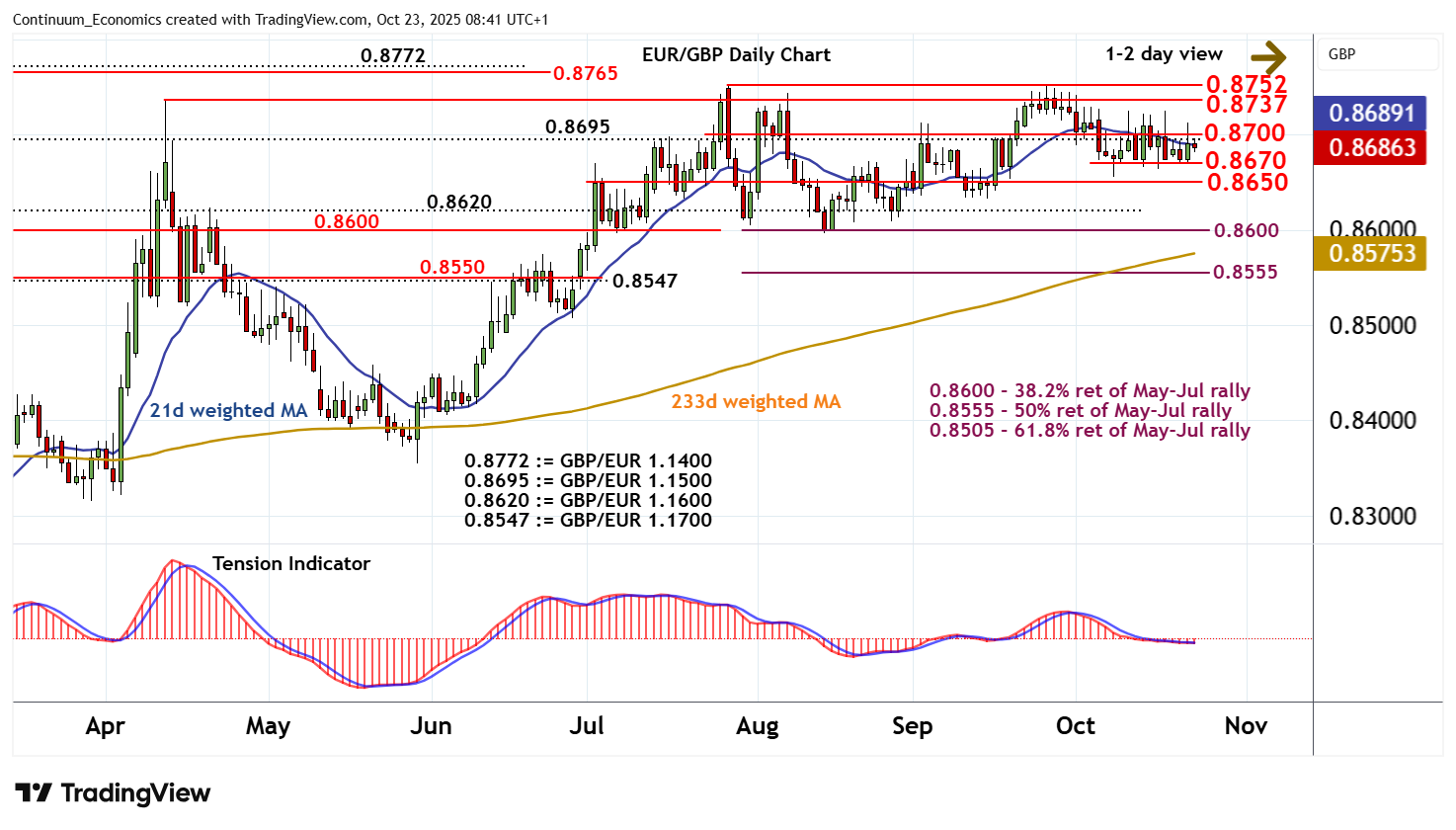

Chart EUR/GBP Update: Further consolidation - background studies under pressure

The test above resistance at 0.8695, (GBP/EUR 1.1500), and congestion around 0.8700 has been pushed back from 0.8710~

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8765 | ** | November 2023 high | S1 | 0.8670 | recent range lows | ||

| R3 | 0.8752 | ** | 28 Jul YTD high | S2 | 0.8650 | ** | congestion | |

| R2 | 0.8737 | ** | 11 Apr (m) high | S3 | 0.8620 | * | GBP/EUR 1.1600 | |

| R1 | 0.8695/00 | ** | GBP/EUR 1.1500; cong | S4 | 0.8600 | ** | cong, 38.2% ret |

Asterisk denotes strength of level

08:35 BST - The test above resistance at 0.8695, (GBP/EUR 1.1500), and congestion around 0.8700 has been pushed back from 0.8710~, with prices once again consolidating above the 0.8670 recent lows. Daily readings are mixed, highlighting a cautious tone and room for further consolidation in the coming sessions. However, broader weekly charts are turning down, suggesting potential for a later break below 0.8670 towards congestion around 0.8650. Further slippage would open up stronger support within 0.8600/20. But already oversold weekly stochastics are expected to limit any initial tests of here in short-covering/consolidation. Meanwhile, any retests above 0.8695/00 should meet renewed selling interest beneath critical resistance at the 0.8752 current year high of 28 July and the 0.8765 high of November 2023.