Published: 2026-01-20T13:13:13.000Z

Chart EUR/CAD Update: Sharp break higher

2

Cautious trade has given way to the anticipated test higher

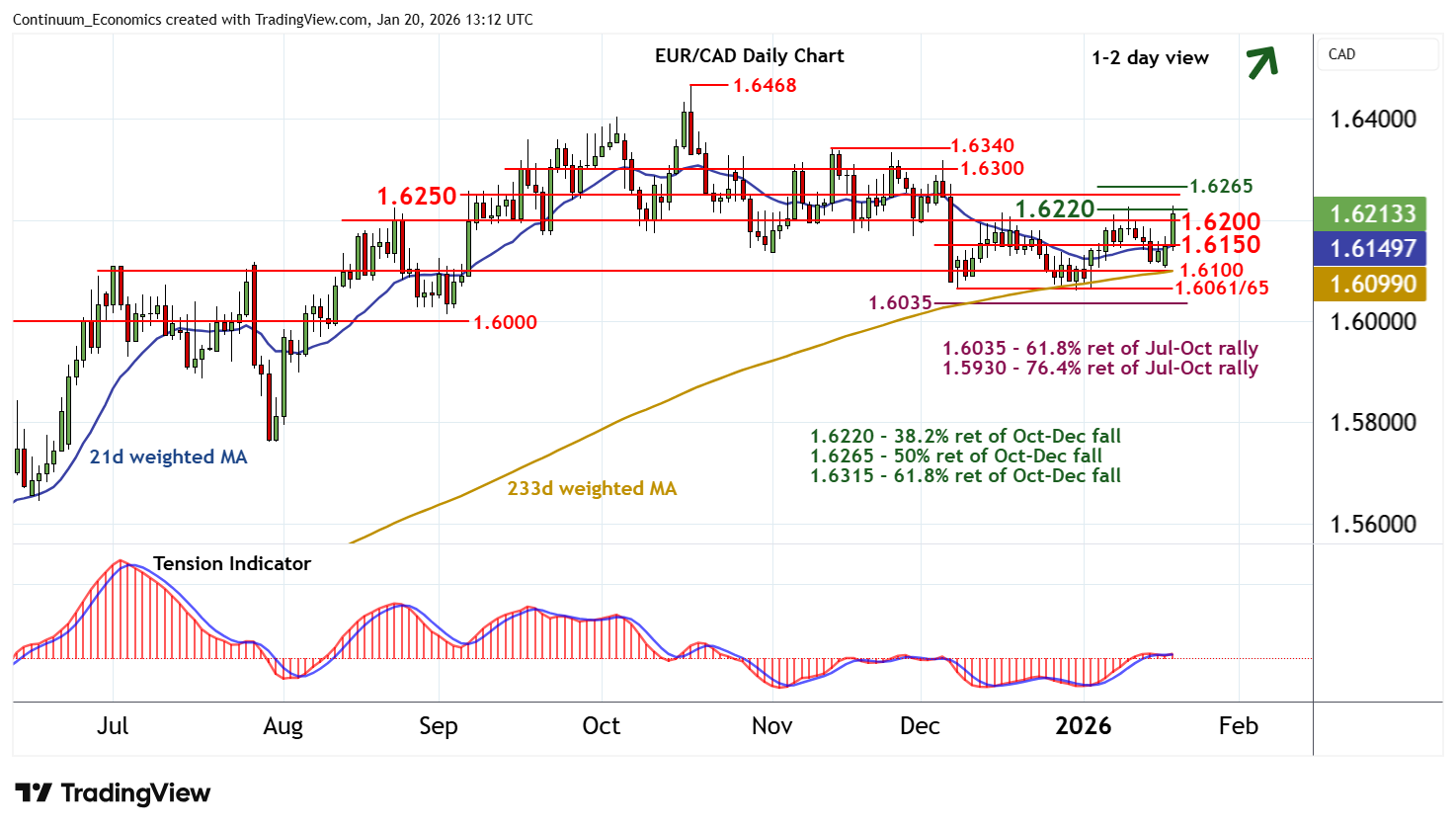

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.6265 | * | 50% ret of Oct-Dec fall | S1 | 1.6150 | * | congestion | |

| R3 | 1.6250 | break level | S2 | 1.6100 | * | congestion | ||

| R2 | 1.6220 | * | 38.2% ret of Oct-Dec fall | S3 | 1.6061/65 | * | 8-31 Dec (m) lows | |

| R1 | 1.6200 | * | congestion | S4 | 1.6035 | ** | 61.8% ret of Jul-Oct rally |

Asterisk denotes strength

12:40 GMT - Cautious trade has given way to the anticipated test higher, as intraday studies continue to rise, with prices currently pressuring resistance within congestion around 1.6200 and the 1.6220 Fibonacci retracement. Daily readings have turned higher and oversold weekly stochastics are unwinding, highlighting room for continuation beyond here. However, the bearish weekly Tension Indicator and negative longer-term charts are expected to limit scope in profit-taking/consolidation towards strong resistance at 1.6250/65. Meanwhile, support is raised to congestion around 1.6150 and extends to 1.6100. This range should underpin any immediate setbacks.