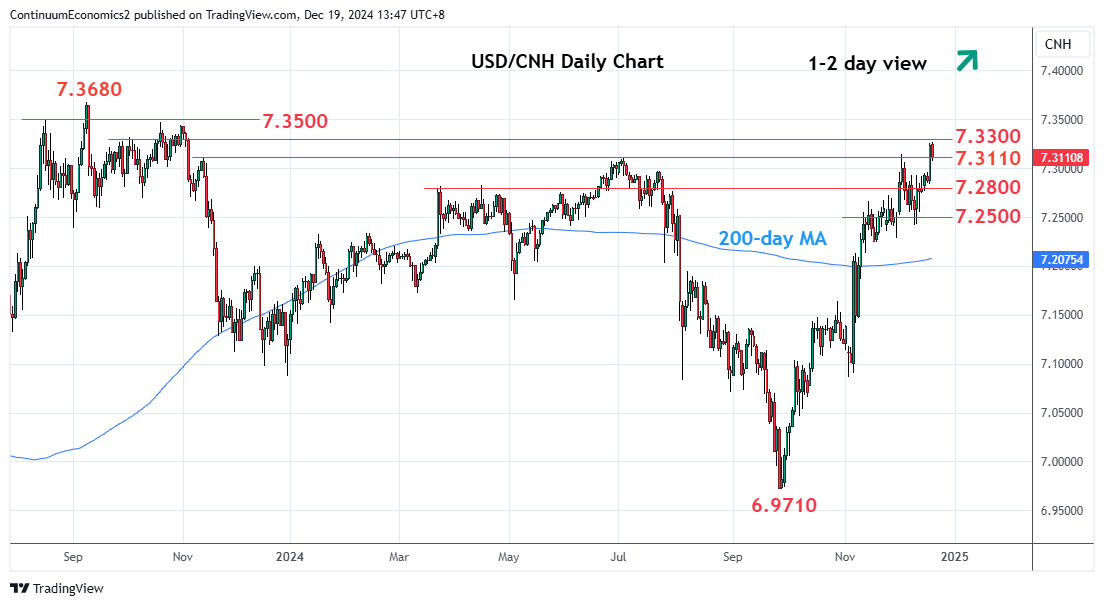

Consolidation below the 7.3000 figure has given way to sharp break higher through the 7.3110/50 high to reach fresh year high at 7.3270

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.3750 | ** | 25 Oct 2022 year high | S1 | 7.3000 | * | figure, congestion | |

| R3 | 7.3680 | ** | 8 Sep 2023 year high | S2 | 7.2800 | * | congestion | |

| R2 | 7.3500 | * | Aug 2023 high | S3 | 7.2500 | * | congestion | |

| R1 | 7.3300 | * | congestion | S4 | 7.2250 | ** | 18 Nov low |

Asterisk denotes strength of level

06:00 GMT - Consolidation below the 7.3000 figure has given way to sharp break higher through the 7.3110/50 high to reach fresh year high at 7.3270. Pause here see prices unwinding overbought intraday studies and pullback to give way to renewed buying interest later. Break here and the 7.3300 congestion will see room to the 7.3500 level. Beyond this will turn focus to 7.3680 and 7.3750, the 2023 and 2022 year highs. Meanwhile, support is raised to the 7.3000/7.2800 congestion area which should underpin. Would take break here to open up deeper correction to the 7.2800 and 7.2500 congestion.