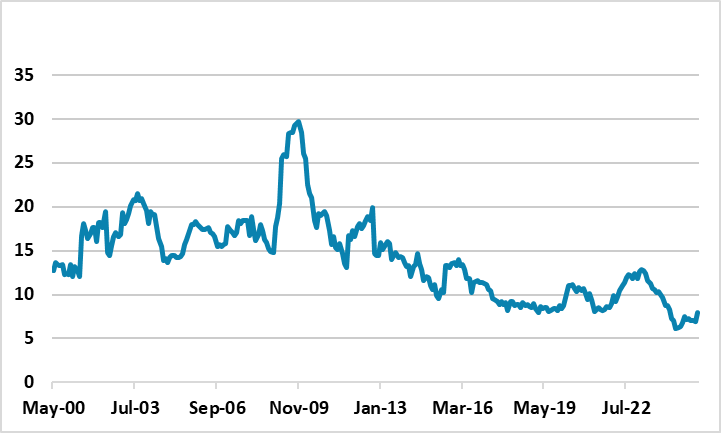

Figure: China M2 (Yr/Yr %)

China is suffering a credit demand problem from households overexposed to property and private businesses that are cautious. Meanwhile, the latest IMF banking stress tests shows sections of the banking system remain weak and this is restraining lending. We remain watchful of money and credit trends, but remain concerned that money supply growth is insufficient to achieve 5% real GDP growth and we still look for 4.2% GDP growth. China M2 growth has picked up recently (Figure ), as the residential property market has become less adverse; the government has injected Yuan500bln equity capital into the largest state owned banks and the government has provided a 5 year Yuan10trn debt swap for local government and LGFV’s. However, we would prefer to see close to 10% M2 growth to be confident of 5% real GDP growth, given the normal relationship between M2 and real GDP.

China has a credit demand problem. Firstly, though the situation is becoming less acute in the housing sector, sentiment is still weak with a multi-year overhang of property; declining house prices and shaken confidence in builders. This will take year to repair, alongside household overall desire to not increase debt burdens. Secondly, private sector companies are less willing to invest than the 1990-2019 period, both due to economic volatility and a lingering sense that China authorities do not favor the private sector – the 2021-22 crackdowns are fading, but the authorities are still not fully pro-business. Thirdly, LGFV’s weak debt is massive due to poor investment decisions. The latest IMF FSAP in April 2025, estimated that 39-45% of debt was in trouble. The IMF has not taken account of the Yuan10trn government debt swap that largely deals with the weak LGFV problems, but this scales in over 5 years and weak LGFV’s may not quickly switch from paying debt down to new normal borrowing.