This week's five highlights

U.S. Government Shutdown Starting October 1

Another Round of Trump Tariffs

FOMC Minutes to show differing views on the future rates path

And this Week's Fed Speakers

Data Dependency Continues for RBA

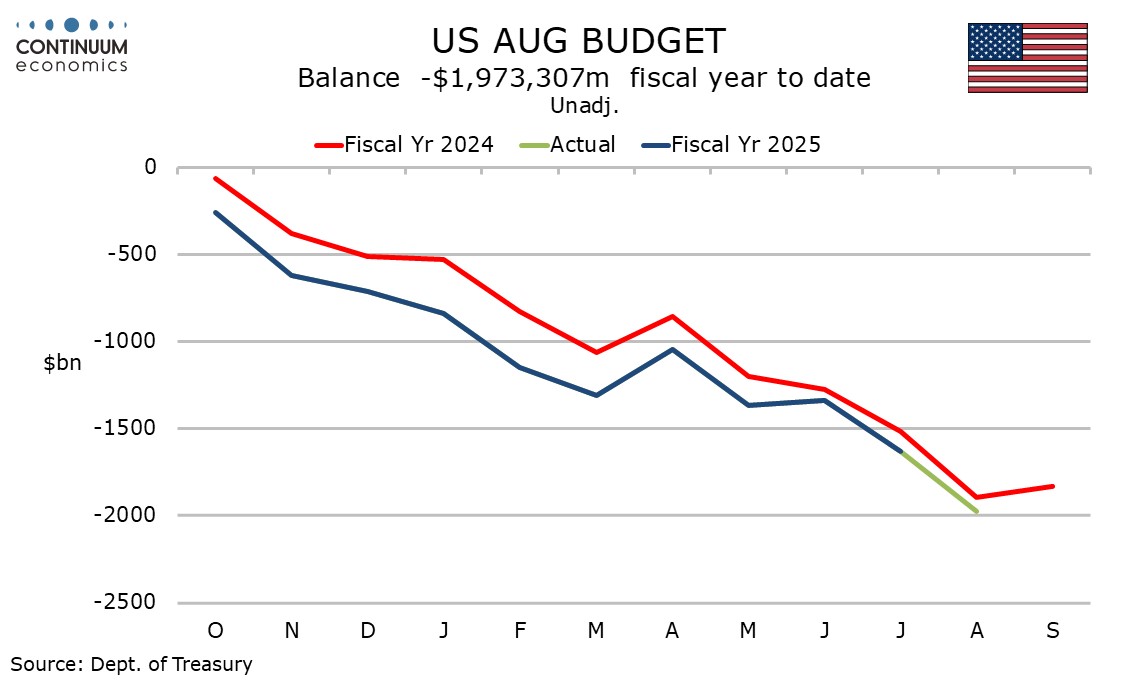

US government has shut down on October 1. Once a shutdown starts, the standoff could last for a few weeks, probably not as far as the next FOMC meeting on October 29, though that cannot be ruled out. As long as the government remains shut, the Fed and financial markets will have to deal with the absence of key economic data.

The Democrats are demanding is that cuts to health insurance subsidies, which will rase premiums for many, and to Medicaid, which provides insurance to poorer Americans, passed in the “One Big Beautiful Bill” be overturned. There is no doubt that the cuts to health care will be unpopular, with the Congressional Budget Office estimating that 17 million would lose health insurance by 2034, and more would be forced to pay more for it. However getting rid of the cuts without offsetting revenue increases would add significantly to the budget deficit, by over $1 trillion over ten years if fully repealed. That will make the Republicans reluctant to back down.

Standoffs in shutdowns usually come down to a test of public opinion. Most government shutdowns in the past have been initiated by Republicans in opposition to the policies of Democratic presidents, and have tended to see the Republicans blamed. Even if the Democratic cause is popular, they may still get the blame for the shutdown. A comparable situation is a 16 day shutdown in 2013 when Republicans tried to derail Obamacare, which was not popular at the time but the shutdown was unsuccessful. The longest shutdown lasted 35 days, starting on December 22 2018, this time with a Republican president, as Trump unsuccessfully demanded funding for a wall on the Mexican border. In this case the shutdown was partial, impacting 380k government workers rather than the 800k that were seen in 2013. In 2018-19 the Labor Dep’t, which releases non-farm payrolls and CPI, stayed open, though the Commerce Dep’t, which releases GDP and core PCE prices, was shut. This time however the Labor Department has indicated that in the event of a shutdown all operations will be suspended.

For markets, the most significant impact of a protracted shutdown would be the absence of key economic data. It is unlikely but not impossible that the October 29 FOMC meeting would arrive without the August non-farm payroll or CPIs being released, but if so the FOMC would have limited fresh information to base a decision on. This would raise the risk that policy would pause, though if so a 50bps easing could be seen in December, which would keep policy consistent with September’s dots, if data eventually came in soft. The hit to the economy would likely to largely reversed by the end of Q4, assuming the shutdown does not extend well into November. Prior estimates that a shutdown of a week takes 0.2% annualized off GDP could however be too low should Trump carry out a threat to permanently layoff government employees rather than the usual temporary furloughs in the event of a shutdown.

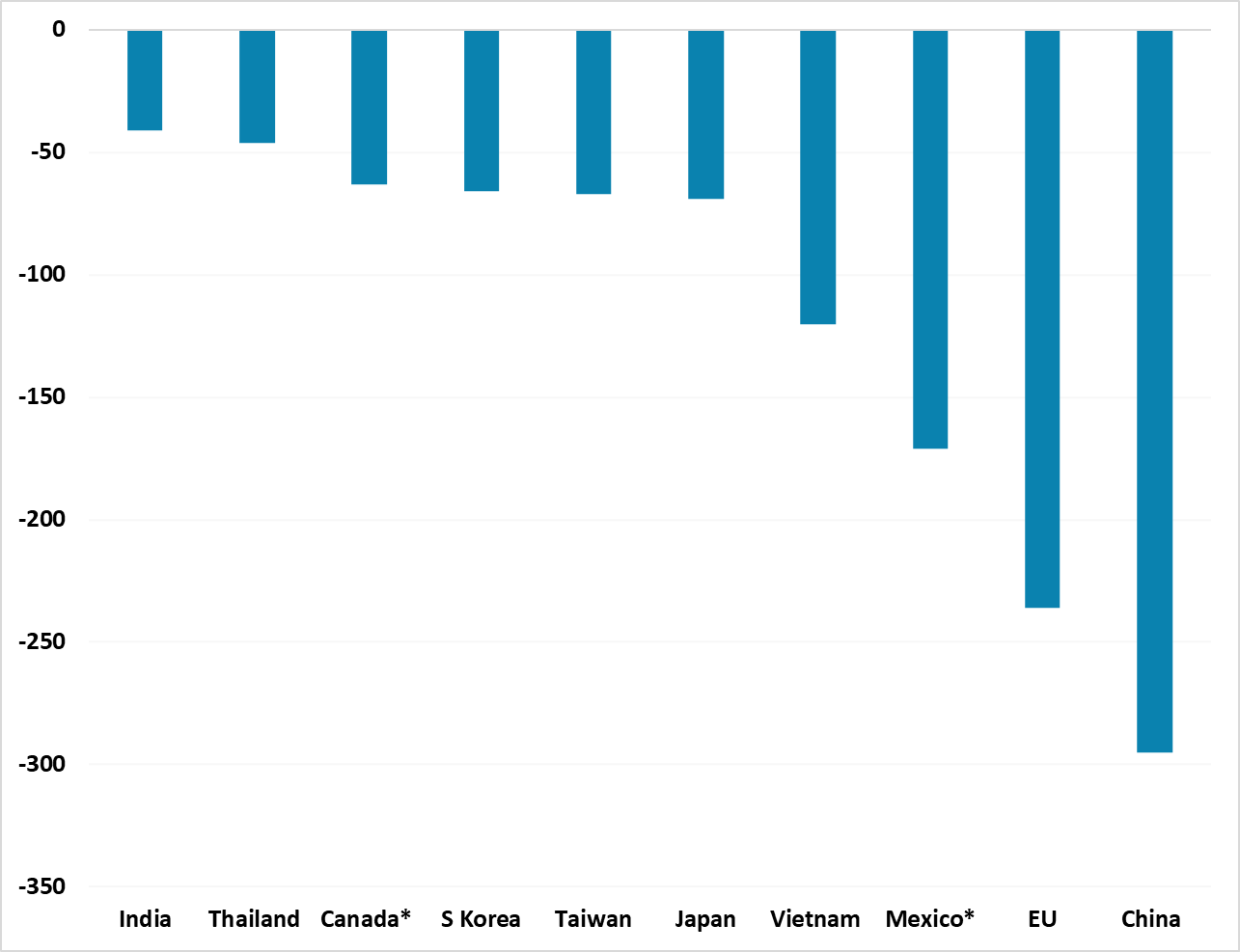

Figure: 2024 Bilateral U.S. Trade Deficits (USD Blns)

Trump’s tariff push is less intense than April and August, but is not finished with a selection of product tariffs last week and outstanding trade disputes. Key points to note.

· Branded Pharma and others. The 100% tariff on branded pharmaceuticals has less bite than the headline, as companies are exempt if they are starting construction projects for new manufacturing in the U.S. Additionally, the U.S. has clarified that existing deals with the EU and Japan will cap branded pharma products at 15%, as agreed in bilateral trade deals. Finally, on pharma the Trump administration has been restrained by the opposing desire not to raise domestic pharma prices, which is an important political topic. Targeted tariffs were also announced in other areas e.g. heavy trucks/furniture. The U.S. could announce some targeted tariff on semiconductors in the coming months, as the next installment in product tariffs but could then pause. The announcements are part theatre to show the world that Trump can still impose tariffs and also keeping the U.S. options open in case the U.S. Supreme Court rejects the reciprocal tariffs in late Q4/early Q1 2026 – unlikely but possible. Uncertainty remains high with the Supreme Court set to consider an appeals court ruling against Trump’s reciprocal and fentanyl tariffs. While Trump’s claim that trade deficits represented an emergency is a dubious one, we expect the Supreme Court will rule in favor of these tariffs, though we would not rule out the possibility of them seeking some middle ground. If the Supreme Court does rule against these tariffs, Trump has legal means that he could pursue to impose other tariffs, and deals made with various trading partners are likely to stick.

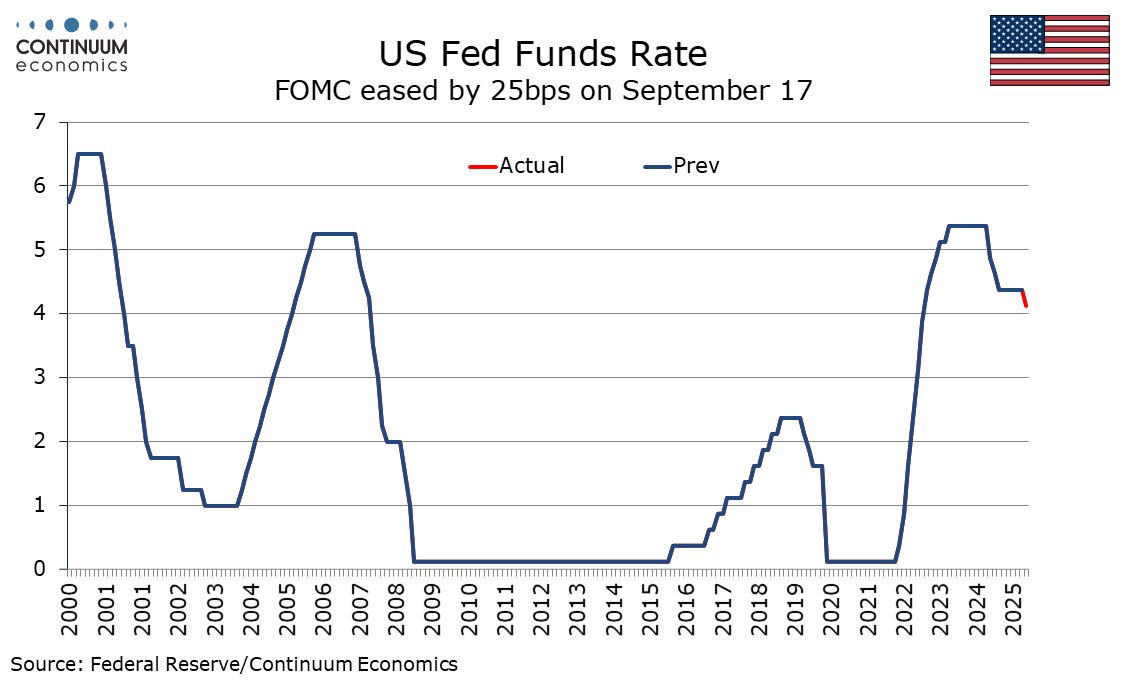

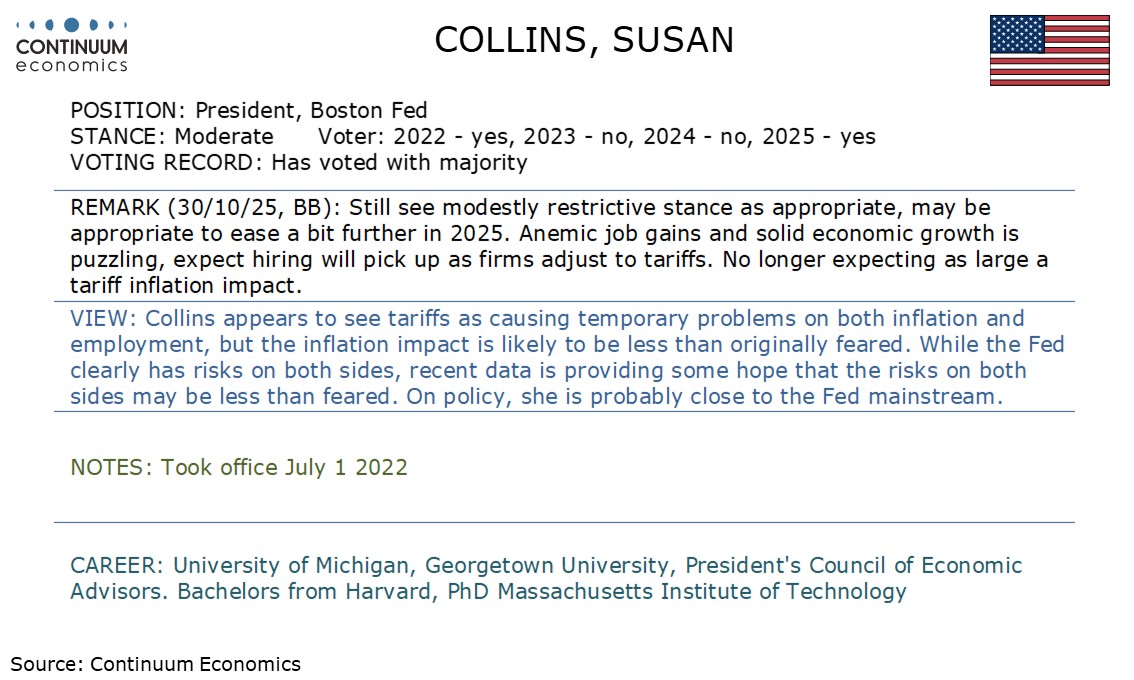

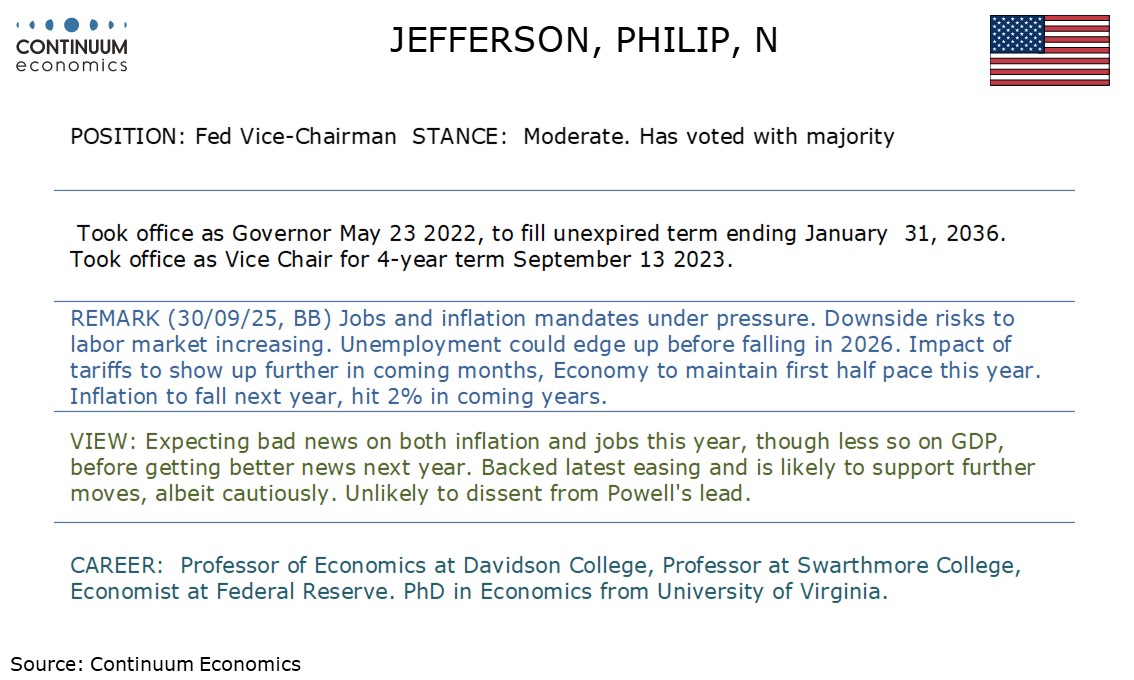

The Fed will continue to function during the government shutdown, and minutes from the September 17 meeting are due on October 8. They are likely to show a broad consensus in favor of the 25bps easing delivered at the meeting, but a variety of views on the appropriate path going forward. The individual opinions will not be identified in the minutes, but it appears clear that the regional Fed presidents are more hawkish than the permanent voters. There was only one dissent from the meeting’s decision, incoming Governor Stephen Miran voting for a 50bps ease. Otherwise notable doves such as Governors Christopher Waller and Michelle Bowman as well as hawks such as St Louis Fed’s Alberto Musalem and Kansas City Fed’s Jeffrey Schmid went along with the 25bps ease. This was presented by Chairman Jerome Powell as a risk management move in response to a changing balance of risks. Most important was a recent slowdown in employment growth to a minimal pace, but also several Fed speakers have also stated that the feed through of tariffs to inflation has been less than initially feared.

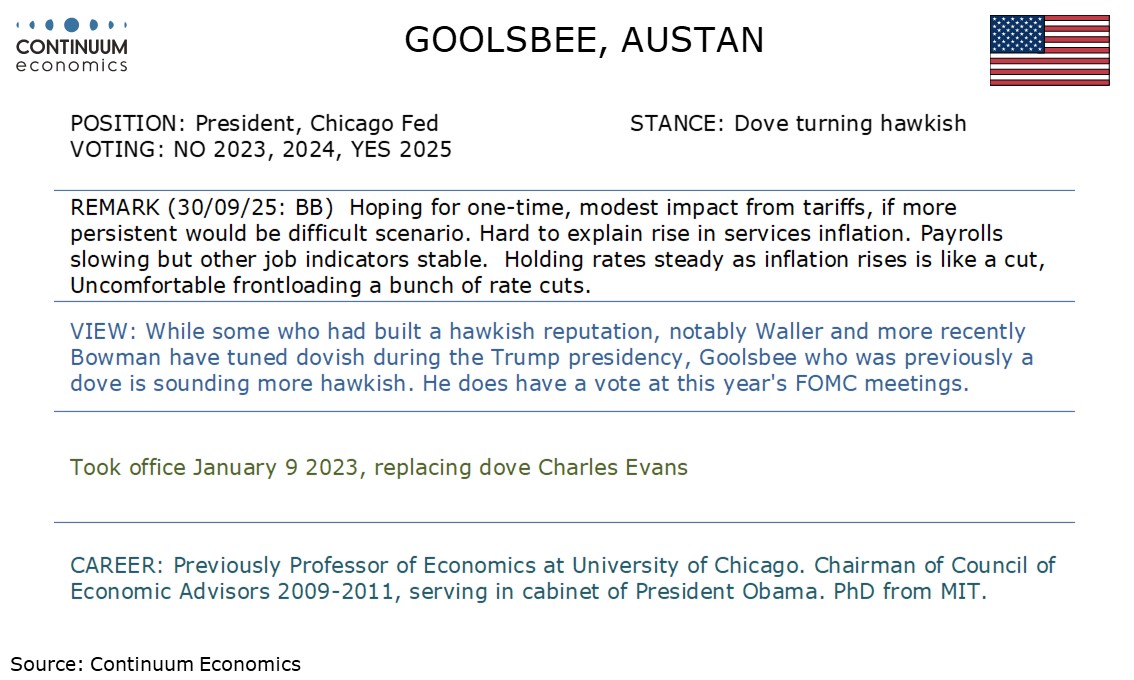

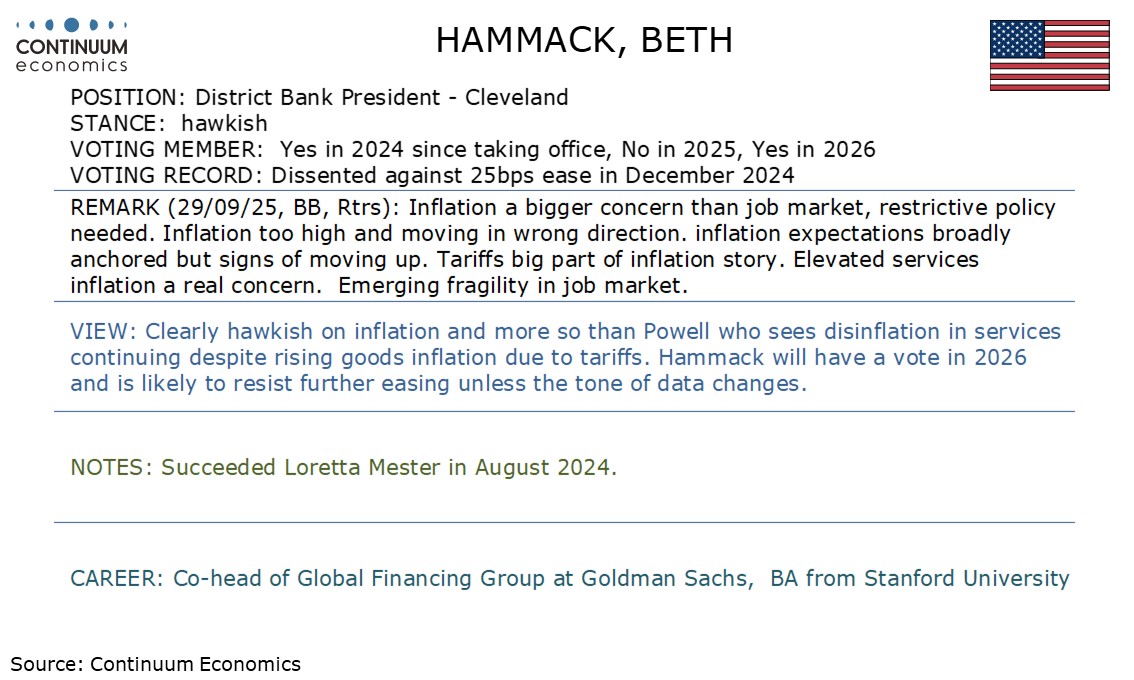

Hawks therefore agreed to a modest fine tuning in rates but are cautious about doing more. Doves, excluding Miran, were willing to back a modest 25bps move too but will want more in coming meetings. These differences are likely to be outlined in the minutes. Some feel the slowing in the labor market is a serious concern which could if it extends further bring risk of recession. Others feel it is to a large extent a matter of slowing labor supply and that the economy is still growing and close to full employment. On inflation some feel the limited feed through from tariffs to inflation so far is significant, while others are concerned the bulk of the impact is yet to come. Some are confident that the inflationary impact will be temporary, and several have suggested their confidence in that has increased. However others are more cautious, and the longer term impact of tariffs is not a debate that can be quickly resolved. Most appear to agree with Powell that excluding tariffs inflation is moving lower, but some disagree, Chicago Fed’s Austin Goolsbee in particular expressing concern over strength in service inflation.

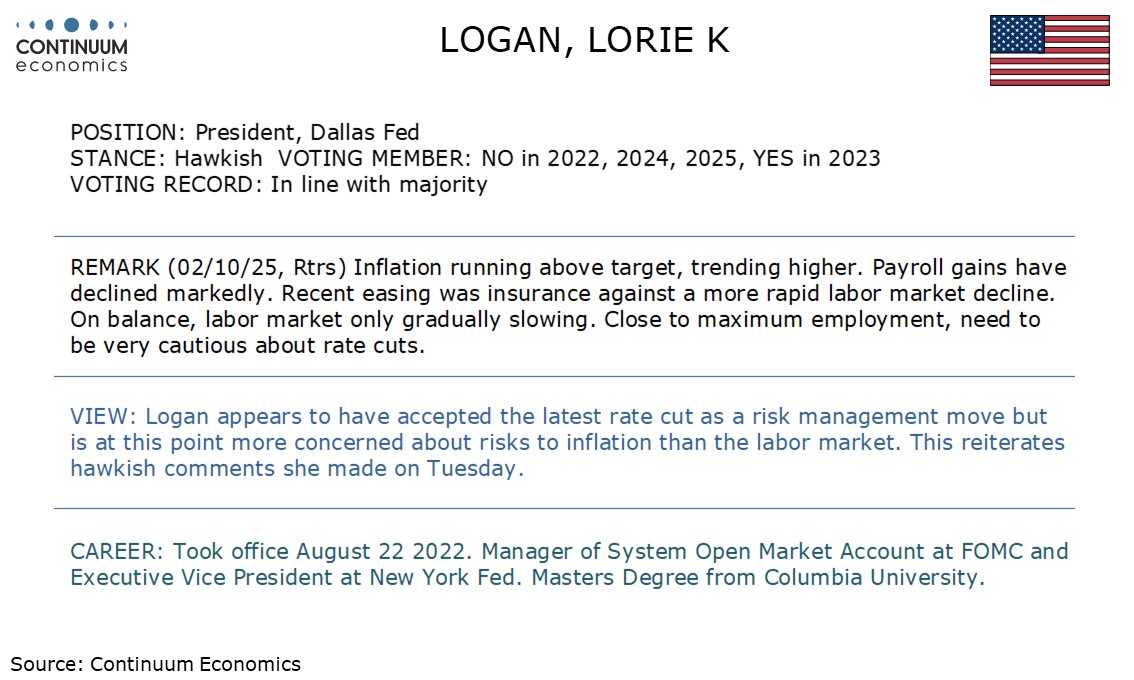

The dots from the meeting showed a clear divide in views, with one (clearly a non-voter) opposing the 25bps cut and six wanting no more easing this year. Two want only one more move, leaving nine out of nineteen more hawkish than the median which is for two more moves. Miran is a sole dovish outlier below the median, wanting 125bps more. Hawkish comments since the meeting have come from Goolsbee, Musalem and Schmid, as well as Dallas Fed’s Logan and Cleveland Fed’s Hammack. We feel Hammack is the most likely to be the one who would not have voted for the latest ease. That leaves two more who favor no more moves this year to be identified. Governor Michael Barr is probably one of them, as he was warning about the risks of persistent tariff-led inflation in the summer, but has said little on the subject recently.

The RBA has kept the cash rate unchanged at 3.6% in the September 30th meeting as per forecast. With headline monthly inflation edging up in the past month, it provided RBA the perfect excuse to keep rates unchanged despite trimmed mean suggest further moderation in underlying inflationary pressure. The broader picture did not change and we expect CPI to tread lower on a quarterly bases with two more cuts in the coming quarter from the RBA, bring rate to 3.1%. The recent volatility in headline monthly CPI seems to have tilt RBA's forecast for the Q3 CPI higher and keep them at bay from cutting rates. They does not seem to be convinced the strong domestic consumption in Q2 to be fully sustainable and would like to wait for more confirmation about their outlook. The forward guidance did not change and continue to point towards data dependency. The timing of another 2025 cut will likely be the November meeting, to give RBA sufficient time to assess the impact of easing and Trump's tariff policy.

On the chart, the pair remains in consolidation below the .6625 resistance as prices stays within Tuesday's .6628/.6571 range. Would take break above .6625 to open up room for extension to resistance at the .6650/60 area. However, negative weekly studies suggest consolidation giving way to renewed selling pressure later with pullback to see support at the .6580/50 congestion then the .6520 low. Break here will extend losses from the .6707 current year high and see room for deeper pullback to retrace the August/September rally to the .6500/.6450 area.