Chartbook: Chart GER 10 Year Yield: Scope for a minor pullback in broad range

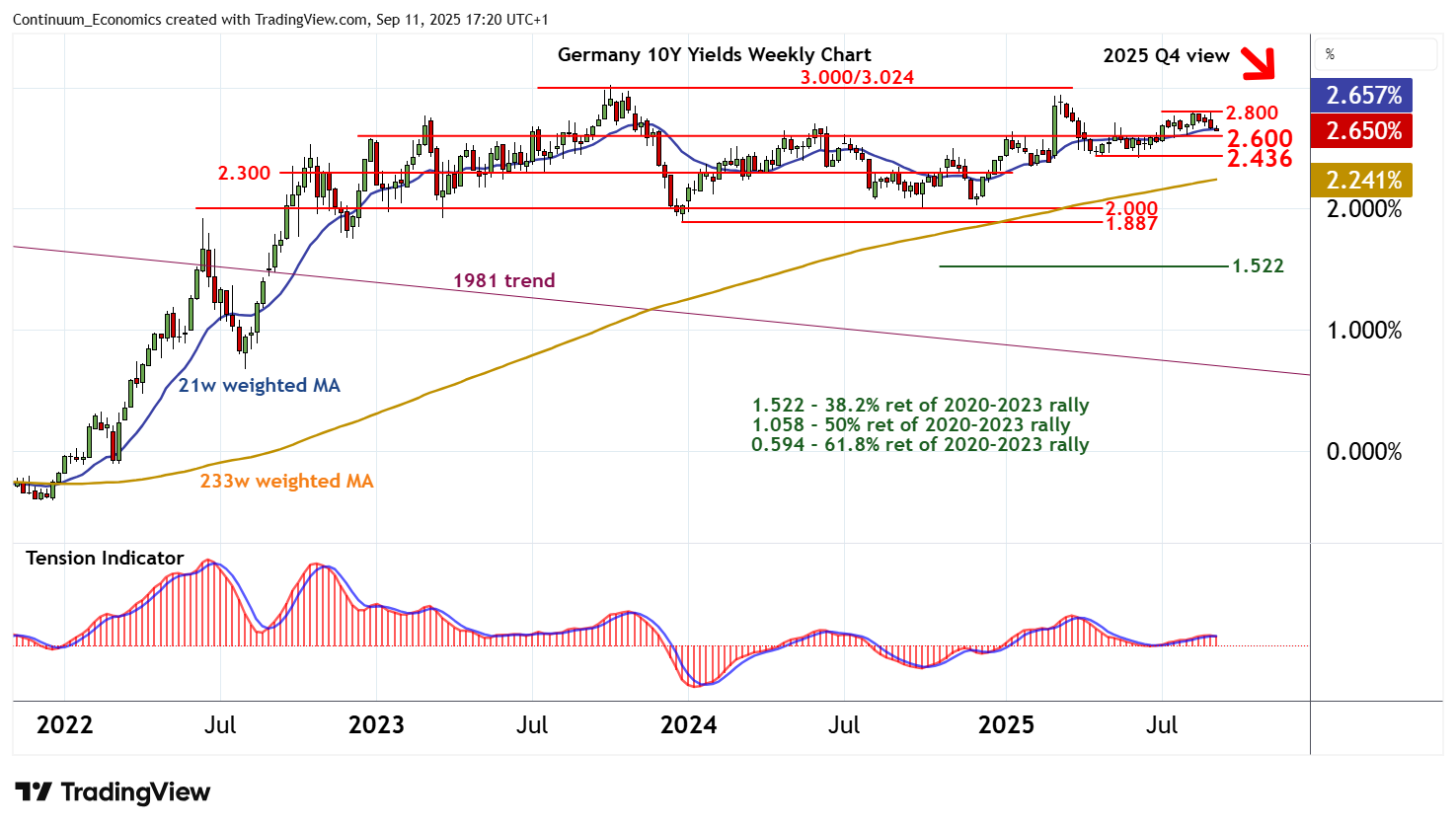

Choppy trade above the 2.436% monthly low of 30 April has given way to a drift higher to 2.800%

Choppy trade above the 2.436% monthly low of 30 April has given way to a drift higher to 2.800%,

where a turn lower in both weekly stochastics and the weekly Tension Indicator are prompting a fresh drift lower.

Focus is on pivot support at 2.600%, with a break putting focus back on 2.436%.

Negative weekly studies highlight room for a later break beneath here towards stronger support at congestion around 2.300%.

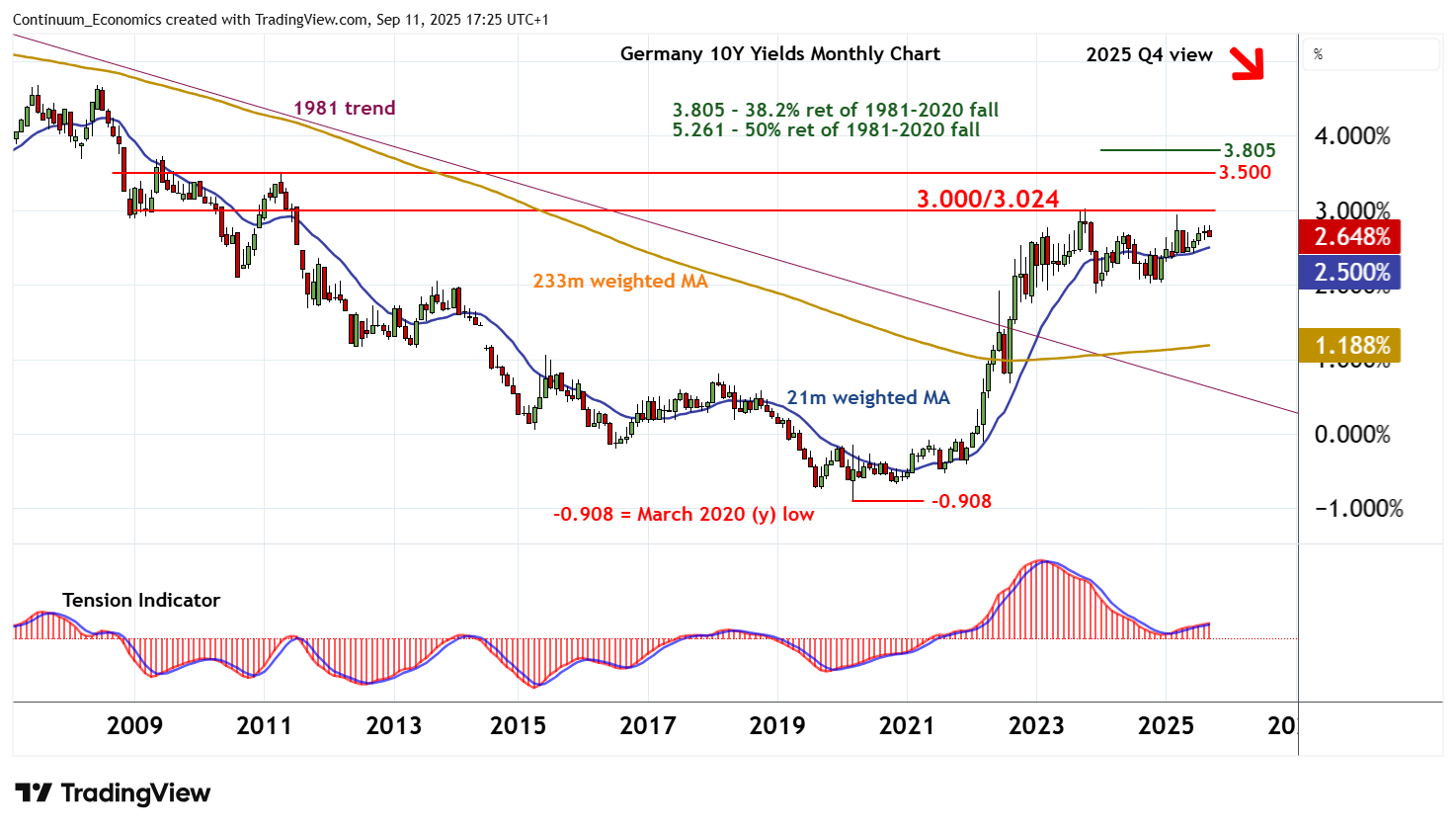

But rising monthly charts should limit any deeper reactions in consolidation above critical support at the 1.887% year low of December 2023 and congestion around 2.000%.

Meanwhile, resistance is at the 2.800% weekly high of 3 September and break level,

and extends to critical resistance at congestion around 3.000% and the 3.024% multi-year high of October 2023.

Any immediate bounce is expected to fade into further consolidation beneath 3.000/3.024%, as monthly stochastics are already overbought and longer-term charts are under pressure.

An unexpected close above here, however, will confirm a multi-month period of rising yields, as yields continue to correct the 1981 bear trend.