This week's five highlights

U.S. January Employment Stronger across the board, will keep Fed in no hurry to ease

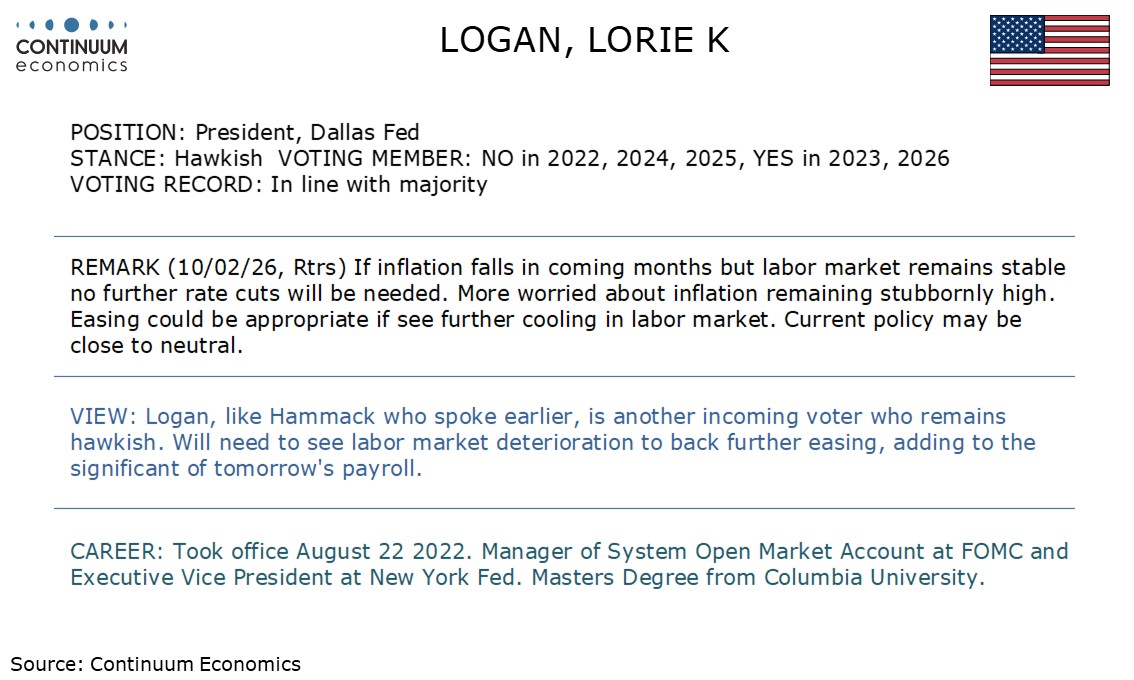

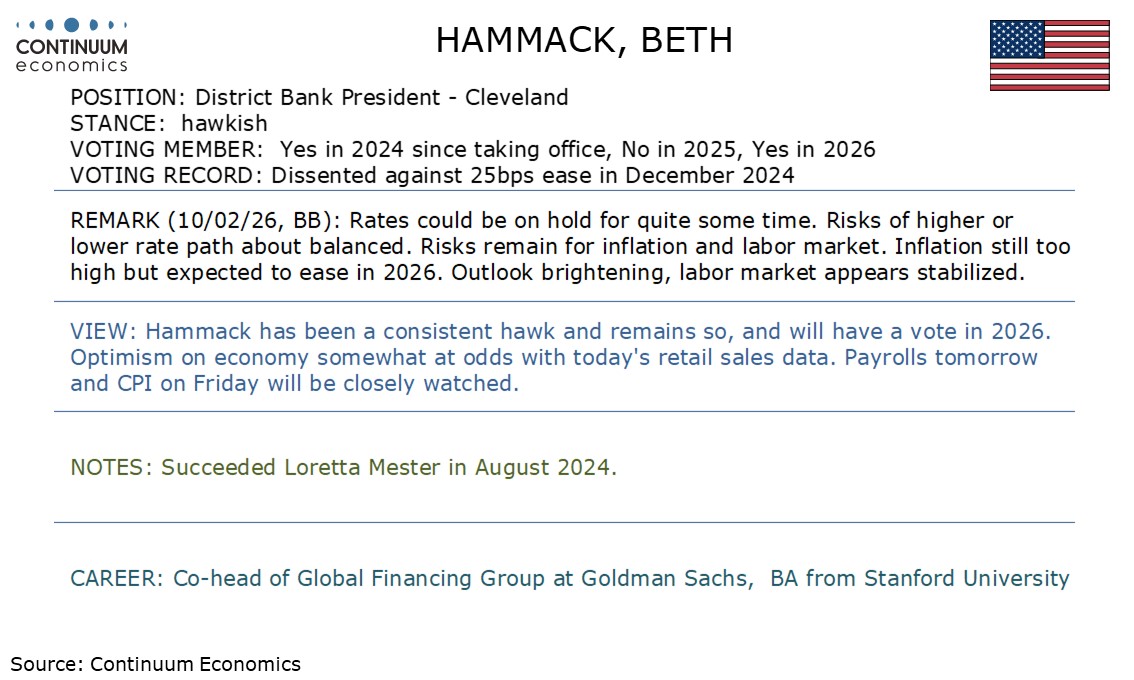

This Week's Fed Speakers

BoC Minutes Show Steady policy dependent on economy evolving as expected

UK GDP Underlying Economy Fragility Does Continue

Landslide Victory for Japan LDP

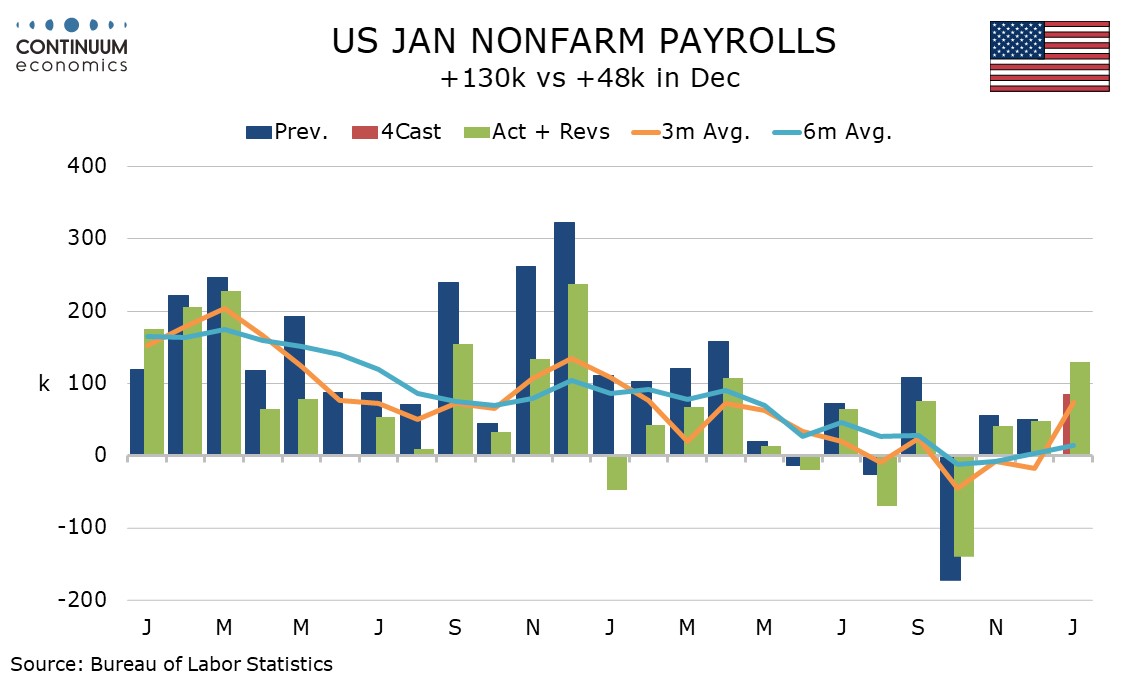

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger than expected across the board. This should ensure the Fed remains in no hurry to ease. This report contains annual historical revisions with the March 2025 benchmark revised down by 862k, in line with signals already given by the Labor Dep‘t. Since March 2025 revisions are relatively modest, totaling a negative 131k, with 50k of that coming in April 2025. December’s data was revised down by only 2k to 48k with private sector data revised up to 64k from 37k. The revisions do not take much away from the surprisingly strong January detail.

January saw some severe weather late in the month but this came after the reference survey and did not impact the non-farm payroll. The payroll gain was more than fully explained by a 137k increase in education and health, the strongest sector in most recent payrolls but particularly strong this month. 123.5k of that came in health. Also above trend was construction at 33k while manufacturing managed a 5k increase, its first in over a year. Professional and business was above trend at 34k but financial was weak at -22k. Retail, a sector where we had seen upside risk after recent slippage, was almost unchanged, up by 1k. This follows a disappointing December retail sales report. Government fell by 42k, led by a 34k decline in Federal.

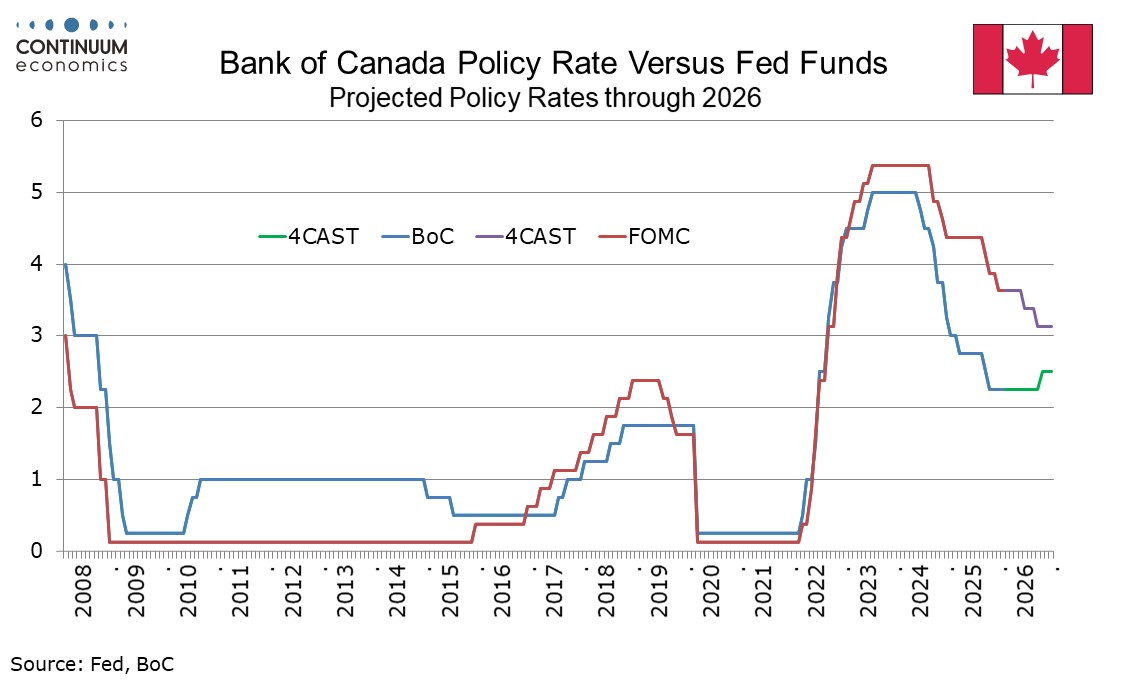

The Bank of Canada has released minutes from its January 28 meeting which provide no major surprises. The meeting saw rates left unchanged at 2.25% but noted heightened uncertainty, which the minutes also emphasize, with steady policy conditional on the economy evolving as expected. Most major economies were seen as proving resilient to US tariffs but were still seen as vulnerable to unpredictable US policy. The Canadian economy was seen as evolving largely as anticipated in October’s Monetary Policy Report. Domestic demand was expected to remain resilient but with investment soft through 2026. Fiscal policy was seen as supportive while the labor market continued to be soft. CPI was seen as evolving in line with expectations with the BoC’s preferred measure of core inflation falling to 2.5% in December from 3.0% in October.

Three broad areas of risk were discussed. Firstly geopolitical, including in Venezuela, Iran and Greenland, as well as threats to the independence of the US Federal Reserve, which added to uncertainty. The review of the Canada-US-Mexico trade agreement as seen as an important risk, and to the downside on growth, though with potential inflationary risk from any retaliatory tariffs. Finally the BoC discussed risks from ongoing trade disruptions and structural adjustments, concluding that risks around the outlook had moved higher.

Members agreed to hold policy given that it was already on the stimulative side and the projection remained in line with October’s, but agreed that holding policy at the current rate was conditional on the economy evolving in line with their outlook. The range of possible outcomes was seen to have broadened with assigning weighs to their probabilities unusually difficult, as was predicting the direction and timing of the next policy change. We expect the BoC to keep policy steady until a modest tightening in Q4, but if there is to be a move before then, it is more likely to be an easing, in response to downside risks materializing.

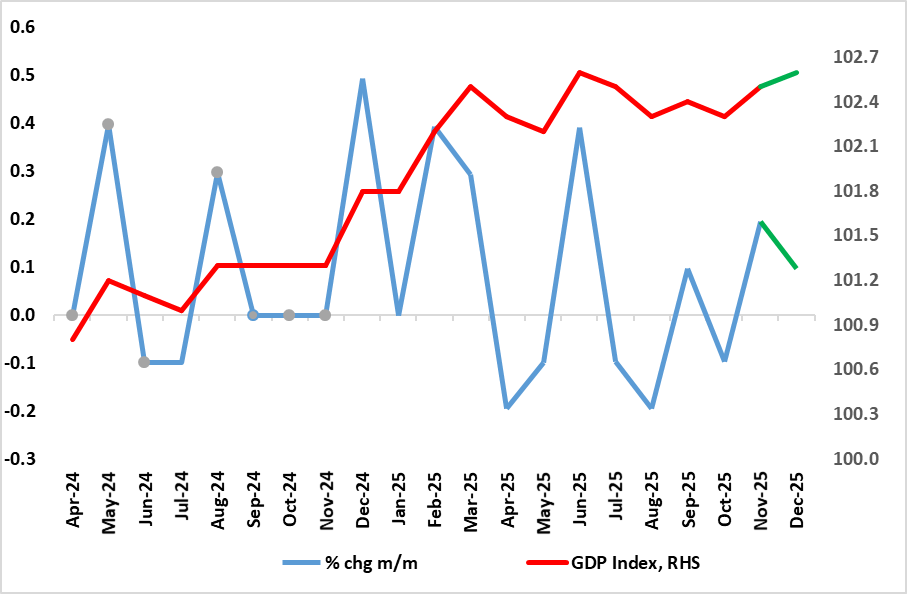

Figure: GDP Growth Volatile but Hardly Strong?

First the good news; the UK economy grew for a second successive month in December, something not seen for almost a year. But as is familiar with recent UK real economy data, there is a negative flip side with the 0.1 m/m December advance negated by downward revisions to previous figures (November pared back 0.1 ppt to 0.2) and September downgraded similarly. As a result, the economy grew by 0.1% q/q in Q4, less than consensus and BoE thinking but matching the feeble gain of the previous quarter with weakness in business investment occurring alongside another gain in imports. Activity in December was impaired by fresh weakness in manufacturing, utilities and construction. The data is likely to reinforce the demand worries of what now seems to be an emerging majority on the MPC; six members of the MPC appear worried about the disinflationary impact from a weak economy - four of whom actually voted for a 25bp cut at this month’s meeting.

Even given the surprisingly solid, but somewhat pared back November GDP release, December merely returns the level of GDP to where it was in June. Partly undermined by wet and warm weather through the month, GDP advanced by a mere 0.1% in December figure, half that of November. This means that Q4 saw a 0.1% q/q rise which would result in 2025 growth of 1.3%, two notches above that seen for 2024. But we still see no more than 0.8% this year; this actually and merely being a minor pick-up from the anemic growth seen in the last two quarters. Regardless, we remain wary about the GDP numbers, even given their relative weakness. Although there have been some better business survey numbers, other such insights provide still sobering reading (Figure 2) as do non-official employment indicators, the latter actually suggesting a worsening backdrop of late.

It is unclear how uncertainty (especially related to budget worries) affected activity in October and whether a degree of more fiscal clarity even ahead of the actual Budget may have helped sentiment in November. But businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies.

It is a landslide victory for Takaichi's LDP. The early result is showing the LDP winning 316 seats and the coalition has secured super majority with 352 seats in the 456 seats Lower House. The opposition, Central Reform Alliance, performed terribly and could see only 49 seats left. The result fits earlier polls but few it is expecting the LDP to get such a huge win. Market participants are reacting by renewed JPY offers, in fear of more fiscal irresponsibility.

In reality, we believe such fear has been exacerbated by neglecting the material changes in Japanese economic landscape compared to Abe's era. While PM Takaichi is definitely pro-stimulus, the business price/wage setting behavior has already substantially changed from a decade ago and the momentum does not look like to be slowing in a short term. Thus, there is no need of Abe's era massive stimulus policy to jumpstart the economy. PM Takaichi seems to be considering market sentiment by shelving food tax cut that was promoted in her campaign, in sight of fiscal irresponsible sentiment and rising yield. These factors lead to our expectation that any potential stimulus wouldn't be COVID era and rather be more targeted at cost relieve and strategic investment.

PM Takaichi's win could be partially attributed to her latest round of economic stimulus, but her strategic approach towards voters can not be neglected. She has taken a more lively approach in public imaging, where she appeared to be more attached to local culture including manga, band music and was not afraid to show that side of her. It is quite uncommon in Japanese politicians. Also distancing herself with old coalition partner Komeito, Takaichi seems to be able to grasp the heart of voters that the LDP is head towards a change.