SEK flows: SEK unmoved by weaker economic tendency survey, but...

SEK little changed despite a weaker March economic tendency survey, but may be vulnerable if we see any more general weakening in sentiment in Europe.

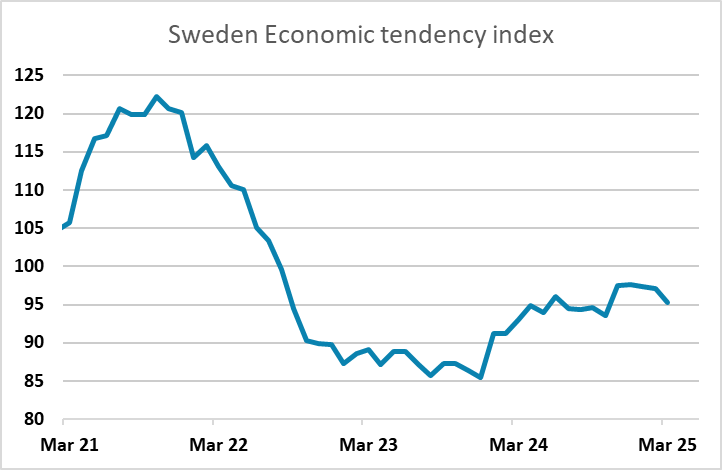

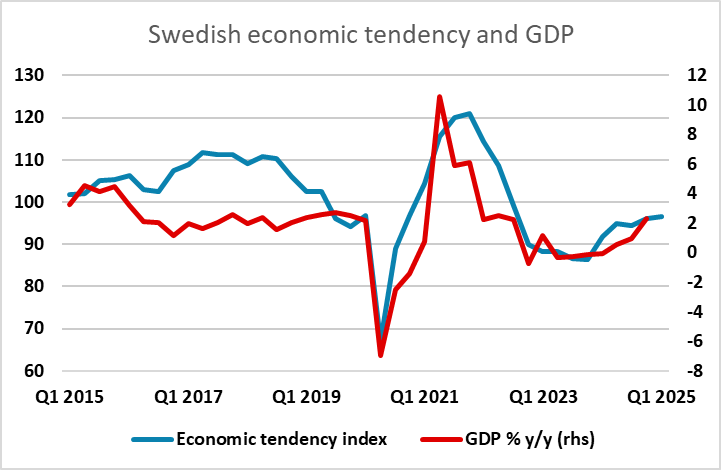

The SEK has been essentially undisturbed by the somewhat weaker than expected economic tendency survey this morning, reflecting weaker consumer confidence. The dip in the March index to 95.2 still leaves the Q1 average above Q4, suggesting the growth picture remained reasonably solid in Q1, but the dip in March creates a lower base for Q2 and creates some doubt about the current momentum of the economy.

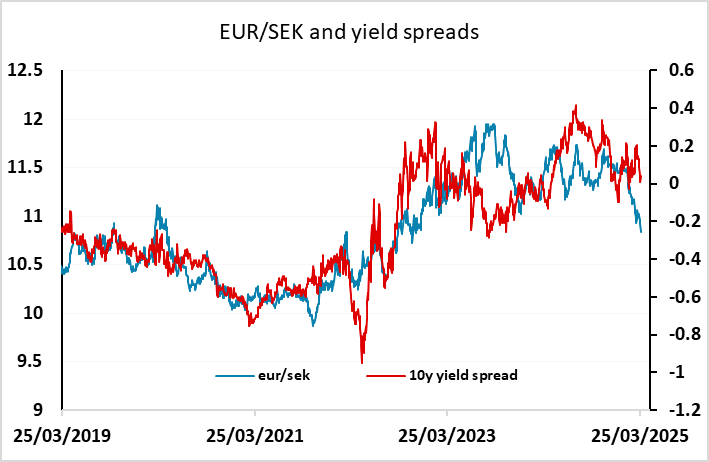

EUR/SEK is nevertheless unmoved, and remains at low levels relative to current yield spreads. There is still sufficient optimism around the European economy to maintain a positive SEK tone for now, but the SEK is vulnerable if European risk sentiment weakens. With the French consumer confidence numbers also weaker than expected this morning, the risks do look to be shifting towards a weaker SEK.