Published: 2025-09-09T00:46:10.000Z

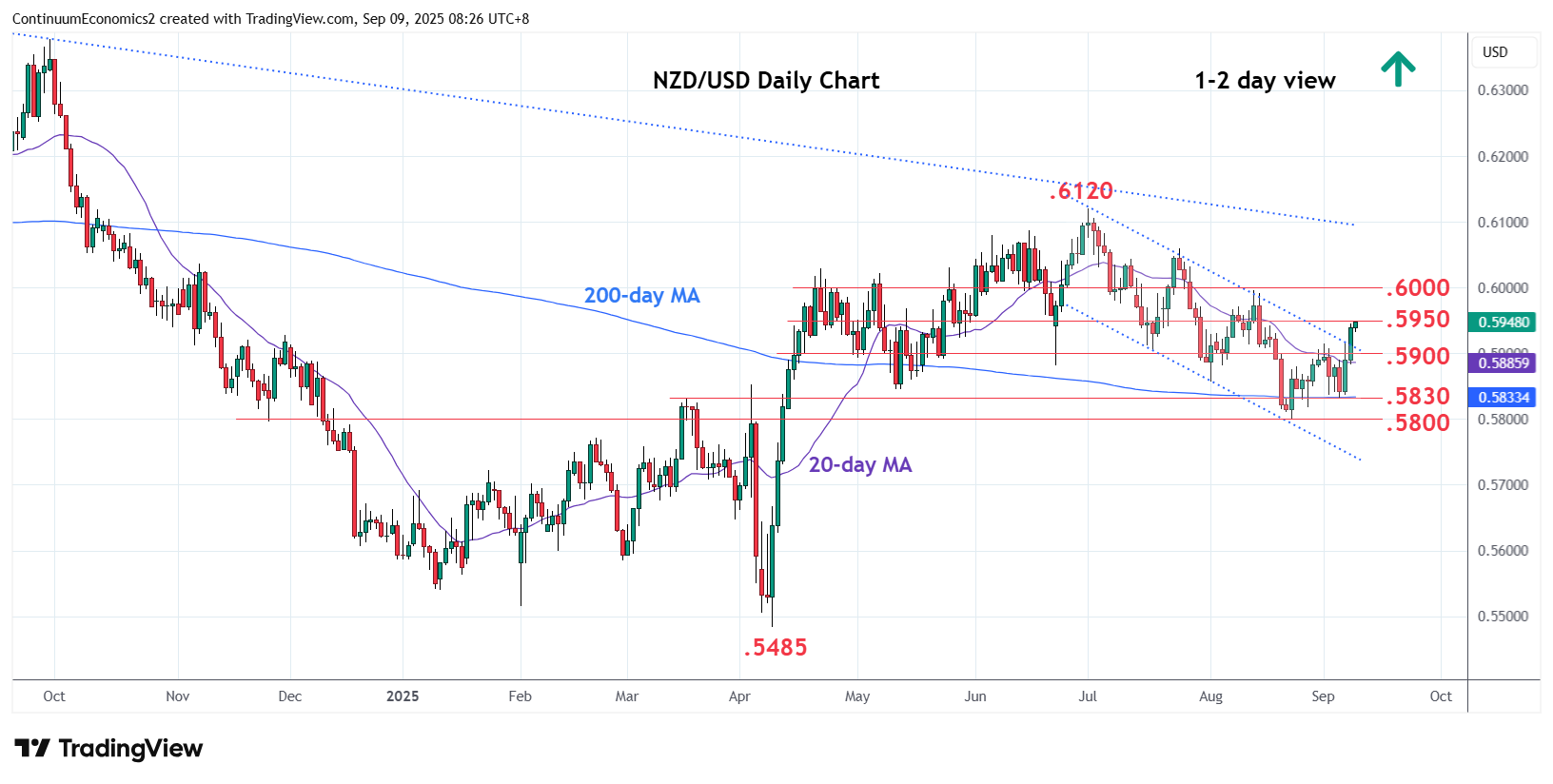

Chart NZD/USD Update: Extending break of July channel

0

1

Break of the .5900/15 area and channel resistance from the July high return focus to the upside

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .6100 | figure | S1 | .5915/00 | * | 1 Sep high, congestion | ||

| R3 | .6050/60 | ** | congestion, 24 Jul high | S2 | .5850/30 | * | congestion, Mar high | |

| R2 | .5995/00 | ** | Aug high, congestion | S3 | .5800 | ** | Aug low, 50% | |

| R1 | .5950 | * | congestion | S4 | .5772 | * | Feb high |

Asterisk denotes strength of level

00:35 GMT - Break of the .5900/15 area and channel resistance from the July high return focus to the upside to retrace losses from the July high. Positive daily and weekly studies keeps pressure firmly on the upside and break above the .5950 congestion will see stronger gains to retrace the July/August losses. Clearance will turn focus to the .5995 high of August and the 6000 level. Meanwhile, support is raised to the .5915/.5900 area which is expected to underpin and sustain gains from the .5800 low.