2025 Q1 Country Insights Scores to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. The access to our full range of scores across 174 countries corresponding to the first quarter of 2025 is now available.

The scores file allows for comparison with other periods and ranking for all countries across the headline indicators and are available as easily accessible time series.

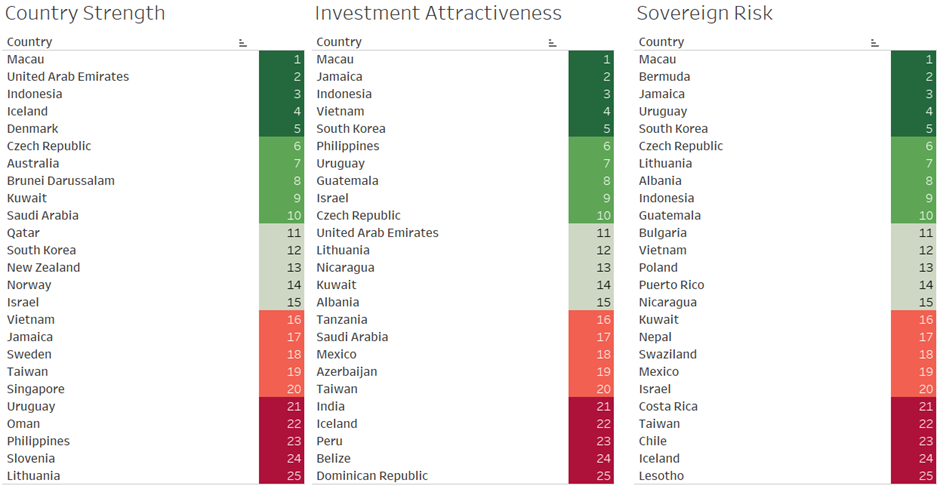

The scores reveal that several countries consistently perform well across all three indexes – Country Strength, Investment Attractiveness, and Sovereign Risk – indicating a strong overall macroeconomic and political environment. Macau is the most notable example, ranking first in all categories, which highlights its exceptional stability and low financial risk. Similarly, South Korea and Indonesia maintain top-ten positions across the board, suggesting they combine robust economic fundamentals with attractive investment conditions and prudent fiscal management. These countries exemplify well-rounded national profiles that are both resilient and conducive to long-term investment.

However, not all countries show such alignment. A divergence between Investment Attractiveness and Sovereign Risk appears in several cases. For instance, Israel ranks high in Country Strength and Investment Attractiveness but falls in the Sovereign Risk Index, implying that despite its innovation-driven economy and political strength, underlying geopolitical concerns might raise investor caution. Likewise, India and Peru are listed among the top 25 for Investment Attractiveness but do not appear as top performers in the Sovereign Risk index, highlighting potential macro-financial vulnerabilities that could impede investor confidence despite their economic potential.

A third trend emerges among countries that demonstrate strong macroeconomic fundamentals but lack equivalent investment appeal. Iceland and Denmark, for example, achieve high ranks in Country Strength but are notably lower in Investment Attractiveness. This suggests that while they may be politically stable and economically sound, factors such as small domestic markets, regulatory constraints, or limited growth prospects may reduce their attractiveness to investors. These cases illustrate that a strong internal environment does not always translate into external investment desirability, emphasizing the multidimensional nature of national competitiveness.

Figure 1: Country Insights Rankings

Source: Continuum Economics

See Article Resources (below) to access the full range of scores.