CHF flows: CHF little changed after SNB hold

SNB holds rates but offers no solution to excessive CHF strength

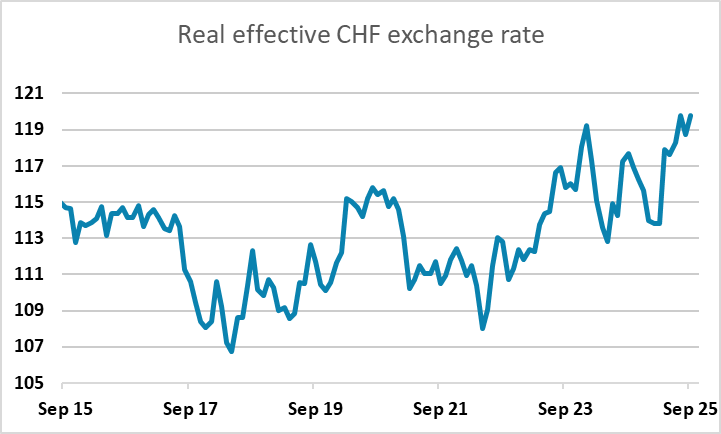

While EUR/CHF initially dipped slightly after the SNB decision to leave rates unchanged, it has subsequently rallied, and still looks to be well supported at 0.93. The SNB’s indication that they are prepared to be active in FX markets is standard, but their concern about the economic impact of tariffs increases the significance of Swiss franc strength. The 39% tariff from the US, on top of the 10 year high in the CHF real effective exchange rate, means Switzerland is an uncompetitive as it has ever been. It is unclear what the SNB might do to alleviate the problem, as all methods to weaken the currency have been tried and failed. Interest rate spreads are already unattractive, and the history of intervention has been mixed at best. While intervention can limit strength in the short run, history shows it risks sharp CHF gains when it is halted. Negative rates are unlikely to be used, and if they are won’t necessarily prevent CHF strength, as no-one is holding CHF for yield anyway. But at some point the persistent strength of the CHF must be challenged. It may be we need o see a Swiss recession for this to happen, At the moment, the latest data doesn’t suggest this is imminent, so although we would expect EUR/CHF to hold above 0.93, don’t expect any sharp gains near term.