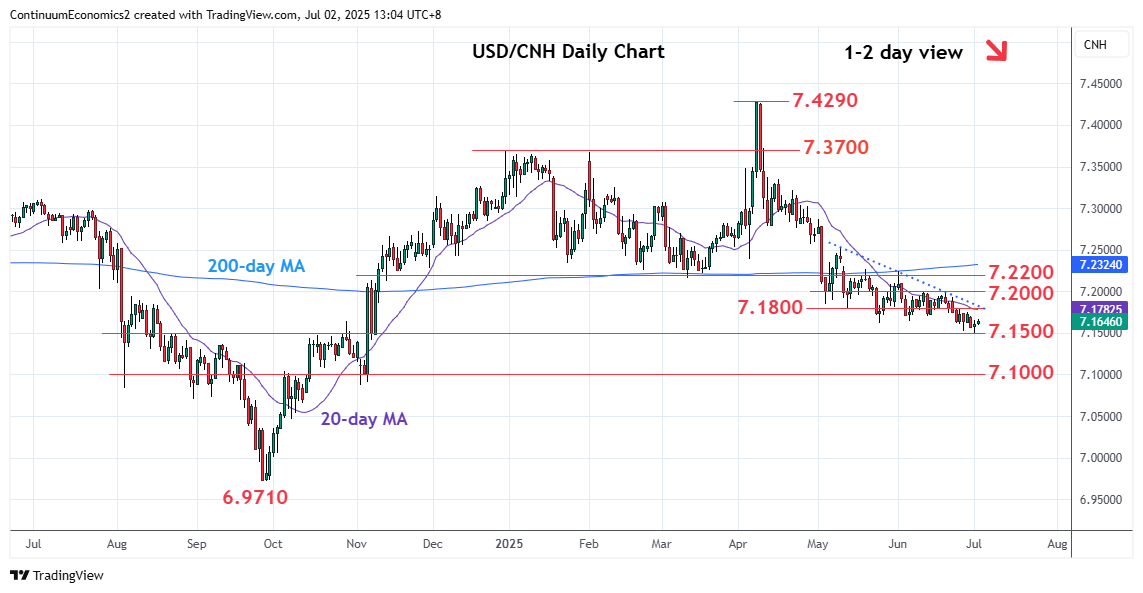

Edged up from test of fresh year low at the 7.1500 congestion as prices unwind the oversold intraday studies

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.2500 | * | congestion | S1 | 7.1500 | * | congestion | |

| R3 | 7.2200 | ** | congestion | S2 | 7.1460 | * | 61.8% Sep/Arp rally | |

| R2 | 7.2000 | * | 11 Jun high, congestion | S3 | 7.1200 | * | congestion | |

| R1 | 7.1800 | * | 13 May low, congestion | S4 | 7.1000 | ** | congestion |

Asterisk denotes strength of level

05:50 GMT - Edged up from test of fresh year low at the 7.1500 congestion as prices unwind the oversold intraday studies. However, bearish price action keeps focus on the downside and highlights risk for break to extend the April losses to target 7.1460, 61.8% Fibonacci level. Lower still, will see room for extension to support at the 7.1200/7.1000 congestion. Meanwhile, resistance at the 7.1800 congestion is expected to cap. Gains above here will delay bearish extension and open up room for stronger corrective bounce to the strong resistance at 7.2000/7.2200 area.