Published: 2025-01-24T14:02:21.000Z

Chart USD Index DXY Update: Room for lower

Senior Technical Strategist

5

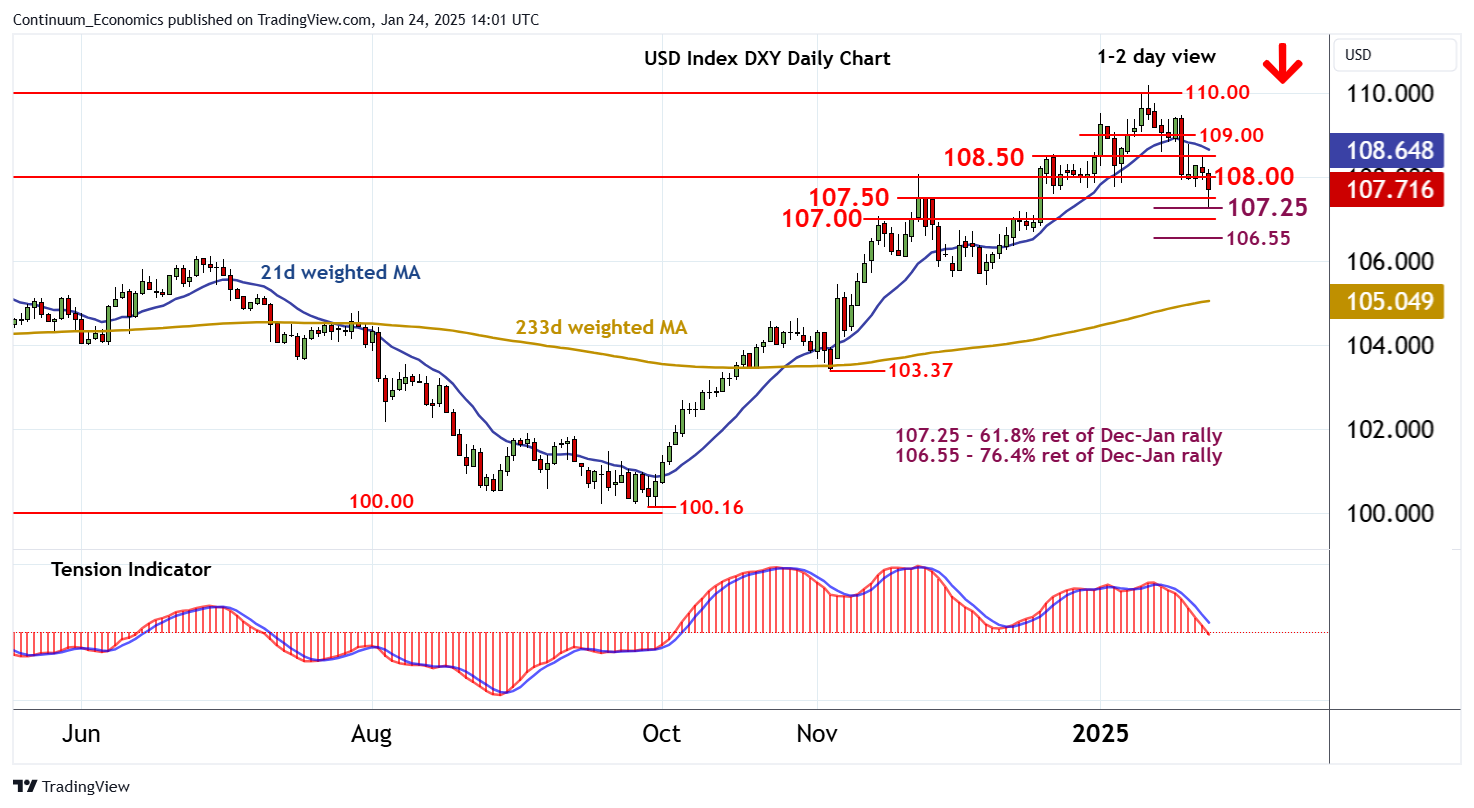

The anticipated break lower has reached congestion support at 107.50 and the 107.25 Fibonacci retracement

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 109.50 | minor congestion | S1 | 107.50 | * | congestion | ||

| R3 | 109.00 | * | congestion | S2 | 107.25 | ** | 61.8% ret of Dec-Jan rally | |

| R2 | 108.50 | minor break level | S3 | 107.00 | * | break level | ||

| R1 | 108.00 | pivot | S4 | 106.55 | ** | 76.4% ret of Dec-Jan rally |

Asterisk denotes strength of level

13:50 GMT - The anticipated break lower has reached congestion support at 107.50 and the 107.25 Fibonacci retracement, where flat oversold daily stochastics are prompting short-term reactions. The daily Tension Indicator continues to point lower, however, and broader weekly charts are under pressure, suggesting room for further losses in the coming sessions. A close below 107.25/50 will add weight to sentiment and extend January losses towards 107.00. Meanwhile, a close back above resistance at 108.00, if seen, will turn sentiment neutral and prompt consolidation beneath 108.50.