CHF flows: CHF falls on 50bp SNB cut, but downside limited

CHF declines on 50bp SNB cut, but limits to the downside while concerns about Eurozone stability maintain wide intra-Eurozone spreads

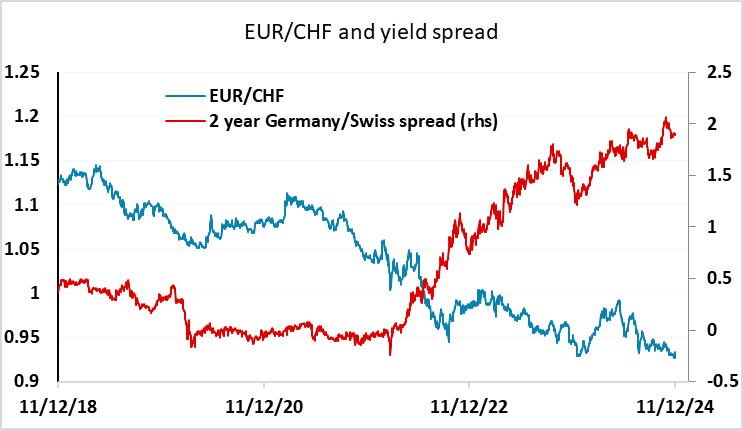

The SNB cut rates by 50bps, more than expected by most forecasters (85% expected a 25bp cut) but the market had priced a 50bp cut as the most likely outcome ahead of the meeting (65% probability). EUR/CHF has jumped half a figure in response. The SNB also said they are prepared to intervene in the FX market as necessary, and implied further rate cuts are on the way by lowering their inflation forecast for 2025 to 0.3% from 0.6%. Although the 2026 forecast was raised marginally to 0.8% from 0.7%, this is still below target.

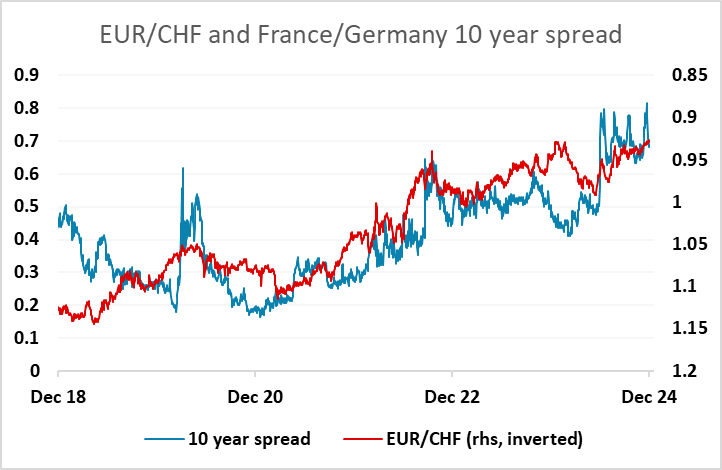

The CHF decline may extend a little today, but the problem for the SNB is that EUR/CHF has very limited responsiveness to interest rate spreads, and rather tends to be driven by geopolitical factors, and particularly by perceptions of the stability of the Eurozone. Intra-Eurozone spreads continue to be significantly correlated with EUR/CHF, and until or unless we see some narrowing in the France-Germany spread, which has widened out significantly in recent months, it will be hard for EUR/CHF to extend gains back to 0.95 and beyond. But the strength of the CHF in real terms is an issue for the SNB, and they will likely oppose any further strength with intervention.