CHF flows: CHF falls on weaker CPI

CHF falls sharply as October CPI comes in below consensus, but declines unlikely to extend far ahead of the US election

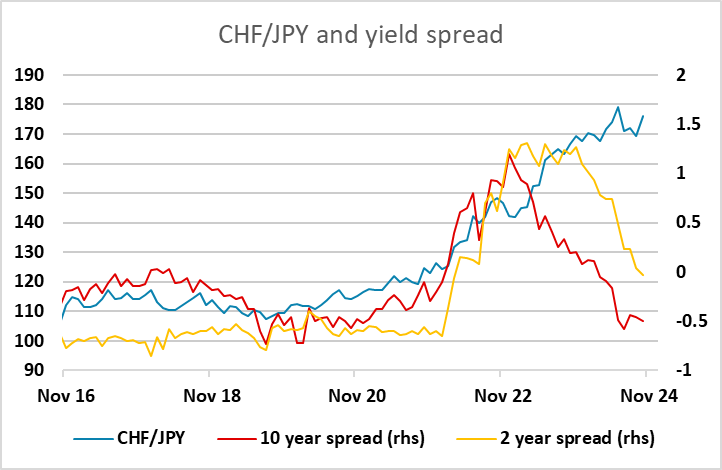

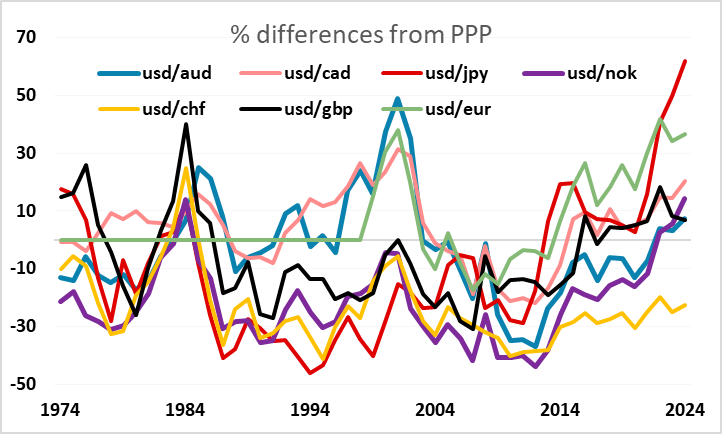

Weaker than expected Swiss CPI has triggered a EUR/CHF move higher this morning. CPI came in at 0.6% y/y against market expectations of 0.8%, and EUR/CHF spiked 25 pips to hit its highest since early October at 0.9429. The CHF remains the world’s most expensive currency, and from a value perspective there is ample reason for the CHF to decline. Yield spreads have also already moved substantially against it, but the CHF doesn’t tend to respond particularly strongly to moves in yield spreads. Rather, it continues to trade as a safe haven, benefitting from rising geopolitical tension, with gains against the EUR usually being most pronounced when there is internal Eurozone tension.

So although yield spreads present a strong case for a weaker CHF, a significant decline remains unlikely this side of the US election. While the SNB have indicated they are on watch to prevent major CHF gains, they are unlikely to drive a significant CHF decline at this stage. It is unclear what US election result would be seen as most positive from a risk perspective. While a Harris victory would represent a more “steady as she goes” view of the US economy, the markets have already priced in some positive equity impact from a Trump victory which would be likely to deliver some corporate tax cuts. So we would anticipate a more positive initial CHF reaction to a Harris win. However, we would still expect the CHF to fall back from current levels in the medium and longer term, particularly against the JPY where the yield spread moves suggest potential for a full reversal of the 50% rise in CHF/JPY in the last few years.