Published: 2025-10-07T01:03:51.000Z

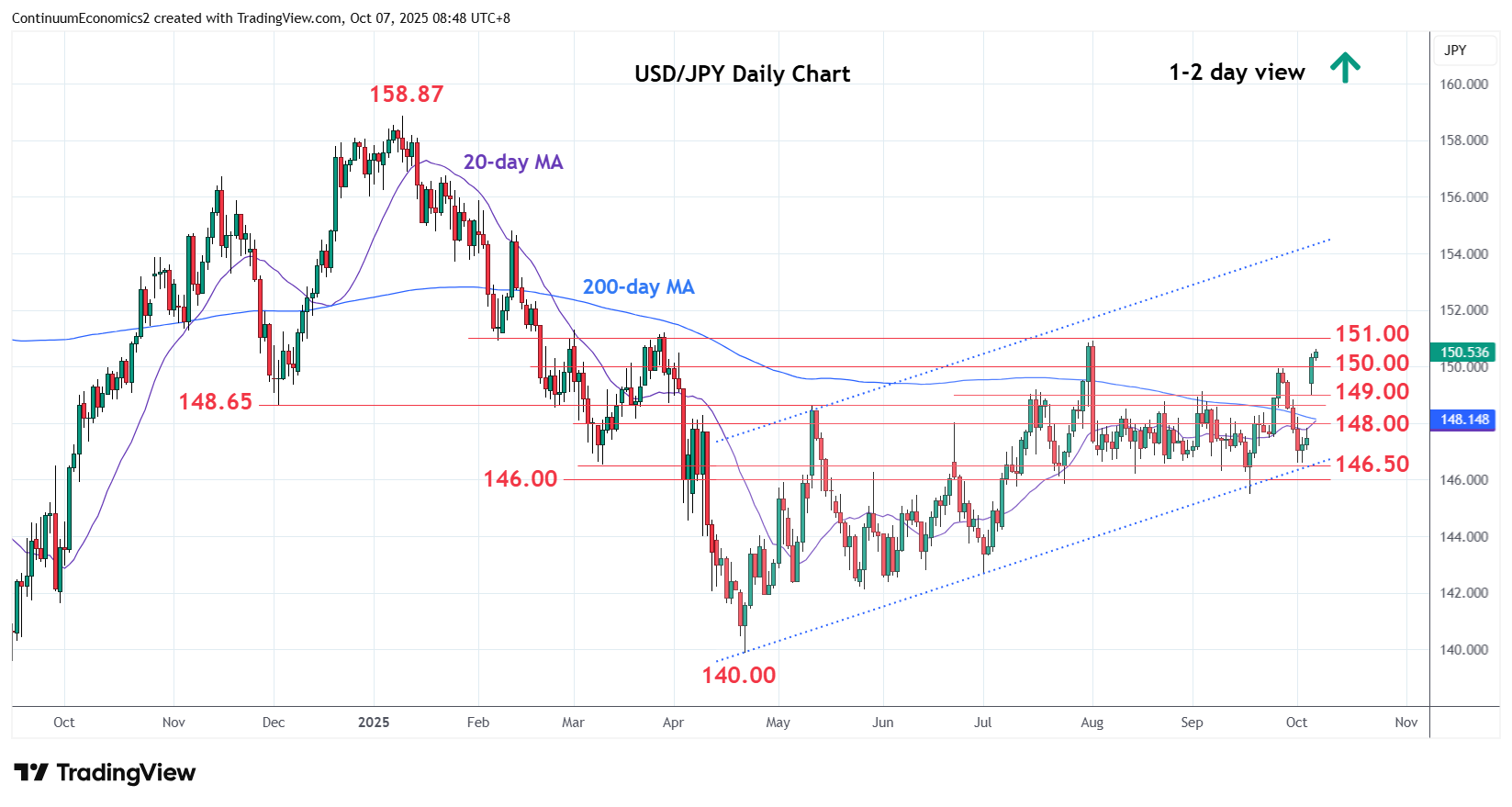

Chart USD/JPY Update: Focus turn to 150.92, August high

2

Extending the sharp gains seen yesterday and break above the 150.00 level turn focus to the 150.92, August high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 151.90/95 | ** | 2023, 2022 year highs | S1 | 149.00 | congestion | ||

| R3 | 151.65 | * | 61.8% Jan/Apr fall | S2 | 148.65 | * | Dec low | |

| R2 | 151.30 | * | Mar high | S3 | 148.00 | * | congestion | |

| R1 | 150.92/00 | ** | Aug high, congestion | S4 | 147.00 | * | congestion |

Asterisk denotes strength of level

01:00 GMT - Extending the sharp gains seen yesterday and break above the 150.00 level turn focus to the 150.92, August high. Would expect reaction here and the 151.00 level but positive daily and weekly studies suggest scope for break later to extend gains within the bullish channel from the April low. Higher will see room to the march high at 151.30 and the 151.65 61.8% Fibonacci level. Beyond these will turn focus to the critical resistance at 151.90/151.95, the 2023/2022 year highs. Meanwhile, support at the 149.00/148.65 congestion and December low now expected to underpin.