This week's five highlights

No Ceasefire Agreement from Trump-Putin Summit

Slow Progress for U.S./China Trade Deal

Riksbank Still Flagging Final Rate Cut

RBNZ Guidance with Dovish Surprise

UK CPI Pull Even Higher by Special Factors

U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next in Ukraine as Trump mentioned Moscow had offered to freeze most of the front lines in Ukraine in exchange for Kyiv withdrawing from the eastern regions of Donetsk and Luhansk while Putin signaled no movement in Russia's long-held demands, which also include a veto on Kyiv's desired membership in NATO. Ukraine President Zelenskyy is now scheduled to meet with Trump on August 18 while we feel the summit had left Ukraine feeling uneasy since it is now obvious that Ukraine will lose some parts of its land to Russia, Russia will likely secure no NATO membership for Ukraine and Crimea will stay as Russian soil. We think the chance of U.S. implementing secondary tariffs on Russia oil buyers is now very low since this would signal the failure of Trump’s efforts to reach a deal and will discourage Russians to get to the table again to discuss a deal. Current situation signals a prolonged negotiation process taking months for sealing a full-scale peace deal since ensuring and finalizing concessions will take time.

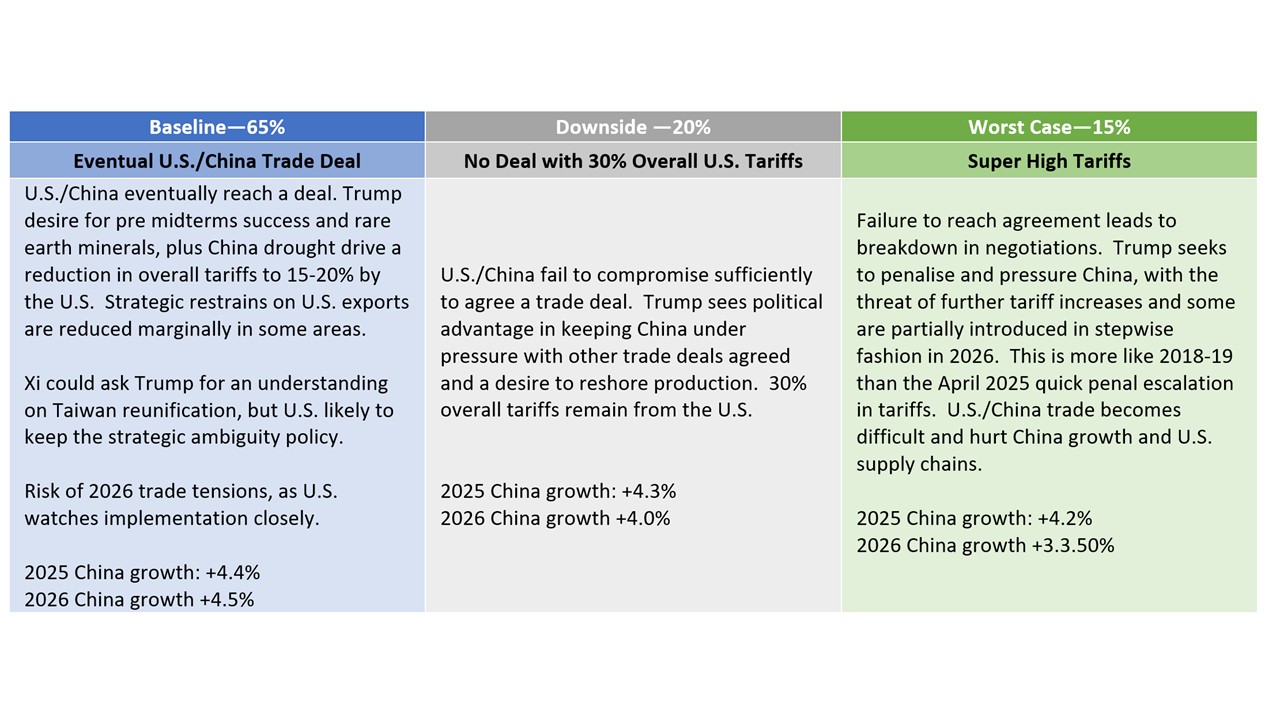

Figure: U.S./China Trade Scenarios

Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or failing (Figure 1). Taiwan and China desire for concessions could prove sticking points.

The second extension of the U.S./China trade truce to November 10 stands in sharp contrast to the 50% tariffs on Brazil and India and the 30% tariff on S Africa in terms of recent actions (here). The threat of secondary tariff over Russian oil is also receding for now, though it is noticeable that the U.S. is more interested in punishing India more on this matter. China is however still operating with 30% across the board tariff. What are the prospect of a U.S./China trade deal?

On balance, we still attach a 65% probability to a U.S./China trade deal being reached, though the odds of a Q4 deal are now down to 50%. U.S. President Trump is keen to reach a trade deal with China, both to show success before the November 2026 mid-terms elections and also given China control over rare earth minerals and magnets that Trump is particularly sensitive too. Trump has also softened strategic export controls in the shape of allowing Nvidia to start exporting high end semiconductor chips to China. Finally, large investment in the U.S. like the EU or Japan/S Korea trade deal are reported not to be required by the U.S. negotiating team. For now, the U.S. team wants to smooth the way towards a trade framework deal potentially by the expected bilateral meeting between President Trump and Xi at the APEC meeting October 30/November 1 in S Korea.

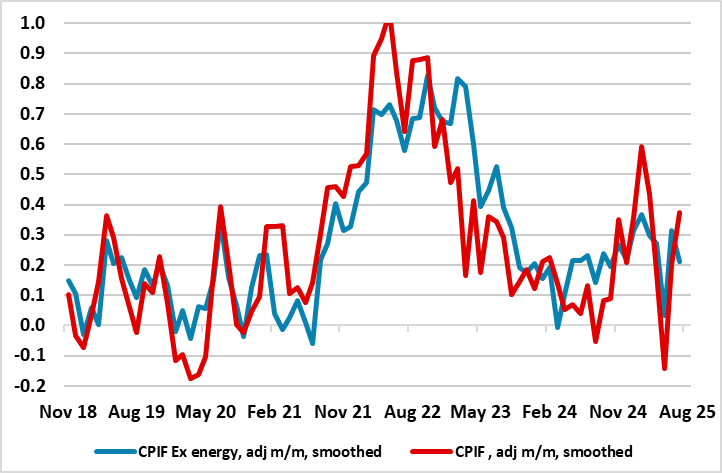

Figure: Adjusted Core Inflation Volatile but Consistent with Target

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we think that the flagged rate cut may materialise by the time of the next meeting in September, taking the policy rate to new cycle low of 1.75%. And with both real activity and adjusted CPI data having delivered downside news and surprises, the rationale as well as scope is there for such a move as it all points to and reflects what may be marked spare capacity in the economy. Indeed, despite the July CPI pick-up, underlying inflation pressures, while volatile, still seem to have fallen at least to levels consistent with the 2% target (Figure). As a result, we do not see any looming policy reversal, as we see this likely rate cut to 1.75% next month staying in place into 2027!

After the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0% in June, the Board then suggested that a further move is possible and did so again after this month’s decision. Implicitly, it seems that the flagged rate cut would have occurred this time around were it not for the CPI spike seen in the July data. Admittedly, and as the Board acknowledges, that spike is almost certainly a reflection of temporary factors, most notably energy price swings, alongside what may be a more sustained but far from demand-driven recent tripling in food inflation. To us, the underlying picture is reassuring as seen in the ex-energy CPIF measures (Figure ) is still consistent with target and this is despite the impact on this measure of food inflation now running at over 5%. Indeed, the Board view this time around backed up such a picture, suggesting that ‘several indicators support the view that inflation will fall back to target going forward’. But the Riksbank’s infamous caution seemingly won the day this month with it purporting that ‘the unexpectedly high inflation calls for vigilance’.

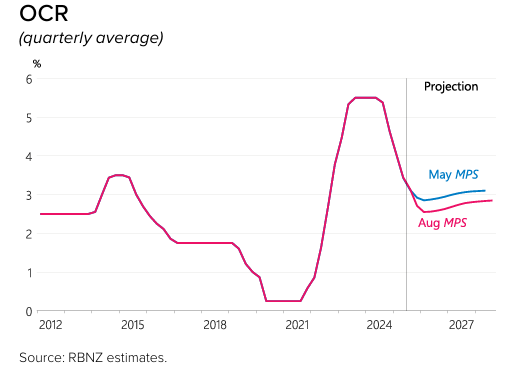

The RBNZ cut its cash rate by 25bp to 3% in the August meeting, revised OCR forecast to indicate more rate cut in 2025 and keep terminal rate below 3% throughout 2026/27, along with slight revision in the inflation forecast. The move was read as dovish with a 4-2 vote, some members were discussing a 50bps cut in the August meeting.

Some key takeaways:

More Cuts to Come: The August OCR forecast see a revision from the May forecast and see two more cut in 2025. OCR forecast seems trough rate at 2.55%, confirmed by RBNZ governor Hawkesby. By September 2025, the OCR is now forecasting one more cut, almost two more cut by September 2026.

Inflation Expectation: The RBNZ sees headline CPI to be higher by September 2026 at 2.2% from the 2.1% May forecast. There seems to be more clarity from the Trump's tariff end and the RBNZ is able to assess its impact towards inflation better, making them more comfortable in easing.

Dovish Forward Guidance: The RBNZ committee voted 4 to 2 for the 25bps cut, citing discussion of 50bps. While they cited data dependency, they are foreseeing a further moderation in inflation with spare capacity, thus seeing two more cut in the rest of 2025.

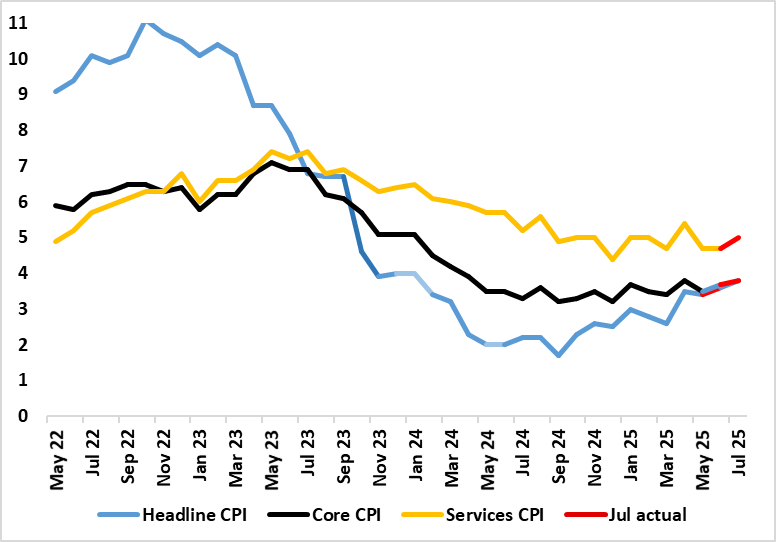

Figure: July Inflation Boosted by Services?

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in line with BoE thinking, and seemingly reflected several special factors (airfares and hotels) as does the notch rise in the core rate but that does not mean it mean it will not trouble the MPC even further, not least the hawkish contingent. Even so, the inflation rise is far from broad as it reflected upward contributions from four (of 12) divisions, partially offset by downward contributions from six divisions. With the headline rate likely to rise toward 4% by the time of the key November MPC decision, a further BoE rate cut at that juncture will need clearer real activity weakness – which we do envisage!

The 0.1 ppt increase in the headline rate reflected upward contributions from four of the 12 CPI divisions, partially offset by downward contributions from six divisions. The largest upward contribution came from transport, particularly air fares. This was partially offset by a large downward contribution from housing and household services including a clear slowing in rental inflation, was influenced by an unusual timing of school summer holidays. The rise in the annual rate also reflected a large upward effect from motor fuels and also hotels, the latter also possibly influenced by unusual factors.

Food price inflation which picked up to an 18-mth high of 4.9% may be a growing concern for the BoE both for its impact of spending power and on inflation expectations and wage demands. The question is whether this may be a poor UK harvest or shops passing on recent NIC hikes. But real economy and labor market weakness, allied to fiscal concerns, may soon be as big worries for the BoE.