Published: 2025-09-04T08:08:42.000Z

Chart USD Index DXY Update: Further consolidation - studies improving

0

-

Still little change, as mixed intraday studies keep near-term sentiment cautious

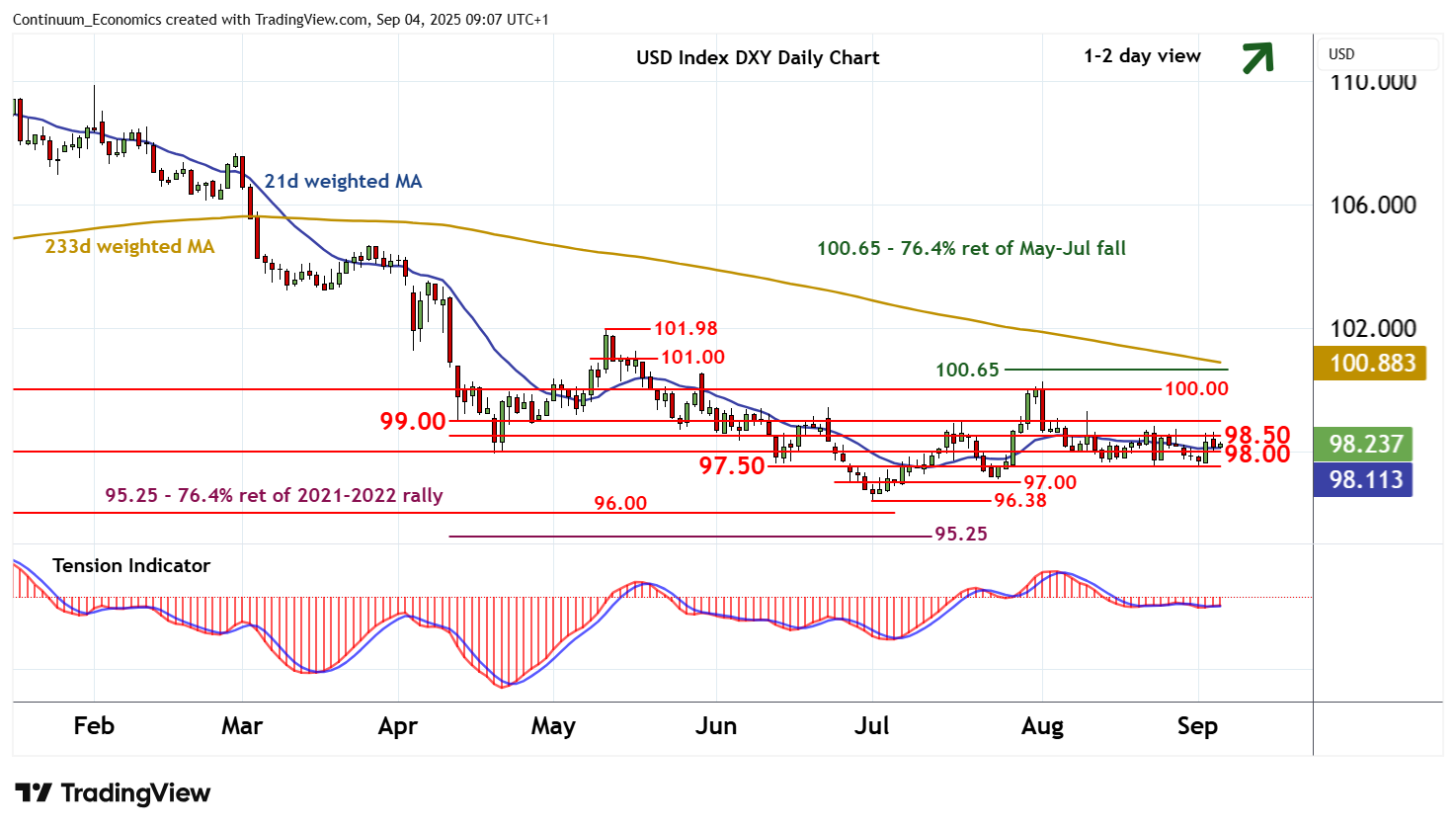

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 100.65 | ** | 76.4% ret of May-Jul fall | S1 | 98.00 | * | congestion | |

| R3 | 100.00 | ** | congestion | S2 | 97.50 | * | congestion | |

| R2 | 99.00 | * | break level | S3 | 97.00 | * | congestion | |

| R1 | 98.50 | congestion | S4 | 96.38 | ** | 1 Jul YTD low |

Asterisk denotes strength of level

08:55 BST - Still little change, as mixed intraday studies keep near-term sentiment cautious and prompt consolidation around congestion resistance at 98.50. Daily readings are rising and broader weekly charts are also showing signs of improvement, suggesting room for a later break above 98.50 towards 99.00. However, already overbought weekly stochastics should limit any continuation beyond here in selling interest towards critical resistance at congestion around 100.00. Meanwhile, support remains at congestion around 98.00 and extends to 97.50. This range should underpin any immediate setbacks.