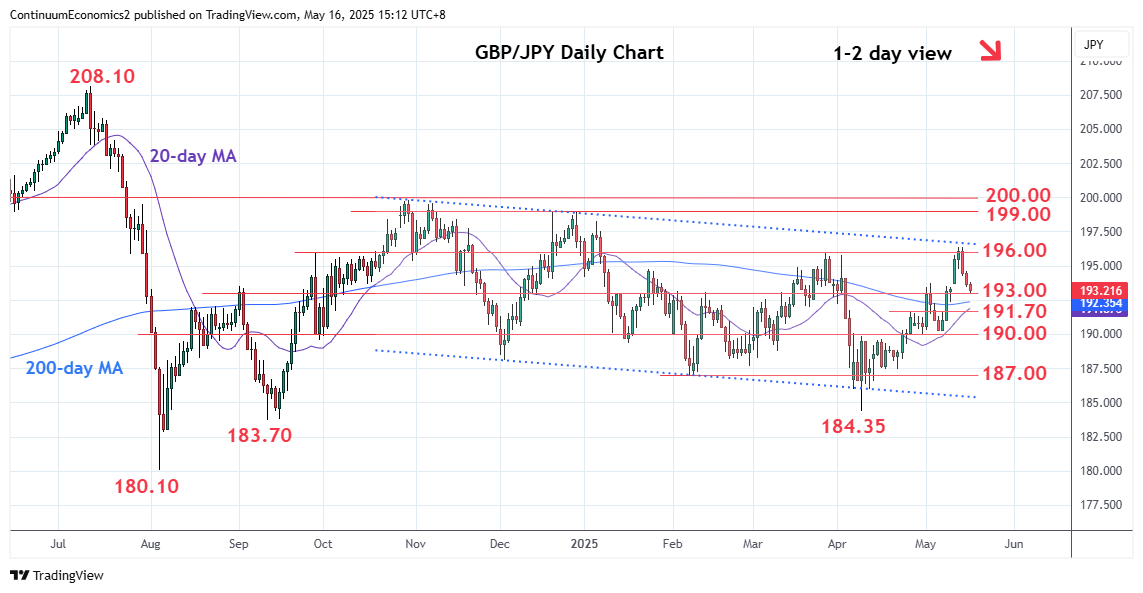

Extending rejection from the 196.40 high and upper channel from the October high to reach support at 193.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 198.95/00 | ** | Dec high, congestion | S1 | 193.00 | * | congestion | |

| R3 | 198.00 | * | congestion | S2 | 191.70 | * | 25 Apr high | |

| R2 | 196.00/40 | ** | congestion, 14 May high | S3 | 190.00 | ** | congestion | |

| R1 | 195.00 | * | congestion | S4 | 189.00 | * | 61.8% Apr/May rally |

Asterisk denotes strength of level

07:30 GMT - Extending rejection from the 196.40 high and upper channel from the October high to reach support at 193.00 congestion. Daily studies have turned lower as prices unwind overbought readings and suggest scope for deeper retracement of gains from the 184.35, April YTD low. Lower will see extension to the 192.00/191.70 area. Meanwhile, resistance is lowered to 195.00 congestion and expected to cap and sustain pullback from the 196.40 high. Break here, if seen, will see further extension to target the January/December highs at 198.00/199.00 congestion.