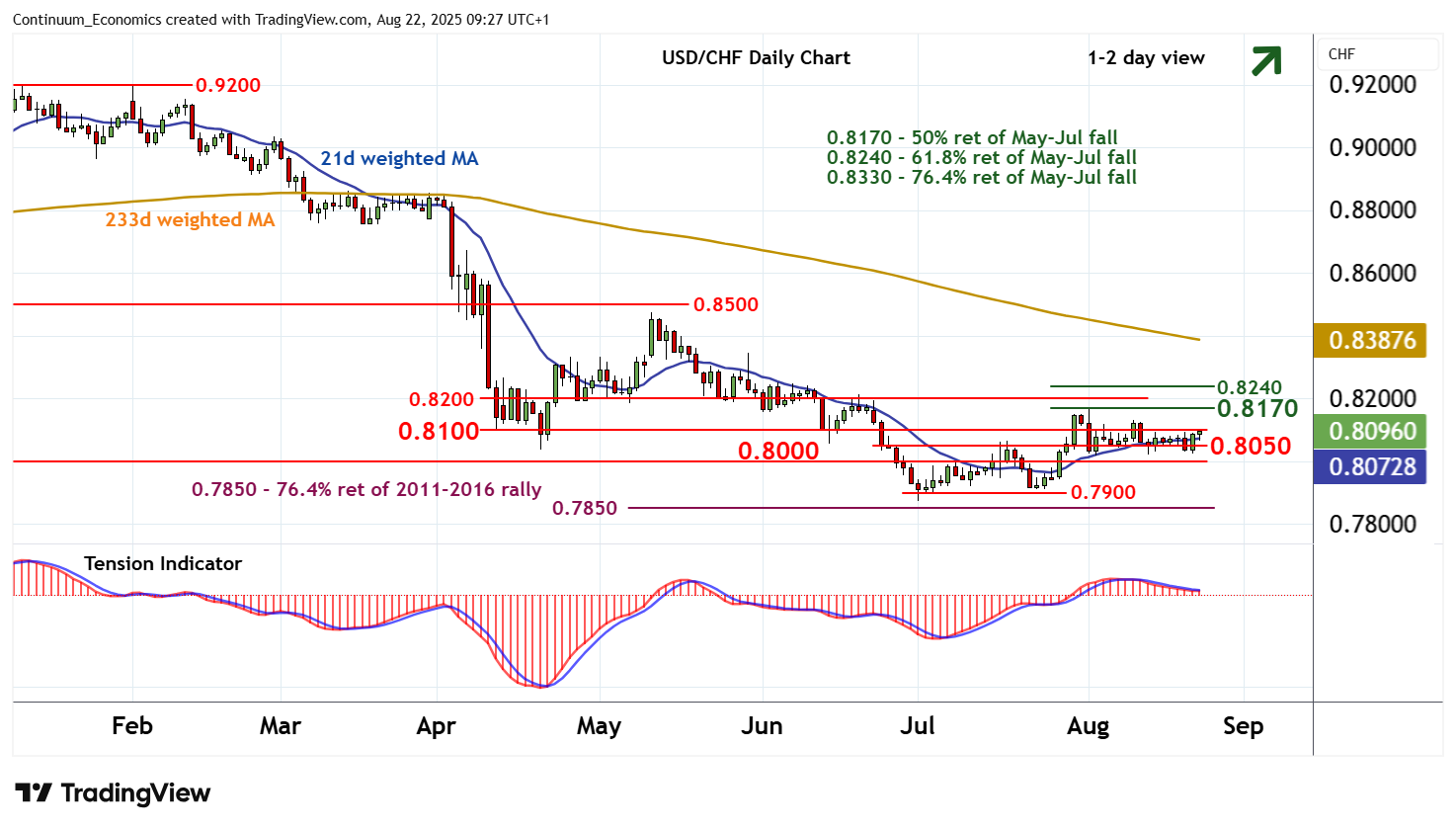

Chart USD/CHF Update: Edging higher

Cautious trade is giving way to a drift higher to congestion resistance at 0.8100

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8200 | ** | break level | S1 | 0.8050 | break level | ||

| R3 | 0.8170 | * | 1 Aug (w) high, 50% ret | S2 | 0.8000 | ** | congestion | |

| R2 | 0.8132 | 11 Aug (w) high | S3 | 0.7900 | congestion | |||

| R1 | 0.8100 | * | congestion | S4 | 0.7872 | ** | 1 Jul YTD low |

Asterisk denotes strength of level

09:15 BST - Cautious trade is giving way to a drift higher to congestion resistance at 0.8100, where overbought intraday studies and the flat daily Tension Indicator are prompting short-term reactions. Daily stochastics have ticked higher and broader weekly charts are rising, highlighting room for a later break towards the 0.8132 weekly high of 11 August. Still higher is critical resistance at 0.8170, but already overbought weekly stochastics and mixed/negative longer-term readings are expected to limit any initial tests in consolidation. Meanwhile, support is at 0.8050 and extends to congestion around 0.8000. This range should underpin any immediate tests lower.