Published: 2025-09-30T06:55:20.000Z

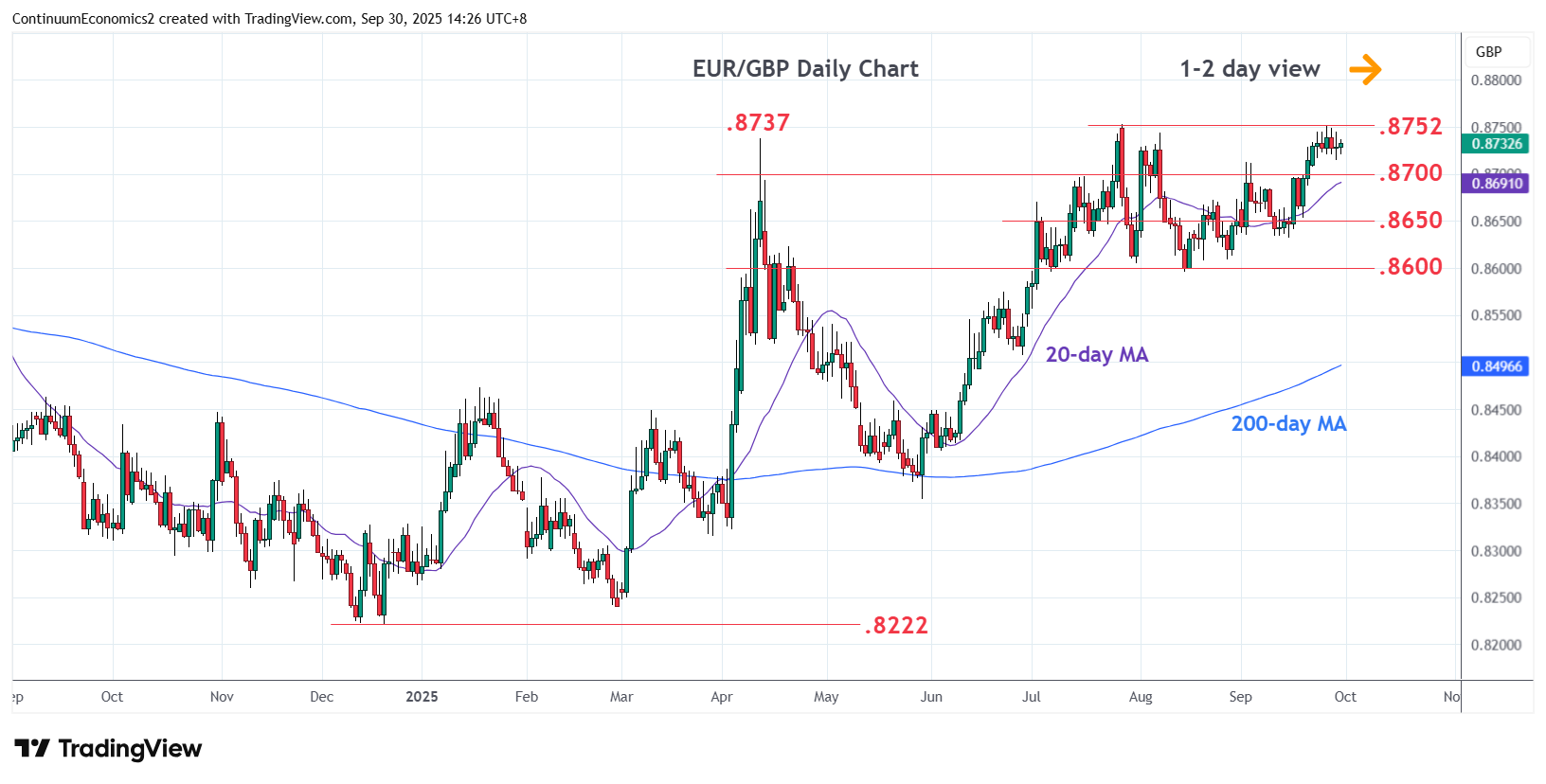

Chart EUR/GBP Update: Consolidating test of .8752 high

-

Little change, as prices extend consolidation below the .8745/.8752, August/July highs and 50% Fibonacci level

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8875 | * | 61.8% 2022/2024 fall | S1 | 0.8700 | * | congestion | |

| R3 | 0.8800 | * | figure, congestion | S2 | 0.8650 | * | congestion | |

| R2 | 0.8765 | ** | Nov 2023 high | S3 | 0.8632 | * | 15 Sep low | |

| R1 | 0.8752 | ** | 28 Jul YTD high, 50% | S4 | 0.8600 | ** | congestion, Aug low |

Asterisk denotes strength of level

06:45 GMT - Little change, as prices extend consolidation below the .8745/.8752, August/July highs and 50% Fibonacci level. Intraday and daily studies are unwinding overbought areas and suggest room for pullback to retrace gains from the .8600, August low. Pullback see support at the .8700 level and where break is needed to fade the upside pressure and see room for support at the .8650/.8632 area. Meanwhile, resistance at the .8752 high is expected to cap. Break here, if seen, will further retrace the 2022/2024 losses and see room for extension to the .8800 level.