SEK flows: SEK slightly weaker after CPI

Softer CPI increases chances of a Riksbank rate cut this month and suggetss SEK downside risks

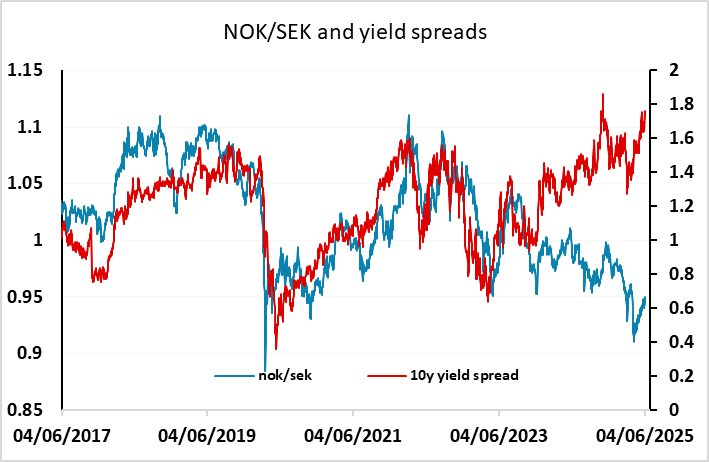

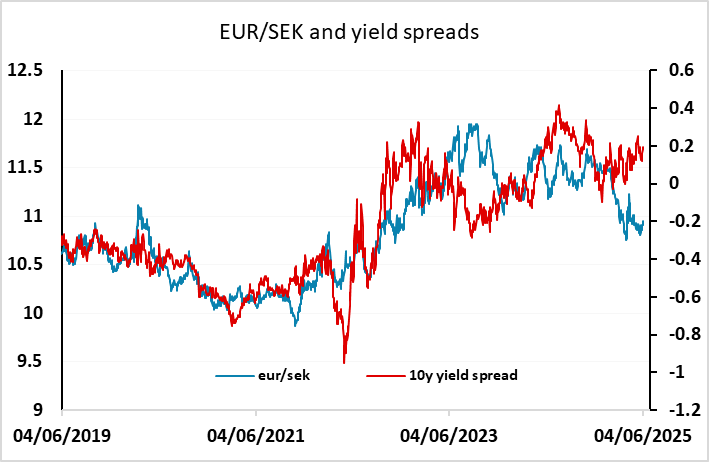

Swedish CPI has come in below market consensus at 2.3% for the targeted CPIF measure, increasing the chances of a Riksbank rate cut at the June 18 meeting. This is now priced as a 73% chance (from 60% yesterday). However, EUR/SEK has moved only very slightly higher in response so far. The SEK has been one of the best performers against the USD in this period of USD weakness seen in the last couple of months, outperforming yield spreads against the EUR and particularly the NOK, and as long as the negative USD sentiment persists, it may continue to outperform. But NOK/SEK in particular should have potential for recovery and EUR/SEK also looks undervalued below 11 if the Riksbank cut rates this month.