Chartbook: Chart USD/JPY: Retracing April/August corrective gains

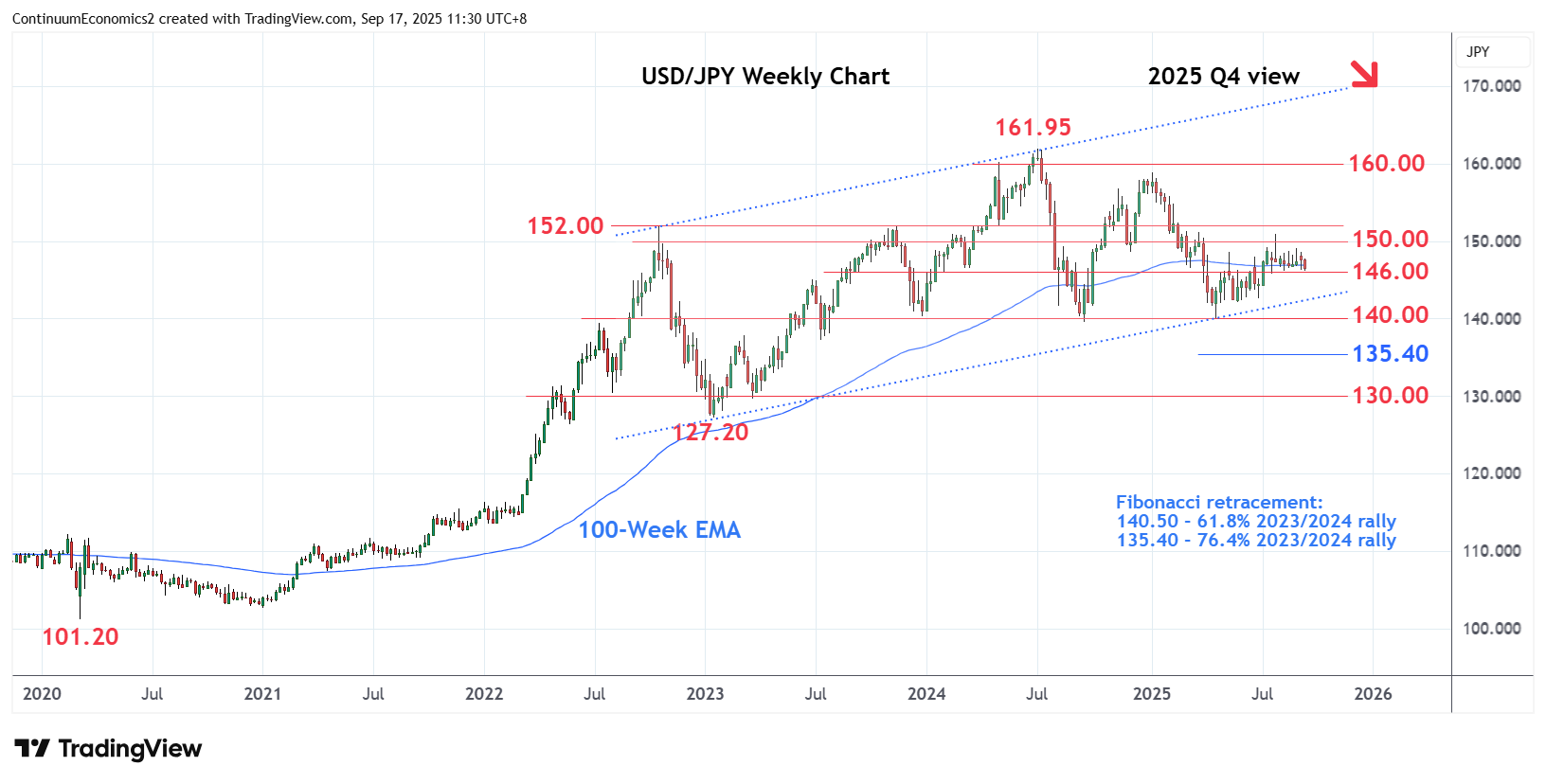

Further extend choppy gains from the 140.00 Q2 low as prices retrace losses from the January high

Further extend choppy gains from the 140.00 Q2 low as prices correct losses from the January high just beneath the 160.00 level.

Corrective gains tested strong resistance at the 150.00/152.00, psychological level and 2022/2023 year highs, before turning lower and settling into a sideway range within the 149.00/146.00 area. This is expected to give way to renewed selling pressure going forward and see extension to retest congestion at 142.00 then the strong support at the 140.00 figure. Break of the latter will confirm a top in place at the 161.95, July 2024 multi-year high and see room for extension to the 137.00 congestion area and 135.40, 76.4% Fibonacci level. Lower still, still turn focus to 132.00/130.00 area.

Meanwhile, resistance at the 149.00 congestion is expected to cap and sustain pullback from critical resistance at the 150.00/152.00 area.