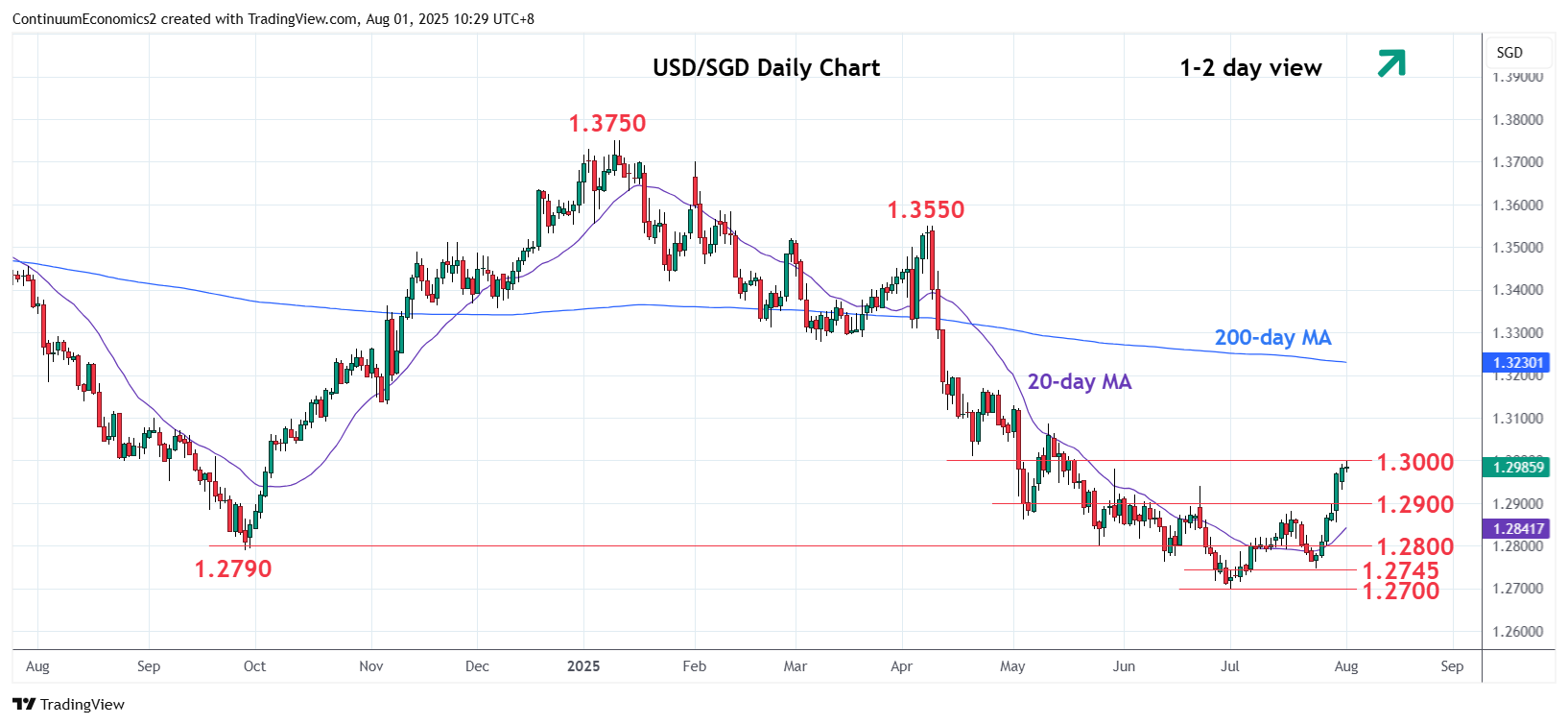

Up to tag the 1.3000 level as prices extend gains from the 1.2700, current year low

| Level | Comment | Level | Comment | ||||

|---|---|---|---|---|---|---|---|

| R4 | 1.3100 | * | congestion | S1 | 1.2900 | * | congestion |

| R3 | 1.3085 | * | 12 May high | S2 | 1.2882 | ** | 17 Jul high |

| R2 | 1.3025 | * | 38.2% Apr/Jul fall | S3 | 1.2800 | * | May low, congestion |

| R1 | 1.3000 | ** | congestion, Apr low | S4 | 1.2745 | ** | 24 Jul low |

Asterisk denotes strength of level

02:30 GMT - Up to tag the 1.3000 level as prices extend gains from the 1.2700, current year low. Overbought intraday and daily studies suggest reaction here likely to consolidate strong gains from the 1.2745 low of last week. However, a later break cannot be ruled out to further retrace losses from the January high. Clearance will open up room to the 1.3025, 38.2% Fibonacci level, then the 1.3085/1.3100 area. Meanwhile, support at the 1.2900/1.2882 area should underpin and limit corrective pullback.