This week's five highlights

Court Ruling Affects Trump Reciprocal and Fentanyl Tariff

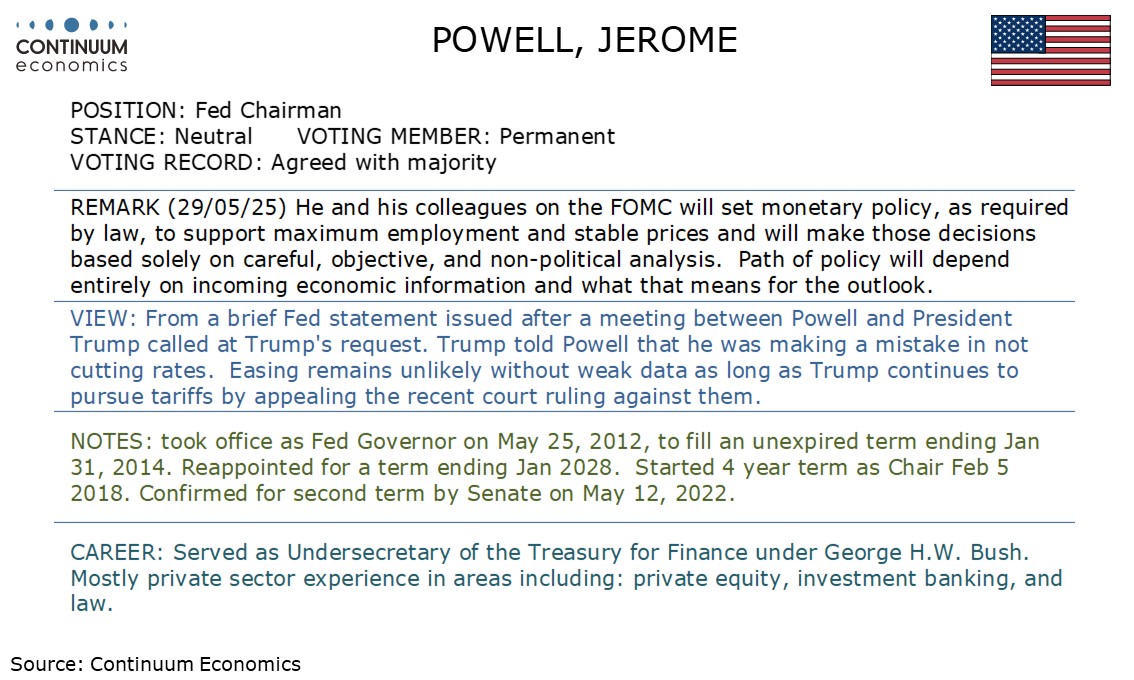

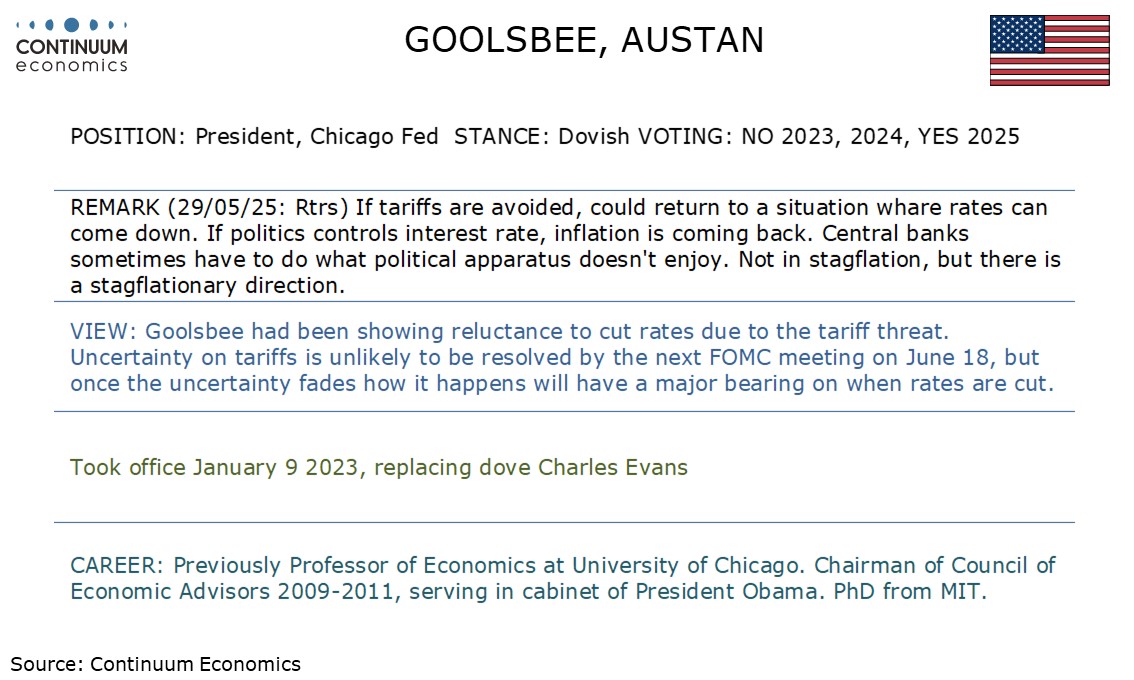

Fed Speakers This Week

RBNZ Sees a Turning Point

US Stepped-Up Tariff Threat on Eurozone

USD/JPY Stays Depressed

The U.S. court of international trade has issued a judgement stopping President Donald Trump’s Reciprocal and Fentanyl tariff. The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against countries with large surpluses) to keep up pressure for trade deals.

The Trump administration has already appealed to the Federal court yesterday, but faces a legal problem that the U.S. court of international trade judgement is final and must be implemented in 10 days. The Trump administration will hope that the Federal court passes an amended judgement, but will likely now change tactics for tariff pressure with other countries. In the meantime the effective tariff rate could fall to around 7%.

The judgement does not impact section 232 tariffs for cars, steel and aluminum. This will likely encourage the Trump administration to announce more product tariffs to keep pressure on other countries to do trade deals. A 25% tariff on pharmaceuticals could be first and now the odds have increased again of a 25% tariff on semiconductors and lumber. The administration could also use 301 tariffs as well, but that would require investigation and would take months. Washington experts also note that section 122 allows tariffs of up to 15% for 150 days for countries that have large or serious balance of payments surpluses with the U.S. This could replace reciprocal tariffs for the top 15 countries e.g. China, EU, Japan, India, Vietnam, Taiwan, S Korea.

The RBNZ cut its cash rate by 25bp to 3.25% in the May meeting, revised OCR forecast to indicate more rate cut in 2025 and keep terminal rate at sub 3% after 2026, along with revision in other economic forecast. However, the vote to a cut is 5 to 1 where market participants take that as a more hawkish signal.

The May OCR forecast see a revision from the February forecast and see one more cut in 2025. While the terminal rate in a two year time frame did not change at sub 3%, the estimate now see the lowest rate in 2025 to be below 3%. The RBNZ sees headline CPI to be higher in the first half of 2025 and lower in the first half of 2026. They see the latest tariff shock to be balanced from the demand and supply side. Moreover, the core inflation forecast is seen to ease. The RBNZ committee voted 5 to 1 for the 25bps cut. They have discussed both scenarios of a cut and a hold but is tilted towards more cutting. The forward guidance suggest little commitment for the RBNZ to continue cutting and may remain fluid depending on data. RBNZ Gov. Hawkesby is citing such decision to be a turning point, which further confirms the potential changes to forecast meeting by meeting.

At least within markets there is some relief that President Trump has deferred his ramped up 50% tariff threat from early June to July 9. Unambiguously positive is the fact that a better line of communication, if not rapport, now seems to exist between the U.S. president and EU Commission President von der Leyen, which may help prevent or at least ease political differences ahead. But the fact that EU governments now seem keener to accelerate trade negotiation ignores the political reality of what will be discussed as the U.S. does not seem interested in a deal in which both it and the EU benefit equally but in winning clear concession that are either unpalatable or unworkable for the EU. The question is how much will the EU concede and given the likelihood that further tariffs increases are still likely, whether any retaliatory action leads to further tariffs from the U.S. and a possible stepped-up trade war.

Perhaps the most predictable thing about Trump is his unpredictability, save for his obvious sensitivity to the vagaries of the U.S. bond market. Having initially announced a 20% levy on EU exports to the U.S. on 2 April, but which were halved a week later to allow for time for talks, last Friday, he threatened a 50% rate and from as soon as 1 June. But after what he called a “very nice call” with von der Leyen, Trump has agreed to delay such ramped-up tariffs until 9 July and where EU leaders have expressed hopes for a quick deal to ease if not resolve any trade war. Seemingly, Von der Leyen initiated the call, all the more notable given Trump’s aversion with the EU and his preference of dealing with individual national leaders. In this regard, an EU spokesperson suggested that this reflected a mutual intention to speak to each other. Adding to the clear attempt to ease tensions between the U.S and EU, Italy PM Meloni, who has a more genuine rapport with Trump is reported to be trying to organise a meeting between U.S. and European leaders in early June or at a planned NATO summit on June 24-25. In the meantime, the EU is now underlining its desire for ‘meaningful and substantive talks.

USD/JPY continue to stay under pressure after a relief rally from the court blocking Trump's universal tariff. To be fair, the trend in USD/JPY broadly follow movement in the DXY as there is little impetus from the Japan side. The BoJ have their hands tied with the uncertainty of Trump's tariff but with rising inflationary pressure and the latest change of winds from the attitude of Japanese government signaling a potential compromise for a deal, they got get moving soon. While the pace will be limited, it is not impossible to see a 25bps hike in Q3 2025, yet it is not priced in by market participants and thus little reflection to the JPY, for now.

On the chart, the pair is under pressure following rejection from strong resistance at 146.00/146.55 congestion and March low. Losses through the 144.00 level return focus to the 27 May low and congestion area at 142.10/00 where reaction can be expected. However, bearish structure from the January current year high at 158.87 suggest scope for break to open up the 140.00 low to retest. Meanwhile, resistance is at 145.08 which is expected to cap and sustain losses from resistance at the 146.00/146.55, lower highs.