This week's five highlights

Japanese PM Ishiba Resigned Under Party Pressure

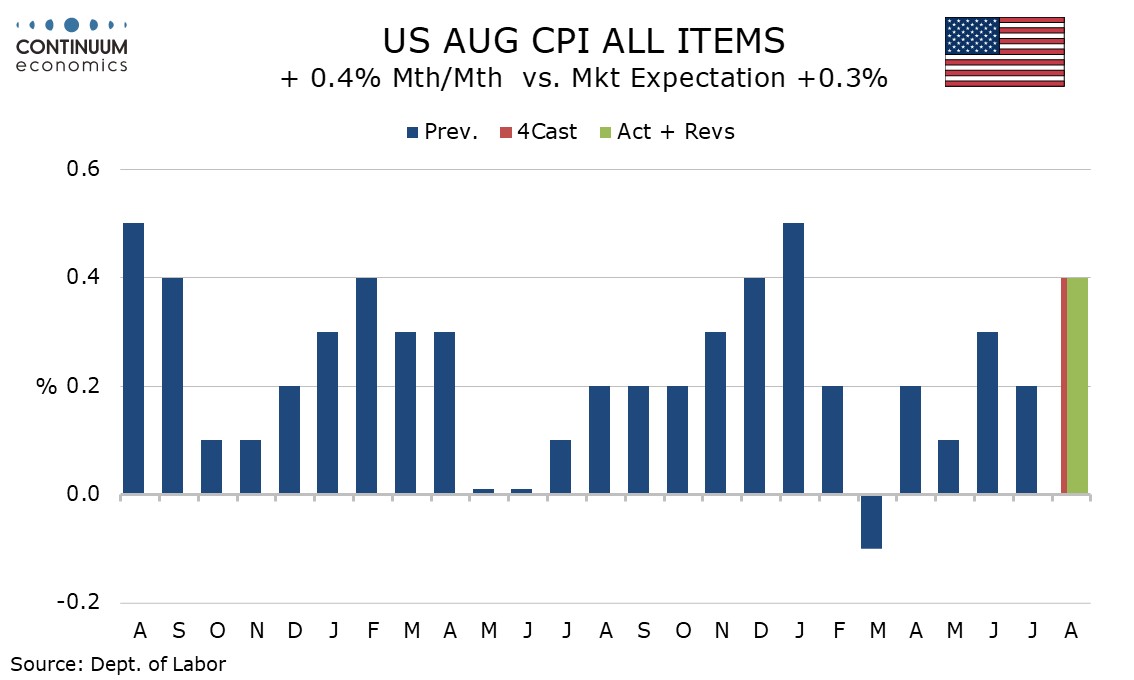

U.S. August CPI firmer than expected

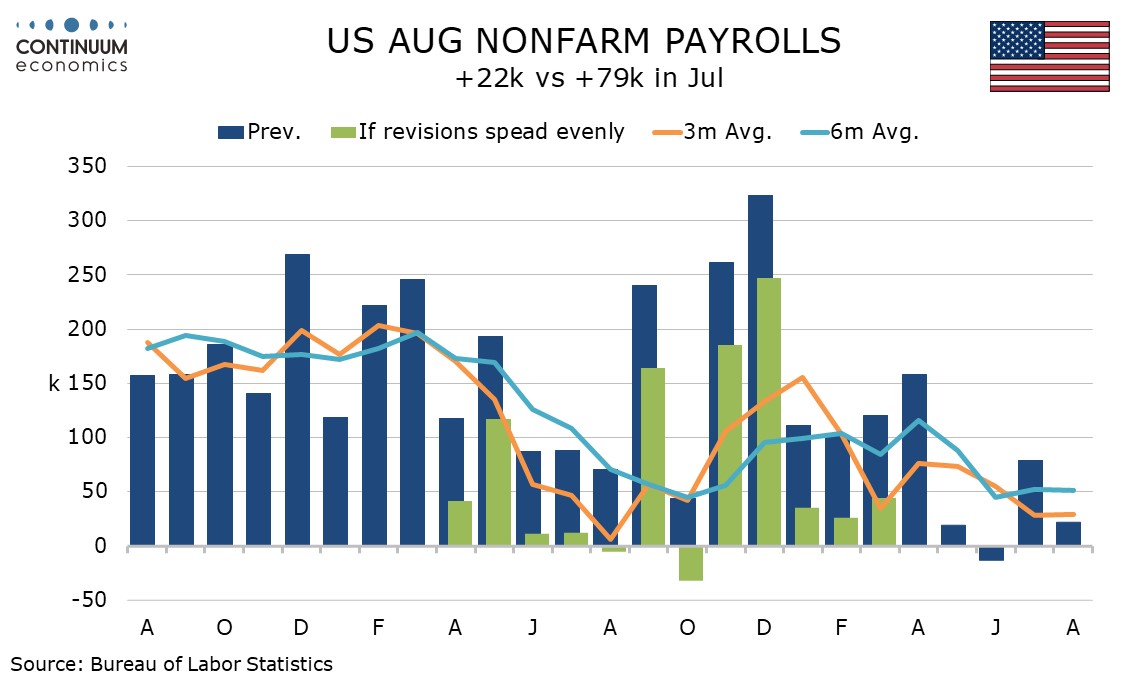

U.S. March 2025 Non-Farm Payroll Benchmark Revised Down

And more political uncertainty in the U.S.

Steady ECB Council Meeting

After Ishiba's initial resistance to step down for the failure in election, he finally bow down to the party pressure and resigned over the weekend. Originally, the Japan LDP has scheduled a vote to oust Ishiba and was expected to be receive approval from most LDP parliamentarians. It is anticipated the LDP party leadership election will be held in early October. Ishiba has stretched his term until the memorandum between U.S.-Japan has been signed. To be fair, the issue for LDP also existed before Ishiba took power in late 2024 and he will unlikely be the last one to have to deal with LDP's predicament.

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. CPI detail shows commodities less food and energy and services ex energy both increased by 0.3%, with the former being an acceleration after two straight months at 0.2% and suggesting an increasing feed through from tariffs. Used autos rose by 1.0% after a 0.5% July rise, a second straight ruse after four straight declines, while new autos at 0.3% saw their first rise since March. Apparel, seen as tariff-sensitive but recently subdued, picked up by 0.5%.

The service detail showed air fares up by 5.9%, a second straight strong rise, while lodging away from home rose by 2.6% to correct two straight significant declines. Owners’ equivalent rent was on the firm side of trend with a 0.4% increase. Weighing against these strong increases was a 0.1% decline in medical care services to correct a 0.8% increase in July.

The preliminary estimate for the downward revision to the March 2025 non-farm payroll benchmark at -911k is steeper than generally than expected and exceeds even the unusually sharp 818k negative revision reported a year ago for the March 2024 benchmark. The data will be incorporated into the January non-farm payroll data due for release in early February. Exactly how the revision will be distributed by month is unclear. The quarterly Business Employment dynamics survey, which hinted at a large negative revision in line with what has just been released, suggests that Q2 2024 could see the largest revisions. However, we suspect that stronger Q4 2024 data is also vulnerable to large revisions.

The chart above shows how payrolls would look like if the revision was spread evenly from April 2024 through March 2025. Then growth in each month from April 2024 through March 2025 would be revised down by 76k. The recent slowdown in job growth would then look less pronounced with the 6-month average below 100k in most of the months from August 2024 assuming evenly distributed revisions.

And the political uncertainty increased when Trump's ally Charlie Kirk being assassinated in a public event in Utah. It has been a while since we see a high profile assassination, especially someone with close connection to the younger generation that are more susceptible to viral transmission of sentiment. Regardless of political tilt, Charlie Kirk has been a public yet close figure to youth and could spark more polarized response after his death. The conflict with the U.S. has been structural and lasted for years but such could trigger a broad base reaction in the coming days.

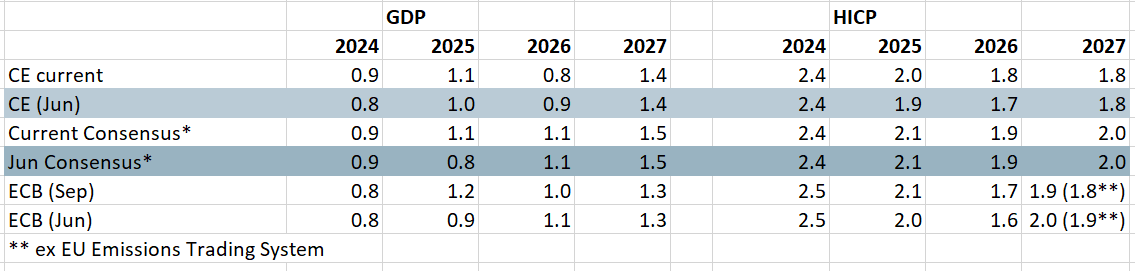

Figure: The EZ Economic Outlook – Alternative Perspectives

Source; ECB, Bloomberg, CE

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections (Figure) which only goes to show that an upward revision to the growth picture can be associated with a drop in underlying price pressures. All of which implies that even with growth risks seen as more balanced, this does not mean that disinflation cannot continue (irrespective of what President Lagarde suggested – possibly again speaking somewhat out of kilter compared to Council thinking). The ECB may now be in mode in which something will now have to trigger further easing, but we think this will occur given tariffs and what are still tight financial conditions likely to mean an undershoot of ECB growth thinking. Thus, data dependence will probably trigger two more 25 bp cuts, probably late this year and early next!

If there was guidance in the pre-prepared statement (as opposed to the Q&A) it was more implicit in suggesting an undershoot of core inflation into 2026 and (a slightly larger one) in 2027. This is not so much about the likelihood of further cuts over but, if policy easing has ended, it will be some time before hiking occurs – this possibly an implicit rebuke to markets which have started to price in rate increases from H2 next year.