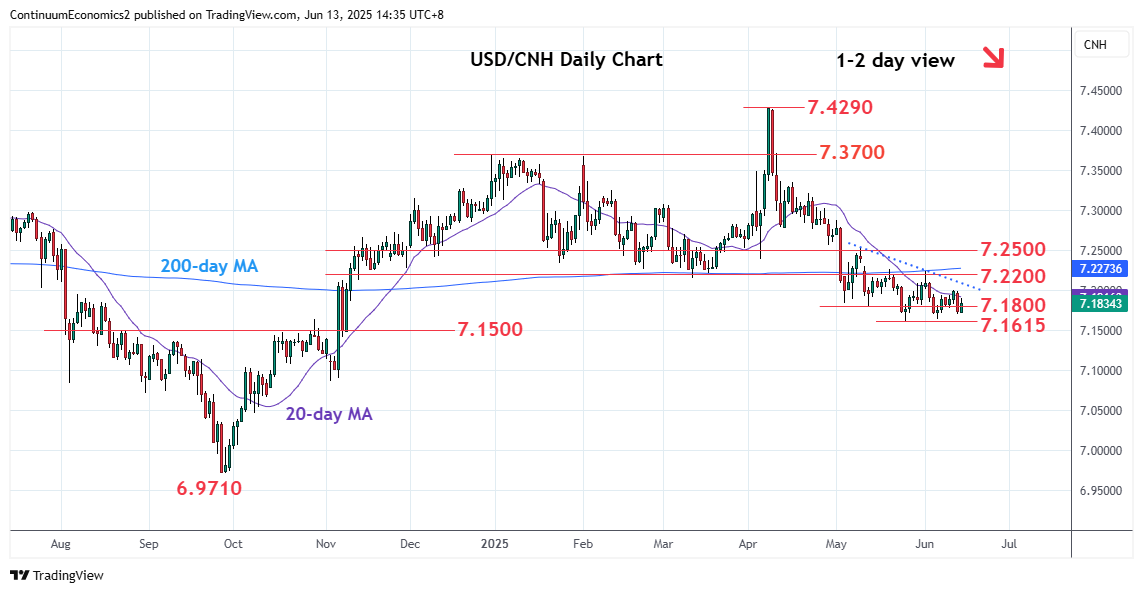

Consolidation below the 7.2000 level has given way to selling pressure to the 7.1700 level

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.2635 | * | 38.2% Apr/May fall | S1 | 7.1700 | * | 12 Jun low | |

| R3 | 7.2500 | * | congestion | S2 | 7.1615 | ** | 26 May YTD low | |

| R2 | 7.2200 | ** | congestion | S3 | 7.1500 | * | Oct high | |

| R1 | 7.2000 | * | congestion | S4 | 7.1460 | * | 61.8% Sep/Apr rally |

Asterisk denotes strength of level

06:40 GMT - Consolidation below the 7.2000 level has given way to selling pressure to the 7.1700 level. Daily studies remains mixed and suggest further choppy trade here likely before pullback to retest the 7.1615, May current year low. Below this will extend losses from the 7.4290 April YTD high and see room to the 7.1500 and 7.1460, 61.8% Fibonacci level. Meanwhile, resistance at the 7.2000 congestion is expected to cap and sustain rejection from the 7.2200/40, congestion and 2 June high.