This week's five highlights

Trump being Trump

U.S. December CPI A Moderate rebound

U.S. Retail Sales and PPI not far from expectations

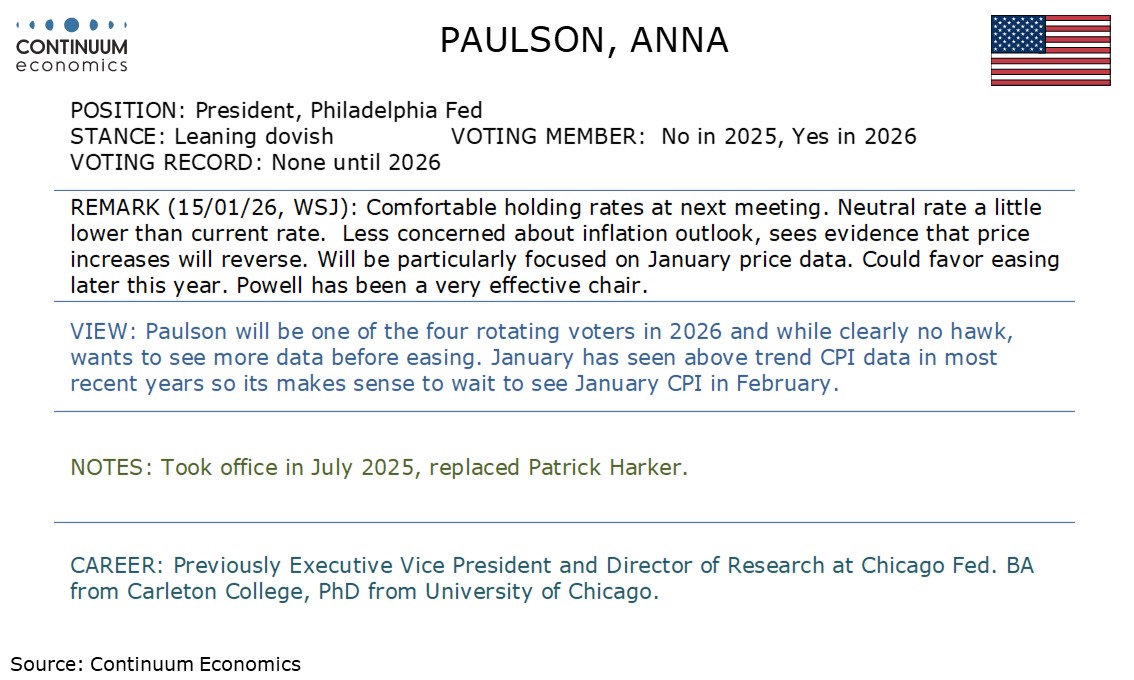

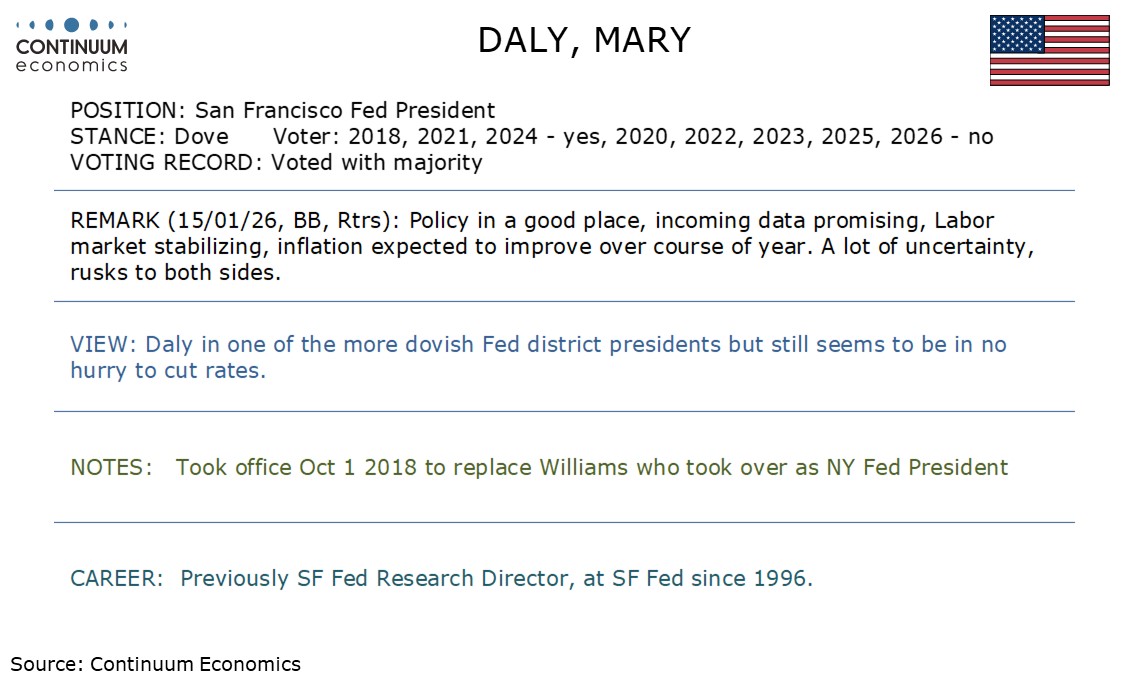

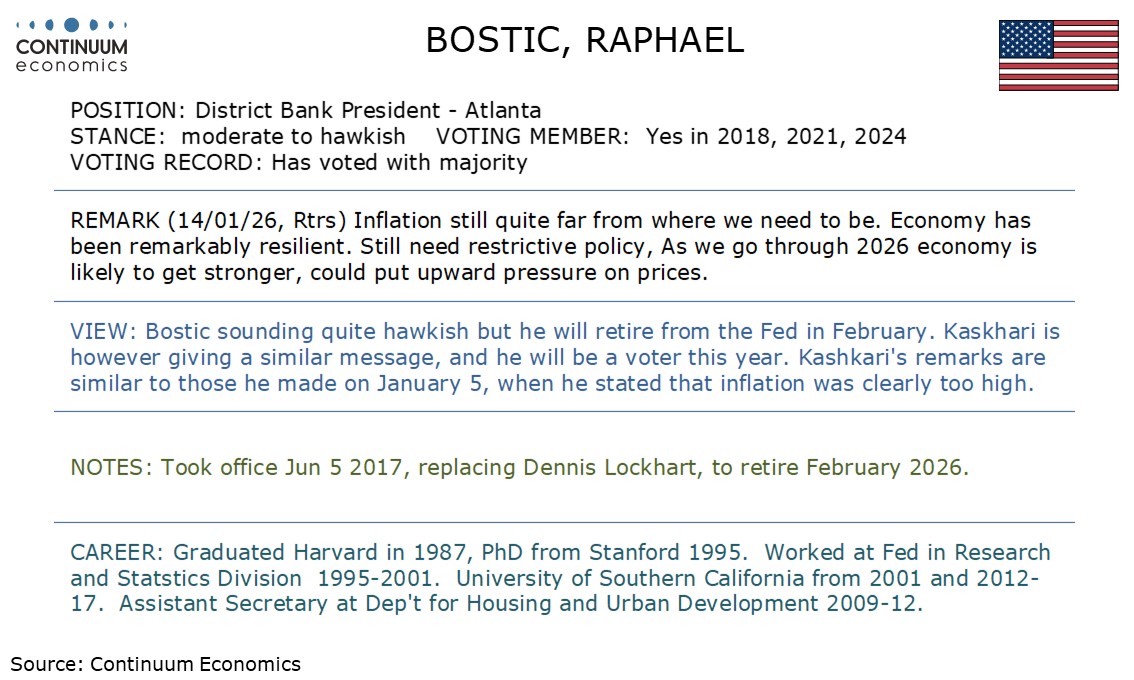

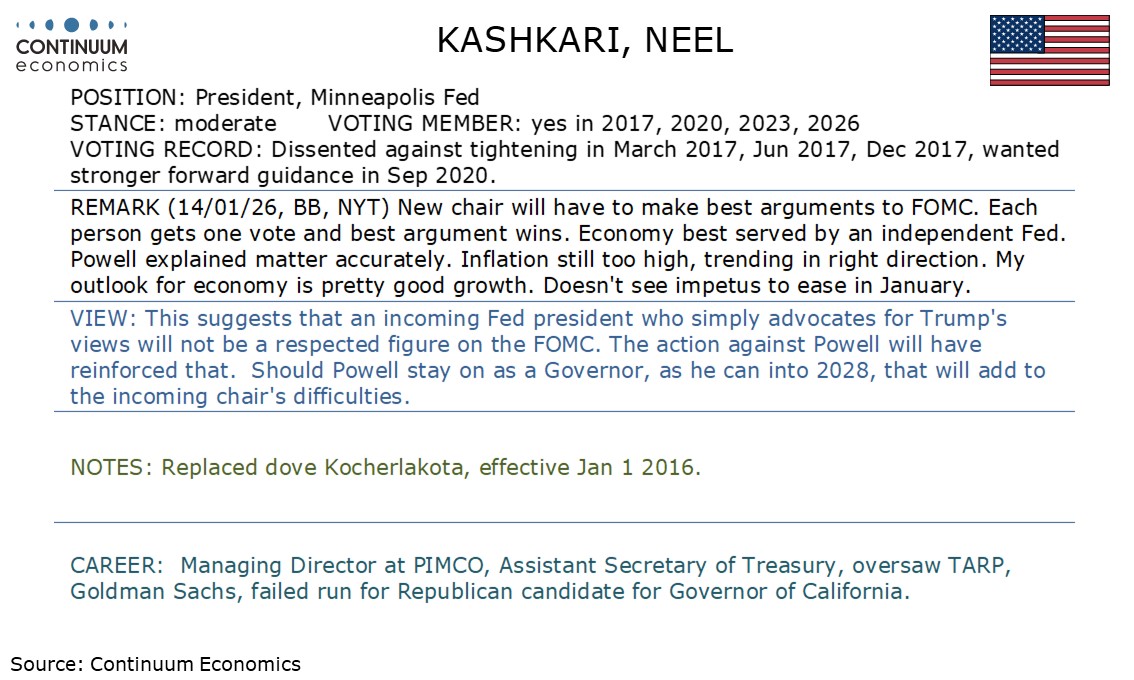

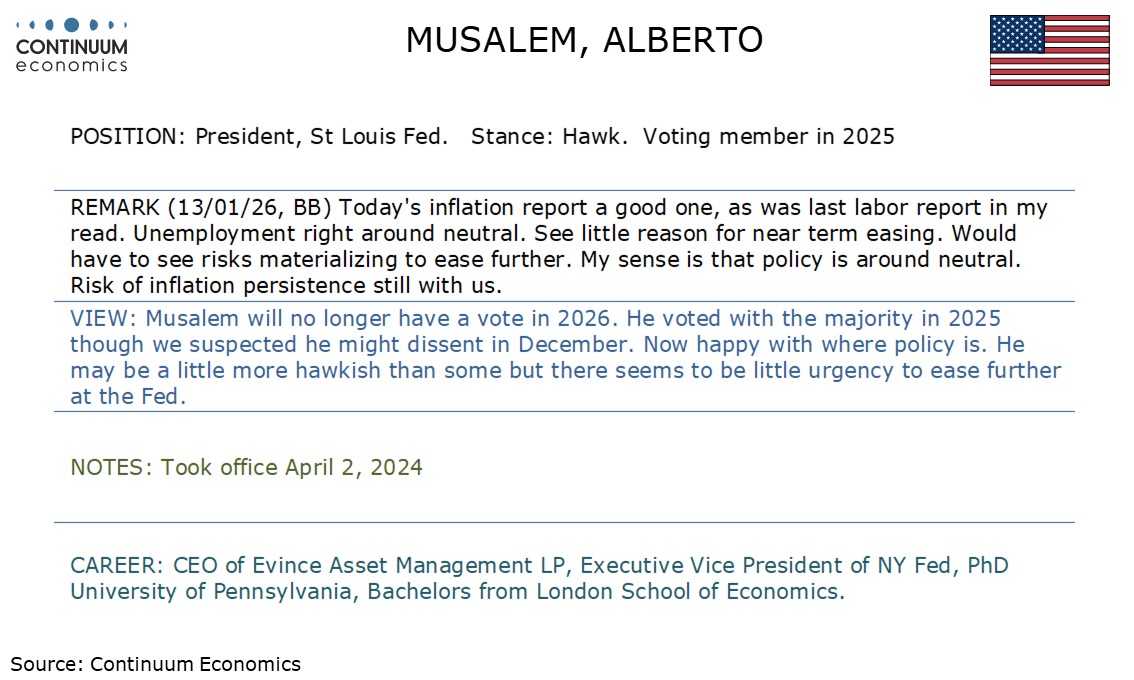

This Week's Fed Speakers

Japan Weighs Snap Election

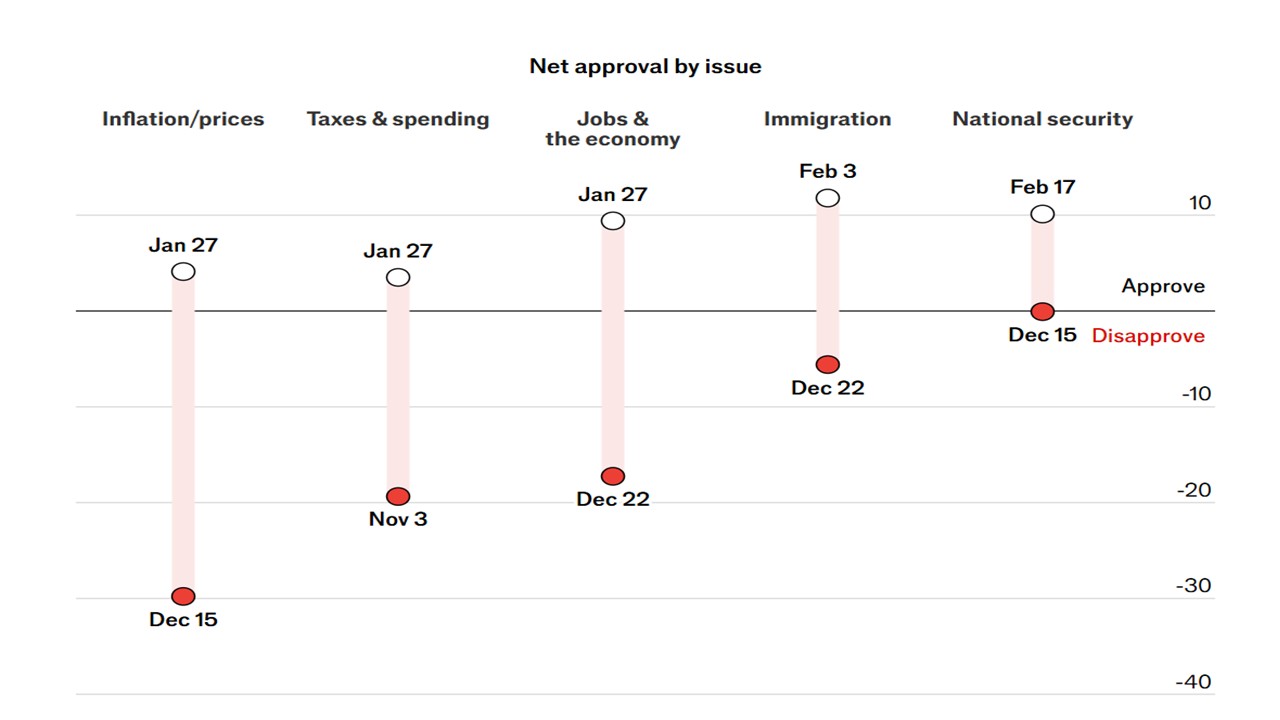

Figure: Trump Net Approval Rating By Issue

Trump has followed up the military operation in Venezuela, with threats against Iran/Greenland and Cuba, as well DOJ subpoena against the Fed Chair Powell. What will be the impact on financial markets? Overall, though Trump action can cause volatility in financial markets, the major issues remain the performance of the U.S. economy and whether the current scale of AI optimism will remain. Monthly TICS data since the April reciprocal tariffs show that global investors continue inward net portfolio flows at a good pace into U.S. assets, though with hedging of existing FX exposure.

The oil market has not reacted noticeably to the military operation in Venezuela, as the consensus is that it will take political stability and many years for a significant ramp-up in oil production. Trump is working with the existing regime, rather than pushing for free elections that some of the oil majors see as a precondition for significant investment. Meanwhile, though the U.S. could relax sanctions against the Venezuelan government later in the year, this would add only a small amount of oil to the global market.

Trump is threatening military action against Iran, as early as this week. Any operation would likely be designed to be surgical and potentially against military targets, but this may not hurt the existing Iran regime on a lasting basis and would likely be meet with retaliation against the U.S. The Iran protests are also being meet with a brutal crackdown by the regime and most experts still feel that this will continue and the existing regime is unlikely to fall. Iran can produce short-term volatility in financial markets, but is unlikely to produce a lasting trend. If Iran was to see a successful revolution followed by free elections, then it would produce a big geopolitical shift in the region that reduces long-term risks. Multi-year it could also mean extra oil exports, but especially Iran emerging as a major gas exporter.

Trump foreign escapades in 2026 appear to be partially designed to deflect attention from the lack of succuss in meeting voters concerns over the cost of living crisis (Figure 1) given the surge in prices since 2019. Though Trump claims some success against cost of living, voters are not convinced. The DOJ subpoena action against Fed chair Powell over the weekend also appears to be designed to shift the blame to the Fed over cost of living – though actual FOMC voting is unlikely to be impacted by Trump now that the district Fed presidents have been reappointed until 2031. Meanwhile, though the backlash against Trump military adventures within Maga has so far been mixed, opinion polls shows that this military adventurism is unpopular. Any U.S. military casualties could risk a backlash in the U.S. All of this is also leading to Trump administration pressure for more fiscal easing (demands for 2k per person tariff windfall and USD1.5trn of military expenditure in 2026). If congress swings behind these desires, then it could upset the U.S. Treasury market and mean a steeper yield curve.

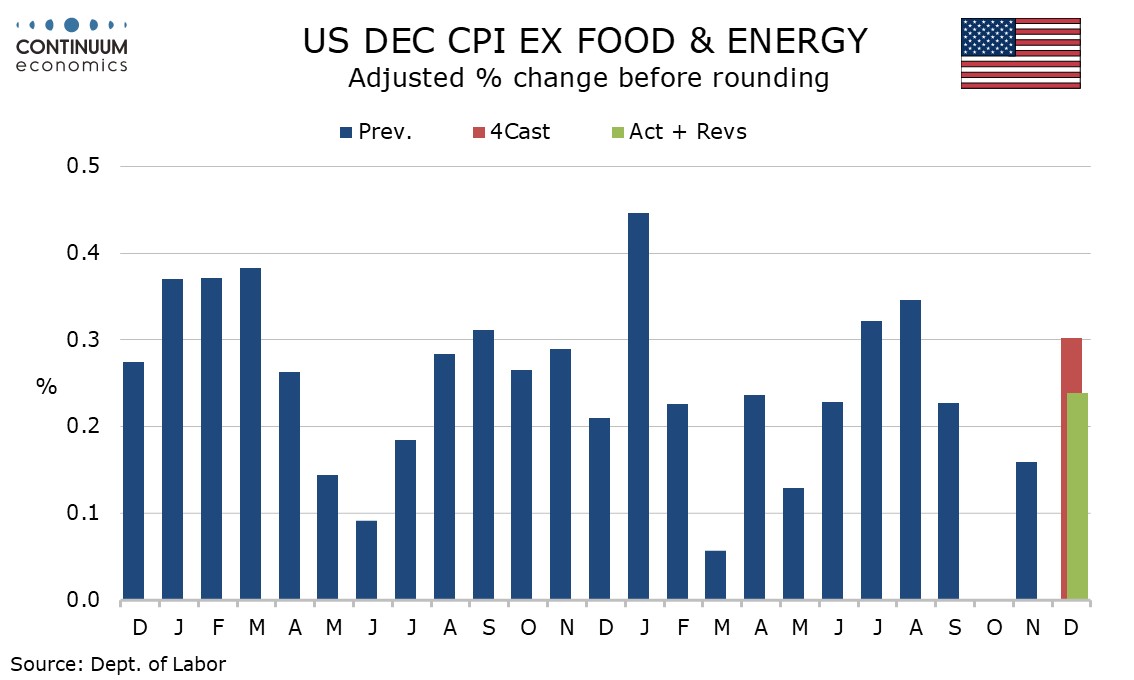

December’s CPI has come in slightly softer than expected, not showing a strong rebound from the weak 2-month change in November and thus leaving a subdued Q4. December CPI rise by 0.3% as expected but with the core rate weaker than expected at 0.2%, 0.24% before rounding. CPI ex food, energy and shelter rose by only 0.1%. This leaves core CPI up 0.4% from September, an average monthly gain of 0.13%. Yr/yr rates are unchanged from November at 2.7% overall and 2.6% ex food and energy, and down from 3.0% in each series in September. The yr/yr core rate is the lowest since March 2021.

Food had a strong month at 0.7% after rising by only 0.1% through October and November while energy rose by 0.3% despite a 0.5% fall in gasoline with energy services up by 1.0% led by piped gas. Commodities less food and energy, which had picked up since April’s tariff announcement, were unchanged, restrained by a 1.1% decline in used autos, which may prove erratic, while new vehicles were unchanged. Apparel was firm at 0.6% but this follows a 0.7% in October through November. Tariff feed through may be fading, though it is also possible pricing decisions are simply being delayed to the new year or the Supreme Court verdict on tariffs.

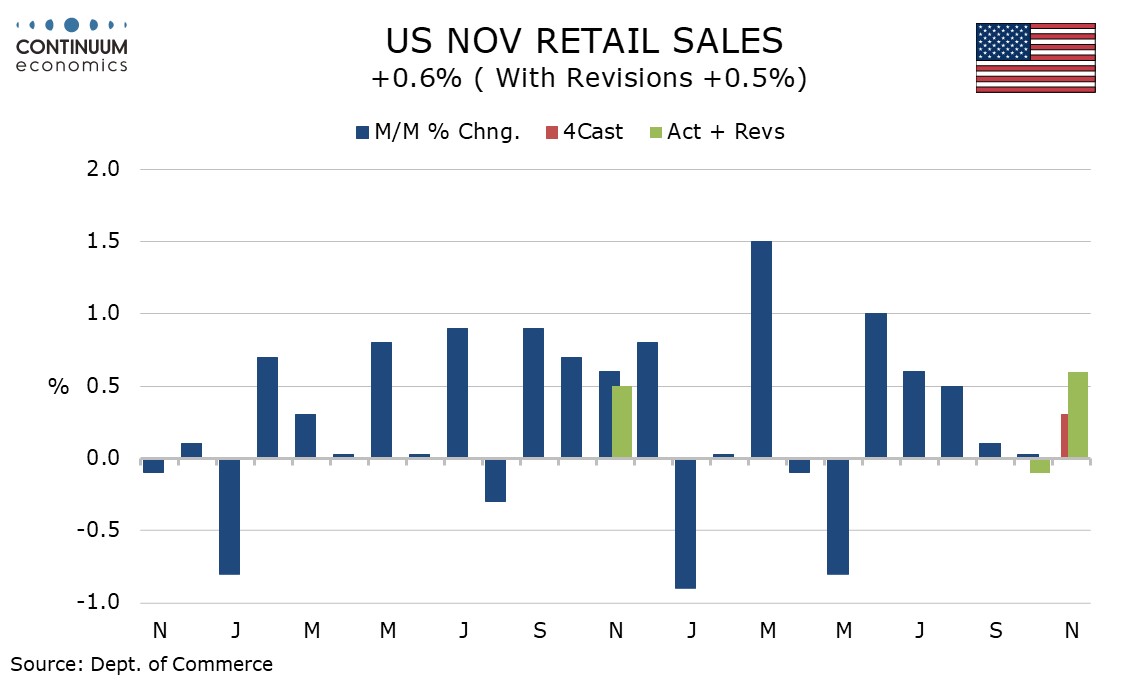

November retail sales with a rise of 0.6% are marginally stronger than expected but the data is close to expectations net of modest negative back month revisions. PPI has been released for both October and November, also net in line with expectations, with October on the firm side in the core rate followed by a more subdued November. November retail sales rise by 0.6% but with October revised down to -0.1% from unchanged the net gain is 0.5%, Ex autos November sales rise by 0.5% but with October revised to a 0.2% increase from 0.4%. Ex auto and gasoline the November gain was 0.4%, with both October and September revised down by 0.1% to a 0.4% increase and a 0.1% decline respectively .

The 3 month/3 month changes (not annualized) are 0.8% overall and 1.0% ex autos, both the lowest since July but far from weak. Ex autos and gasoline the 3 month/3 month change is 0.8%, this the slowest since March but implying only a moderate loss of consumer momentum. Some of the slowing will reflect slower price gains, though November gasoline prices picked up from a dip in October. Auto sales rose by 1.0% after a 1.6% October decline that coincided with the ending of a tax credit for electric vehicle purchases. December data from the auto industry suggests a further bounce in autos sales, suggesting that Q4, while likely to see some slowing, is not going to be weak. In addition to autos and gasoline, building materials and eating and drinking places saw rebounds from October slippage. Clothing saw a second straight solid gain.

Riding on the wave of positive review from latest policies, Japan PM Takaichi is likely to call for a snap election on the 8th of February. She will be targeting to dissolve the lower house and aim to persuade the new government (coalition with right wing Ishin) is different than the previous one, which is in coalition with Komeito. Some survey is showing Takaichi approval rating as high as 70%, and is projected to win back the majority in the lower house. Her opponent, opposition parties CDP (largest opposition party) and Komeito (previous LDP coalition partner), are having plans to form a new party to deal with the snap election call. They will be targeting the centrist audience.

USD/JPY has been taking a beating since the news but the rationale seems to not be on solid ground. On the chart, the pair is range-bound in consolidation above the 158.00 level following pullback from the 159.45 high. Prices are unwinding the overbought daily studies and threatens deeper pullback retrace recent gains from the 154.40, December low. Break of support at the 158.00/157.90 congestion area will open up room to the 157.00/156.00 congestion area. Meanwhile, resistance at the 159.45 high now expected to cap. Break here, if seen, will open up room to the 160.00 figure. Beyond this will turn focus to the 161.95, the July 2024 year high.