USD, CAD flows: CAD lower on drop in employment

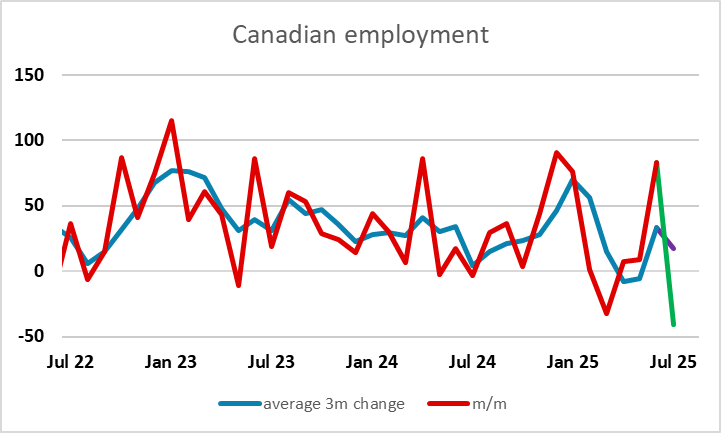

July employment drops 40.8k but underlying trend still mildly positive

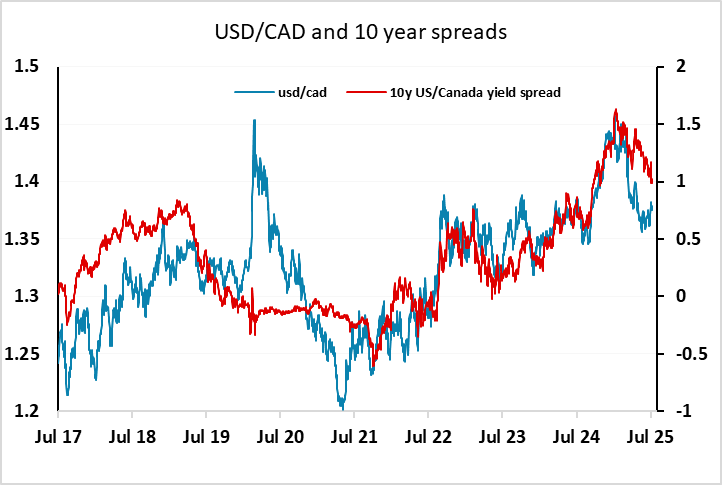

The Canadian employment report was weaker than expected, with a 40.8k decline in July employment well below the consensus expectation of a 15.3k rise. However, it follows an 83.1k rise in June, and doesn’t materially change the underlying trend, which has been of modest and gently declining increases in employment in the last coupe of years. Over the period, the unemployment rate has risen steadily, due in large part to immigration, and the rise in unemployment compares unfavourably with the trend in the US, but the unemployment rate was steady at 6.9% this time around, after peaking at 7% in May. There may yet be a lot worse to come if the tariffs hit the US and Canadian economies, but for now the data is only enough to push the CAD marginally lower. There remains scope for a move back towards 1.40 on a general USD reversion to the correlation with yield spreads, or on evidence of a severe slowdown in Canada, but for now the risks are to the USD/CAD upside, but momentum is weak.