This week's five highlights

U.S. September Employment Makes Case for a December easing looks a little weaker

And See Risk Asset Continue its Correction

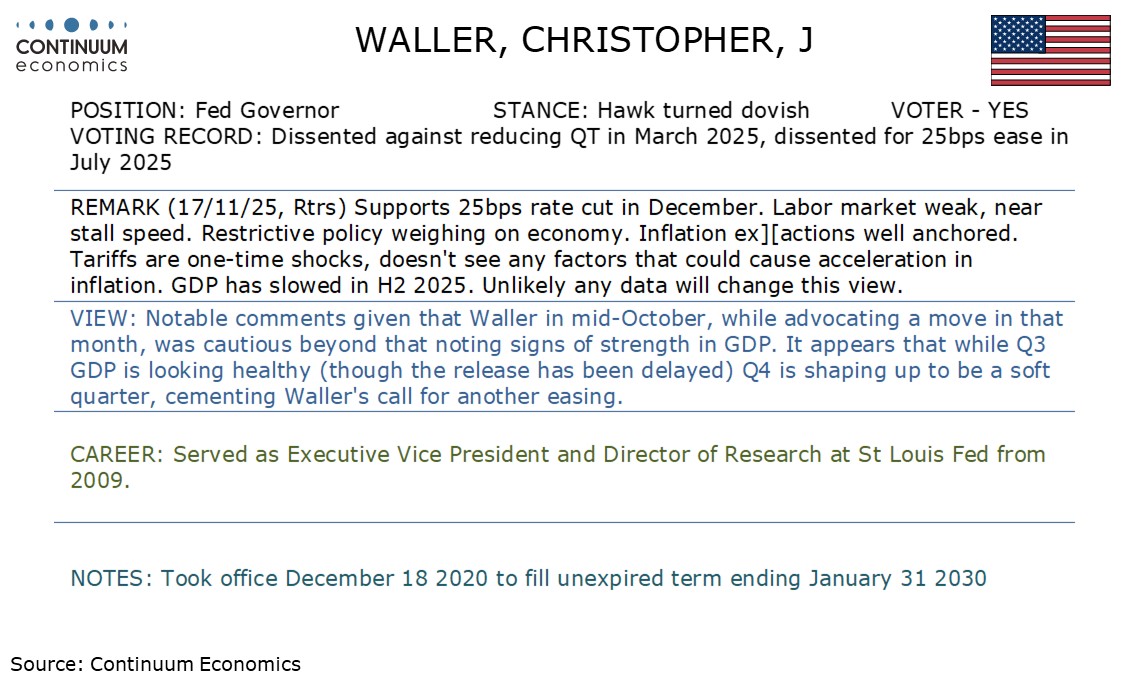

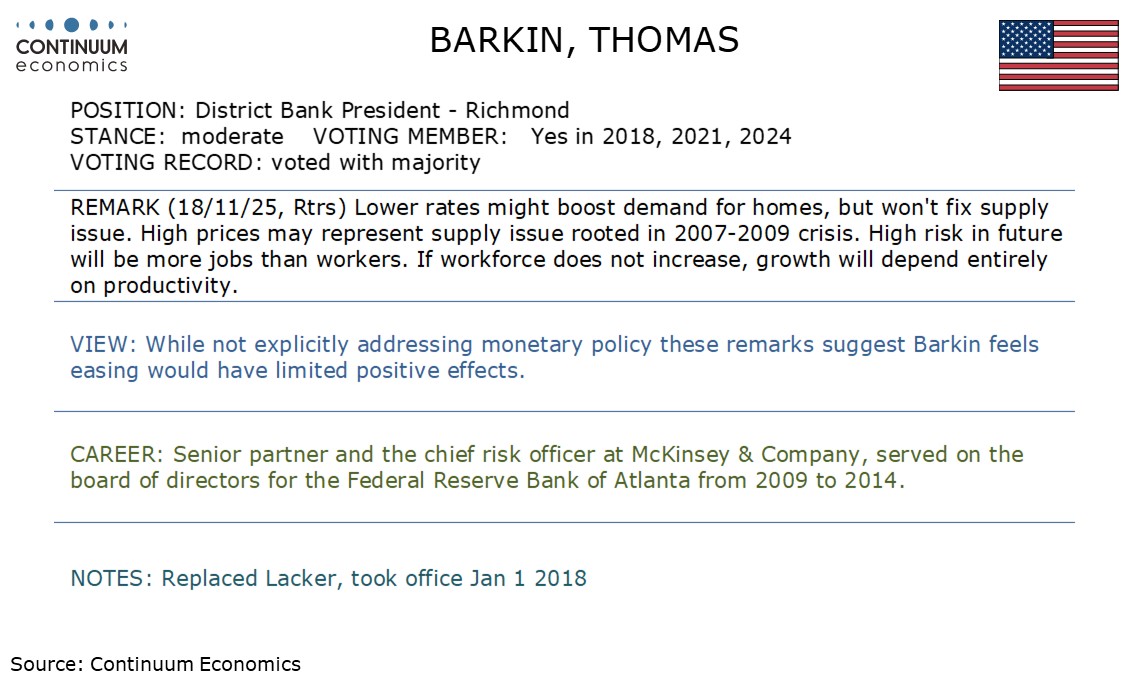

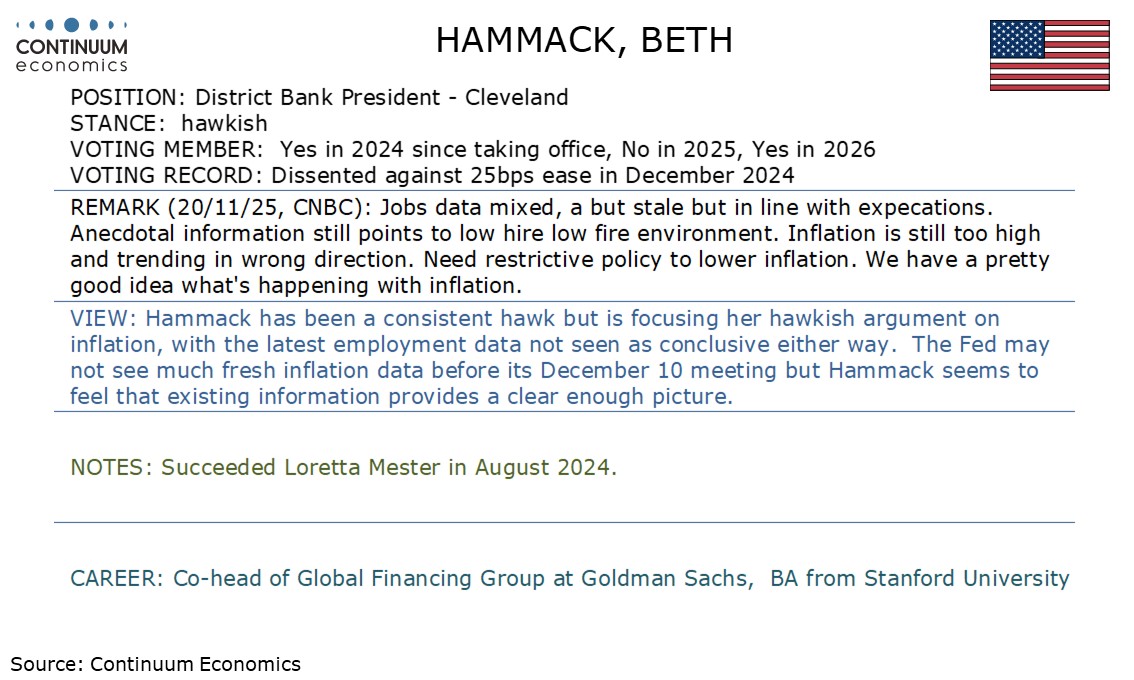

These Week's Fed Speaker

Japan's Takaichi Outlines More Stimulus

UK CPI Down from Likely Peak

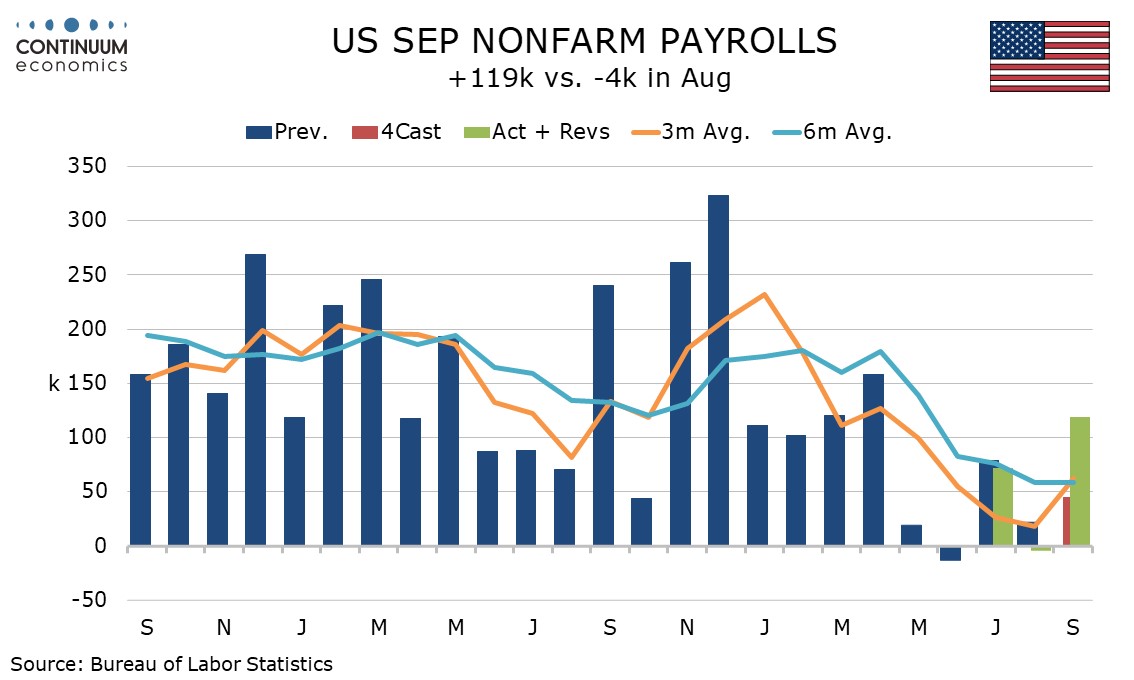

September’s non-farm payroll will be the last released before the December 10 FOMC meeting and is surprisingly firm at 119k, albeit with 33k in negative revisions. A rise in unemployment to 4.4% from 4.3% and a 0.2% rise in average hourly earnings provide only marginal offsets to the headline. November’s (and October’s) payroll will not be seen until December 16, but initial claims for its survey week at 220k do not suggest much has changed in the labor market since September’s payroll.

The resilience of November’s payroll and the likelihood that the FOMC will have limited fresh information before it next meets argues against an easing in December, though with several Fed speakers due to speak in the remainder of this week and the data schedule, including for Q3 GDP and October and November CPI, still unclear, we will not make a final call on December’s meeting quite yet.

The anticipation of less rate hike is renewing valuation concern in the U.S. equity space. It led a fresh wave of selloff despite NVidia's strong earning. The flight in risk asset also turned into contagion as it becomes a "sell everything" day. The December rate cut has been the hopium for equity buyers as they thirst for a trigger to see another leg higher. However, with a diminshing expectation, the correction in the equity space could continue if speculators throw in the towel.

Long awaited, the new Japan PM Takaichi is finally rolling out her stimulus package. It is reported that the stimulus package focusing on cost relief and key investment will be around 135 billion USD, exceeding the 60 billion estimate in late October. While exceeding early estimates, it is not that different from the stimulus size in 2023/24 and only a quarter of COVID era stimulus. Takaichi has been viewed as pro-stimulus since her election and this stimulus plan seems to be true with her words in providing cost relief for Japanese residents and increase investment in strategic area such as AI and chips.

Details will not be revealed until late Friday but could see similar measures being rolled out with a twist. Cost relief will likely be twofold. For Japanese residents, they could see income and residential tax and energy rebates with one-off stimulus check less likely. For Japanese business, we feel more stimulus will be targeted at SMEs for they are the ones having difficulties in catching up wage growth against large enterprise. The package could include one off grants for SMEs, to encourage their transition in price/wage setting behavior.

PM Takaichi is calling for a supplementary budget of 17.7 trillion JPY, including 2.7 trillion JPY of tax cuts. It would require Japan issuing new bond. The trillions of new bond will worsen the debt to GDP for Japan, affecting investor confident. PM Takaichi has vowed to exert a level of fiscal restrain and we will have to wait and see how she can interpret the inevitable worsening fiscal picture. We expect her to downplay short term impact and convert to multi-year fiscal balance, in hopes of reinforcing confident.

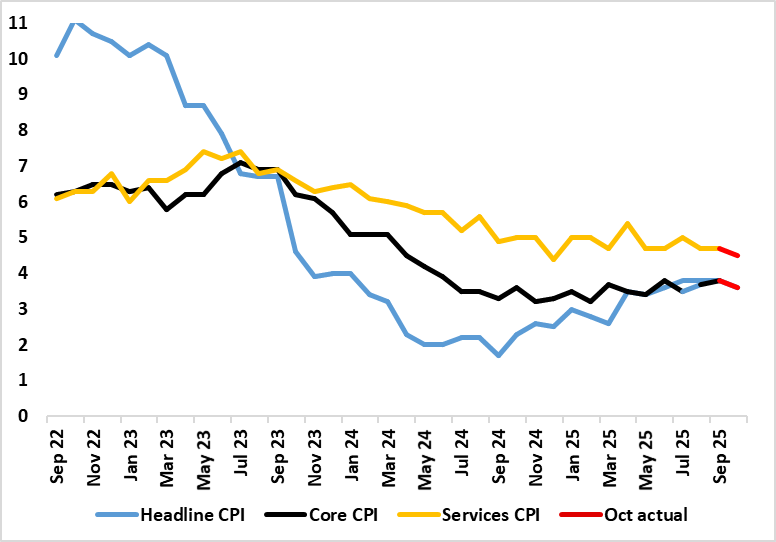

Figure: Headline and Core Fall Further

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base effects, with the core rate seen dropping 0.1 ppt to a six-month low of 3.4% (Figure). Other base effects meant food inflation rose afresh after a clear and belated fall in September. After some further aberrant factors, services inflation (helped by airfares), dropped 0.2 ppt to a 10-mth low of 4.5% in October, partly explaining the anticipated fall in the core rate. Notably, in adjusted terms of late (Figure 2), a clear fall may be occurring as far as underlying inflation is concerned, this also evident in regard to services.

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable base effect through 2026, with maybe moves in the opposite direction given suggestions of lower VAT on energy in the looming budget. This is one reason why shorter-term, but adjusted m/m data, are useful as they to not encompass price rises that took place months before and are unlikely to be repeated – Figure 2 shows a more reassuring picture for core inflation in this regard. In fact, the BoE also now employ some use of such short-term adjusted data, showing services price pressures having dropped sharply of late.