This week's five highlights

The Fragile Ceasefire Between Iran and Israel

Ukraine War Continuing Probability is Now at 70%

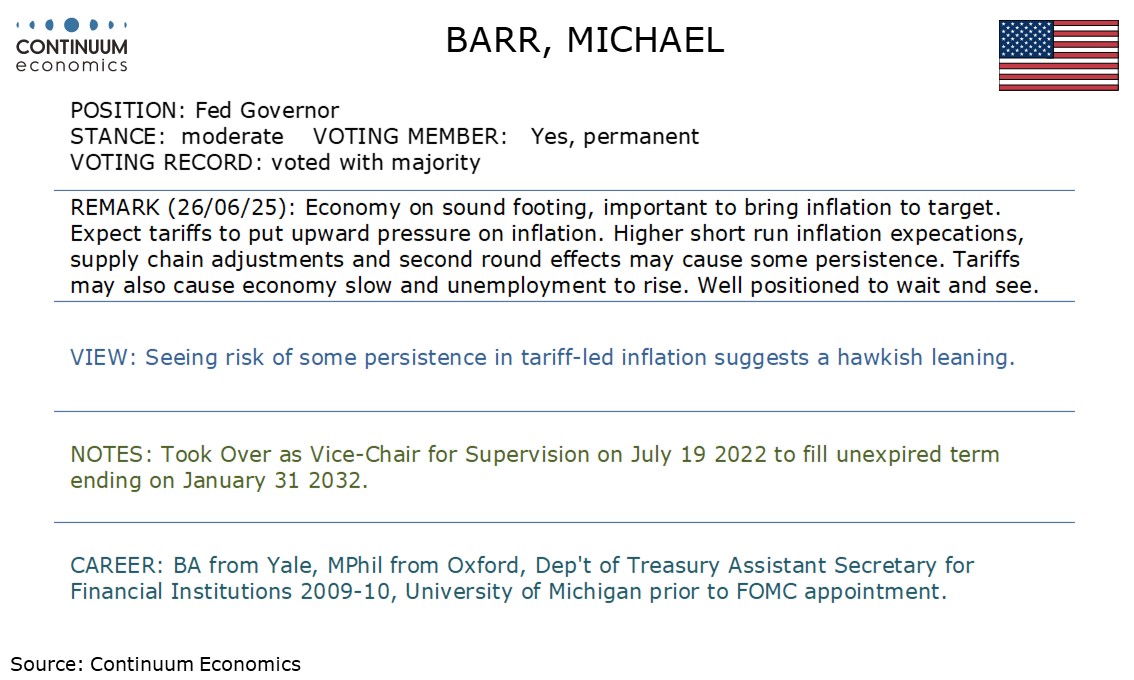

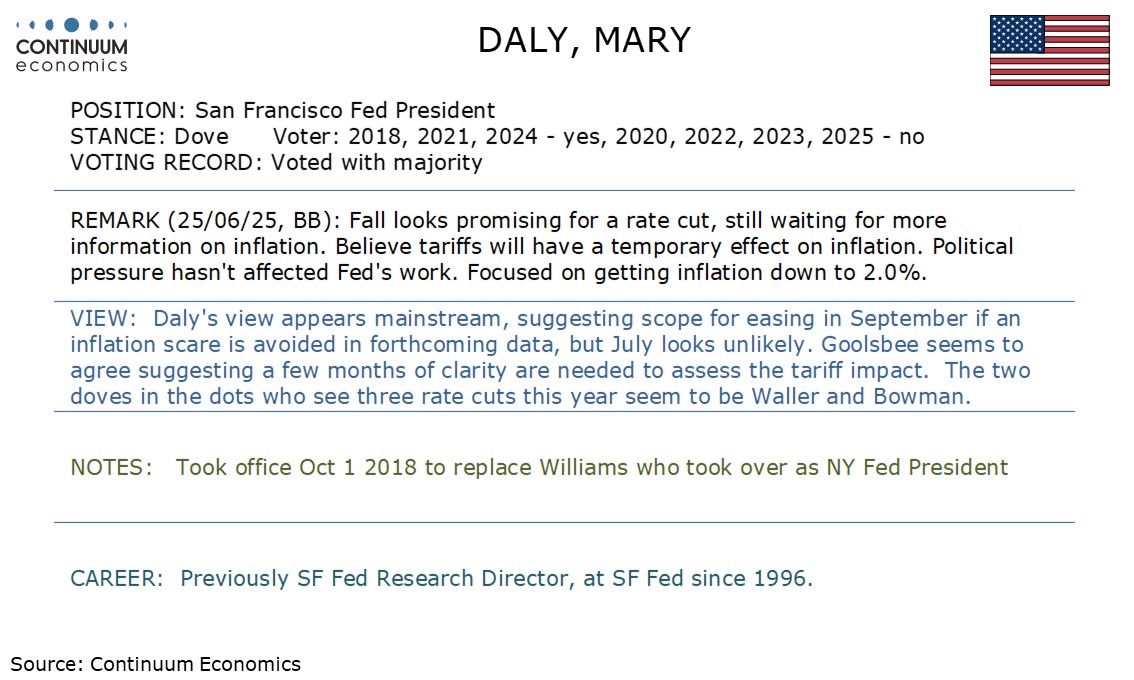

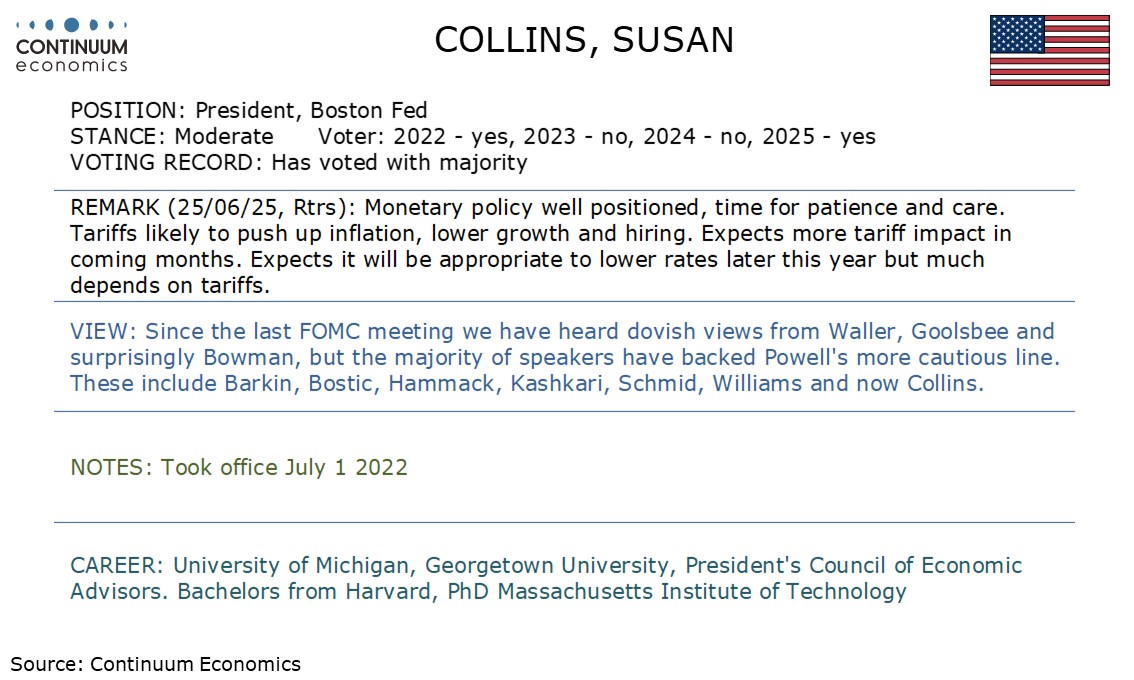

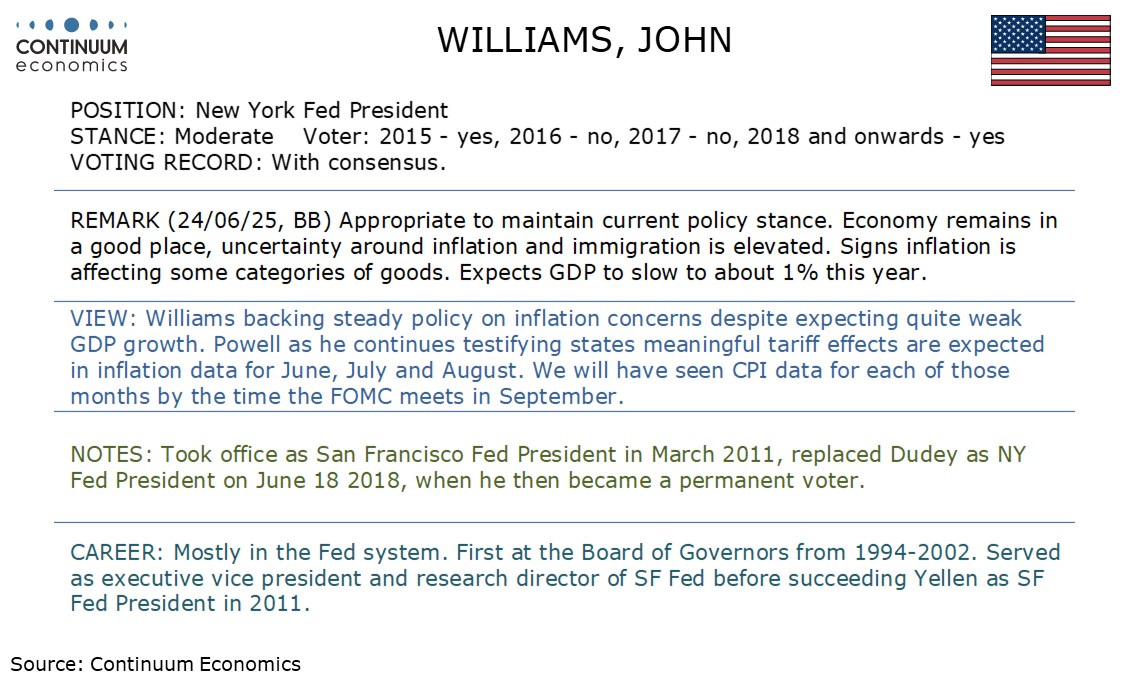

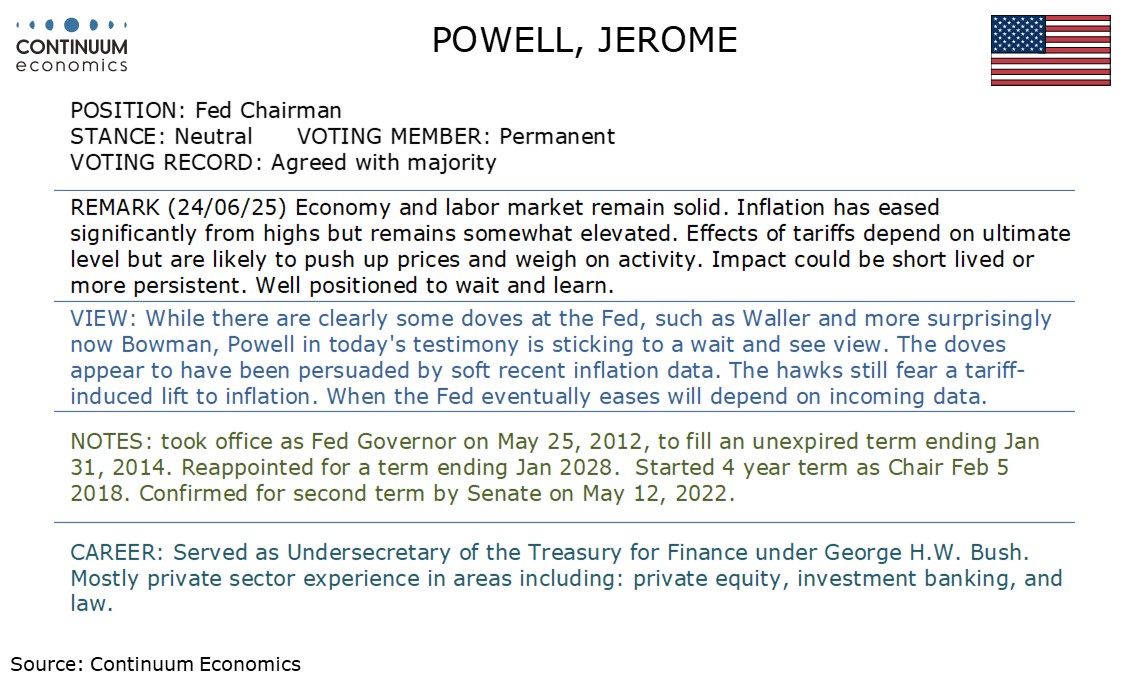

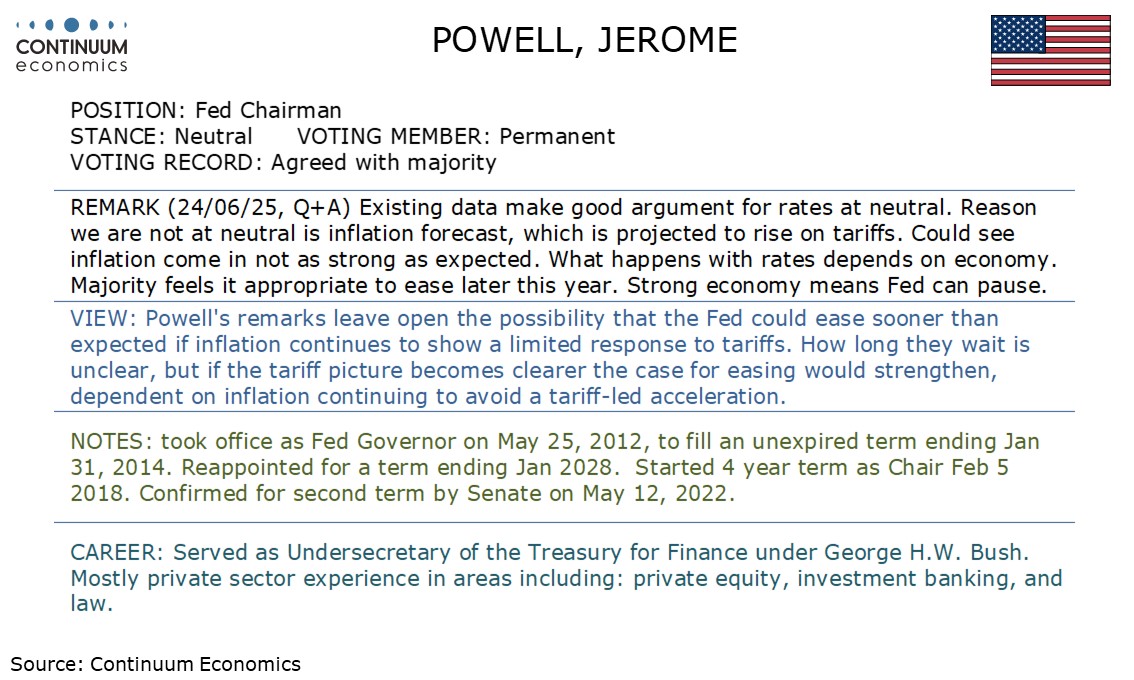

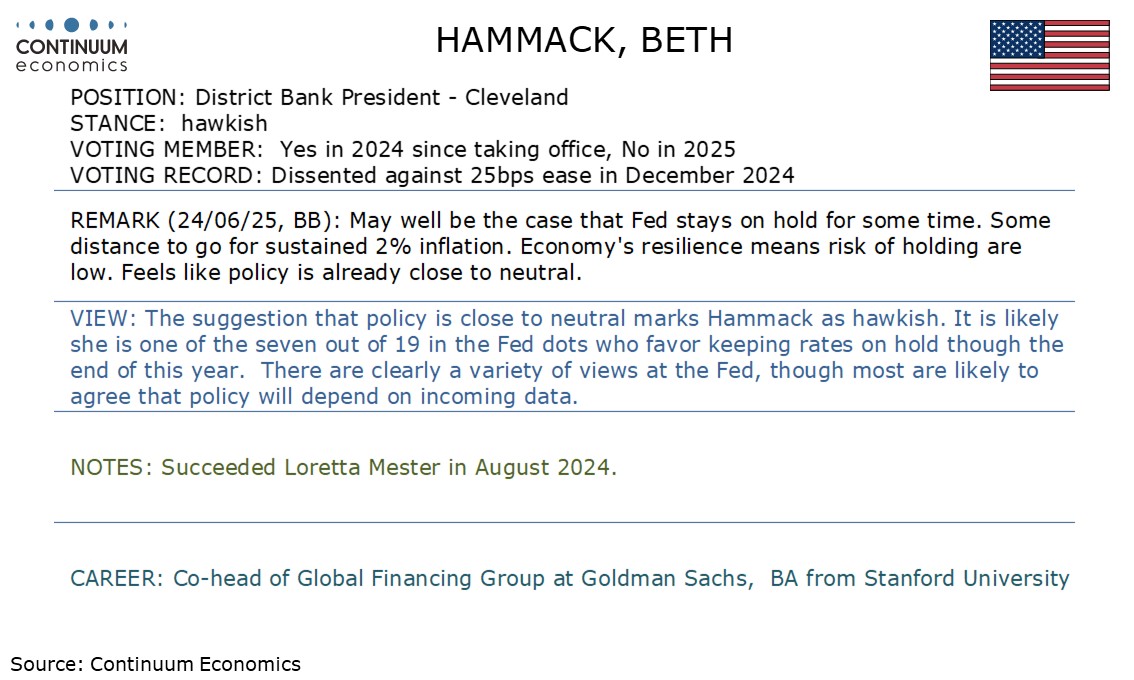

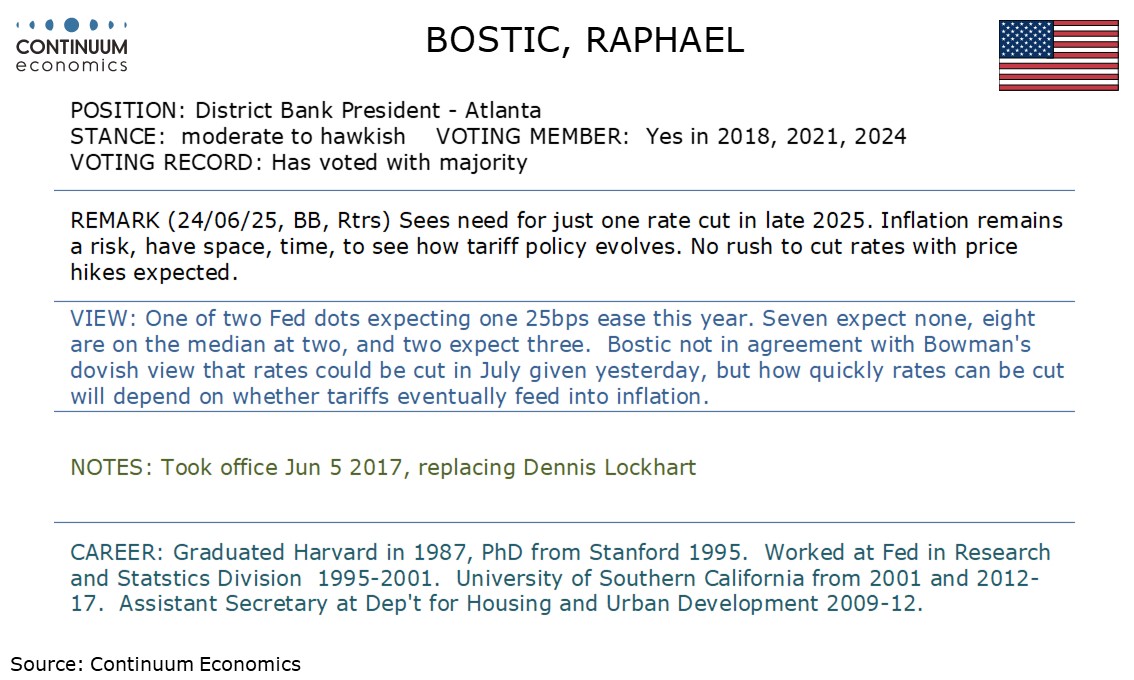

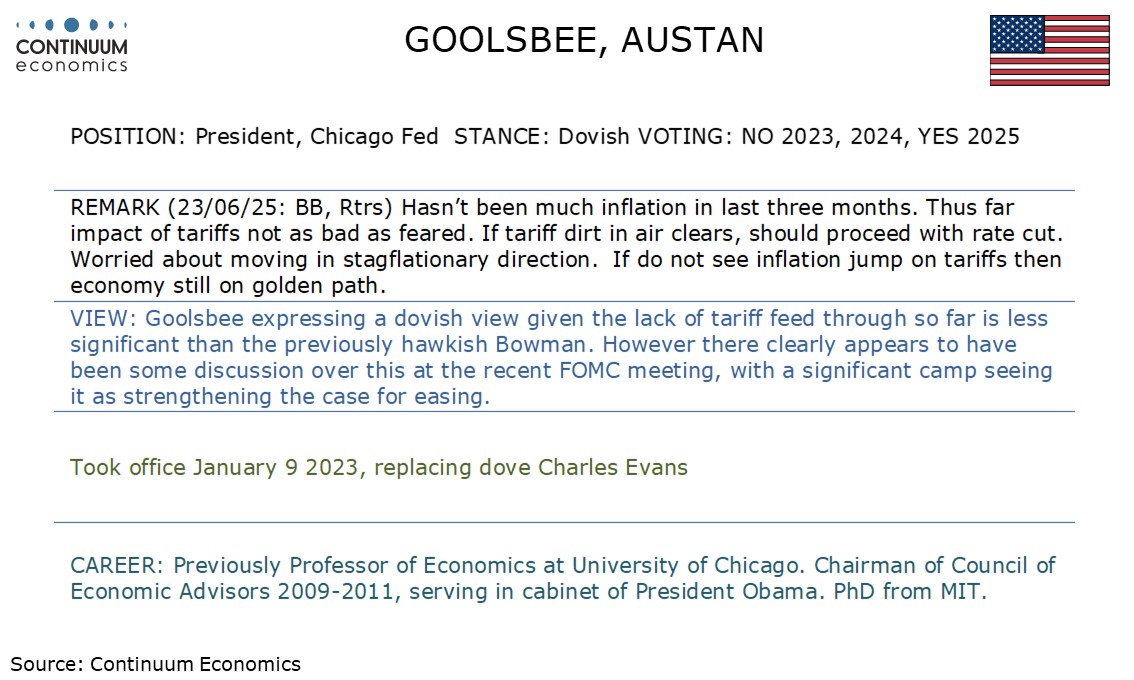

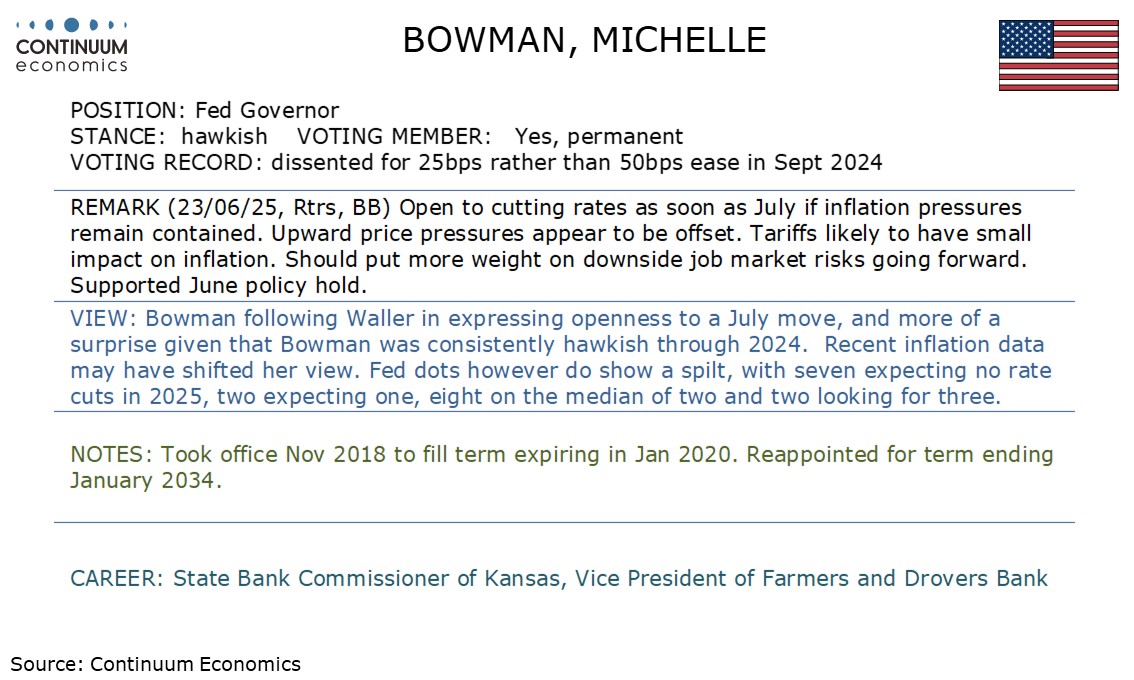

This Week's Slate of Fed Speakers

Seems to be tilted dovish

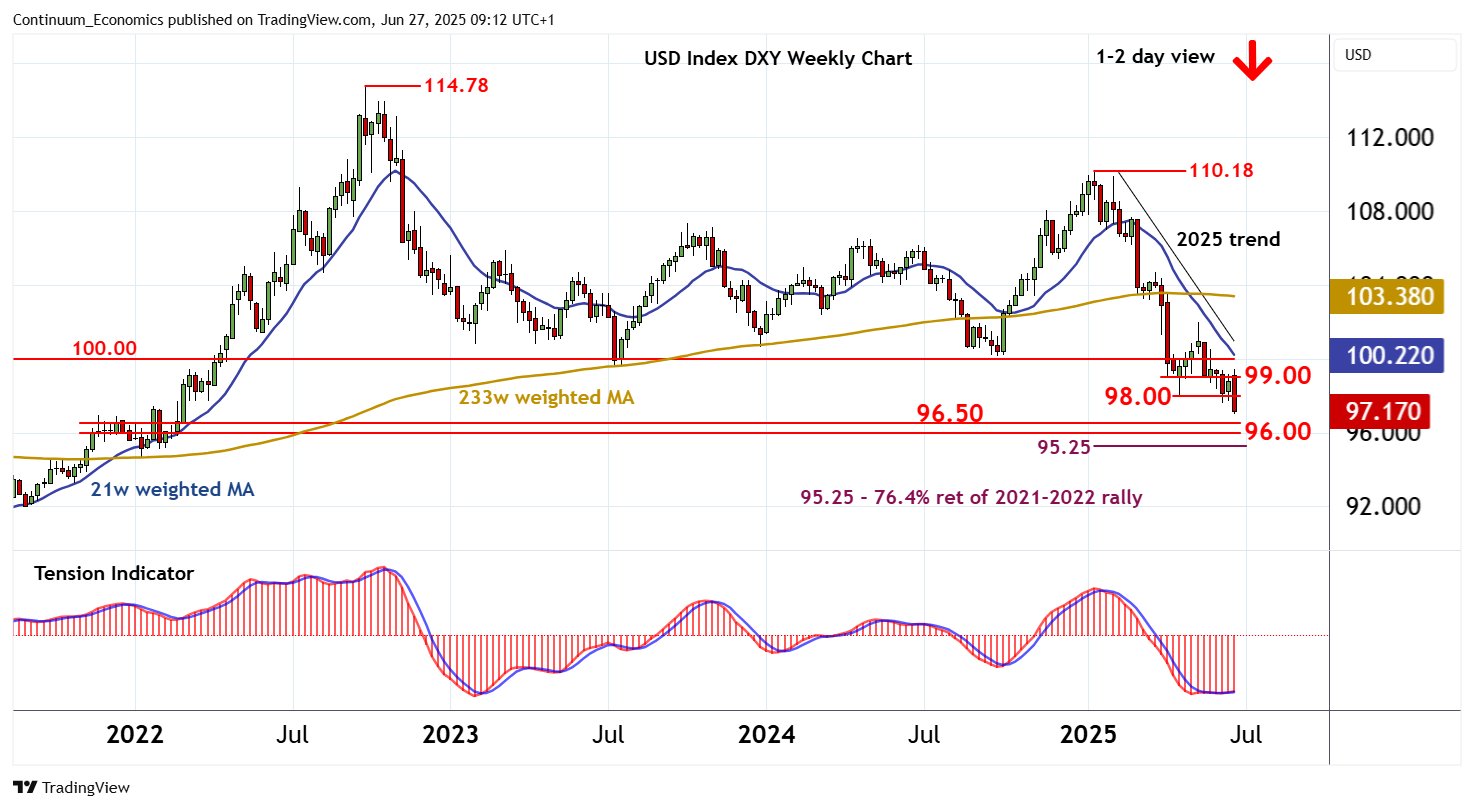

And Could Pressure the DXY

After the weekend bombing of Iran nuclear site, the U.S. has brokered a ceasefire deal between Iran and Israel swiftly. While it is a surprisingly positive outcome to avoid further escalation, the peace seems to be on shaky grounds. Right after the activation of ceasefire, Israel and Iran exchanged another round of rockets. Fortunately, both sides shows restrain after being slammed by Trump. The next step will likely be the U.S. pressuring Iran to nuclear talks, where they are showing little enthusiasm towards. Just watch out for any false flag to give Israel reasons to reignite their targeted attack on Iran.

Our baseline scenario (70%) is based on the war continuing after talks fail since president Putin insists on his peace terms. President Trump is reluctant to threaten or implement of secondary tariffs on Russia oil buyers, that would really pressure president Putin. The U.S. financing of Ukraine will also likely decrease. Our second scenario is based on a Russia-friendly peace deal (30% probability) with Russia annexing areas in and around four Ukrainian oblasts that it occupied, securing no NATO membership for Ukraine and no foreign troops in Ukrainian territory. We continue to foresee two major scenarios in Ukraine, but decided to change the probabilities we assign for our scenarios, when compared with our last update.

Our first scenario is based on the war continuing after talks fail since president Putin insists on his peace terms. After Trump-Putin call early June, we decided to increase the probability of war continuing to 70% from 50%, considering peace negotiations continue to develop very slowly, and there are no significant moves expected by president Trump such as implementation of secondary tariffs on Russia oil buyers, which could have a real impact and push Russia for a deal. We feel the war will likely continue for a longer period than expected, due to president Putin’s stubbornness, and the U.S. being reluctant to commit new financing and military support to Ukraine as Ukraine remains in a weaker negotiating place.

We continue to envisage if no balance is struck, Europe could step up and help Ukraine financially and militarily. Europe could partly fill the U.S. financial gap for a number of years, but without U.S. military support a Ukraine win will be almost impossible. (Note: European countries will be more focused on increasing their own military spending until 2035 after the agreement during the NATO Summit on June 24-25). Under these circumstances, we think Ukraine will probably continue to lose more ground to Russia since it lacks military equipment and manpower, with Russia gaining more land and a weaker Ukraine.

Those Fed speakers remark are likely going to pressure the DXY, that is already in a down trend for 2025, more. It is mostly triggered by anticipation of an earlier rate cut. The anticipation was exacerbated by WSJ reporting that Trump eyes on replacing Powell earlier than expected. Combined with his repetitive comments to call for more rate cut, market particpants are speculating more than currently priced in rate cut to come once Trump replaces Powell.

On the chart, there is little change, as mixed intraday studies keep near-term sentiment cautious and prompt consolidation above the 97.00 fresh year low of 26 June. Daily readings continue to track lower and broader weekly studies are under pressure, highlighting room for further losses in the coming sessions. A break below 97.00 will put focus on congestion around 96.50, with room for continuation down to further congestion around 96.00. Extension to the 95.25 Fibonacci retracement cannot be ruled out, but already oversold weekly studies could limit any initial tests in consolidation. Meanwhile, resistance is up to congestion around 98.00. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath 99.00.