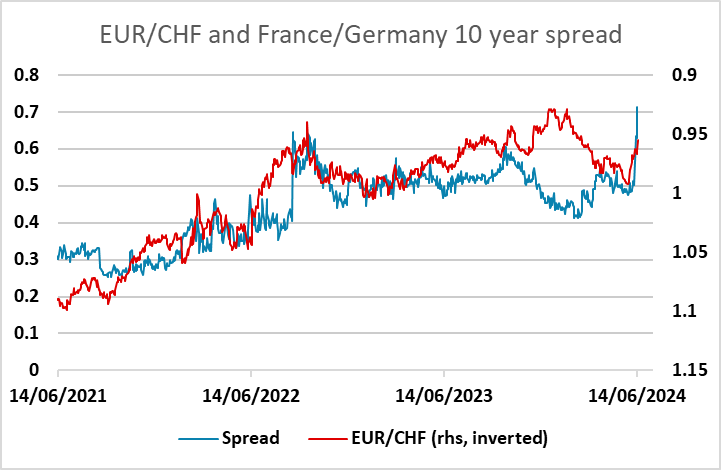

CHF flows: EUR/CHF continues to probe lower

Concerns about French politics and underlying fiscal fragility maintain downward pressure on EUR/CHF

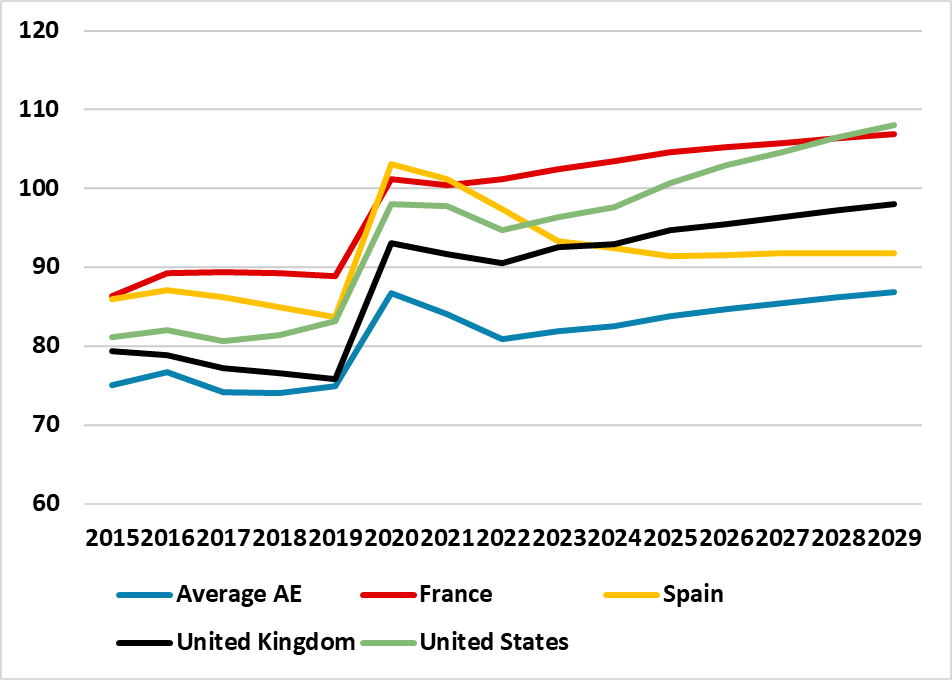

EUR/CHF has continued to probe lower this morning as the widening in the French/German 10 year spread continues. The upcoming French election is the proximate cause of the spread widening and concerns about the Eurozone, but the current French fiscal situation is also a factor, with the recent downgrade from S&P highlighting the deterioration in the public finances. However, while the French fiscal position looks fragile, it is not significantly worse than that of the US, with a somewhat smaller deficit and a similar net debt position. But the US is rated higher because of the USD’s dominance as a reserve currency and the lack of ability of the French government to use monetary finance (although it is clear the ECB would step in in a crisis as they have elsewhere). The offer in EUR/CHF looks likely to continue up to the French election, but the French story maybe should be a warning that fiscal issues could become a more general concern going forward.