This week's five highlights

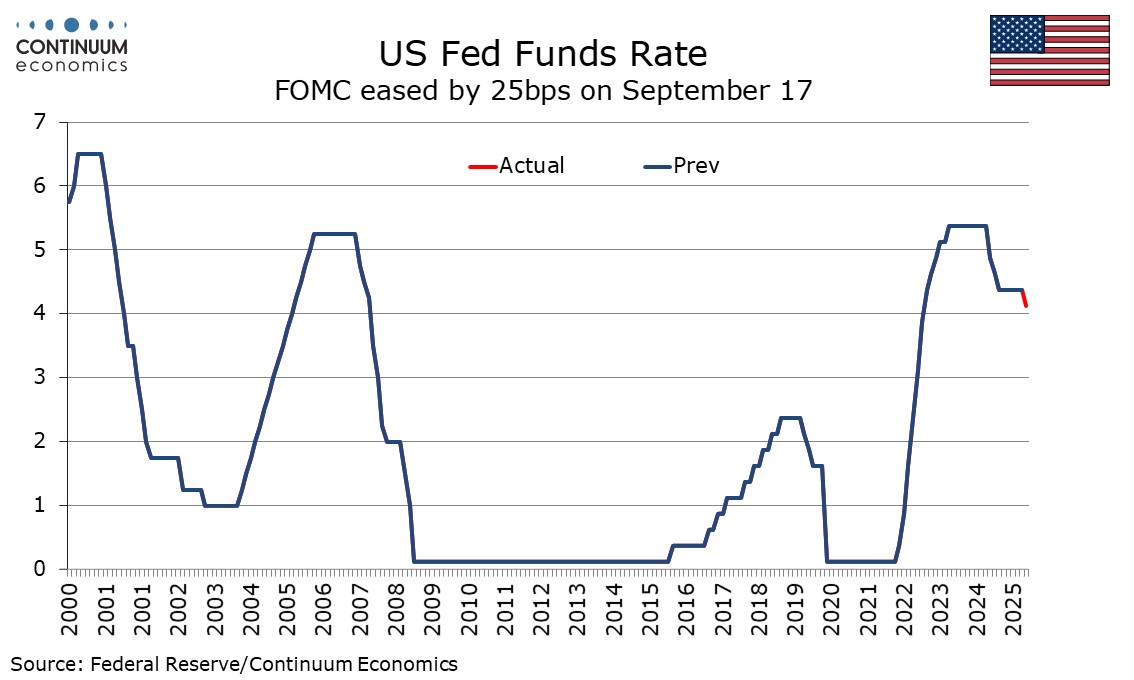

FOMC eases by 25bps, dots see two more 25bps moves this year

BoJ Holding the lines

Guillotine for Gilts after BOE

Clear consensus to ease from Bank of Canada

More Caution But Another Cut Flagged for Norges Bank This Year

The FOMC has eased rates by 25bps to 4.0% to 4.75% with only one dissenting vote, the incoming Miran voting for 50bps. The main story in the dots is that the median sees two further 25bps moves this year rather than the expected one before seeing only one move in both 2026 and 2027, with no further moves in 2028 by when the rate will be near neutral. Nine of the dots are on the median seeing two more moves, with one outlier below, presumably Miran, who wants 125bps in further easing. Two back one more move, six back no more, and one dot, presumably a non-voter, would like to see the latest move reversed. The dots for the next few years are reasonably balanced though only two are actually on the median for 2026.

Despite the more dovish dots, GDP forecasts have been revised higher for 2025. 2026 and 2027 while unemployment has been revised lower for 2026 and 2027. PCE prices have been revised higher for 2026, though unchanged for 2025 and 2027, and seen on target for 2028.

The BoJ has kept rates unchanged at 0.5% in the September 19th meeting with two votes of dissent. It came as no surprise for the BoJ as there is current political uncertainty until the October 4 LDP election. However, current inflationary dynamics are supportive and the clarity from the U.S.-Japan trade front seems to have free the BoJ's hand for some indirect tightening. They have announced the "disposal" of ETFs and J-REIT at approximately 0.05% of trading values in the market or equivalent to "stocks purchased from financial institution". While the beginning date is to be announced, it is the first change to BoJ's holding of ETFs and J-REITs since the March 2024 meeting. While it is not as direct tightening as selling JGB, it is still a kind of shrinking of the bank's balance sheet and drains some liquidity.

Additionally, they have set three principle in selling these asset. They will sell these asset for "adequate prices", avoid incurring losses as much as possible and without disrupting the financial market. They also kept the doors opened by suggesting such pace and magnitude could change in future meeting if the sale did not go well.

There does not seem to be much changes in the bank's rhetoric, in terms of economic development and inflation. BoJ seems to be downplaying headline inflation and attribute the stubborn underlying inflationary figure to long term structural labor shortage. They are seeing such to reach their inflation target in the second part of economic outlook, which is late 2026.

We continue to see an October rate hike of 25bps as inflationary dynamics are supportive and any trade/political uncertainty will mostly dissipate.

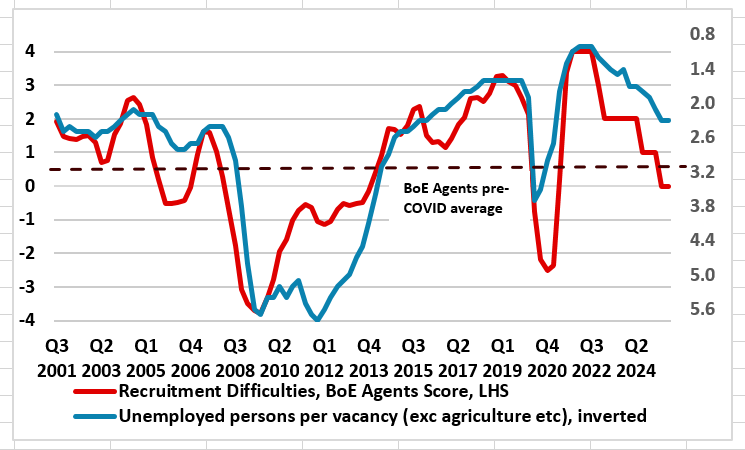

Figure: Labor Market Looser than Pre-Pandemic

That the BoE kept Bank Rate at 4% after this month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MPC majority, was that the MPC adhered to its (conventional) policy guidance, still suggesting that a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate and that policy is not on a pre-set path, but will instead respond to the accumulation of evidence. Otherwise the MPC made its annual adjustment to the QT program, cutting back the overall pans from GBP 100 bln to GBP 70 bln for the year to next October, although this actually means that active sales will rise by GBP 8 bln. The conventional policy outlook remains uncertain given both divergences if current data and great uncertainty about the outlook especially fiscally. But we see still a further circa-75 bp of rate cuts into H1 next year.

The BoE is keen to stress that the restrictiveness of monetary policy has fallen as Bank Rate has been reduced. However, the timing and pace of future reductions in the restrictiveness of policy will depend on the extent to which underlying disinflationary pressures continue to ease. But recently, the MPC majority has hinted that the recent regular pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns, this reflecting the MPC majority’s complacency regarding what we think is a rapidly (not gradually) deteriorating labor market that warrants the further circa-75 bp of rate cuts we have pencilled in into H1 next year. The BoE view is that the ratio of vacancies to unemployment had continued to fall below Bank staff’s estimate of its equilibrium level. But its own (agents) survey data suggest that this has occurred faster and more clearly that (far from authoritative) ONS official labor market data (Figure), this also backed up by BoE survey data regarding employment that chime with the clear y/y falls seen in now fully accredited HMRC payroll figures,

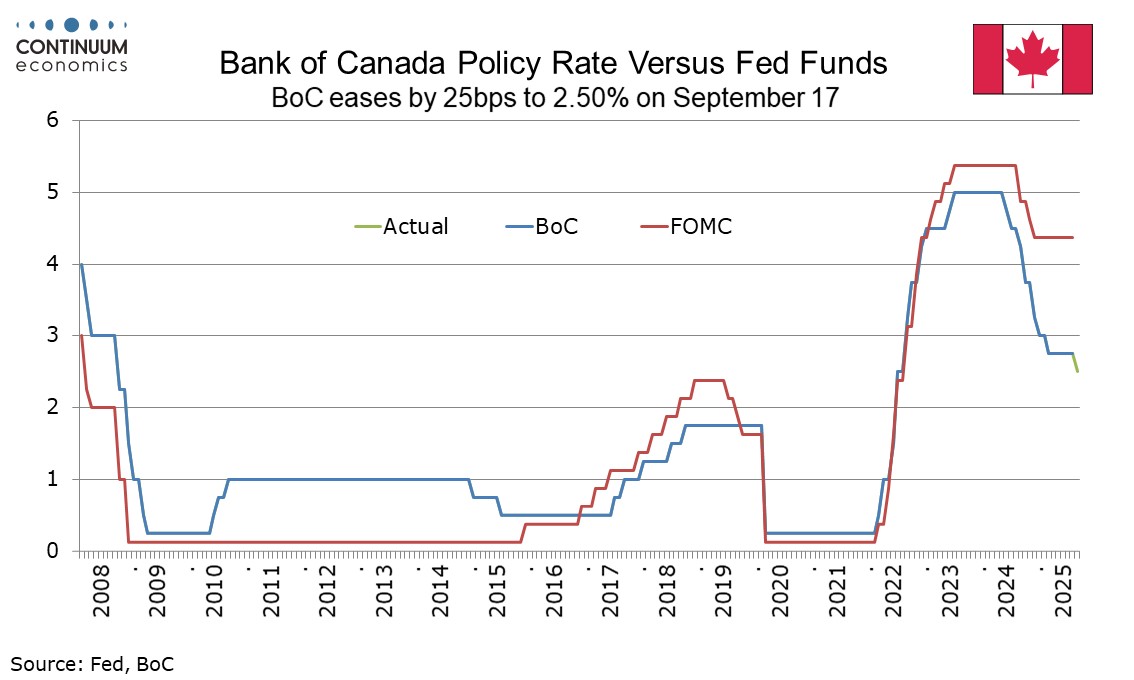

The Bank of Canada’s decision to ease today for the first time since March, by 25bps to 2.50% was as the market expected. We expect two further easings from the BoC, in Q4 of this year and Q1 of 2025, which would take the rate to 2.0%, which is likely to prove the floor. The BoC had a clear consensus to keep rates on hold at its last meeting in July but this time had a clear consensus to ease. Three factors were noted. Firstly, the labor market softening further, with weak employment reports for July and August which more than fully erased strength in June that was fresh at the time of July’s meeting. Sectors sensitive to trade led the job losses. Secondly, while signals remain mixed recent inflationary data suggests underlying inflationary pressures on inflation have diminished. Headline inflation is below target at 1.9% but excluding tax changes the rate is seen as 2.5%. The BoC’s preferred core rates remain near 3.0%, but monthly momentum has faded, with ex food and energy CPI (not one of the BoC’s core rates but a decent guide to the underlying picture) having seen two straight 0.1% gains after seasonal adjustment. Thirdly the removal of most of Canada’s retaliatory tariffs against the US has reduced upside inflationary risk.

The BoC provides little forward guidance, and the BoC states it will continue to assess the risks, look over a shorter horizon than usual and be ready to respond to new information. Policy will be dependent on incoming data and potentially policy developments. Our view is that after a decline in Q2 that was fully explained by net exports Canadian GDP will show a more broadly based subdued picture in the second half of the year, while underlying inflation will continue to move towards the 2.0% target. We expect two further easings, in Q4 2025 and Q1 of 2026, with the next move more likely to come in December than October. In 2026 we expect growth to gradually pick up while inflation stabilizes near 2.0%. We expect that in Q4 2026, the BoC will start to move rates back towards neutral with a 25bps tightening to 2.25%. The BoC sees the neutral range as being 2.25-3.25%.

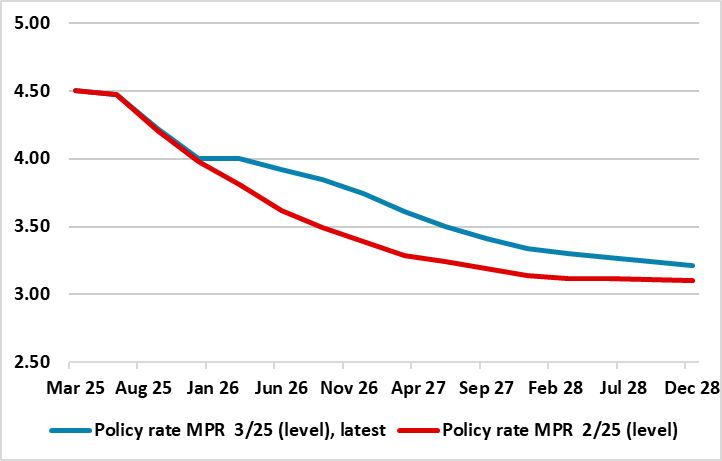

Figure: Revised Policy Rate Outlook

Despite the stronger than expected data seen of late (real and price-wise), as we expected, the Norges Bank cut is policy rate by a further 25 bp to 4.0%, an outcome markets had dithered over. But with a small cumulative upgrade to the real economy outlook and an ensuing reduction in the anticipated scale of an output gap, the Board pared back its projection for the policy rate in the coming years, albeit still flagging a third move for later this year. We think that the Norges Bank is being too cautious and that (on the basis of its own calculations), policy will be very restrictive through the projected timeframe out to 2028 and where we wonder why inflation only just approaches the 2% target by the end of that period, especially as m/m adjusted data already suggest the core rate is around target.

We are a little less confident about the extent of easing into 2026 but see another 25 bp cut likely in December and then every quarter through next year. That would still leave the policy rate roughly in the middle of the neutral rate range estimated by the Norges Bank. In other words, the Norges Bank will be merely taking its foot of the brake, rather than pressing on the accelerator.