This week's five highlights

Trump on Greenland and the Fed

U.S. Initial Claims remain low in payroll survey week, GDP revised higher on inventories

U.S. Personal Income underperforming Spending, Core PCE Prices maintaining trend

BoJ Kept Rates Unchanged with Inflation Forecast Revised Higher

ECB Steady Signals

Trump has provided some relief to markets by stating that he will not take Greenland by force, though his tone towards Europe remains hostile, suggesting that he will impose tariffs, which may receive a limited European response. Separately Trump stated he would announce a new Fed Chair soon. Trump’s speech contained plenty of criticism of Europe, notably on their immigration and climate policies while stating NATO had treated the US unfairly and asking for immediate talks on the acquisition of Greenland. He also took a critical shot at Canada, following a speech by Canadian PM Carney the previous day that suggested middling powers would need to adjust to a changed world.

This suggests Trump’s threatened tariffs on eight European nations, six of which are in the EU, plus the UK and Norway, are still on. This would see a 10% tariff implemented on February 1 with 25% threatened on June 1. The economic damage done by 10% tariffs would be modest and we doubt that there will be a strong retaliation, though the EU parliament’s delay in ratification of the EU-US trade deal that eliminated EU tariffs on US goods could become significant if the US Supreme Court decides Trump’s reciprocal tariffs are unconstitutional. With Trump still insisting on acquiring Greenland and Denmark not prepared to sell, it is unclear how the June 1 tariff escalation can be avoided, but the Europeans may play for time while markets will not exclude the possibility of a resolution before June. The Supreme Court is likely to rule on Trump’s tariffs well before then.

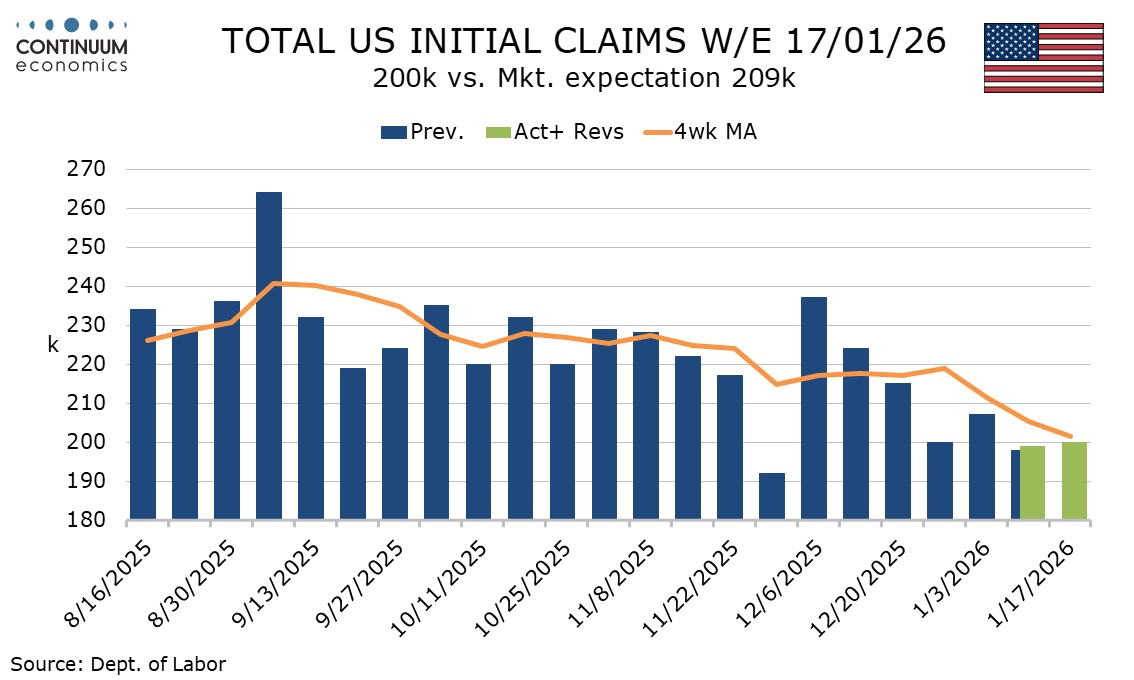

Initial claims remain low in the survey week for January’s non-farm payroll, rising by only 1k to a lower than expected 200k. The Q3 GDP revision to 4.4% from 4.3% is marginal, but is even stronger than an already strong pace. The 4-week average for initial claims is the lowest since October 2022 and while two of those four weeks include holidays the soft data of the two subsequent weeks suggests that the low outcome in Christmas week may have been less distorted than was generally believed at the time.

Continued claims cover the week before initial claims and are also lower than expected, falling by 26k to 1.849m. This is a 6-week low. The 4-week average of 1.871m matched that of three weeks ago and lower has not been seen since April 2025. The upward revision to GDP was fully due to inventories with final sales (GDP less inventories) revised marginally lower to 4.5% from 4.6%. Consumer spending was unrevised after rounding at 3.5% but slightly lower before rounding. Housing investment was also revised slightly lower but business investment and net exports slightly higher as an upward revision to exports exceeded an upward revision to imports.

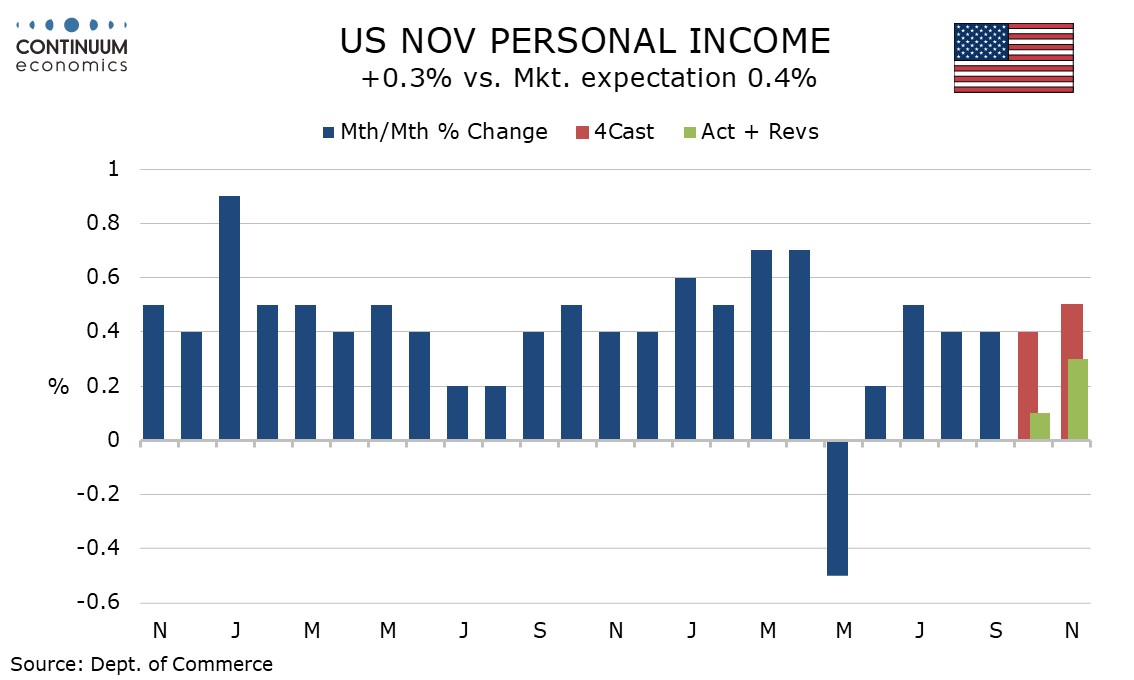

The personal income and spending report for both October and November has been released and shows healthy spending, up by 0.5% in each month outperforming income which rise by 0.1% in October and 0.3% in November. PCE prices, both overall and core, rise by 0.2% in each month, modest, but stronger than the CPI suggested. As a consequence of spending outperforming income, the savings rate at 3.5%, down from 3.7% in October and 4.0% in September is the lowest since October 2022. Real disposable income is up only 1.0% yr/yr, compared with 2.6% for real spending, suggesting some consumer vulnerability entering 2026.

Wages and salaries outperformed personal income, rising by 0.3% in October and 0.4% in November. Farm and dividend income were particularly weak in October. Retail sales saw stronger gains in November than October but services saw the stronger rise in October. Before rounding core PCE prices rise by6 0.21% in October and 0.16% in November. Yr/yr growth at 2.8% in October and 2.7% in November looks fairly stable.

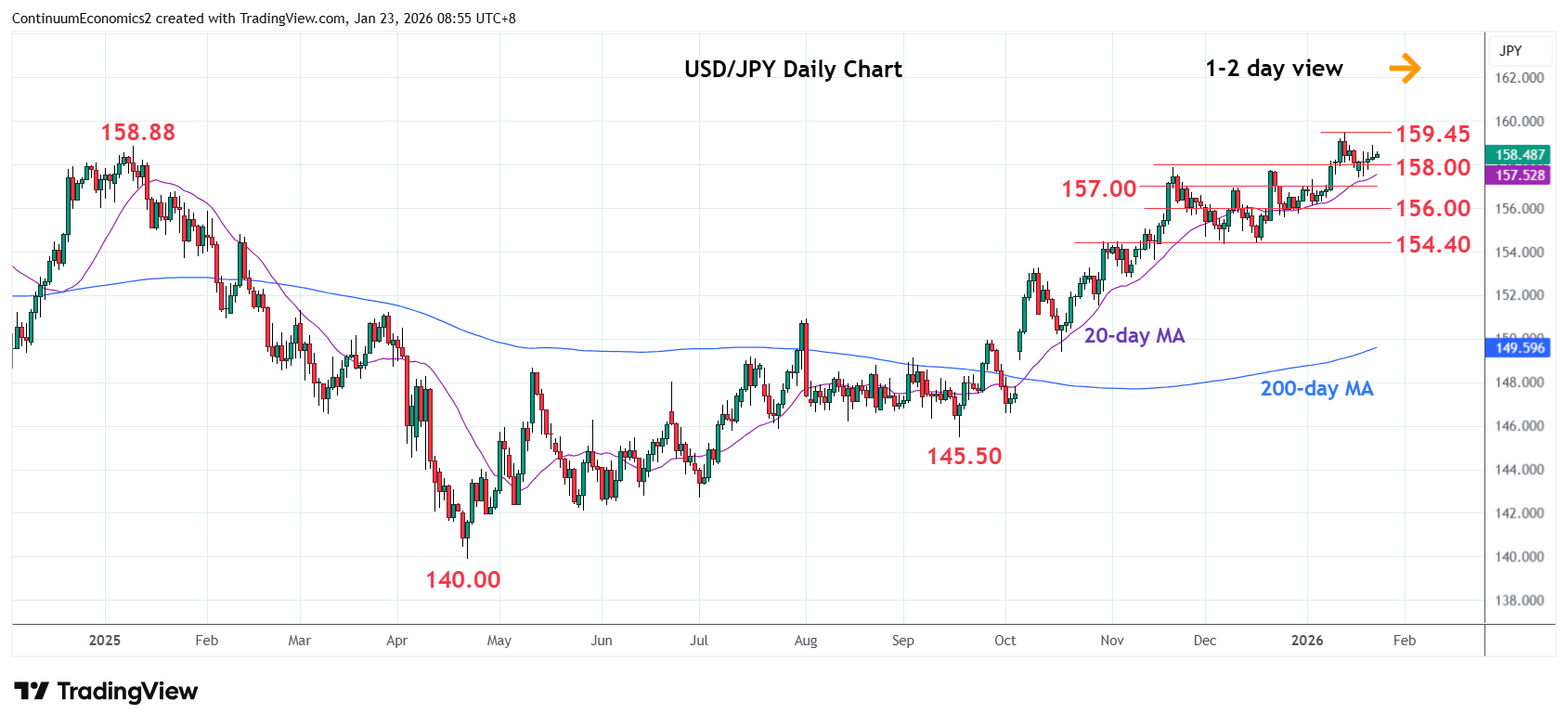

The BoJ has kept rates unchanged at 0.75% in the January meeting with one vote dissent that is looking for another 25bps hike. The press conference from Ueda also provided little cues but reinforce "larger focus on inflation in making policy decisions". The BoJ's economic forecast has been revised, mostly higher for both CPI and GDP. Core-core CPI for 2025 has been revised higher to 3% from 2.8%, 2.2% from 2% in 2026 and 2.1% from 2% in 2027 while core CPI is unchanged in 2025/27 and 0.1% higher in 2026. GDP growth is also revised higher for 2025 to 0.9% from 0.7%, to 1% from 0.7% but revised lower to 0.8% from 1% in 2027.

Broadly speaking, the BoJ continue to see Japanese growth to be moderate and inflation target to be met. The subtle language of inflation target "more likely" to be met is just tactics for the BoJ to avoid market participants' anticipation of an imminent hike. We do see one more rate hike in H1 2026 but as Ueda emphasizing focus on inflation figure and new energy rebates expected to kick in Q1 2026, the next rate hike will likely come in late H1. There is not much new information so far and we continue to call for 1% being terminal rate for 2026/27.

Figure: Money Market ECB Depo Rate Expectations (%)

We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts. However, these are more likely to come later than we thought and we now pencil in June and September 2026. In the meantime, ECB communications will continue to lean against early ECB rate hike talk.

ECB officials guidance in January so far remains that the consensus on the ECB council is that interest rates have reached an appropriate level. What will happen in the remainder of 2026?

• Leaning against 2026 hike talk. A number of ECB officials have dismissed ideas that the ECB could hike in 2026, as money markets have tilted towards the next moving being a 25bps rate hike in 2027 (Figure 1) – fueled by hawks likely Schnabel suggesting the next move in policy rates is up. This will likely be the ECB communications throughout 2026, as the ECB needs lagged easing to feedthrough and wants to avoid lending rates rising due to hike speculation.

• Steady for now, but. Most on the ECB council appear to be comfortable with steady policy in 2026, after a cumulative 200bps of cuts. This will likely be the message from the December minutes on January 22 and at the February 5 ECB meeting. ECB Lane reemphasized this stance on January 16 and he is normally a good guide to policy. Though we look for a further two 25bps cuts in 2026, the economics are only partially in place. We have argued that financial conditions and lending are worse than the ECB depo rate would suggest, which reflects the extra refinancing costs for loans taken out between 2008-21 or return of investment calculations for new loans. Additionally, a wide set of economic indicators suggest the EZ economy is not really picking up, which the ECB should come round too. Thirdly, the ECB focus on compensation for workers is backward looking, with forward looking data (e.g. Indeed survey and wage tracker) suggesting wage inflation will be consistent with CPI inflation just below target (Figure 2). Finally, though defense and infrastructure spending will help Germany in 2026, other major EZ countries are fiscally restrained (see EZ Outlook here). Incoming economic data will build the case for further rate cuts, but it is unlikely to be in place for the March ECB meeting and so we have delayed our rate cut forecasts to 25bps in June and September. We also still see the ECB slowing the monthly pace of APP and PEPP QT by 25% in 2026, given the adverse impact on lending and financial conditions.