Published: 2025-12-22T17:29:46.000Z

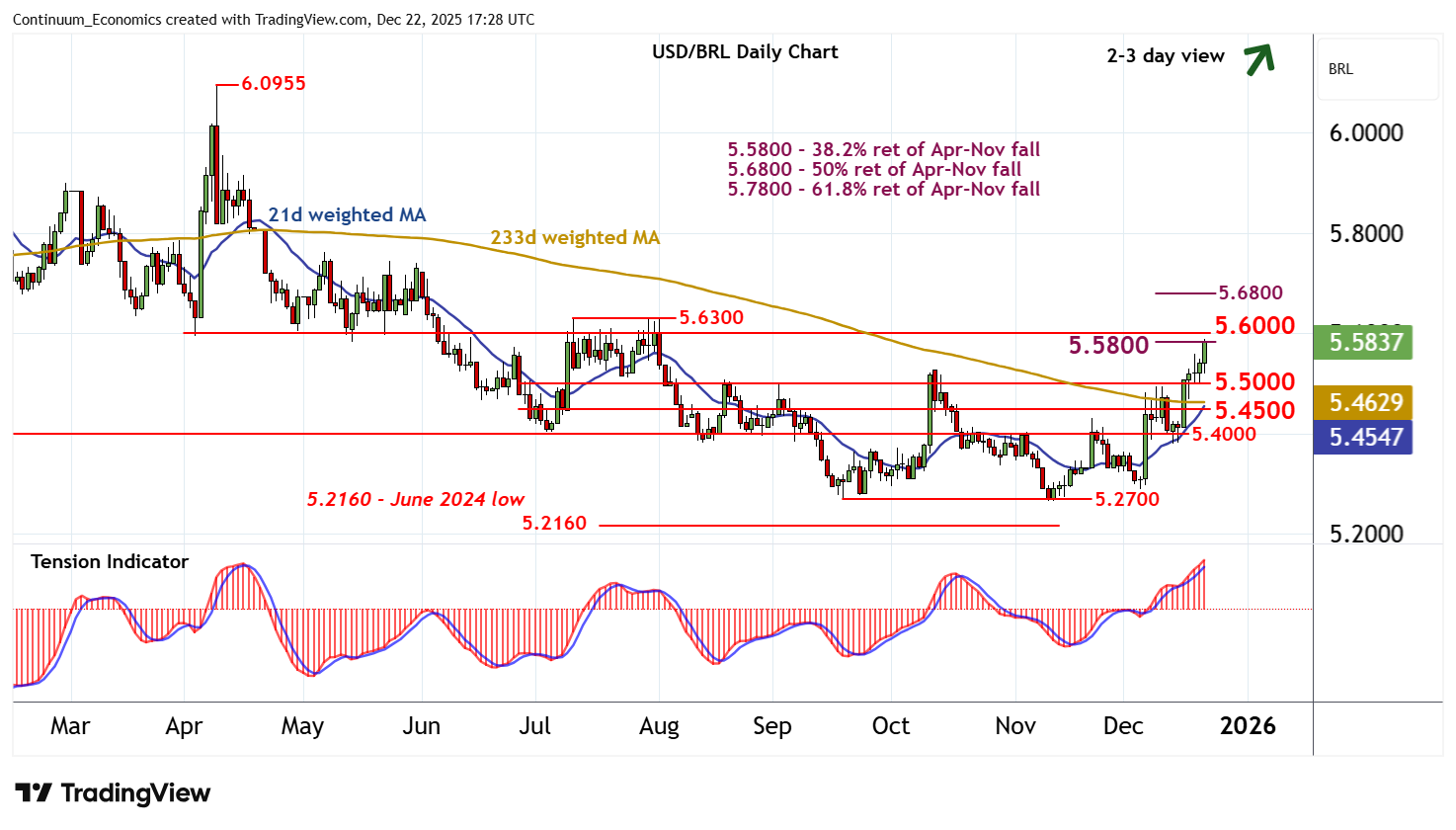

Chart USD/BRL Update: Pressuring the 5.5800 Fibonacci retracement

-

Consolidation above 5.4000 has given way to steady gains

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 5.6800 | * | 50% ret of Apr-Nov fall | S1 | 5.5000 | ** | break level | |

| R3 | 5.6300 | ** | Jul-Aug highs | S2 | 5.4500 | * | break level | |

| R2 | 5.6000 | ** | congestion | S3 | 5.4000 | * | congestion | |

| R1 | 5.5800 | * | 38.2% ret of Apr-Nov fall | S4 | 5.3500 | * | congestion |

Asterisk denotes strength of level

17:10 GMT - Consolidation above 5.4000 has given way to steady gains, with prices currently pressuring resistance at the 5.5800 Fibonacci retracement. A break will open up congestion around 5.6000. But flat overbought daily stochastics are expected to limit any initial extension beyond here in consolidation beneath the 5.6300 highs from July-August. Broader weekly charts are rising, pointing to room for still further strength, with a close above here improving sentiment and extending November gains towards the 5.6800 retracement. Meanwhile, support is down to 5.5000 and should underpin any immediate setbacks.