FX Daily Strategy: Europe, June 14th

BoJ the focus on Friday and surprised market again

Already plenty of reasons for JPY recovery, but increasingly hard to find a trigger

SEK vulnerable vs NOK unless CPI comes in strong

USD generally looks vulnerable if US outperformance fades

BoJ the focus on Friday and surprised market again

Already plenty of reasons for JPY recovery, but increasingly hard to find a trigger

SEK vulnerable vs NOK unless CPI comes in strong

USD generally looks vulnerable if US outperformance fades

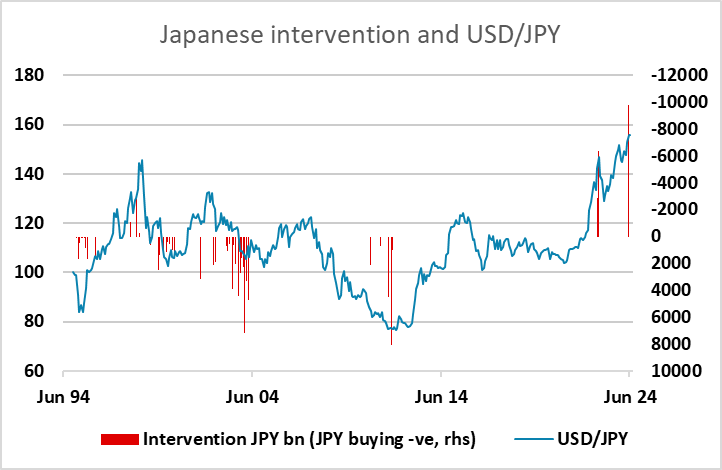

The BoJ decision is the main focus in Friday. The consensus view is for no change in the policy rate but a cut in JGB buying from JPY6trn to JPY5trn. The market is pricing less than a 10% chance of a 10bp rate hike this month, but close to a 60% chance of a hike in July. And the BoJ once again surprise market participants with no change to bond purchase program nor rates. They did guide that the planning for bond purchase cut will be decided in July. It came as a surprise to market as Ueda hinted such, so as multiple 'source" news report, not to mention wage and inflation both picked up to above 2%. The uncertainty in economic outlook and price setting behavior seems to be the key reason led BoJ to this decision.

Our central forecast sees inflation to flare up from wage hikes by a smaller magnitude than BoJ's own forecast and thus expects only one hike of 0.1% in July 2024. Although further tightening cannot be ruled out if wage-inflation translation turns up, the probability is low on consumers' reluctance in higher price and business inability to sustainably hike wages leading to lower inflation in the coming year.

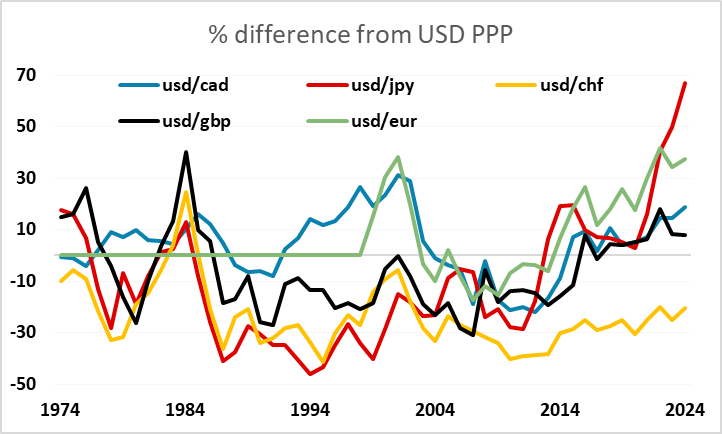

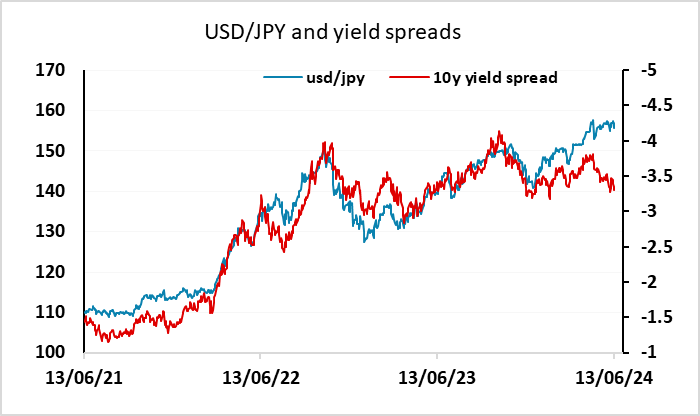

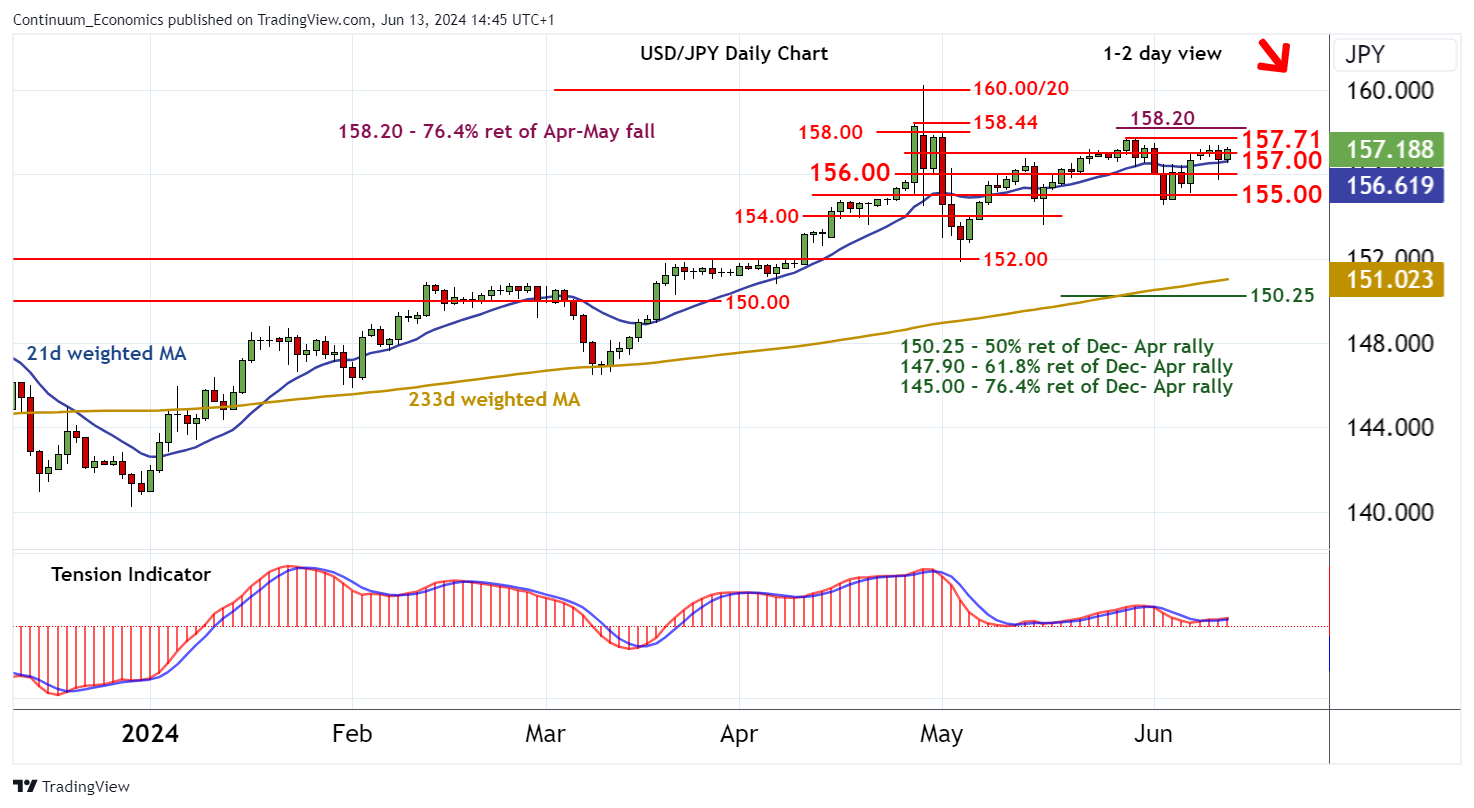

This suggests the risks for USD/JPY are on the downside, but the failure of USD/JPY to decline in spite of significant declines in US yields and spreads makes it hard to know what is required to take USD/JPY lower. Yield spreads are already at levels that should put USD/JPY below 150 based on historic correlations, while the real JPY is at all time lows and the BoJ have already intervened to halt JPY weakness and raised rates once (albeit only marginally). But none of this has been sufficient to propel USD/JPY lower thus far, which leads to the question of what is necessary to turn the trend lower. It may be that the first Fed rate cut will lead to a significant decline in USD/JPY, but general signs of weakness in the global economy and particularly the US equity market may be necessary to trigger a change in sentiment. We believe that when the JPY rally comes, it will be huge, as the JPY is enormously undervalued from a longer term perspective, but it is hard to pick a trigger for a turn higher at this point given the lack of reaction to the plethora of JPY positive news we have already seen. Nevertheless, the risks look weighted to the USD/JPY downside.

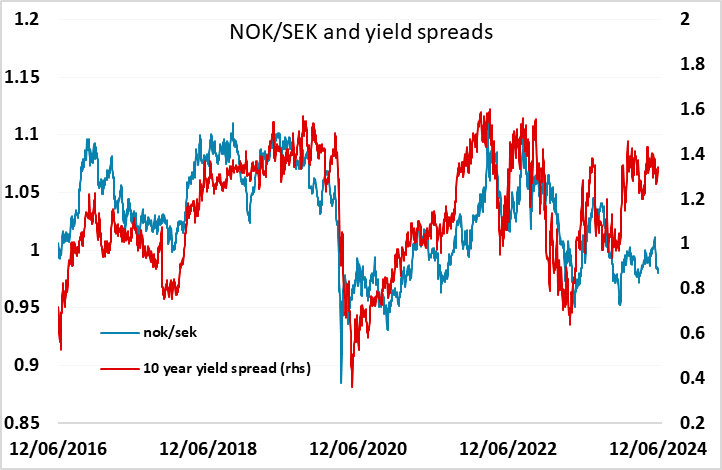

Otherwise Friday sees Swedish May CPI data, which should be of interest given the sharp SEK gains in the last month which have not been supported by moves in SEK yields. The consensus if for a further decline in y/y inflation to 2.1% headline and 3.5% core, but declines may need to be smaller than this to support the recent SEK rise. We continue to see scope for the SEK to fall back against the NOK, where the historically strong yield spread correlation suggest scope for a rebound above parity, even if the upside for EUR/SEK is restricted by negative EUR sentiment related to concerns around the upcoming French elections.

USD strength in general continues to look a little fragile after the softer than expected CPI and PPI data and the higher jobless claims data seen in the last few days. While there may be limited enthusiasm for the EUR due to the current political uncertainties, the USD remains at generally elevated levels that will be hard to justify if US growth numbers stop outperforming those elsewhere.