This week's five highlights

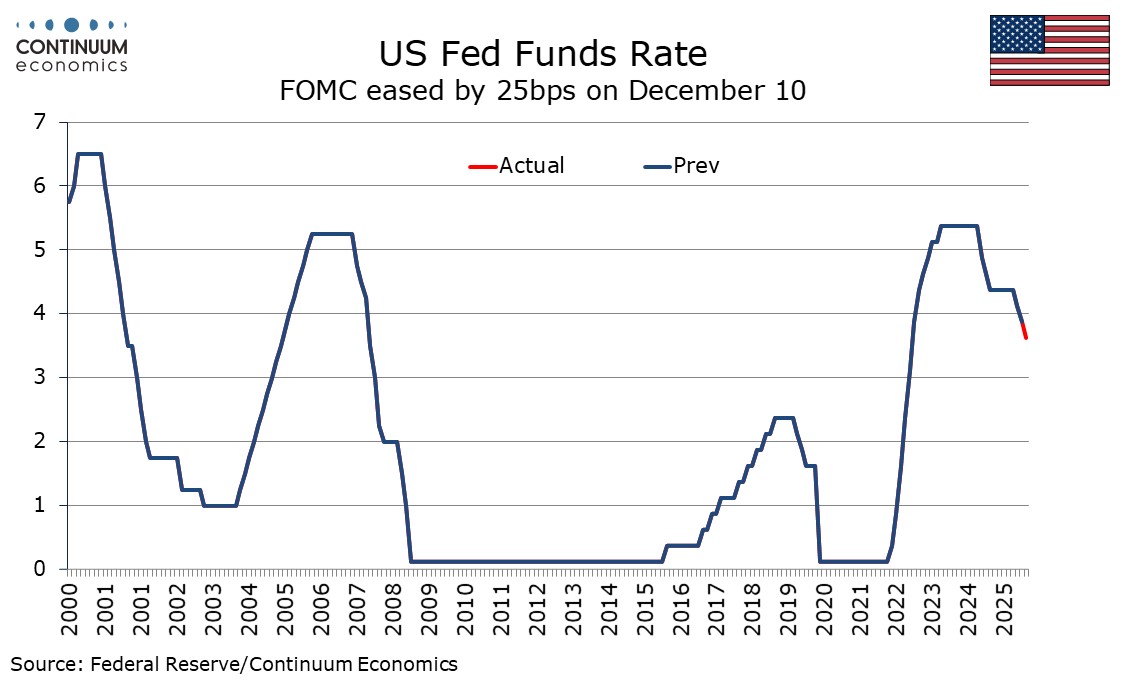

FOMC eases by 25bps, dots unchanged from September

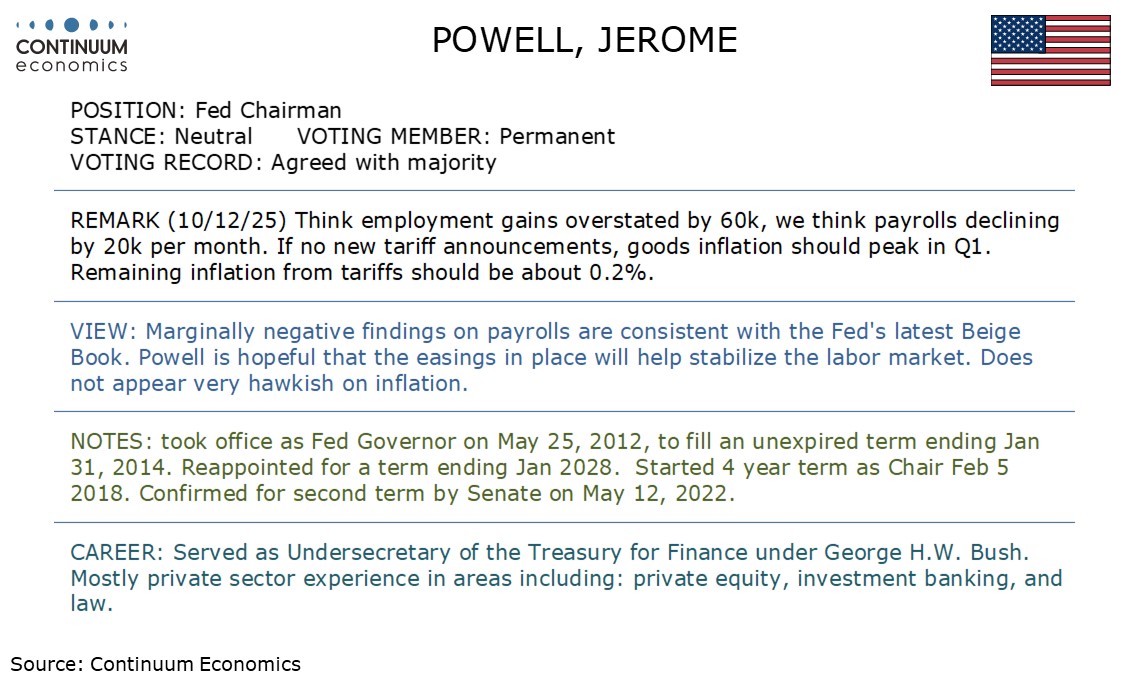

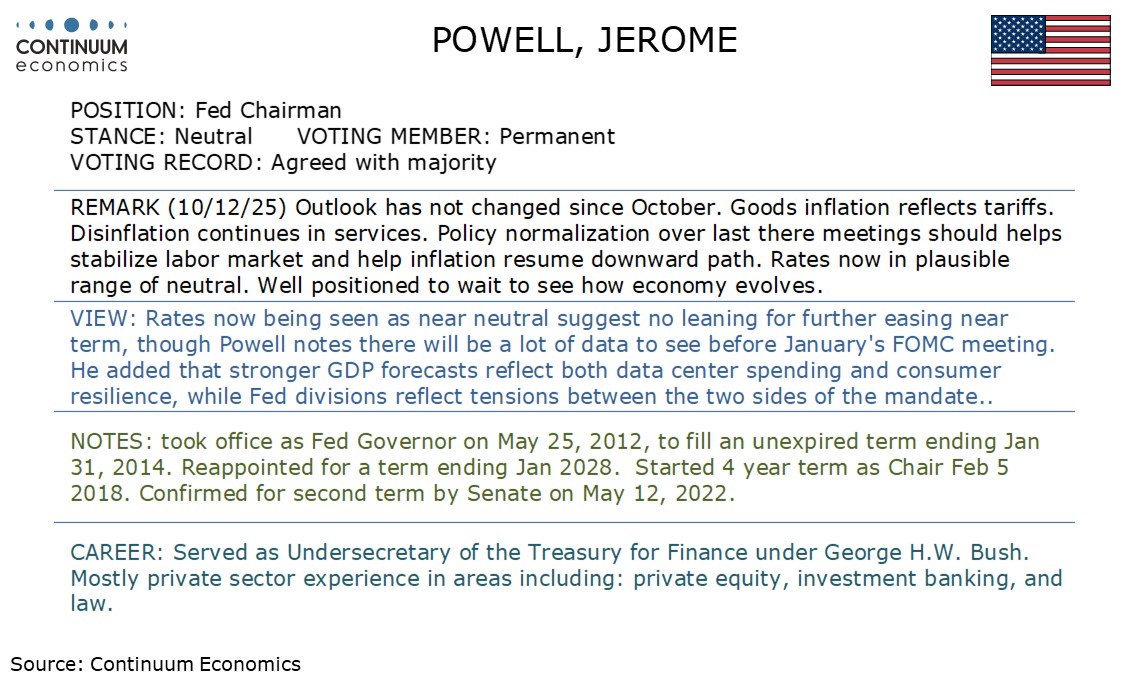

Powell's Remark Post FOMC

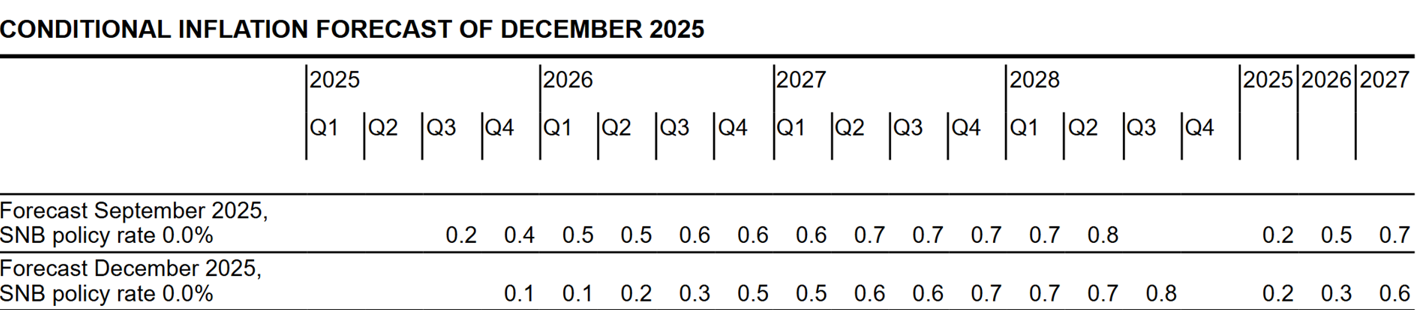

Swiss SNB Preserving Ammunition

Bank of Canada Rate Level Still Appropriate Despite Stronger Data

UK GDP Shows Underlying and Headline Economy Negative, Fragile and Listless

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 2026 and 2027 which would take policy to near neutral. The 2025 dots show six favoring no change, implying four non-voters opposed the latest ease. The 2026 dots show seven above the median, eight below and four on the median. The economic forecasts show GDP surprisingly upgraded for each tear from 2025 through 2028, 2026 particularly sharply to 2.3% from 1.8%. PCE price forecasts are revved marginally lower for 2025 and 2026, which may have assisted the decision to ease.

Changes to the statement are moderate. A reference to unemployment edging up persists but a reference to it remaining low is removed. Inflation is still seen as somewhat elevated. The FOMC will now consider the extent and timing of additional changes to the target range, rather than just additional changed. Reserve balances are no seen at adequate levels meaning the Fed will now initiate purchases of shorter term Treasury securities to maintain an ample supply of reserves

Figure: SNB Inflation Outlook Little Changed

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure), this despite a gloomy 2026 activity picture with projected GDP growth of around 1% masking the fact that the underlying picture is more sobering given the circa-0.25 ppt boost sports events will provide next year. But with inflation forecast to be within the confines of its target range of less than 2%, this was and will be enough to justify stable policy. We still see policy remaining on hold until at least mid-2027, with only a slight possibility of a return to sub-zero rates given the high(er) bar seen by the SNB for this to occur.

However, in the Q&A, explicit was a retained not so much an easing bias but an acknowledgement that the policy rate could go negative again, but with it likely that a high, if not higher, bar exists in which to make this occur. Indeed, although not formally mentioned in the press conference, financial stability issues may have featured more in the Board’s discussions as the summary of this month’s discussion (due Jan 8) may subsequently highlight. Notably real estate prices are very much on a recovery track, if not clearly rising, all very much correlated with the low SNB policy rate.

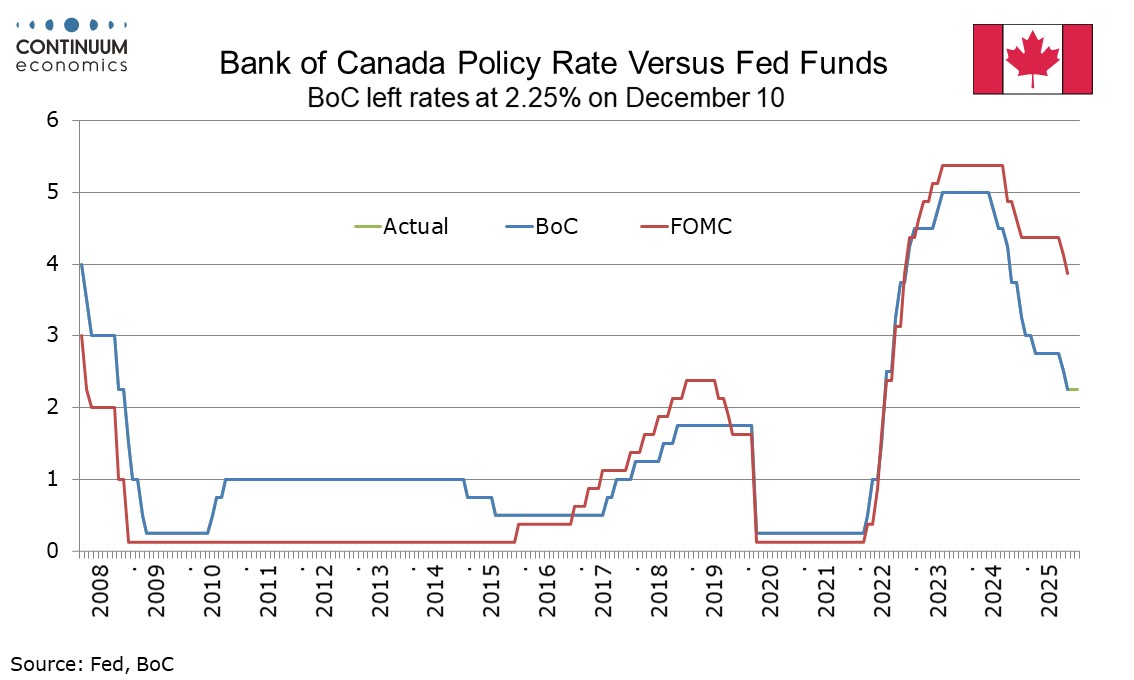

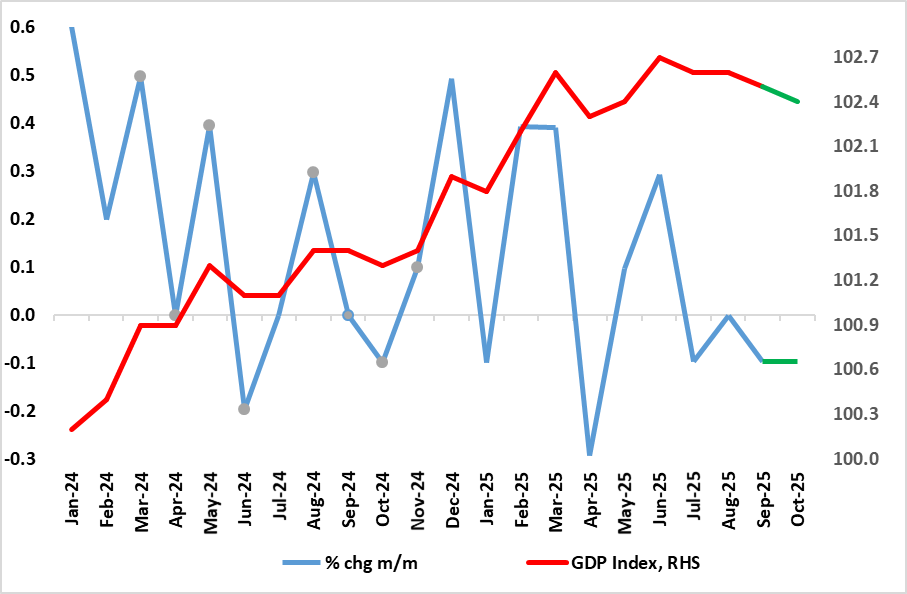

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s meeting. This suggests tightening is some way off, if subject to the future evolution of data. Our view is that the next move will be a 25bps hike in Q4 2026. Governor Macklem’s press statement addressed the economic developments in more detail than did the BoC’s statement. He first noted upward revisions to GDP in 2022, 2023 and 2024 as suggesting the economy was healthier than thought ahead of the recent trade conflict and that may help explain resilience in recent data. Q3 GDP with a 2.6% annualized rise was much stronger than the BoC’s October forecast of 0.5%, though domestic demand was near flat. Q4 GDP is seen weaker on slippage in net exports but domestic demand is seen picking up, as is GDP in 2026. Three strong months of employment growth were also noted but looking ahead hiring intentions are seen as muted. Inflation is seen as having evolved about as expected with the BoC still seeing the underlying pace as around 2.5%, A near term lift is expected as a sales tax holiday a year ago drops out, but looking ahead the BoC expects economic slack to roughly offset trade-related cost pressures and keep inflation close to the 2% target. Increased spending in the budget is seen boosting both demand and supply, and Macklem does not see it adding to inflationary pressure.

Figure: Solid GDP Growth Turning Negative?

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure), and where the unexpected further 0.1% m/m drop in October came in spite of a recovery from a cyber-attack at JLR vehicle manufacturing and by weather swings. But amid less friendly weather patterns and what have already been weak retail sales numbers as well as only a slow recovery on the vehicle side and even with modest rises for the rest of the quarter, this points to Q4 GDP possibly falling by 0.1% q/q) a projection well below the 0.3% forecast of the BoE. This weakness chimes nevertheless with what surveys still suggest (especially construction), namely the economy is at best moving sideways, and very probably contracting further.

It is unclear how uncertainty affected activity in October. Businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies. If so, then this may damage November GDP numbers too. This increases the chance that Q4 may see a small fall in q/q terms for the first time in two years. This would be sharp contrast to the 0.3% BoE Q4 projection and this likelihood not only reinforces the probability of the Bio cutting rates later this month but also in limiting dissents