This week's five highlights

Market Correction or Profit-Taking?

More Hikes to Come From the RBA

ECB Papering Over the Cracks

EZ HICP Services Inflation Less Resilient as Core Hits Cycle-Low

BOE March Cut and Then More

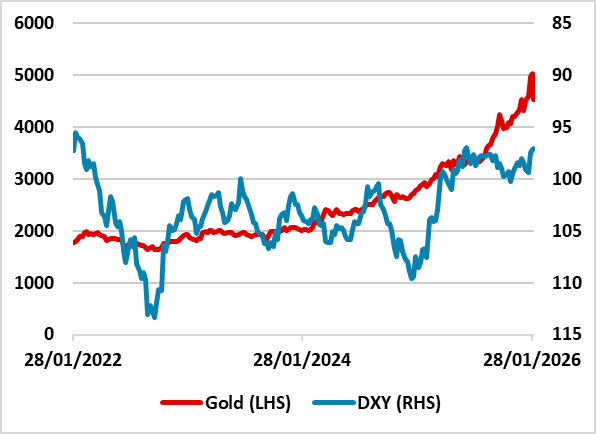

Figure: Gold Prices and Inverted DXY ($ and Index)

For now we see some further profit-taking on risky positions in gold/silver/copper/equities and short USD positions. However, a bigger macro catalyst is required to produce a deep correction in equities and major risk off. The nomination of Kevin Warsh for Fed chair is unlikely to be the catalyst, as his previous hawkishness is not representative and a major change in Fed decisions remains unlikely. The U.S. economy/AI revenue growth and Trump erratic decision making are all catalysts for a deeper correction, but none at the moment is producing the news flow to immediate turn a pullback into say a 5-10% U.S. equity market correction. Iran/reciprocal tariffs and U.S. labor market will be watched in the coming weeks.

After a great performance last year, interest intensified for gold, silver and copper in January but has gone into significant reverse in the past few sessions. Some have pointed to Kevin Warsh appointment as Fed chair as a catalyst. While this could be partially true for gold/silver, the DXY and U.S. Treasury market has not seen the magnitude of movements elsewhere. The DXY has bounced, but it’s recent correlation with Gold has been weak (Figure). Meanwhile, 10yr U.S. Breakeven inflation expectations have hardly moved (Figure 2). As we shared in our thoughts on Kevin Warsh (here), he will likely be more dovish than his previous role as Fed governor but restrained by the majority of voting FOMC members remained focused on their views on economy/inflation/Fed Funds and neutral rates. This is why the reaction to Warsh nomination as Fed chair has been muted in the U.S. Treasury market. The gold and silver sharp pullback reflects speculative longs taking profits and then liquidating as stops got hit. Copper longs have built up on anticipation that Trump could impose 15% tariffs on Copper imports (Commodity Outlook here) and have also been hit by profit-taking and now stops. This selloff in metals could carry on for a couple of days and dent sentiment multi week/month, but what about equities?

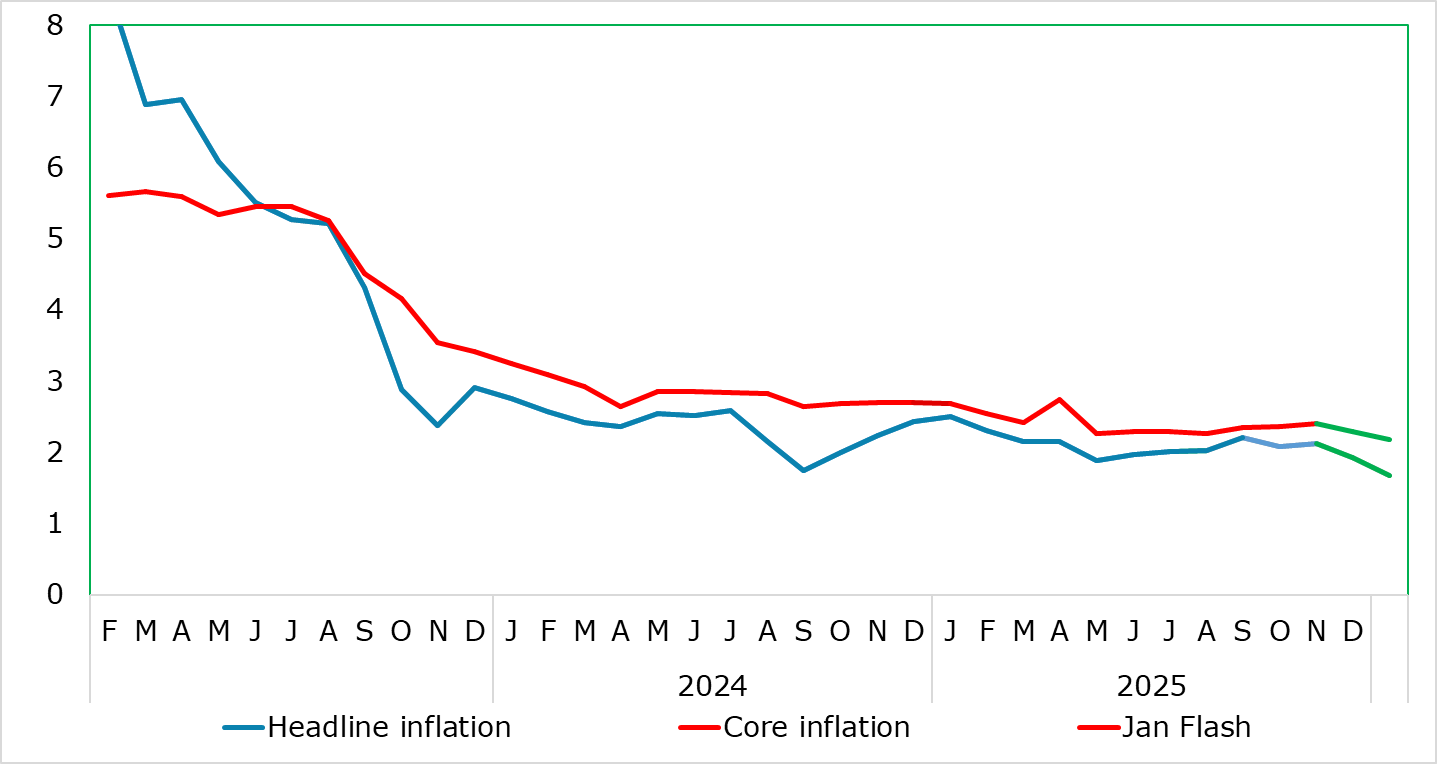

The RBA has increased the cash rate to 3.85% in the February meeting as Inflation continues to run hot. The inflationary picture has turned hot after the Q3, partially from previous year's energy rebate base effect but also suggest stronger underlying inflation. The rate hike is mostly priced in and thus the forward guidance in cash rate assumption is the real hawkish surprise.

In the latest cash rate assumption, the RBA is seeing two more hike to 4.2% by year end 2026. It came as a hawkish surprise with most market participants expecting only one more hike this year. Their CPI forecast has also been revised higher, with headline shooting to 4.2% in mid 2026 before retreating back with target range in mid 2027. Trimmed mean CPI is also revised 0.5% higher throughout 2026. Moreover, the RBA is visualizing a stronger labor market and more economic growth for Australia in 2026.

While the forward guidance "The Board is focused on its mandate to deliver price stability and full employment and will do what it considers necessary to achieve that outcome." is quite a similar rhetoric, the forecast in private demand seems to be driving RBA to the hawkish end of the road. We believe their forecast on inflation is too aggressive and could only see more more rate hike in 2026.

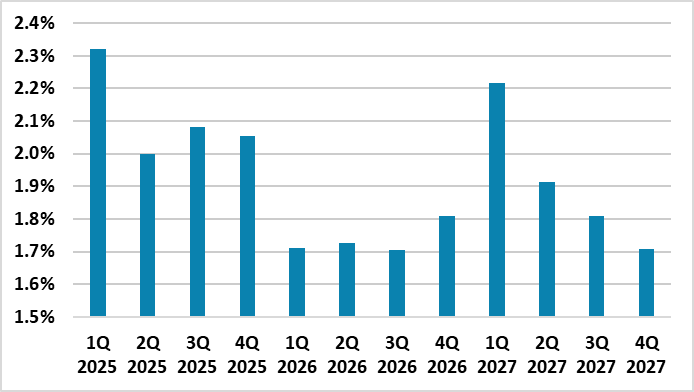

Figure: EZ HICP Including Projections (%)

As widely expected the ECB kept the policy rate unchanged at the February meeting. The broad message remains that the ECB Council is comfortable with current policy rates, which provides short-term forward guidance of no change in rates. This message came from the ECB statement and also Lagarde’s press conference. However, the December minutes show a split between the doves and hawks multi quarter and we agree with the doves’ concerns. We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts in June and September 2026.

ECB Lagarde emphasized what the majority of the council could agree on, which is that policy rates are currently appropriate and expect no change in policy rates in the near-term amid a broadly balanced risk assessment. However, Lagarde is talking mainly about the near-term and the December ECB minutes show a clear division between doves and hawks multi quarter. The doves are concerned about the economic recovery, but also that slowing wage inflation could mean an undershoot of inflation. Either could mean further rate cuts are needed. The hawks take a more upbeat view of the GDP trajectory, but are also concerned that recent wage compensation data means that inflation could now be slow to fall. For the hawks this could mean that tightening is required into 2027. The ECB moved away from risk assessment on each to a broad list, with Lagarde admitting that views diverged on the ECB council.

Figure: Headline and Services Down Clearly

Having been range bound for some 5-6 months between 2.0% and 2.2% until November but after a fall to 1.9% in December headline HICP inflation dropped to 1.7% in the flash January data, thereby matching expectations and the short-lived Sep 24 outcome. The drop came in spite of higher food inflation, instead being pared back by energy, where base effects were at work, but with services down 0.2 ppt to match the September low of 3.2%. In turn, this allowed the core rate to fall a notch to 2.2%, the lowest in over five years and hinting at a clear undershoot of the ECB’s Q1 2026 projection.

We see this as the continuation of what may be a short-lived fall toward 1.5% for the headline rate in the current quarter, but where the core rate easing may prove more durable. To what extent the fall in this latest data at least partly reflects a softness in non-energy industrial goods (NEIG) inflation. The latter may possibly reflect an increasing sign of softer import prices possibly related to Chinese export dumping and/or the stronger euro, either being an issue for the ECB.

As of these latest numbers, several methodological changes take effect in the HICP. Over and beyond the usual annual reweighting of the components, the index will also now be compiled according to the new classification. Games of chance will be included in the HICP under the division of recreation, sport and culture. The index reference period will also be updated to 2025=100. What is clear is that with (relatively resilience) services having seen an increase in its weighting in the last three years this has acted to push up recorded overall inflation but the reverse may now be occurring. To what extent this reweighting may be behind the fall in January services inflation is unclear at this juncture. Regardless, it may just as much reflect weak demand paring back the ability of companies to raise prices, particularly those typically made at the start of each year!

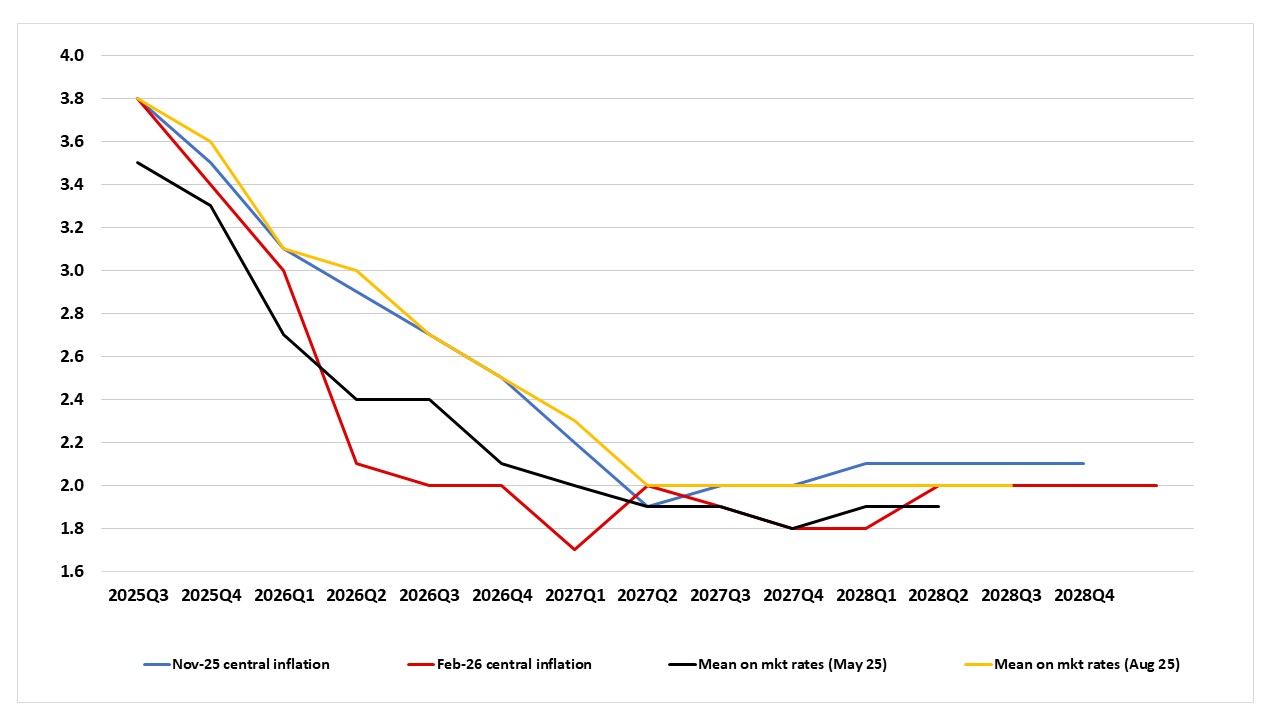

Figure: Marked Downgrade to Medium-Term Inflation Outlook

Six members of the MPC appear worried about the disinflationary impact from a weak economy and four of whom actually voted for a 25bps cut at the February meeting. BOE Bailey and Mann, looking at the MPC minutes, are very close to voting for a rate cut, which suggests high confidence that a 25bps cut will be delivered at the March MPC meeting and this is our forecast rather than April. Indeed, we have long argued that the weak economy/tight financial conditions would build the case for three 25bps cuts in 2026 to 3.00% and Mann’s conversion away from a hawk to a centrist only increases our confidence, alongside economic data and wage inflation that suggests CPI will come down. We pencil in these two extra cuts for the June or July and November and December (the timing of the Budget statement will impact the timing of a cut to 3.00%).

The February MPC minutes are perhaps the most interesting with Andrew Bailey and Catherine Mann having greater confidence that the inflation persistence risk would be mitigated by the lower near-term path for inflation and placed greater emphasis on the risks to inflation from weaker activity. It only needs one of these members to vote for a cut in March and a 25bps cut will be delivered (given that four voted to cut 25bps today) and we are now confident that a 25bps cut will be delivered. The BOE Monetary policy report forecasts have reduced Q1 2026 and 2027 GDP and Q1 2027 and Q1 2028 CPI inflation forecast (Figure 1) and Bailey noted in the press conference that most on the MPC agree with this changed picture, which also builds the case for BOE Bank rate cuts in March and beyond.