This week's five highlights

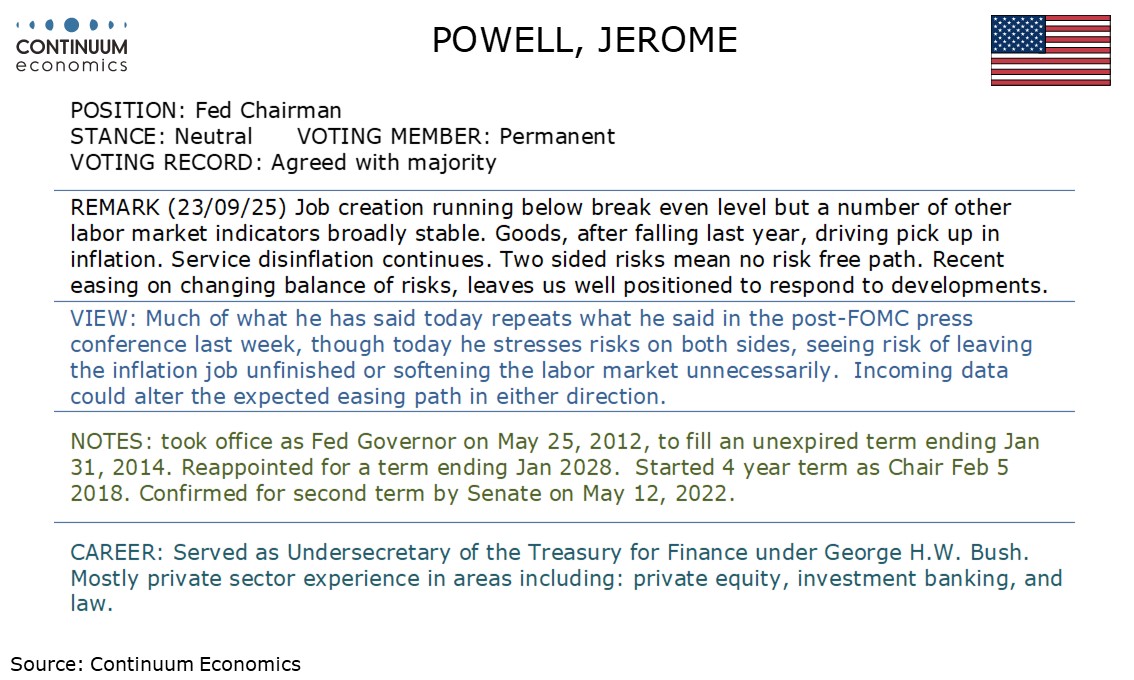

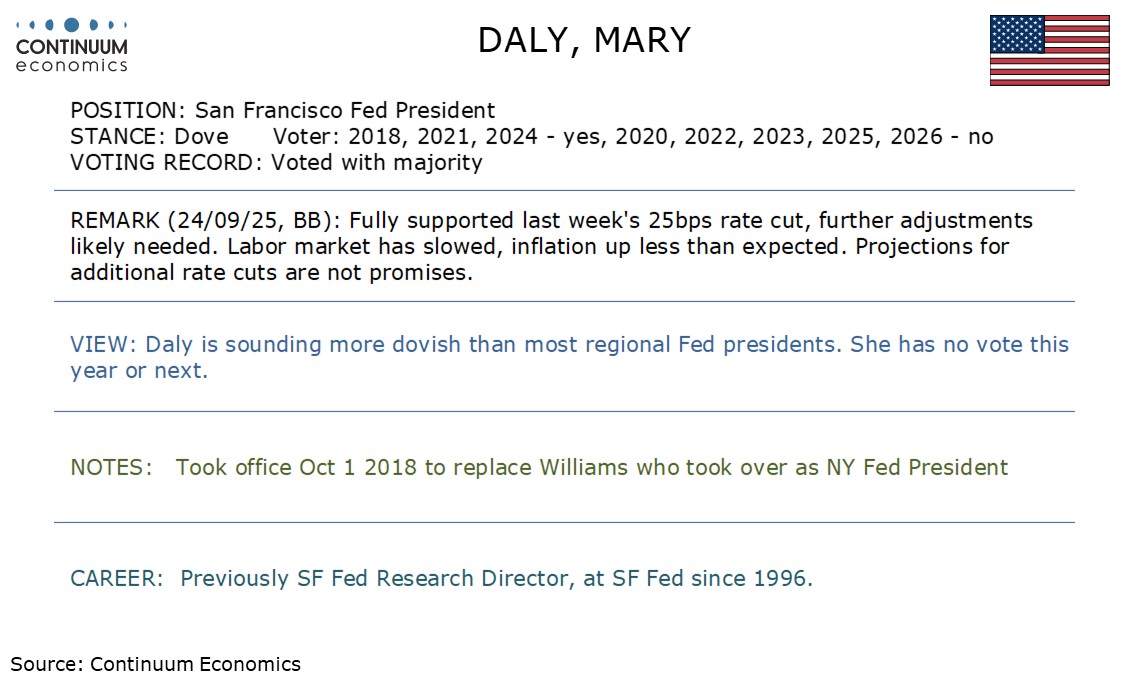

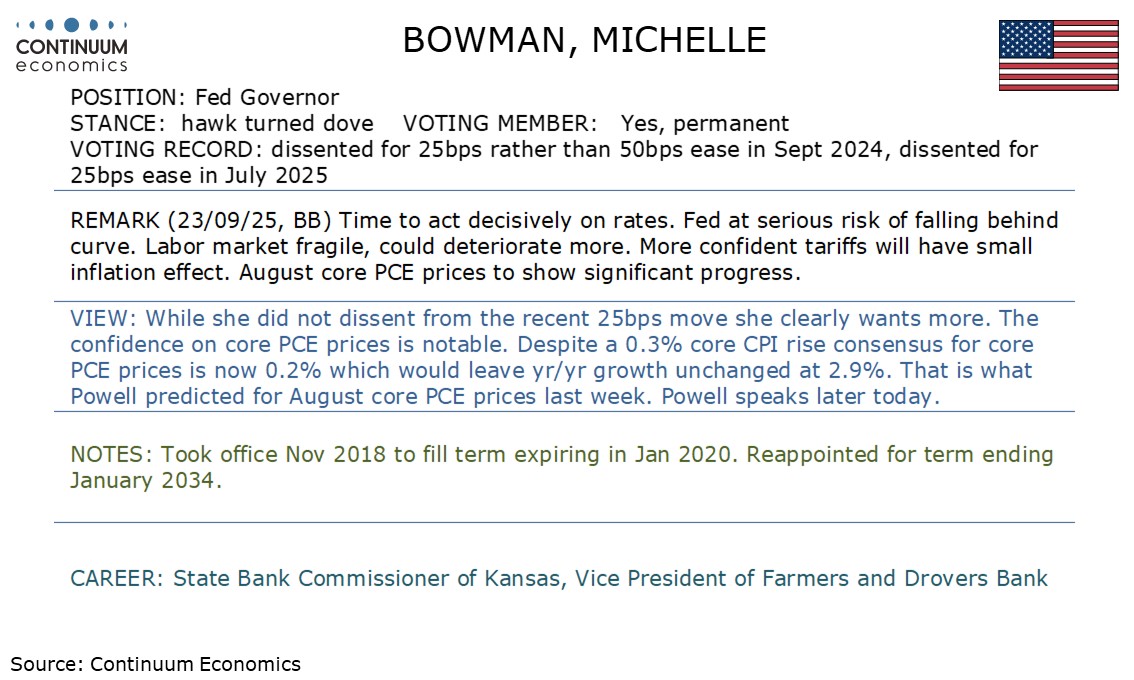

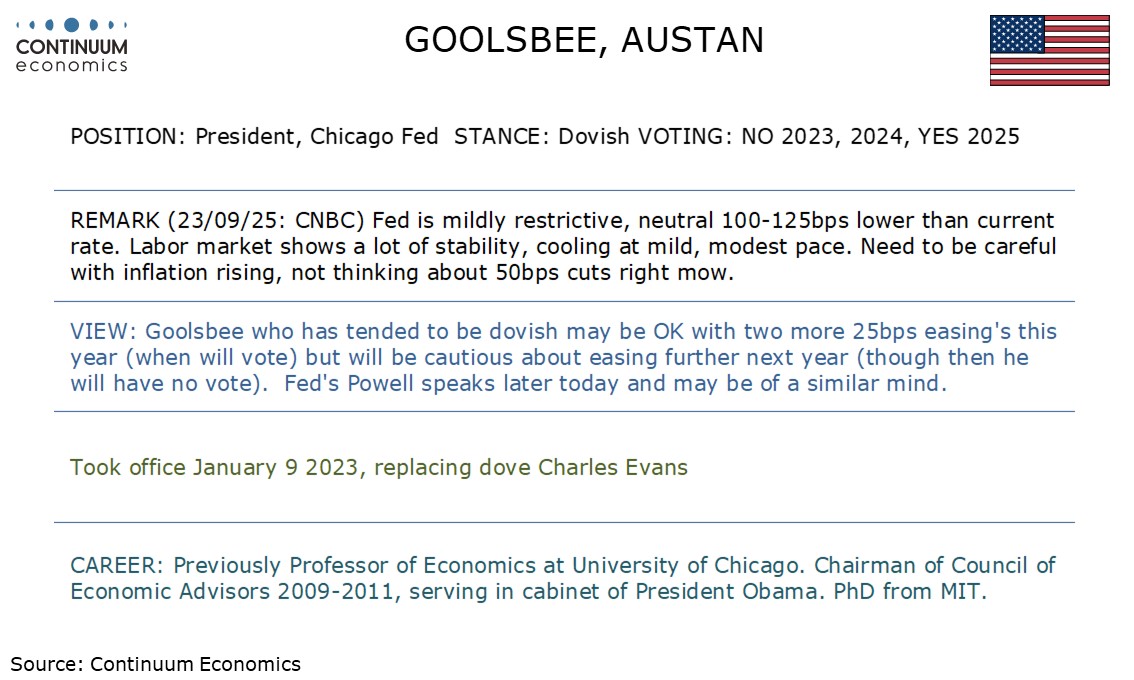

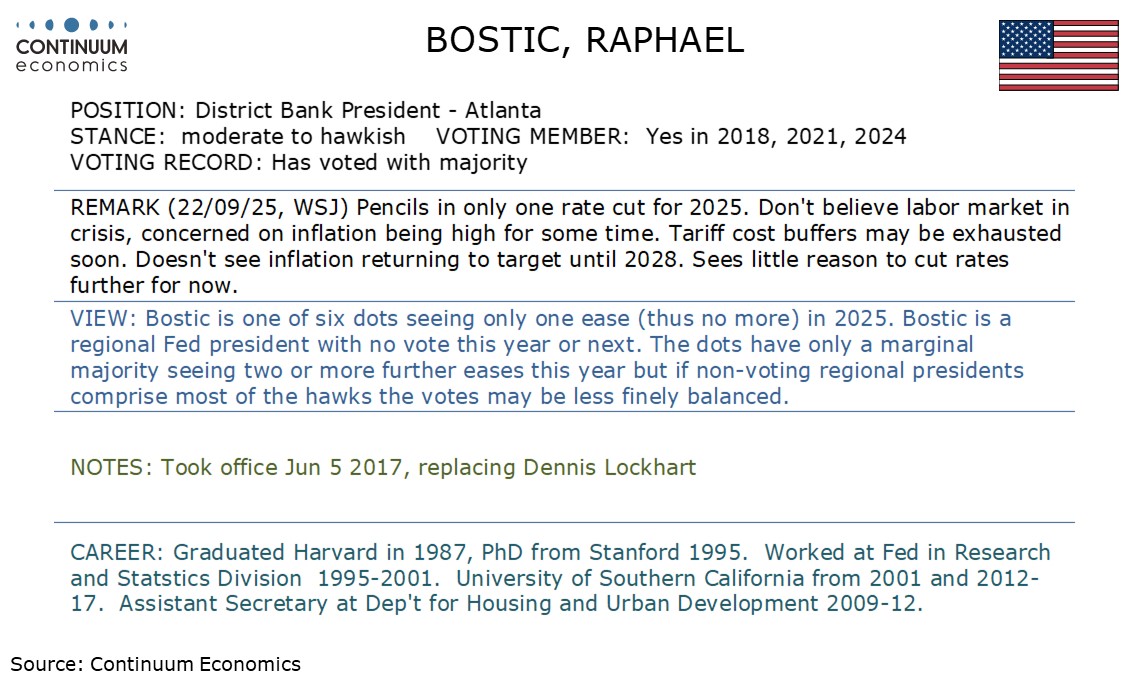

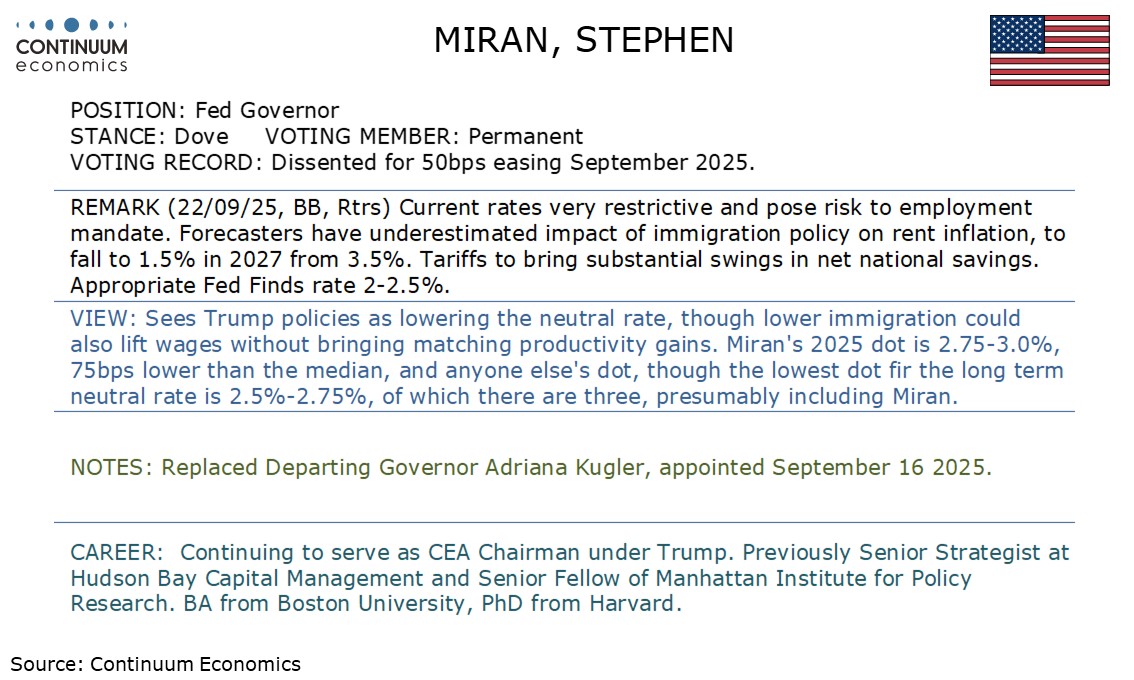

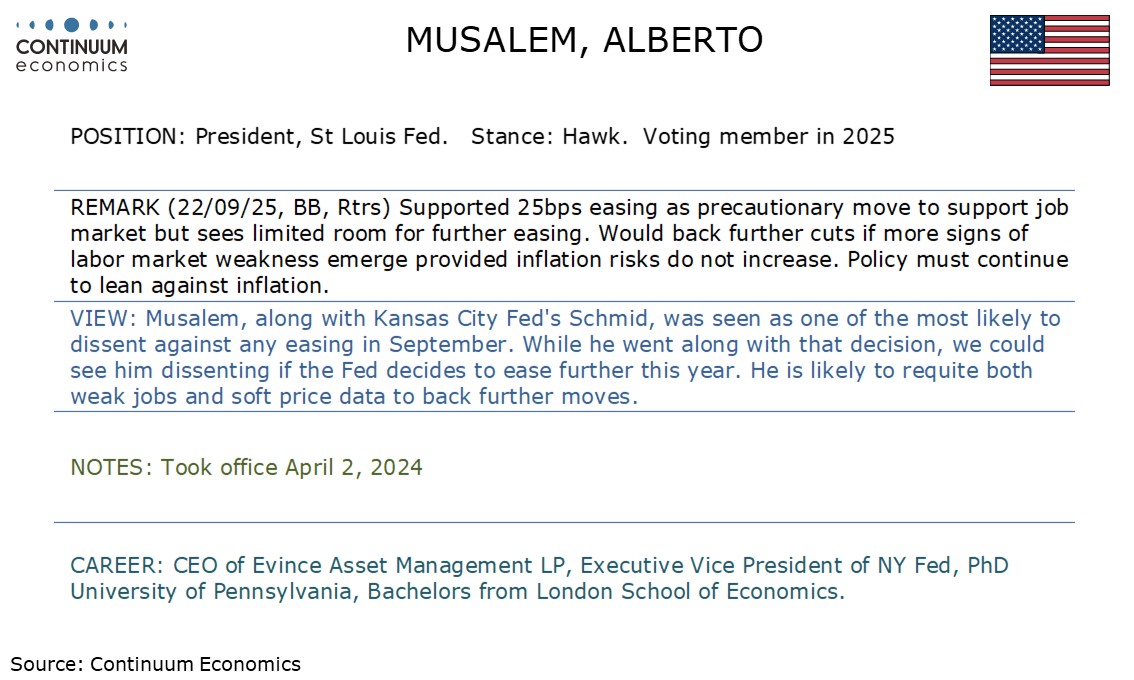

This Week's Fed Speakers

U.S. Initial Claims, GDP revisions, Durables and Trade all stronger than expected

No Deadair For Trump

SNB Staying at Zero

Riksbank Delivers Final Rate Cut

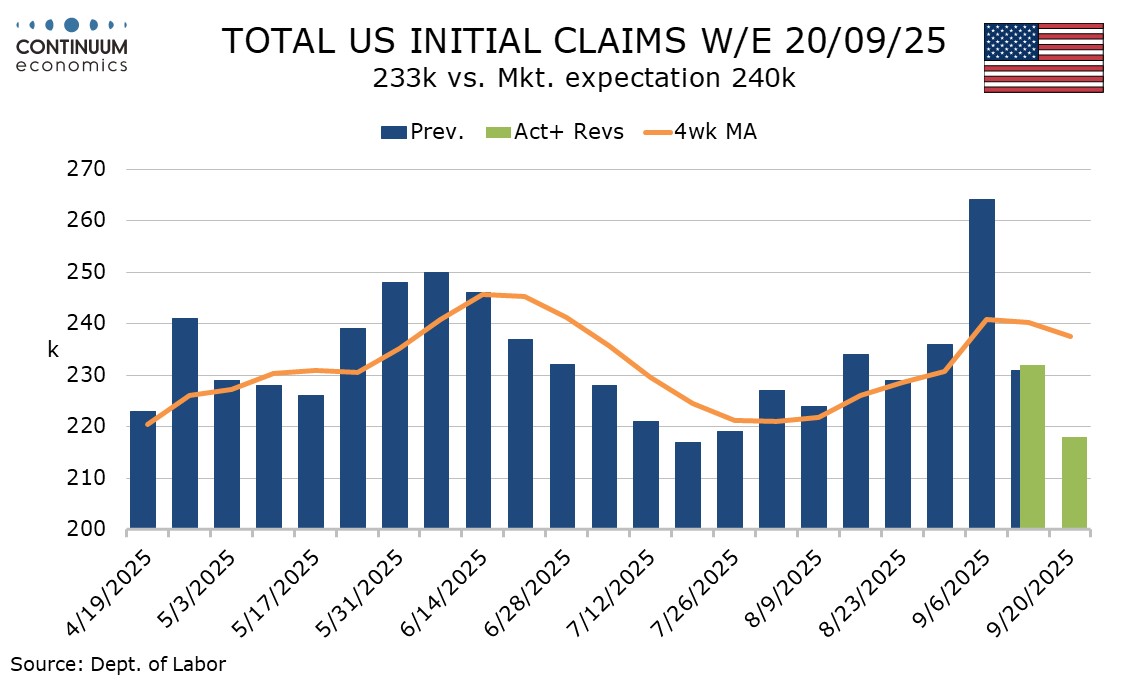

The latest set of US data is clearly on the strong side of expectations, with Q2 GDP revised up significantly to 3.8% from 3.3%, August’s advance trade deficit falling to $85.5bn from $102.8bn, August durable goods orders rising by 2.9% with a 0.4% increase ex transport, and initial claims falling to 218k from 232k. The initial claims total is the lowest since July 19. The data covers the week after September’s non-farm payroll was surveyed, and the latest low figure can be seen as an offset for a high total of 264k two weeks ago in the week that included Labor Day.

The 4-week average of 237.5k is down from 240.25k last week, the payroll survey week, but still above the 226k seen in August’s payroll survey week. Continued claims are down by 2k to 1.926m after a 1k increase, though with last week’s marginal rise being the only one in the last five weeks the 4-week average of 1.930 is at its lowest since June and the latest continued claims data covers the September non-farm payroll survey week.

There is no dead air for Trump after his UN speech. While slamming the UN, he also pressed the EU to bear more weight in the Russia-Ukraine war and encourage secondary sanction on those that purchase Russian oil. His stance towards Ukraine also changed as he refer Russia as "paper tiger" on economic turmoil. Despite it seems like a negotiation tactic, more uncertainty awaits in the geopolitical front. And by Friday, tariff man came back on line to introduce potential pharmaceutical, heavy truck, etc... tariffs. Details are still lacking but is enough to give U.S. equities a beat down.

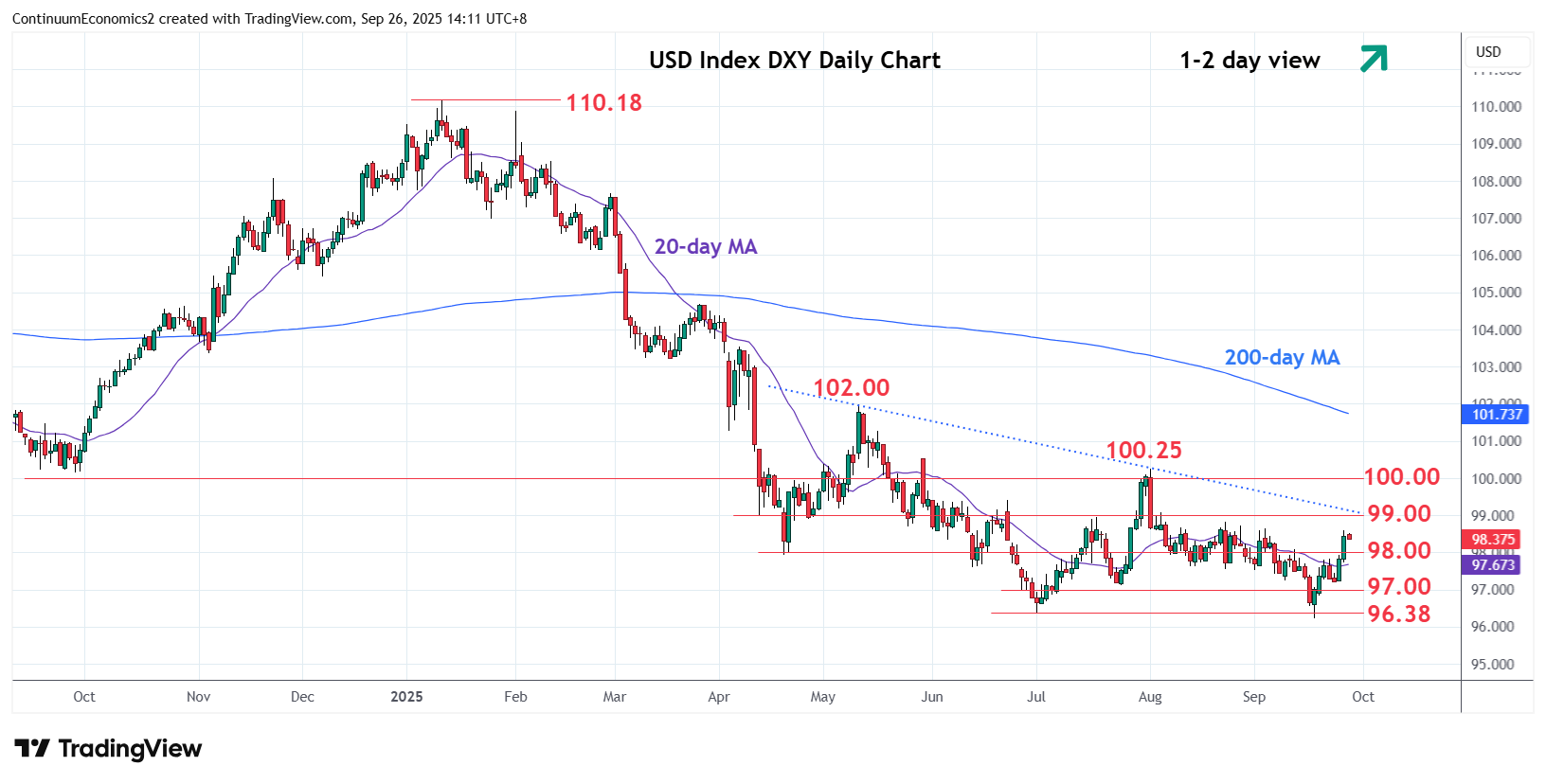

On the chart, the rally to regain the 98.00 level see prices extending gains from the 96.22 low. Bullish momentum from the latter turn focus to 99.00 level. Daily and weekly studies are tracking higher from oversold areas and suggest scope for break here to open up room for stronger gains to retrace the August/September losses. Higher will see room to retest 99.42 June high. Beyond this will expose the 100.00/25 high to retest. Meanwhile, support is raised to the 98.00/97.60 area which should underpin and limit corrective pullback.

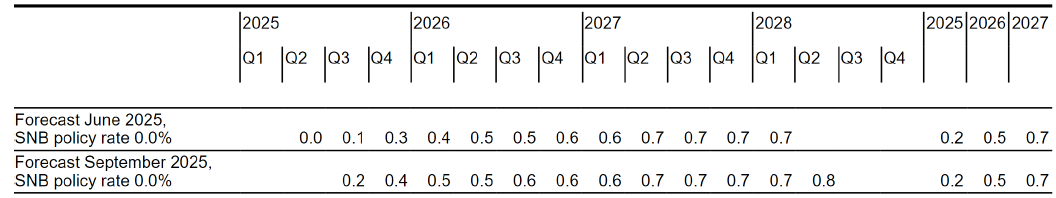

Figure: SNB Inflation Outlook Unchanged

Very much as expected, both in deed and word, the SNB kept the policy rate at zero this month having cut by 25 bp back in June in June. Indeed, markets priced out what was previously seen as a good chance of rates turning negative, even against a backdrop of the punitive tariff scheme the Swiss economy faces and which will damage the real economy and also add to already weak price pressures. Indeed, the SNB now sees 2026 GDP growth at the lower end of the 1%-1.5% range it offered three months ago. While still pointing to possible FX intervention and a continued willingness to adjust policy accordingly, the statement was (probably deliberately) vague about both taking rates below zero and what the consequences would be. Regardless, we point to stable policy out through 2026 at least, with a possible return to zero rates, although the (unchanged) inflation outlook rules against that risk – at least at the current juncture.

The swing back in market thinking has been a result of clear hints from the SNB Board itself suggesting that there is now a high bar for any return to negative borrowing costs because of the adverse impact on savers and pension funds. Indeed, SNB President Schlegel stressed in a recent interview adverse impact of negative rates on the likes of savers and pension funds, going on to warn that doing so may need stronger countermeasures later on, this possibly a result of the fresh pick-up in property prices now emerging. But while the bar may be high it is still there and this effectively does not rule out negative rates, but merely that something not yet considered would have to warrant it

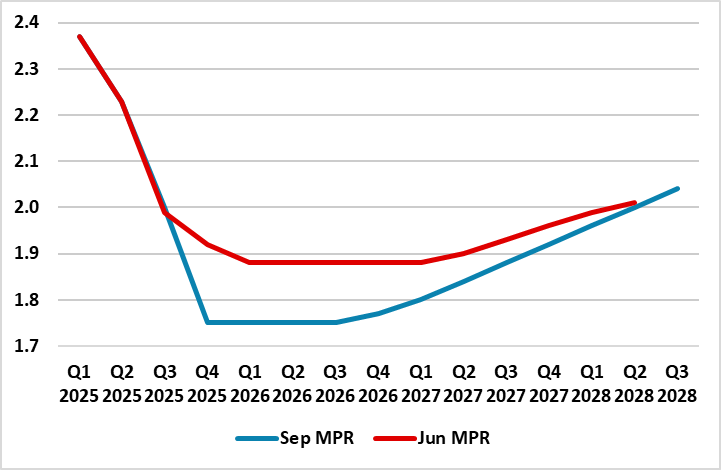

Figure: Updated Riksbank Policy Outlook

Although aware of the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises as well as what now looks to be a clear fiscal loosening, the Riksbank delivered the 25 bp final rate cut we expected. The Board was very clear that no further easing is expected but that rates will stay at this new lower level (1.75%) for some time to come – the projections show a lower rate profile but a slightly earlier policy reversal (Figure). There was one dissent, preferring a deferral of any cut partly on fiscal easing considerations. The rationale is clear; the Board accept that growth and now the labor market have been weak for a long time and any recovery may arrive later, so there is a need to support to the recovery and to stabilise inflation We go along with the Riksbank thinking although it may have to revise any suggestion that the hefty tax cuts dished out into 2027 as the recent Budget envisages will have no inflationary consequences. Regardless, we do not see any looming policy reversal, as we see this projected rate cut to 1.75% staying in place into 2027.