2024 Q3 Shadow Credit Ratings to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. We produce Shadow Credit Ratings for 162 countries, comparable to those from credit rating agencies.

The ratings are based on our Country Strength Index (CSI), which is our most comprehensive assessment across our full range of Country Insights data. The ratings are consistent with our 2024 Q3 Country Insights update.

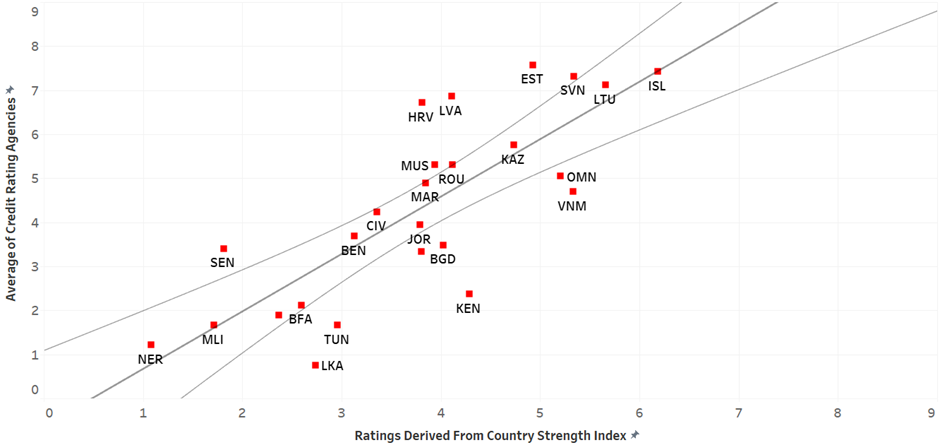

The analysis of the ratings, as shown in Figure 1, indicates that countries like Lithuania (LTU), Slovenia (SVN), and Iceland (ISL) have relatively high scores from Credit Rating Agencies (CRAs) and Country Strength Index scores, outperforming their Frontier Markets peers. Conversely, Niger (NER) and Mali (MLI) have low scores in both metrics, highlighting consensus regarding their weaker economic and social conditions.

Some outliers emerge in the analysis. For instance, Latvia exhibits a relatively low rating on the CSI, despite receiving higher scores from CRAs. Of the four CSI pillars—external adjustment capacity, institutional robustness, medium-term growth potential, and social inclusion—Latvia underperforms in medium-term growth potential, primarily due to demographic challenges and lagging innovation and technology. However, Latvia demonstrates strength in institutional robustness, supported by favorable indicators such as a general government gross debt of 45.2%, a fiscal deficit of 3.4%, and a capital adequacy ratio of 20.8%, according to the International Monetary Fund.

Figure 1: Shadow Ratings for Selected Frontier Markets

Source: Continuum Economics

See Article Resources (below) to access the full range of scores.