CAD flows: CAD slightly firmer after BoC leaves rates unchanged

CAD hgiehr after BoC leaves rates unchanged

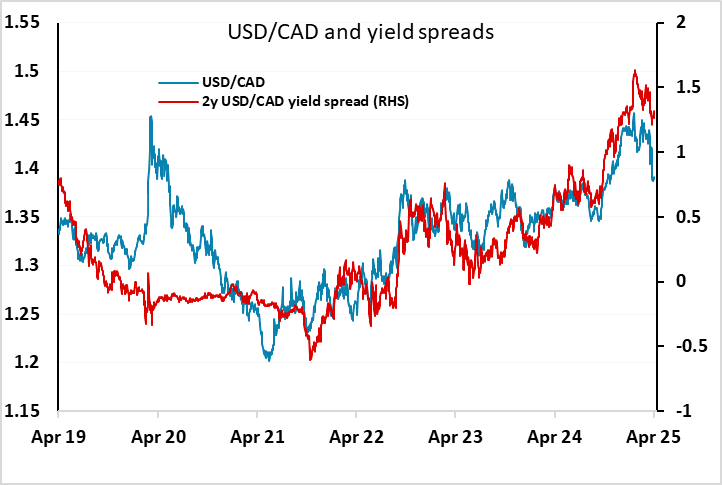

The BoC left rates unchanged as we and the majority of the rest of the market expected, but the market was pricing a better than 40% chance of a rate cut so the CAD has rallied modestly on the news. The comments from BoC governor Macklem suggest that there is still a good chance of further rate cuts, quite possibly starting at the next meeting in June, but depending on developments on tariffs and the upcoming data. However, the market is now only pricing a June cut as around a 25% chance, as Macklem indicated that the BoC would be less forward looking near term as the impact of tariffs unfolds. Given that he also says firms are seeing suppliers raise prices in anticipation of tariffs, the tone isn’t particularly dovish. The knee-jerk reaction has been CAD positive, with CAD yields modestly higher, but USD/CAD has already dropped somewhat below the level suggested by yield spreads, and with the Canadian economy set to suffer in Q2, the CAD upside looks quite limited from here. Other currencies are more likely to benefit from an USD weakness, so we would still expect CAD weakness on most crosses.