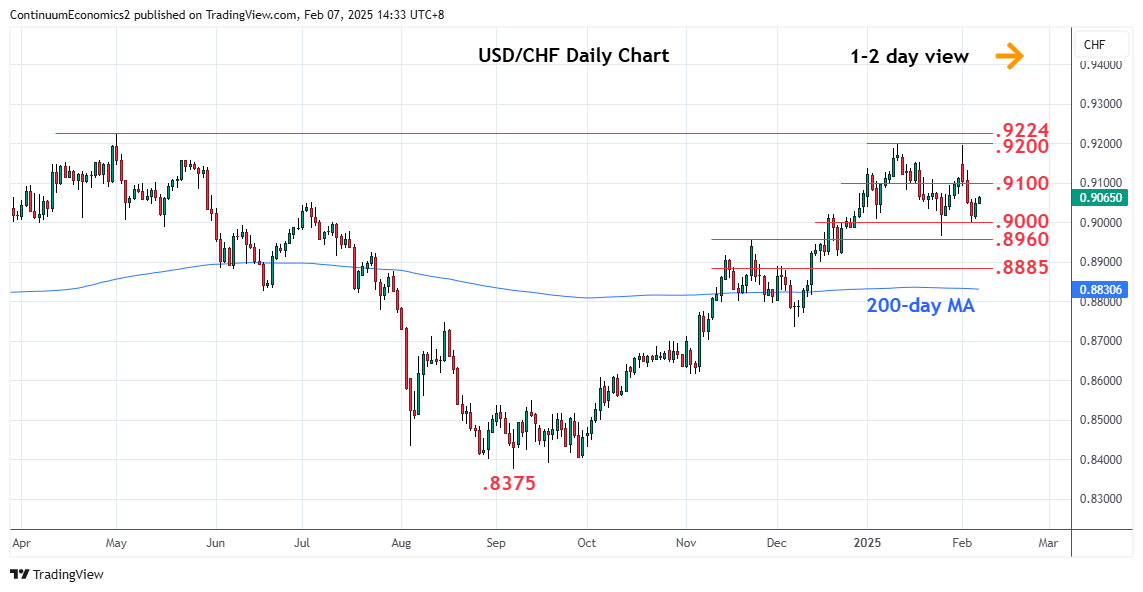

Turned up from test of the .9000 level to consolidate drop from the .9200 resistance

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9224 | ** | May high | S1 | 0.9000 | * | congestion | |

| R3 | 0.9200 | ** | 13 Jan YTD high | S2 | 0.8965/60 | ** | 27 Jan YTD low, Nov high | |

| R2 | 0.9150 | * | 17 Jan high | S3 | 0.8910/00 | * | 23 Dec low, congestion | |

| R1 | 0.9100 | * | congestion | S4 | 0.8885 | * | 38.2% Sep/Jan rally |

Asterisk denotes strength of level

06:40 GMT - Turned up from test of the .9000 level to consolidate drop from the .9200 resistance and unwind oversold readings on intraday studies. However, the negative daily studies suggest consolidation here giving way to further losses later and open up the critical support at the .8965/60 support to retest. Break here will confirm a top in place at the .9200 high and see further slide to retrace the September/January rally to the .8910/00 area then .8885, 38.2% Fibonacci level. Meanwhile, resistance is lowered to 0.9100 congestion which is expected to cap and limit corrective bounce.