USD, CAD flows: CAD in focus as employment report approaches

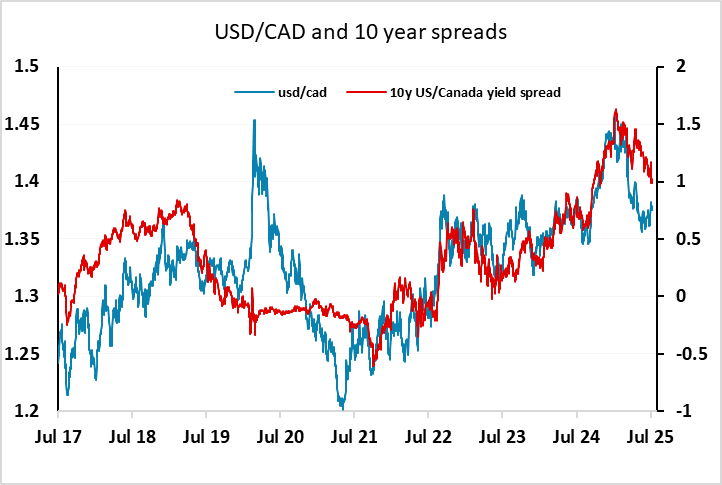

CAD remains resilient but USD/CAD upside risks persist

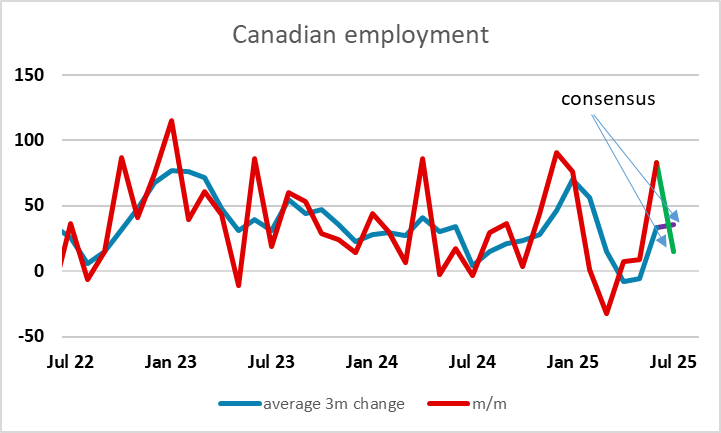

Friday looks relatively quiet, with just the Canadian employment report on the data front. The CAD has held up well despite the tariff increase to 35% announced last week, and while USD/CAD rose at the end of July, it has fallen back in August. The strength of the last Canadian employment report has helped support the CAD, with concerns about the economic impact of tariffs somewhat reduced. However, the dangers of a negative impact in the coming months remain, and the CAD may be vulnerable, particularly on the crosses if tariff related weakness shows up in the US economy.

As far as today’s Canadian data, the strength of the June data means there is less reason to fear a significant market impact from today’s July data, as even a significantly weaker than expected outcome would likely leave the underlying trend relatively healthy. The market consensus of a 15.3k rise in employment would still leave the 3 month average above 35k, broadly consistent with a stable unemployment rate. USD/CAD could nevertheless still move closer to the level suggested by the longer-term yield spread correlation, which is close to 1.40. The general USD underperformance of yield spread relationships since April means such a move is unlikely to happen in isolation, but USD/CAD looks less likely to sustain lower levels than currencies of countries that are less directly dependent on US trade.